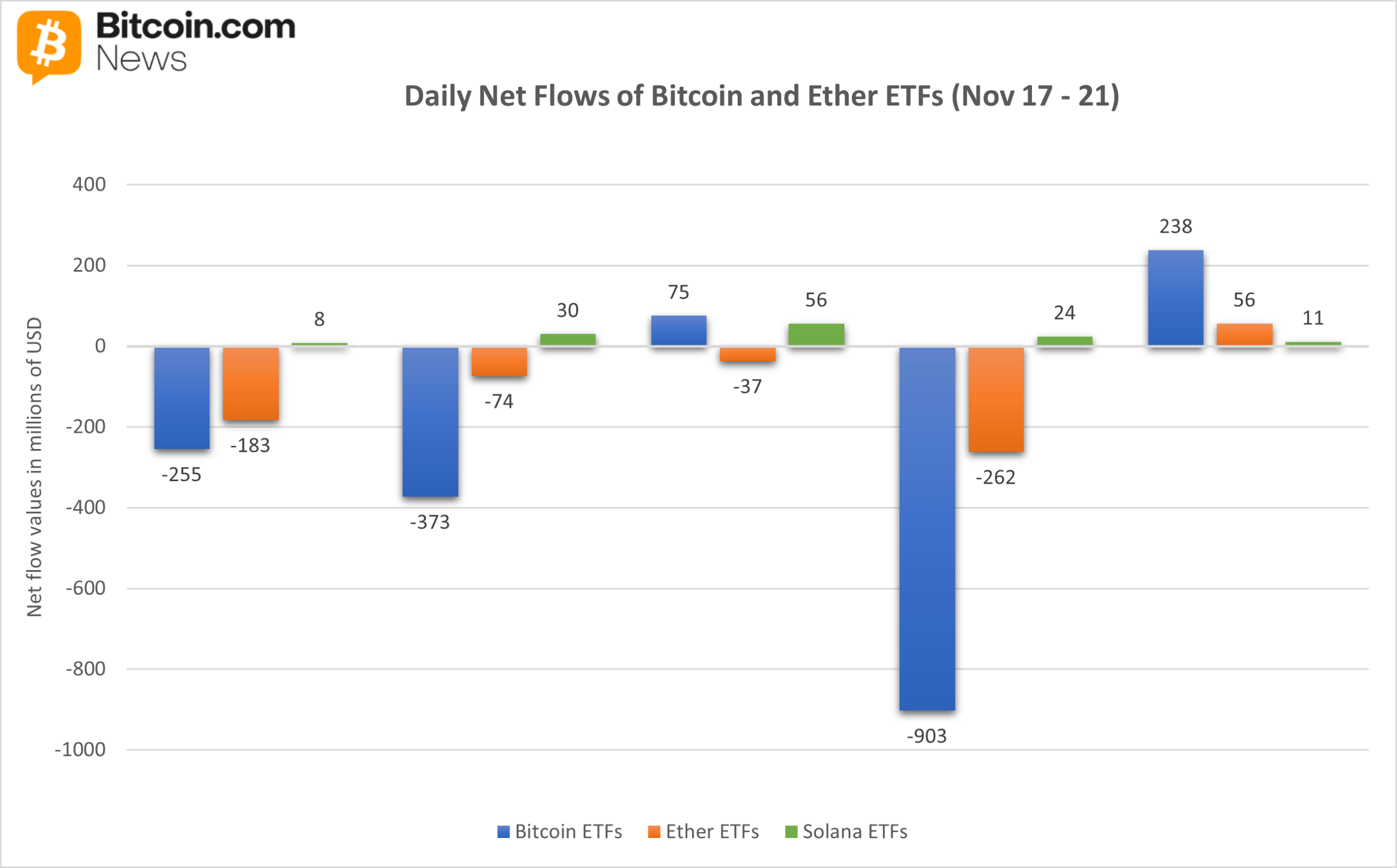

Some weeks tell a story before the numbers even settle. This one was loud, lopsided, and unmistakably patterned: bitcoin and ether continued to leak capital, while solana maintained its improbable streak as the only bright spot in an otherwise risk-off market. From Nov. 17 to 21, the market delivered a tale of contrast, with heavy exits on established giants and steady inflows into a rising contender.

Bitcoin ETFs: A Tumultuous Week of Heavy Exits

Bitcoin exchange-traded funds (ETFs) recorded a punishing $1.22 billion in weekly net outflows, marking the fourth straight week in the red and the third consecutive week of billion-dollar outflow. Blackrock’s IBIT was at the center of the storm, seeing an exit of $1.09 billion for the entire week.

Grayscale’s GBTC was not spared, finishing the week with a –$172.33 million net outflow. Fidelity’s FBTC fared similarly, ending the week down by –$115.68 million. Ark & 21 Shares’ ARKB saw a choppy stretch with a mix of inflows and outflows all week, but ended up with a net outflow of –$85.03 million. Vaneck’s HODL saw a -$63.22 million net outflow, while Bitwise’s BITB closed the week with a -$7.8 million deficit.

A few funds managed to close the week in the green with Grayscale’s Bitcoin Mini Trust seeing a net inflow of $274.20 million, Invesco’s BTCO registering a net entry of $35.80 million for the week, and Franklin’s EZBC seeing a modest net weekly inflow of $3.25 million. Total value traded was $40.32 billion, the highest on record for bitcoin ETFs.

Ether ETFs: A Week Dominated by Massive Exits

Ether ETFs continued their streak of deep red with a $500.25 million net weekly outflow.

Blackrock’s ETHA led the downturn, bleeding -$558.98 million in exits. Grayscale’s ETHE ended deeply negative, with outflows across multiple days totaling –$31.82 million. Vaneck’s ETHV saw a -$14.08 million exit for the week.

Meanwhile, Grayscale’s Ether Mini Trust posted a mixed week but closed positive with $80.88 million, buoyed by strong mid-week inflows. Bitwise’s ETHW saw a net inflow of $14.19 million, Franklin’s EZET closed positively too with $4.76 million, Invesco’s QETH finished the week in the green with $2.93 million, and Fidelity’s FBTC edged it to close at $1.88 million.

Read more: Bitcoin and Ether ETFs Log Third-Largest Weekly Outflows on Record

Solana ETFs: Four Weeks of Green and Growing

Solana ETFs were the lone bright spot, notching $128.20 million in net inflows. Bitwise’s BSOL carried most of the inflows, closing the week with $86.31 million. Grayscale’s GSOL added consistent gains across all five trading days, ending with $18.13 million. Fidelity’s FSOL added $12.81 million, 21Shares’ TSOL added $7.17 million, Vaneck’s VSOL brought in $3.54 million for the week, and Canary’s SOLC provided a small but steady contribution of $244.74K.

Each category told its own story, but taken together, the week revealed a market still jittery, still rotating, and still placing selective bets as crypto sentiment searches for direction.

FAQ🪙

- What was the overall trend in ETF flows this week?

Bitcoin and ether ETFs saw major outflows, while solana remained the only category posting steady inflows. - How did bitcoin ETFs perform during the week?

Bitcoin ETFs lost $1.22 billion, with Blackrock’s IBIT driving most of the week’s declines. - What happened with ether ETFs?

Ether ETFs recorded $500 million in outflows, extending their multi-week downtrend despite a few isolated inflows. Why did solana ETFs stand out again?

Solana ETFs gained $128 million in new capital, marking their fourth consecutive week of strong inflows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。