12月的第一个交易日,数字货币交易所交易基金(ETF)市场呈现出混合的基调。一些细分市场表现出韧性,另一些则遭遇挫折,所有市场都反映出仍在与变化的动能作斗争。比特币ETF保持在正区间,以太坊产品则大幅撤资,而索拉纳基金则因大规模流出而逆转了近期的强势表现。

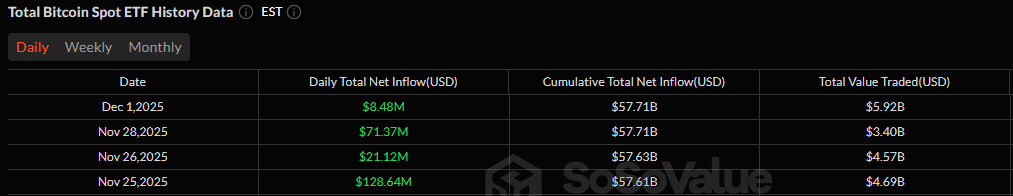

比特币ETF继续保持近期紧张、谨慎的流动模式,但以848万美元的净流入结束了交易日。富达的FBTC表现突出,吸引了6702万美元的显著资金,而ARK和21Shares的ARKB也贡献了738万美元的流入。下行压力来自黑石的IBIT,该基金出现了6592万美元的重大流出,几乎抹去了其他两大主要参与者所带来的收益。尽管如此,该类别仍然稳住了阵脚,最终以绿色收盘。交易量活跃,达到了59.2亿美元,净资产为1119.4亿美元。

比特币ETF连续四天实现流入

以太坊ETF以明显的负面开局。黑石的ETHA录得了2665万美元的强劲流入,但这远不足以抵消该领域其他产品的重撤资。灰度的ETHE引领下滑,流出4979万美元,其次是富达的FETH,流出3162万美元。灰度的以太坊迷你信托流出2028万美元,Vaneck的ETHV以403万美元的流出收盘。总的来说,以太坊ETF录得7907万美元的净流出,交易者纷纷减少对ETH的敞口。每日交易量达到16.3亿美元,净资产在当天结束时为172.1亿美元。

阅读更多:以太坊ETF引领周度涨幅,比特币和索拉纳保持绿色

索拉纳ETF在经历了一段令人印象深刻的多日流入后,终于遇到了阻力。Bitwise的BSOL带来了1718万美元的强劲流入,灰度的GSOL也增加了182万美元。但21Shares的TSOL则出现了3254万美元的急剧流出,足以使整个类别当天转为负值。该组以1354万美元的净流出收盘。交易价值达到5435万美元,净资产为7909.1万美元。

常见问题📍

- 为什么比特币ETF今天保持正值?

比特币基金凭借FBTC和ARKB的强劲需求实现了848万美元的净流入。 - 是什么导致以太坊ETF出现大规模流出?

ETHE、FETH和其他主要基金的重撤资超过了ETHA的流入,导致7900万美元的净流出。 - 为什么索拉纳ETF在多日上涨后转为负值?

TSOL的3254万美元大规模流出逆转了BSOL和GSOL的强劲流入。 - 这种混合的开局对加密ETF情绪意味着什么?

随着12月的开始,投资者积极调整头寸,导致BTC、ETH和SOL之间的交易不均但交易量高。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。