Grayscale launches GXRP ETF on NYSE Arca as latest institutional XRP product. XRP falls despite ETF expansion, slipping toward critical psychological support.

News Background

Grayscale expanded its exchange-traded product lineup on Monday with the launch of the Grayscale XRP Trust ETF (GXRP) on NYSE Arca, offering investors direct and “straightforward exposure” to XRP. The product—originally introduced as a private placement in September 2024—was formally converted into a spot ETF as part of Grayscale’s dual listing alongside its new Dogecoin ETF.

Krista Lynch, Senior Vice President of ETF Capital Markets at Grayscale, said GXRP’s listing is “another meaningful step in broadening access to the growing XRP ecosystem,” positioning the fund as an efficient gateway for both institutional and retail investors.

GXRP joins an expanding roster of XRP-based ETFs, including products from Canary Capital and REX Shares, with several more issuers filing under Section 8(a) for automatic approval. The ETF momentum reflects strong institutional appetite for regulated XRP exposure as the asset continues holding its position as the fourth-largest cryptocurrency by market capitalization.

The growing ETF ecosystem emerges despite XRP’s turbulent regulatory past. The U.S. SEC previously accused Ripple of raising $1.3 billion through unregistered XRP sales. A 2023 federal ruling determined that Ripple’s programmatic exchange sales did not violate securities laws due to their blind bid/ask structure, though direct institutional sales were deemed securities offerings. This partial clarity has helped pave the way for broader institutional acceptance—though price action now depends heavily on technical factors rather than purely regulatory developments.

Price Action Summary

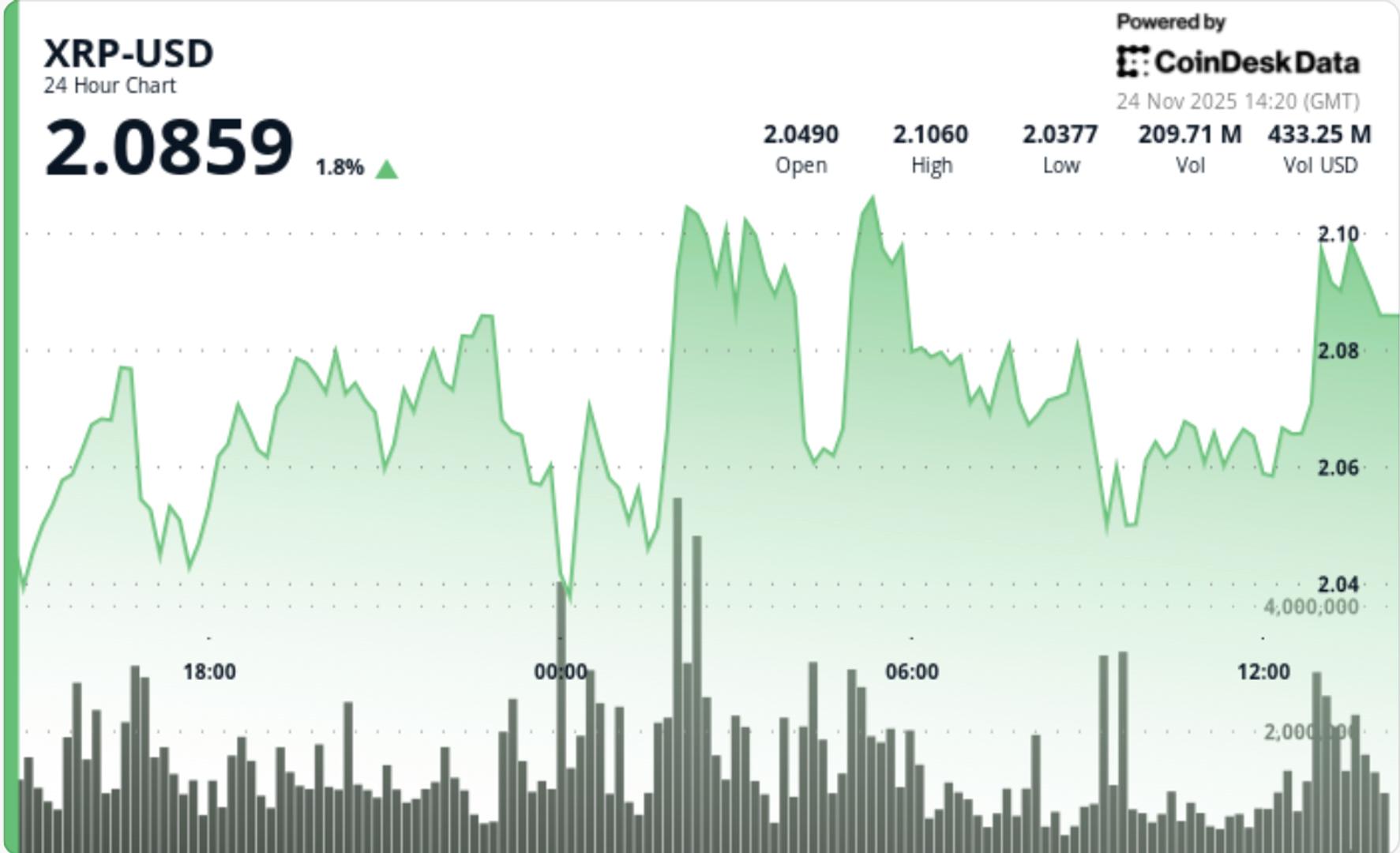

XRP declined steadily through Tuesday’s session, slipping from $2.13 to $2.08 as profit-taking and weak spot flows overshadowed the bullish ETF news cycle. The token traded within a volatile range of $2.03 to $2.15, reflecting persistent uncertainty across crypto markets.

• Volume surged 28% above average, hitting 177.9M during the strongest selloff phase

• Price briefly tapped the $2.03 demand zone, rebounding toward $2.11 before stalling

• Multiple failed attempts to reclaim $2.14–$2.15 confirmed resistance dominance

• Late-session selling cracked the $2.10 support floor, turning it into immediate resistance

Despite the ETF expansion and strengthening institutional infrastructure around XRP, the immediate reaction in spot markets showed traders prioritizing technical levels over fundamentals.

Technical Analysis

The breakdown below $2.10 created a new sequence of lower highs and lower lows, confirming the broader short-term downtrend that has been forming since XRP rejected $2.30 earlier in the week.

- Primary support: $2.03–$2.05 demand zone

- Immediate resistance: $2.14–$2.15 failure region

- Mid-term resistance: $2.20–$2.24 cluster

- Breakdown target: Sub-$2.00 liquidity pocket at $1.91

- The $2.03 level remains critical. A clean breakdown would expose deeper retracement levels tied to October’s structure.

- XRP remains in a short-term descending channel

- Daily timeframe shows sellers defending every retest of $2.15

- A potential base is forming at $2.03–$2.07 but lacks conviction

Momentum indicators (RSI/MACD) show oversold signals forming, but no trend reversal confirmation has emerged.

What Traders Should Watch

- A breakdown opens a direct path toward $1.91 and potentially $1.78 if market-wide risk-off intensifies.

- GXRP and other newly launched ETFs must show sustained inflows, not one-day spikes, for institutional sentiment to translate into spot bid support.

- This resistance cluster determines whether bulls regain control. Acceptance above here targets $2.20–$2.24.

- BTC’s renewed weakness directly impacts high-beta tokens like XRP. If Bitcoin continues violating structural support, XRP may not hold $2.00.

- Whale distribution has slowed—if inflows to exchanges spike again, downside pressure returns immediately.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。