Hello everyone, I am Lao Lu. The market trend yesterday was still quite interesting; it can be described as jumping up and down. Anyone who understands a bit about the market knows that this kind of trend is definitely hard to trade. In our article yesterday, we actually anticipated that the price would show such a trend, mainly for two reasons, which I will repeat here. One reason is that the daily chart has no room left to fall. The previous four-hour big bearish pressure makes it not a quick task for the price to push up; the bearish pressure is definitely still strong. The second reason is that Bitcoin has already risen over $8,000 from the bottom, and the bulls are not weak either. This clearly indicates a tug-of-war between bulls and bears, with the entire market choosing a direction. Looking at today, the market has indeed moved in this way; neither the bulls nor the bears hold an absolute advantage. If positions are held for too long, profits will be given back, which is also one of the two key strategies mentioned at the end of yesterday's article: first, to close profits in a timely manner and only leave a small portion for speculation; second, not to hold positions for too long. Taking Ethereum as an example from yesterday, it reached our short position of 2880 at 1 PM yesterday, with a minimum drop to 2782. After we internally suggested reducing positions, the second follow-up was again pushed back to its original state! This is mainly because the market tends to change in the late night; the Americans are still bad, and sweeping the market is their specialty. Given the repetitiveness of price movements, in future paid articles, Lao Lu will include the price for reducing positions and the moving stop-loss plan in the articles to avoid confusion for those who pay for reading. Although $5 is not much, it is still a trust in Lao Lu.

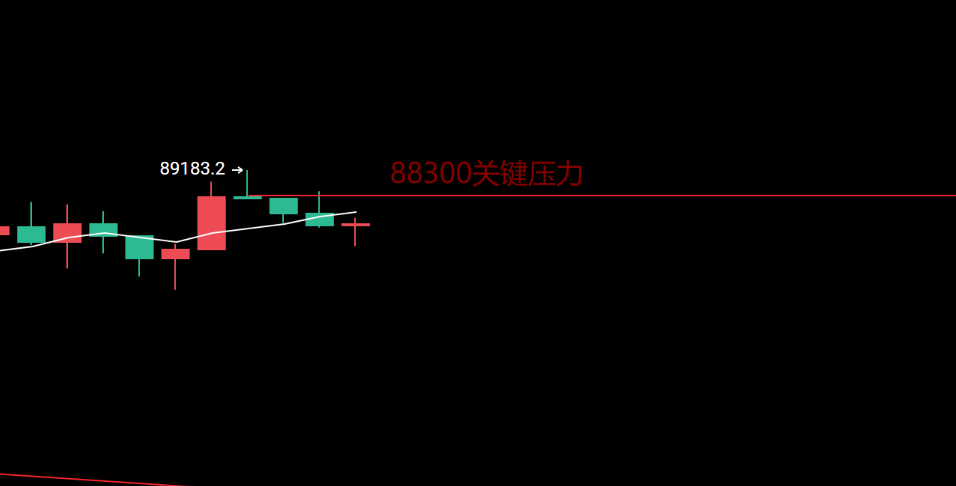

Bitcoin, according to our internal morning tips, the price still hasn't fully broken and stabilized above $88,300. Although the price rose to $89,183 last night, it is important to note the four-hour K-line pattern during the day today, which is a hanging bearish line, and the hanging body part is below $88,300. Therefore, before noon today, we advised not to rush to be bullish, as this is a false breakout. So in terms of operations, we still need to wait because our thought process this week was clear: the price will either rise significantly or fall significantly, and both long and short positions must be at key levels. This is not only for today but also something we need to pay attention to this week. Next, we still need to continue to monitor the K-line's entity breakthrough at $88,300. I will place the line in the chart, and everyone can pay attention to it later. A four-hour big bullish line must stabilize above this line before we can officially go long.

Currently, Bitcoin is not stabilizing above this line, and the upward space is not opening up. Even if Ethereum makes a push upwards, it will still be pushed back to the starting point. Therefore, the focus in the near term should still be on Bitcoin's movements, as the funds for Ethereum still depend on the flow of Bitcoin. If we treat the current price movement as a consolidation, both short and long positions are most taboo to be caught in the middle position, as stop-losses are hard to set. Our maximum stop-loss for Bitcoin is only $1,000, and for Ethereum, it is only $50. In this market, being caught in the middle while shorting or going long can easily lead to being swept away. If we consider shorting, the pressure above Bitcoin is still $88,300. If we consider going long, the support below is $84,800, and for Ethereum, the range is $2,966-$2,835. Both cryptocurrencies are currently within a short-term upward channel, so we should continue to maintain the strategy of buying high and selling low.

Under the premise that Bitcoin does not break the major cycle pressure of $88,300, personally, I am not very willing to go long. However, the market is moving, and analyzing this work is something that must be faced head-on. If we go long, we should set a smaller stop-loss and then speculate. Therefore, at the entry point, we need to be meticulous. The key support for Ethereum is $2,830, and the maximum retracement cannot exceed $2,820. The small support for Bitcoin is $86,200, but considering the current continuous bearish trend, we will not go long in the short cycle. Let's look at tonight's major support level: $84,800.

Currently, in this market, it is better to watch more and act less, opening positions at key levels. The arrangements can be as follows: Bitcoin long at $85,300, with a stop at $84,800. For long positions, $500 is completely sufficient, and even a small profit of $0.10 is enough; if it breaks, it will all be profit. For Ethereum, long at $2,843, with a stop at $2,820. The reason for such a small stop-loss is to consider the high risk of long positions on one hand, and on the other hand, to trade close to the support level, which can easily bring back the risk-reward ratio. If anyone asks what to do if the price rises directly, then just watch! The target for small long positions is for Ethereum to look for $80-$100, and for Bitcoin, between $1,000-$1,500, with a risk-reward ratio of 1:4 being sufficient. Additionally, it is especially important to note that once the price of Ethereum approaches around $2,770, do not think about going long again; $2,620 is definitely not the bottom, and the same goes for Bitcoin. If it is bullish later, the price must not see $84,600; if it breaks, this wave of upward movement will be declared over.

Today: Written by Lao Lu on the evening of November 25, 2025, at 7:25 PM. Please note that all strategies are effective once and cannot be reused! Pay attention to the text version and specific entry prices in the lower right corner of the chart or video.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。