In his book “Irrational Exuberance,” published in 2000, Nobel prize-winning economist Robert Shiller put the blame of market bubbles squarely on the shoulders of overzealous investors. Shiller went on to accurately predict the dot-com bubble and the 2007-8 financial crisis. But what if his theory also works in reverse? What if sometimes, markets can become irrationally pessimistic even when economic fundamentals are sound? Some experts are saying this is exactly what’s happening with bitcoin right now.

(Yale Economics Professor and Nobel laureate Robert Shiller wrote the popular book “Irrational Exuberance” in 2000 / Yale University)

“Why are digital assets still selling off on every piece of bad news but failing to rally with good news?” asks Jeff Dorman, CEO of crypto investment firm Arca. “I have no idea.”

Read more: Is Bitcoin’s Price Being Manipulated?

Stocks have been rallying; the Fed has been cutting rates; institutional interest in bitcoin is higher than it has ever been. So why is the cryptocurrency almost 30% down from the all-time high it printed just eight weeks ago? Many explanations have been offered, but none seem to be widely accepted enough to calm skittish bears. First, it was tariffs, then it was Binance’s whoopsie-daisy on margin positions that many blamed for the $19 billion crypto liquidation event on October 10 and 11. Several other factors for bitcoin’s poor price performance have been proposed, but so far, no comprehensive explanation seems to exist.

“We can at least try to rationalize some of the moves lower in the market,” Dorman says. “But this persistent weakness certainly has us scratching our heads.”

And now, in what may be a moment of frustration, many are beginning to suspect price manipulation by unscrupulous whales while others are displaying signs of paranoia by questioning the fiscal soundness of companies like Tether, which appears by all accounts, to be much better capitalized than the average American bank.

“A roughly 30% decline in the gold + $ BTC position would wipe out their equity, and then USDT would be in theory insolvent,” wrote Bitmex founder Arthur Hayes on Sunday. “Get out your popcorn, I expect the MSM to run wild with this.”

Tether has about $181 billion in assets to support its $180 billion in circulating USDT. Roughly $112 billion of its reserves are treasury bills. The gold and bitcoin combination Hayes referenced adds up to approximately $23 billion. Hayes thinks a 30% drop in the prices of bitcoin and gold would lead to a scenario where Tether’s liabilities would exceed its assets, rendering the firm insolvent. But such a scenario is highly unlikely, and if it ever did happen, Tether has a separate $30 billion reserve to address that exact situation.

“Tether will continue to maintain a multi-billion-dollar excess reserve buffer and an overall proprietary Group equity approaching $30 billion,” the firm states on its website.

(Shiller’s New York Times bestseller, “Irrational Exuberance,” explores market bubbles and is currently on its third edition. / Princeton University Press)

That once again raises the question of pessimism. Could it be that bitcoin investors, historically known for being what Shiller describes as “irrationally exuberant” have now become irrationally pessimistic? Perhaps thought leaders like Hayes are part of a contagion characterized by gloom and doom, that is infecting crypto markets while stock traders, still grounded in rational analysis, are busy enjoying record highs.

“People are ready to believe the majority view or to believe authorities,” Shiller wrote in Irrational Exuberance. “Even when they plainly contradict matter-of-fact judgment.”

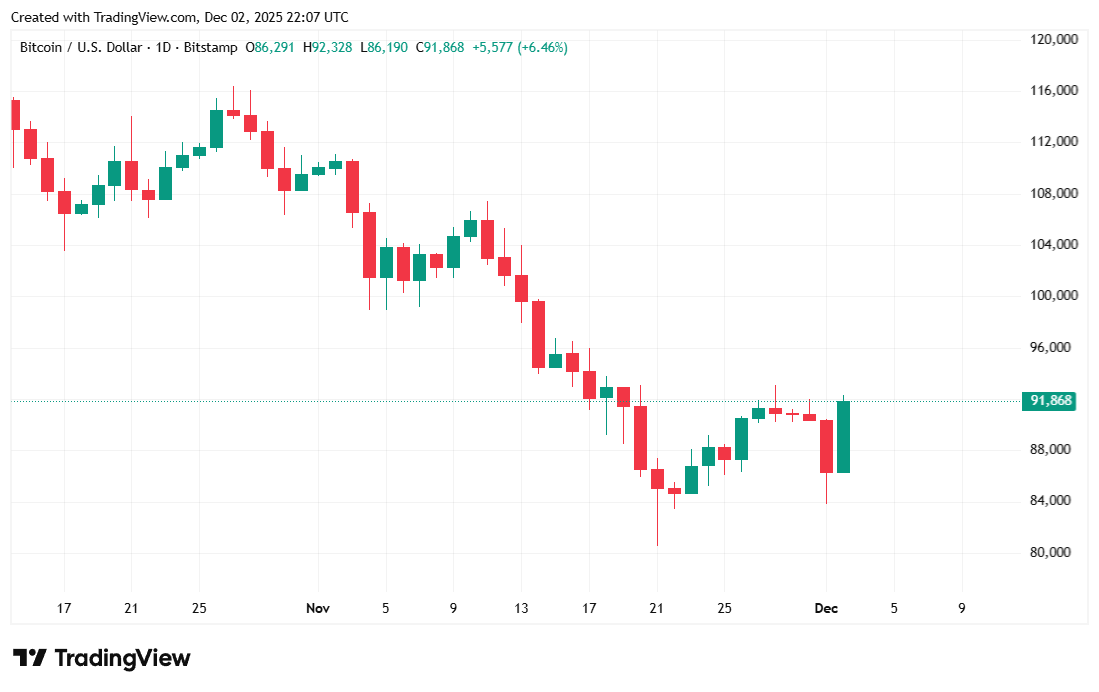

Bitcoin was trading at $91,767.67 at the time of reporting, up 6.03% for the day and 5.88% on a weekly basis, according to Coinmarketcap. Volatility, much like yesterday, remained high with BTC’s price fluctuating between $86,202.19 and $92,316.63 over 24 hours.

( BTC price / Trading View)

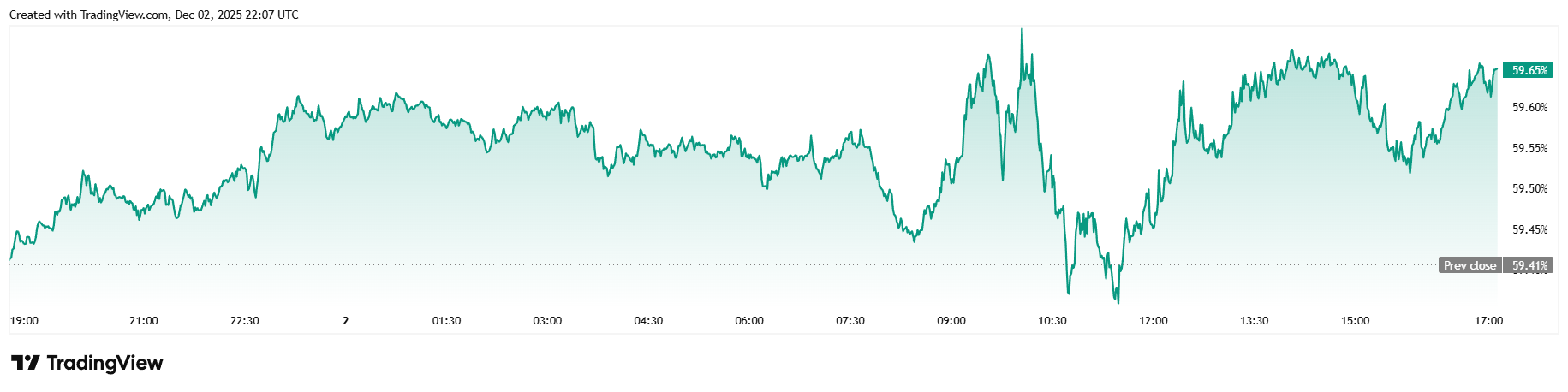

Daily trading volume fell 10.3% to reach $77.97 billion and market capitalization rose to $1.92 trillion. Bitcoin dominance was also up, climbing by 0.42% to arrive at 59.65% at the time of writing.

( BTC dominance / Trading View)

Total bitcoin futures open interest moved up 2.12%, reaching $59.28 billion, according to Coinglass data. Liquidations fell by more than 50% but remained relatively high at $183.41 million. This time it was the bears who got wiped out to the tune of $168.24 million while bulls were mostly spared, losing only $15.17 million in liquidated margin.

- Why is bitcoin struggling despite strong economic fundamentals?

Some analysts say investors are exhibiting irrational pessimism that isn’t supported by data or market conditions. - Is Bitcoin’s recent sell-off being driven by manipulation?

A growing number of traders suspect coordinated whale activity, though no conclusive evidence has emerged. - Why are some investors suddenly worried about Tether?

Misinterpretations of its financials sparked concerns, even though the company maintains a large excess-reserve buffer. - Could sentiment alone be suppressing bitcoin’s price?

Experts argue that fear and contagion could be overpowering fundamentals, creating a mood-driven downturn in digital assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。