Original Title: Bank Outlooks 2026 Research Plan

Original Author: szj capital

Original Translation: Deep Tide TechFlow

As the year comes to a close, major institutions are beginning to forecast the market for the coming year.

Recently, overseas netizens compiled the annual outlook reports from eight top investment banks, including Goldman Sachs, BlackRock, Barclays, and HSBC, allowing Gemimi Pro3 to conduct a comprehensive interpretation and analysis.

Below is the full translation to help you save time and get an overview of the important economic trends for next year.

Executive Summary: Navigating the "K-Shaped" New World Order

The year 2026 is destined to be a period of profound structural change, characterized not by a single synchronized global cycle, but by a complex and diverse economic reality, policy disconnection, and thematic disruption interwoven in a matrix. This comprehensive research report gathers the forward-looking strategies and economic forecasts from leading global financial institutions, including J.P. Morgan Asset Management, BlackRock, HSBC Global Private Banking, Barclays Private Bank, BNP Paribas Asset Management, Invesco, T. Rowe Price, and Allianz.

These institutions collectively depict a "bent but not broken" global economic landscape: the "easy money" era of the past decade has been replaced by a new pattern of "Higher for Longer" interest rates, fiscal dominance, and technological disruption. The core theme for 2026, referred to as "The Interpretation Game" by Barclays Private Bank, describes an environment of contradictory economic data and rapidly changing narratives, where market participants must actively interpret conflicting signals rather than rely on passive investment.

One of the core pillars for 2026 is the significant divergence between the United States and other countries. J.P. Morgan and T. Rowe Price believe that the U.S. economy is driven by artificial intelligence (AI) capital expenditures and a fiscal stimulus known as the "One Big Beautiful Bill Act" (OBBBA), creating a unique growth momentum. This stimulus is expected to bring an "excitement effect" of over 3% economic growth in early 2026, gradually fading thereafter; meanwhile, Allianz and BNP Paribas anticipate a "plain is beautiful" recovery model for the Eurozone.

However, beneath the surface growth numbers lies a more turbulent reality. Allianz warns that the global business bankruptcy rate will hit "historical highs," with a projected increase of 5% in 2026, marking the final impact of high-interest rate lag effects on "zombie companies." This scenario outlines a "K-shaped" expansion: large tech companies and the infrastructure sector thrive due to "AI Mega Force" (a BlackRock concept), while small businesses reliant on leverage face existential crises.

The consensus on asset allocation is undergoing a significant transformation. The traditional 60/40 investment portfolio (60% stocks, 40% bonds) is being redefined. BlackRock proposes the concept of a "New Continuum," suggesting that the boundaries between public and private markets are dissolving, and investors need to permanently allocate to private credit and infrastructure assets. Invesco and HSBC recommend a return to "quality" in fixed income investments, favoring investment-grade bonds and emerging market debt while shunning high-yield bonds.

This report analyzes the investment themes of each institution, covering "Physical AI" trading, the "Electrotech Economy," the rise of protectionism and tariffs, and the strategic focuses investors should adopt in this divided world.

### Part One: Macroeconomic Landscape — A Multi-Speed Growth World

In the post-pandemic era, the synchronized global recovery many anticipated has not materialized. The situation in 2026 is characterized by unique growth drivers and policy divergence. Major economies are progressing at different speeds due to their respective fiscal, political, and structural forces.

1.1 United States: The "North Star" of the Global Economy and OBBBA Stimulus

The United States remains the undisputed engine of the global economy, but its growth drivers are changing. It is no longer solely reliant on organic consumer demand but increasingly dependent on government fiscal policy and corporate capital expenditures in artificial intelligence.

The Phenomenon of the "One Big Beautiful Bill Act" (OBBBA)

Key findings from J.P. Morgan Asset Management and T. Rowe Price regarding the 2026 outlook highlight the anticipated impact of the "One Big Beautiful Bill Act" (OBBBA). This legislative framework is considered a decisive fiscal event for 2026.

· Mechanism of Operation: J.P. Morgan notes that OBBBA is a broad legislative proposal that extends key provisions of the 2017 Tax Cuts and Jobs Act (TCJA) while introducing new spending items. It includes approximately $170 billion for border security (enforcement, deportation) and $150 billion for defense spending (such as the "Iron Dome" missile defense system and shipbuilding). Additionally, the act raises the debt ceiling by $5 trillion, indicating that fiscal easing will continue.

· Economic Impact: T. Rowe Price believes that this act, combined with AI spending, will help the U.S. economy escape the growth panic of late 2025. J.P. Morgan predicts that OBBBA will drive real GDP growth in Q4 2025 to about 1% and accelerate to over 3% in the first half of 2026, as tax refunds and spending directly enter the economy. However, this growth is viewed as a temporary acceleration—a reversal of a "fiscal cliff"—with growth expected to retreat to a 1-2% trend line in the second half as the stimulus effect fades.

· Tax Impact: The act is expected to permanently maintain a 37% top personal income tax rate and restore 100% bonus depreciation and R&D expense deductions for corporations. Morgan Stanley points out that this is a significant supply-side incentive that could lower effective corporate tax rates in certain industries to as low as 12%, thereby driving a "Capex Supercycle" in manufacturing and technology.

The Paradox of the Labor Market: "Economic Drift"

Despite fiscal stimulus, the U.S. economy faces a significant structural headwind: labor supply. J.P. Morgan describes this environment as "Economic Drift," noting that a sharp decline in net immigration is expected to lead to an absolute decrease in the working-age population.

· Impact on Growth: This supply constraint means that the U.S. is expected to add only 50,000 new jobs per month in 2026. This is not a failure on the demand side but a bottleneck on the supply side.

· Unemployment Rate Ceiling: Consequently, the unemployment rate is expected to remain low, peaking at 4.5%. This "full employment" dynamic, while preventing a deep recession, also sets a hard ceiling on potential GDP growth, further exacerbating the sense of "drift" in the economy—despite positive data, the economy appears stagnant.

1.2 Eurozone: The "Plain is Beautiful" Surprise

In stark contrast to the volatile and fiscally dramatic narrative of the U.S., the Eurozone is gradually becoming a symbol of stability. Allianz and BNP Paribas believe that Europe may exceed expectations and perform well in 2026.

Germany's "Fiscal Reset"

BNP Paribas points out that Germany is undergoing a critical structural transformation. Germany is gradually moving away from its traditional "Black Zero" fiscal austerity policy and is expected to significantly increase spending in infrastructure and defense. This fiscal expansion is anticipated to create a multiplier effect throughout the Eurozone, boosting economic activity levels in 2026.

Consumer Support Policies

Additionally, BNP Paribas mentions that policies such as permanently lowering VAT for the restaurant industry and energy subsidies will support consumer spending, thereby avoiding a collapse in demand.

Growth Forecast

Allianz expects the Eurozone's GDP growth rate in 2026 to be between 1.2% and 1.5%. While this figure appears modest compared to the U.S. "OBBBA stimulus," it represents a robust and sustainable recovery from the stagnation experienced from 2023 to 2025. Barclays shares a similar view, believing that the Eurozone may "bring positive surprises."

1.3 Asia and Emerging Markets: "Extended Runway" and Structural Slowdown

The outlook for Asia shows a clear polarization: on one hand, a gradually maturing and slowing China, and on the other, a vibrant and accelerating India and ASEAN region.

China: Orderly Deceleration

Major institutions generally agree that China's era of rapid growth has come to an end.

· Structural Headwinds: BNP Paribas predicts that by the end of 2027, China's economic growth rate will slow to below 4%. T. Rowe Price adds that despite stimulus measures, these are unlikely to provide a "substantial boost" due to deep-rooted issues in the real estate market and demographic structure.

· Targeted Stimulus: Unlike a comprehensive "full throttle" stimulus, the Chinese government is expected to focus on supporting "advanced manufacturing" and strategic industries. This shift aims to push the economy upstream in the value chain but will sacrifice short-term consumption growth. Barclays predicts that China's consumption growth in 2026 will be only 2.2%.

India and ASEAN: Growth Engines

In contrast, HSBC and S&P Global believe that South Asia and Southeast Asia are becoming new champions of global growth.

· India's Growth Trajectory: HSBC expects India's GDP growth rate in 2026 to be 6.3%, making it one of the fastest-growing major economies. However, HSBC also issues a tactical warning: despite strong macroeconomic performance, corporate profit growth momentum may be relatively weak in the short term, potentially leading to a disconnect with high valuations, which could affect equity investors.

· AI Supply Chain: Both J.P. Morgan and HSBC emphasize the significant driving force of the "AI theme" in Asian emerging markets, particularly in Taiwan and South Korea (semiconductors) and ASEAN countries (data center assembly and component manufacturing). The "expansion" of AI trade is a key driver for the region.

1.4 Global Trade: The "Tax Effect" of Tariffs

A potential shadow in the 2026 outlook is the resurgence of protectionism. HSBC has explicitly lowered its global growth forecast from 2.5% to 2.3%, primarily due to the "multi-purpose tariffs" initiated by the U.S.

Stagnation of Trade Growth

HSBC predicts that global trade growth in 2026 will be only 0.6%. This near-stagnation reflects a world where supply chains are shortening ("nearshoring") and being reconfigured to avoid tariff barriers.

Inflationary Pressures

Pionex warns that these tariffs will act as a consumption tax, leading to persistent inflation in the U.S. "above target levels."

### Part Two: The Dilemma of Inflation and Interest Rates

The era of the "Great Moderation" before the 2020s has been replaced by a new normal of volatility. The stubborn inflation in the U.S. intertwines with deflationary pressures in Europe, driving a "Great Decoupling" in central bank policies.

#### 2.1 The Divergence of Inflation

· United States: Stubborn and Structural

Pionex and BNP Paribas believe that U.S. inflation will remain high due to the effects of OBBBA fiscal stimulus and tariffs. J.P. Morgan provides a more detailed analysis: inflation is expected to peak near 4% in the first half of 2026 due to tariffs, but as the economy gradually absorbs the shock, inflation will fall back to 2% by the end of the year.

· Europe: Unexpected Deflation

In contrast, BNP Paribas points out that Europe will face deflationary pressures, partly due to the "recycling of cheap Chinese export goods" entering the European market. This could lead to inflation below the European Central Bank (ECB) target, sharply contrasting with the inflation trends in the U.S.

#### 2.2 Decoupling of Central Bank Policies

The divergence in inflation dynamics directly leads to differences in monetary policy, creating opportunities for macro investors.

· Federal Reserve ("Slow" Path)

The Federal Reserve is expected to be constrained. J.P. Morgan believes that the Fed may only cut rates 2-3 times in 2026. Pionex takes a more hawkish stance, warning that if OBBBA fiscal stimulus leads to an overheating economy, the Fed may be completely unable to cut rates in the first half of 2026.

· European Central Bank ("Dovish" Path)

Faced with weak growth prospects and deflationary pressures, the ECB is expected to cut rates significantly. Allianz and BNP Paribas anticipate that the ECB will lower rates to 1.5%-2.0%, well below current market expectations.

· Impact on Foreign Exchange Markets

The widening of this interest rate differential (high U.S. rates and declining Eurozone rates) suggests a structural strength of the dollar against the euro, contradicting the common belief that the dollar weakens when the economic cycle matures. However, Invesco holds the opposite view, betting that a weaker dollar will support emerging market assets.

### Part Three: In-Depth Analysis of Themes — "Mega Forces" and Structural Change

Investment strategies for 2026 are no longer focused on traditional business cycles but revolve around structural "Mega Forces" that transcend quarterly GDP data, as proposed by BlackRock.

#### 3.1 Artificial Intelligence: From "Hype" to "Physical Reality"

The narrative around artificial intelligence is shifting from software (like large language models) to hardware and infrastructure ("Physical AI").

· "Capex Supercycle": J.P. Morgan notes that data center investments now account for 1.2%-1.3% of U.S. GDP and are continuing to rise. This is not a fleeting trend but a substantial expansion of rebar, concrete, and silicon-based technologies.

· "Electrotech Economy": Barclays introduces the concept of the "Electrotech Economy." The demand for energy from artificial intelligence is endless. Investments in the grid, renewable energy generation, and utilities are seen as the safest ways to participate in the AI wave. HSBC agrees and suggests shifting portfolios towards utilities and industrial sectors, which will "power" this revolution.

· Contrarian View (HSBC's Warning): In stark contrast to the market's optimistic consensus, HSBC holds deep skepticism about the financial viability of current AI model leaders. According to their internal analysis, companies like OpenAI may face up to $1.8 trillion in computing capacity leasing costs, leading to a massive funding gap by 2030. HSBC believes that while AI is real, the profitability of model creators is questionable. This further supports their recommendation to invest in "tools and equipment" (like chip manufacturers and utility companies) rather than model developers.

#### 3.2 The "New Continuum" of Private Markets

BlackRock's 2026 outlook centers on the evolution of private markets. They believe that the binary distinction between traditional "public markets" (high liquidity) and "private markets" (low liquidity) is outdated.

· The Rise of the Continuum: Through "Evergreen" structures, European Long-Term Investment Funds (ELTIFs), and secondary markets, private assets are gradually achieving semi-liquidity. This democratization trend allows more investors to access "liquidity premiums."

· Private Credit 2.0: BlackRock believes that private credit is evolving from traditional leveraged buyout models to "Asset-Based Financing" (ABF). This model uses real assets (like data centers, fiber networks, and logistics centers) as collateral rather than relying solely on corporate cash flows. They see this as bringing "far-reaching incremental opportunities" in 2026.

#### 3.3 Demographics and Labor Shortages

J.P. Morgan and BlackRock view demographic changes as a slow but unstoppable driving force.

· Immigration Cliff: J.P. Morgan predicts that the decline in net immigration will become a key limiting factor for growth in the U.S. This means that labor will continue to be scarce and expensive, which not only supports wage inflation but also further incentivizes companies to invest in automation and artificial intelligence to replace human labor.

### Part Four: Asset Allocation Strategies — "60/40+" and the Return of Alpha

Multiple institutions agree that 2026 will no longer be suitable for the passive "buy the market" strategy popular in the 2010s. In the new market environment, investors need to rely on active management, diversify into alternative assets, and focus on "quality."

#### 4.1 Portfolio Construction: The "60/40+" Model

J.P. Morgan and BlackRock explicitly call for a reform of the traditional 60% stock/40% bond portfolio.

· Components of the "+": Both institutions advocate for adopting a "60/40+" model, allocating about 20% of the portfolio to alternative assets (private equity, private credit, real assets). This allocation aims to provide returns uncorrelated with traditional assets while reducing overall portfolio volatility in a context where stock and bond correlations are increasing.

#### 4.2 Stock Market: Quality and Rotation

· U.S. Stocks: BlackRock and HSBC are overweight on U.S. stocks, primarily due to the AI theme and economic resilience. However, HSBC recently reduced its allocation to U.S. stocks due to high valuations. They recommend shifting from "mega-cap tech stocks" to a broader range of beneficiaries (such as financials and industrials).

· International Value Stocks: J.P. Morgan sees strong investment opportunities in value stocks in Europe and Japan. These markets are undergoing a "corporate governance revolution" (including stock buybacks and increased dividends), and their valuations are at historically discounted levels compared to the U.S.

· Emerging Markets: Invesco is most optimistic about emerging markets. They bet that a weaker dollar (contrary to other institutions' predictions) will unlock value in emerging market assets.

#### 4.3 Fixed Income: The Revival of Yield

The role of bonds is shifting, no longer relying solely on capital appreciation (betting on rate cuts) but returning to their essence of "yield."

· Credit Quality: In light of Allianz's warning about rising corporate bankruptcy rates, HSBC and Invesco strongly favor investment-grade (IG) bonds over high-yield (HY) bonds. The risk premium of high-yield bonds is deemed insufficient to compensate for the impending default cycle.

· Duration Allocation: Invesco is overweight on duration (especially UK government bonds), expecting central banks to cut rates faster than the market anticipates. J.P. Morgan suggests maintaining "flexibility," trading within ranges rather than making large directional bets.

· CLOs (Collateralized Loan Obligations): Invesco explicitly includes AAA-rated CLOs in its model portfolio, believing their yield enhancement and structural safety are superior to cash assets.

#### 4.4 Alternative Assets and Hedging Tools

· Infrastructure: Infrastructure investment is the most confident trade direction among "real assets." BlackRock calls it a "cross-generational opportunity," capable of not only combating inflation but also directly benefiting from the wave of AI capital expenditures.

· Gold: HSBC and Invesco view gold as a key hedging tool in investment portfolios. In the context of geopolitical divisions and potential inflation volatility, gold is seen as necessary "tail risk" insurance.

### Part Five: Risk Assessment — The Shadow of Bankruptcy

Despite a strong macroeconomic outlook for the U.S. due to fiscal stimulus, credit data reveals a gloomier side. Allianz provides a sobering reflection on the market's optimism.

#### 5.1 Wave of Bankruptcies

Allianz predicts that the global business bankruptcy rate will rise by 6% in 2025 and increase by another 5% in 2026.

· "Lagging Trauma": This increase is attributed to the delayed effects of high interest rates. Companies that locked in low rates in 2020-2021 will face a "maturity wall" in 2026, forced to refinance at significantly higher costs.

· "Bursting of the Tech Bubble" Scenario: Allianz explicitly simulates a downside scenario in which the "AI bubble" bursts. In this scenario, the U.S. is expected to see an additional 4,500 bankruptcy cases, Germany 4,000, and France 1,000.

#### 5.2 Vulnerable Industries

The report highlights several industries particularly susceptible to shocks:

· Construction: Highly sensitive to interest rates and labor costs.

· Retail/Discretionary Consumer Goods: Pressured by the "K-shaped" consumption trend, with significantly reduced spending from low-income consumers.

· Automotive Industry: Facing multiple pressures from high capital costs, supply chain restructuring, and tariff wars.

This risk assessment further supports the inclination towards "quality first" in asset allocation. The report warns investors to avoid "zombie" companies that survive solely due to cheap capital.

### Part Six: Comparative Analysis of Institutional Views

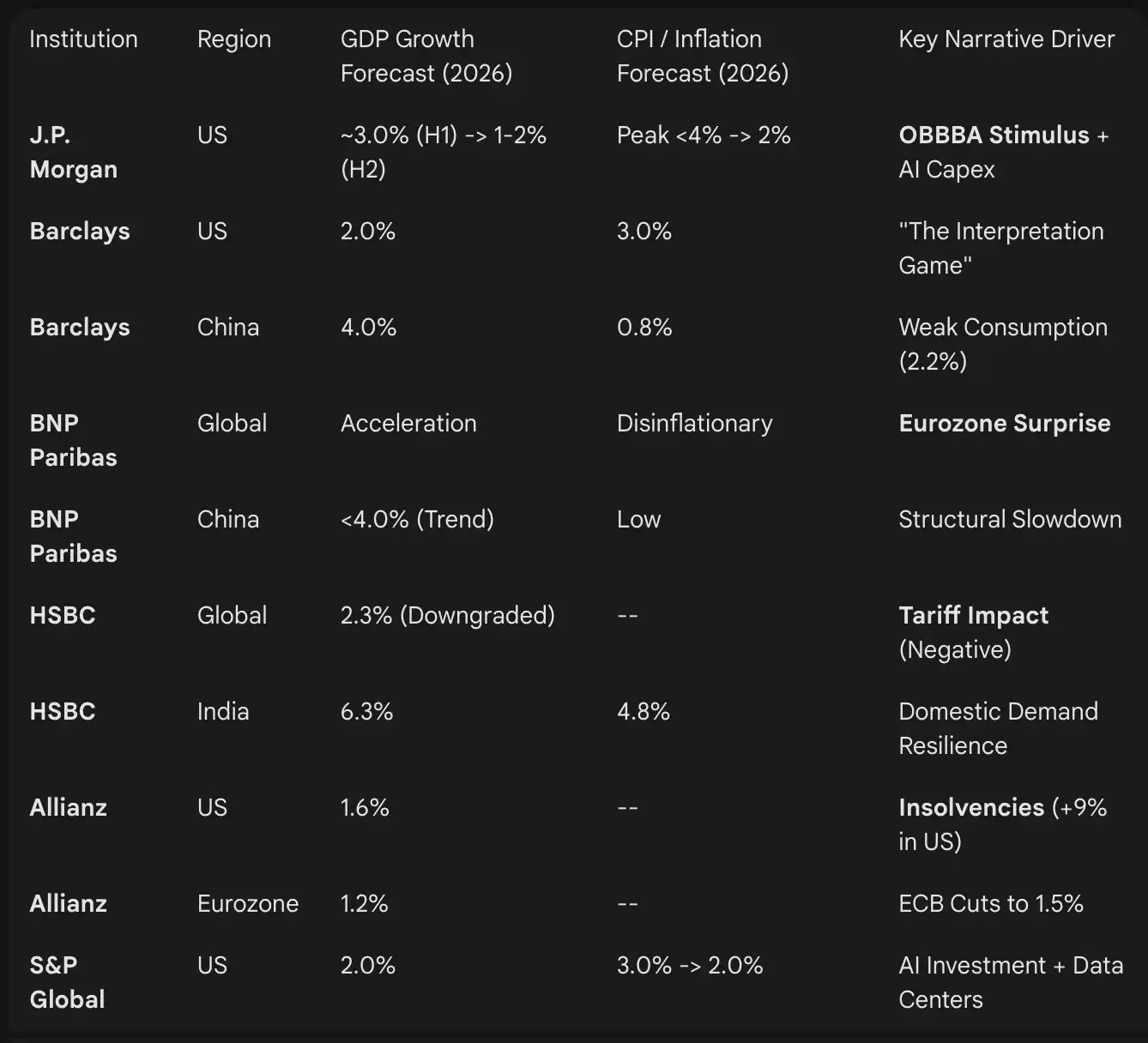

The following table summarizes the specific GDP and inflation forecasts for 2026 provided in institutional reports, highlighting the expected divergences.

### Conclusion: Strategic Imperatives for 2026

The investment landscape in 2026 is defined by the tension between two forces: fiscal and technological optimism (U.S. OBBBA plan, artificial intelligence) and credit and structural pessimism (wave of bankruptcies, demographic issues).

For professional investors, the future path requires bidding farewell to broad index investing. The characteristics of the "K-shaped" economy—prosperity in data centers and bankruptcies in construction companies—demand that investors actively select industries.

Key Strategic Points:

· Focus on the Pulses of "OBBBA": The timing of U.S. fiscal stimulus will determine the rhythm for the first half of 2026. It is wise to develop tactical trading strategies in response to the "stimulant effect" on U.S. assets in the first and second quarters, as well as the potential pullback in the second half (J.P. Morgan).

· Invest in the "Tools and Equipment" of Artificial Intelligence: Avoid the valuation risks of pure AI models (HSBC's warning) and focus on physical infrastructure, such as utilities, the grid, and data center REITs (Real Estate Investment Trusts) (Barclays, BlackRock).

· Diversify through Private Markets: Utilize the "new continuum" to enter private credit and infrastructure sectors, ensuring these assets are "asset-based" to withstand the impact of the wave of bankruptcies (BlackRock, Allianz).

· Hedge the "Interpretation Game": In a rapidly changing narrative environment, maintain structural hedging tools like gold and adopt a "barbell strategy" (growth stocks + quality income assets) to cope with volatility (HSBC, Invesco).

2026 will not be a year suitable for passive investing, but rather a year for those adept at interpreting market signals.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。