Severe policy disagreements have emerged within the Federal Reserve, with the focus now on whether to cut interest rates in December. Powell's silence has intensified market uncertainty, while political pressure and a lack of economic data complicate decision-making.

Written by: White55, Mars Finance

The Federal Reserve is currently experiencing one of the most intense policy disagreements in recent years. According to the latest statistics, among the 12 FOMC members with voting rights this year, 5 have clearly expressed a preference to hold steady in December, while another faction, including influential New York Fed President Williams, supports continuing to cut rates.

Since the Fed's most recent interest rate decision on October 29, Chairman Powell has surprisingly remained silent, while his colleagues have taken to the media and public forums to express their positions, laying bare the internal conflicts before the public.

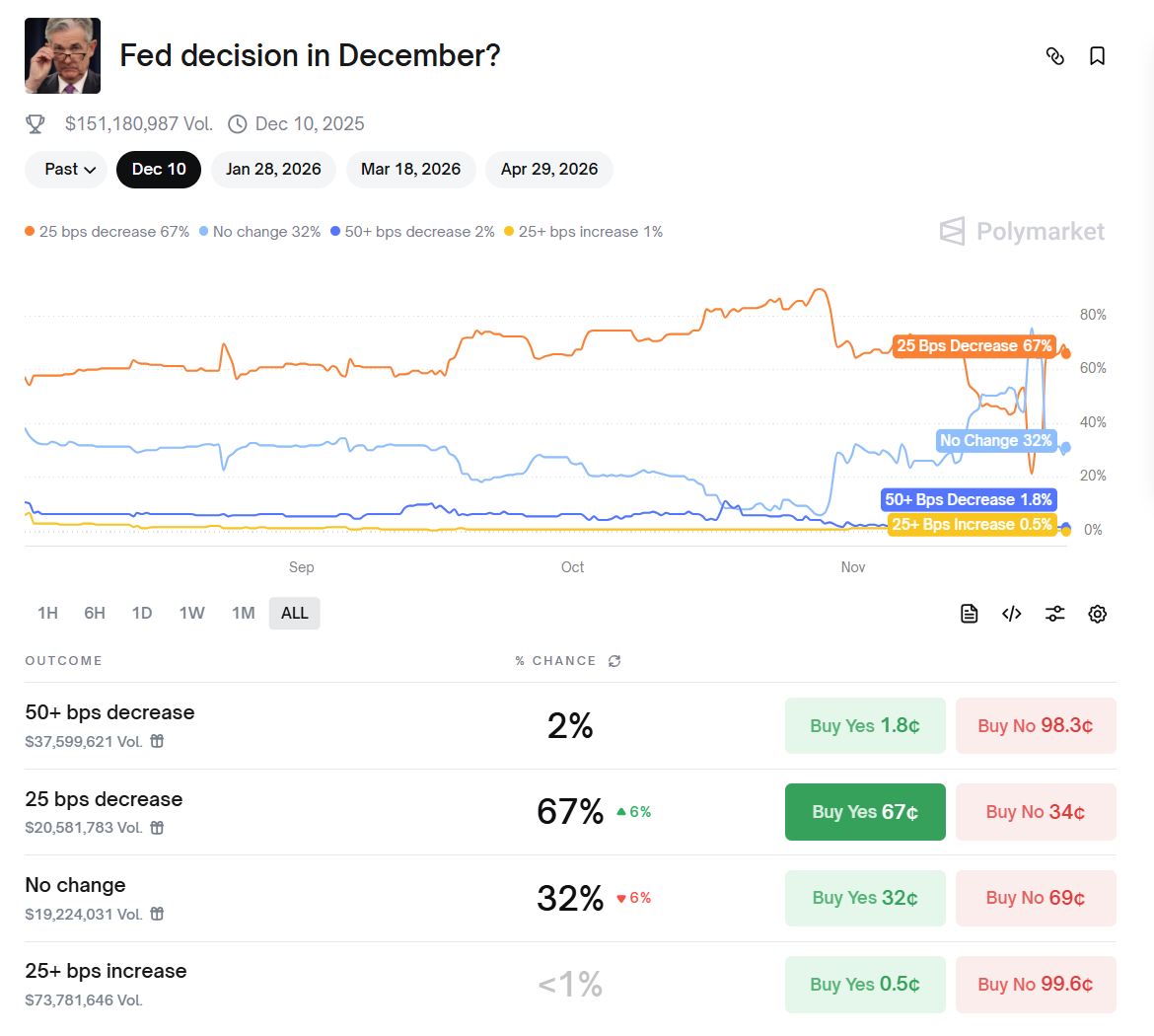

Polymarket data shows the probability of a rate cut rising to over 67%

The depth of this disagreement is evident from the dramatic fluctuations in market expectations: within just a few weeks, the probability of a rate cut in December plummeted from a high of 95% to below 30%, only to quickly rebound to over 60% after Williams spoke. This rollercoaster-like change in expectations reflects the irreconcilable policy conflicts within the Federal Reserve.

Powell's Silence and the Divided Committee

Powell's unusual strategy of silence has sparked widespread speculation. Claudia Sahm, an economist who previously worked at the Fed, interprets this as Powell allowing each FOMC member to express their opinions and be heard, suggesting that this approach of permitting internal debate is "actually a good thing" in the current complex environment. However, under Powell's silence, the divisions within the Fed have become increasingly public.

The results of the October meeting already showed signs of polarization—at that time, the Fed announced a 25 basis point rate cut with a 10-2 vote. Surprisingly, the camp that originally supported the rate cut is now fracturing. St. Louis Fed President Bullard, who supported the cut last month, has now shifted to a skeptical stance, stating, "We must be cautious at this moment; this is crucial."

Even more concerning is that Chicago Fed President Goolsbee, once a dove, has hinted at a possible shift to a cautious stance. Goolsbee, who has never voted against the chair during his nearly three years at the Fed, now clearly states, "If I ultimately firmly support a position that is contrary to everyone else's views, then so be it. I think that's healthy."

Hawks vs. Doves—Ideological Showdown Amid Data Shortages

The Federal Reserve is currently divided into three main factions.

One faction is represented by Kansas City Fed President George, who emphasizes that inflation risks can no longer be ignored. George warns, "In my view, given that inflation remains at elevated levels, monetary policy should suppress demand growth to create space for supply expansion."

On the other side is the dovish faction led by Fed Governor Brainard, who not only supports a rate cut but even calls for a 50 basis point reduction at the December meeting. Brainard believes, "There is already ample evidence that inflation is declining rapidly and the labor market is weak, so further easing is imperative."

The centrist faction is represented by San Francisco Fed President Daly, who is open to a rate cut but emphasizes caution. Daly points out, "We also do not want to make the mistake of keeping the policy rate too long, only to find that it harms the economy. Making the right policy requires an open mindset."

This division was foreshadowed at the July meeting, where for the first time in 32 years, two governors, Waller and Bowman, voted against the chair, breaking the long-standing consensus culture at the Fed.

Data Black Hole and the Fed's Dilemma Amid Government Shutdown

One major difficulty in the Fed's decision-making dilemma is the lack of key economic data. The U.S. federal government shutdown has led to a halt in the release of official data, with the Bureau of Labor Statistics explicitly stating it will not release the October employment report, and the November CPI data will be delayed until December 18—after the Fed's December meeting.

Powell himself has likened this predicament to "driving in a fog," where "you would slow down." The lack of data forces the Fed to rely on private sector data, which presents a contradictory economic picture.

On one hand, inflation remains persistently high. The consumer price index rose 3% year-on-year in September, far exceeding the Fed's 2% inflation target. Particularly concerning is the resilience of service inflation—core service prices, such as housing and healthcare, have maintained year-on-year increases of over 3.5%.

On the other hand, the labor market shows signs of cooling. According to data from employment consultancy Challenger, U.S. companies announced layoffs of 153,000 in October, a staggering 183% increase from September, marking the highest level for the same period in over 20 years. The Chicago Fed's forecast report indicates that the U.S. unemployment rate may slightly rise to 4.4%, the highest level in four years.

Market Voting Patterns and the 50-50 Rate Cut Probability

Faced with such clear divisions within the Fed, market participants have had to change their strategies, shifting from focusing on Fed consensus to "counting votes one by one." This strategic shift clearly reflects the failure of the Fed's communication mechanism and has led to dramatic fluctuations in market expectations.

Morgan Stanley analysts point out that the lack of data and the delayed release of labor market indicators mean that "the Fed will face a dilemma of incomplete information when making decisions at the December meeting." This uncertainty has led traders to reflect a high degree of uncertainty in their bets on the December decision. New York Fed President Williams' remarks last Friday temporarily changed the market landscape. As the third-ranking official at the Fed, Williams stated, "A rate cut may be reasonable in the near future," prompting investors to significantly raise their expectations for a December rate cut.

However, Boston Fed President Collins' hawkish remarks last Saturday doused the market's enthusiasm. Collins believes "there is no need for the Fed to continue cutting rates in December," emphasizing that "there are risks on the inflation front, and a moderately restrictive policy helps ensure inflation declines."

Currently, the CME FedWatch Tool shows a 71% probability of a 25 basis point rate cut in December, with a 29% probability of maintaining rates. However, many analysts believe the actual situation is more complex. Some, like Deutsche Bank senior economist Brett Ryan, believe Williams' remarks have locked in a rate cut, while former Fed economist Claudia Sahm candidly states, "I really think it's still a 50-50 situation."

Historical Reflection and the Fed's Battle for Independence

The current internal divisions are not without precedent in the history of the Fed. In the 1980s, when the Fed pushed interest rates to punitive highs to curb inflation, and in the 1990s, when ongoing concerns about price pressures led many policymakers to worry about excessive easing, there were numerous dissenting votes.

However, what makes this disagreement particularly notable is that it occurs against a backdrop of unprecedented political pressure. President Trump has repeatedly expressed dissatisfaction with Powell, even "half-jokingly threatening" at the U.S.-Saudi Business Forum that "if rates don't go down, I'll fire Treasury Secretary Mnuchin." This intertwining of political pressure and internal disputes has raised deep concerns about the Fed's independence. Economists warn that the tense relationship between the White House and the Fed could undermine the central bank's independence in monetary policy, damaging its ability to control inflation. Dallas Fed President Logan pointed out the fundamental dilemma in current decision-making: "Uncertainty is a common feature of macroeconomic and monetary policy-making. Policymakers cannot know the current state of every relevant aspect of the economy, yet they must still make policy decisions."

The probability numbers from the FedWatch Tool continue to fluctuate, but more analysts are beginning to agree with Claudia Sahm's assessment—that this debate is truly a 50-50 situation. Regardless of the outcome of the December 10 meeting, Powell will face a divided committee, and his leadership will be put to an unprecedented test.

The market has already realized that the era when the Fed could easily reach a consensus is over. As Fed Governor Waller stated, "You may see the FOMC exhibiting the least groupthink it has in a long time."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。