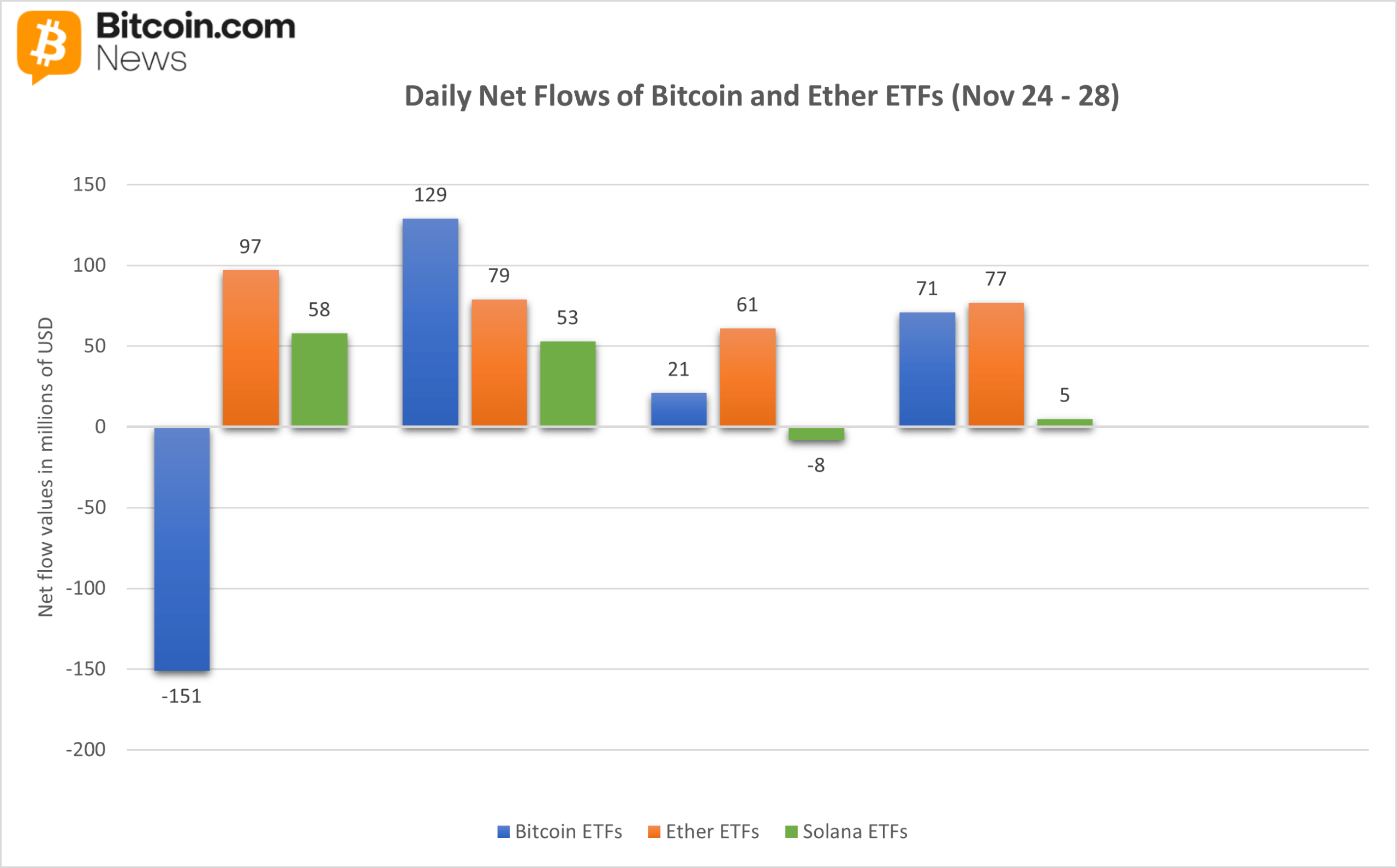

A calmer macro backdrop and renewed appetite across digital assets reshaped exchange-traded fund (ETF) flows this week, transforming what had been a month of persistent exits into a widespread resurgence. Spot ether ETFs led the charge with a $313 million net inflow, marking an emphatic reversal after three straight weeks in the red. Bitcoin ETFs followed with a modest but meaningful $70.05 million entry, snapping their four-week outflow streak. Solana ETFs once again proved to be the market’s most consistently bid segment, securing $108 million in new capital and extending their inflow run to five consecutive weeks.

Bitcoin ETFs: A Gradual Turn Back to Green

For bitcoin ETFs, the week was defined by uneven yet ultimately positive flows. Fidelity’s FBTC delivered the bulk of the inflows with a $230.44 million entry for the week. Grayscale’s GBTC and Bitcoin Mini Trust added $16.33 million and $8.88 million, each. The inflows were wrapped up with a $6.44 million addition from Ark & 21Shares’ ARKB.

The week wasn’t all green with Blackrock’s IBIT shedding -$137.01 million for the week. Vaneck’s HODL saw a -$36.95 million exit with a further exit of -$18.10 million from Bitwise’s BITB. While the daily push-and-pull underscored lingering market caution, the week closed with net inflows, just enough to break a month-long downturn.

Ether ETFs: A Dominant, Broad-Based Rebound

Ether products delivered the most coordinated recovery by far. Blackrock’s ETHA led with a $257.18 million entry. Fidelity’s FETH added $45.32 million for the week. Grayscale’s Ether Mini Trust brought in $24.37 million at the end of the week. 21Shares’ TETH and Bitwise’s ETHW rounded up the week’s inflow with $742.32K and $66.13K. Only one fund recorded an outflow, with Grayscale’s ETHE seeing a -$15.05 million exit for the week. With every major fund participating, ether ETFs clearly led the week’s resurgence.

Solana ETFs: Strong Momentum Continues

Solana ETFs added another week in the green. Bitwise’s BSOL dominated with $83.76 million for the week. Grayscale’s GSOL was equally solid with a $35.38 million weekly entry. Fidelity’s FSOL added $19.49 million, with Vaneck’s VSOL bringing in $4.47 million. The only disruption for the week came from 21Shares’ TSOL with a -$34.77 million exit, its first major exit, but Solana’s inflow momentum held firm overall.

FAQ🚀

- Why did ether ETFs dominate this week?

Ether saw broad-based demand with over $313 million in inflows, its strongest weekly rebound in a month. - Did bitcoin ETFs finally recover?

Yes, BTC products ended a four-week outflow streak with a modest $70 million net inflow despite mixed issuer performance. - How did solana ETFs perform?

Solana secured $108 million in fresh capital, extending its multi-week inflow streak despite one major fund outflow. What does this week signal for crypto ETF sentiment?

Investors shifted decisively toward accumulation across ETH, BTC, and SOL after weeks of risk-off behavior.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。