Coinbase opted to move about 4.01% of the 19,952,526 BTC circulating today in a hefty shift “from legacy internal wallets to new internal wallets.”

In short, the coins previously sat in P2PKH (Pay-to-Public-Key-Hash) wallets and have now been relocated to upgraded P2WPKH (Pay-to-Witness-Public-Key-Hash) addresses. Btcparser.com spotted the activity, and onchain analyst Sani, who operates timechainindex.com, also flagged the movement.

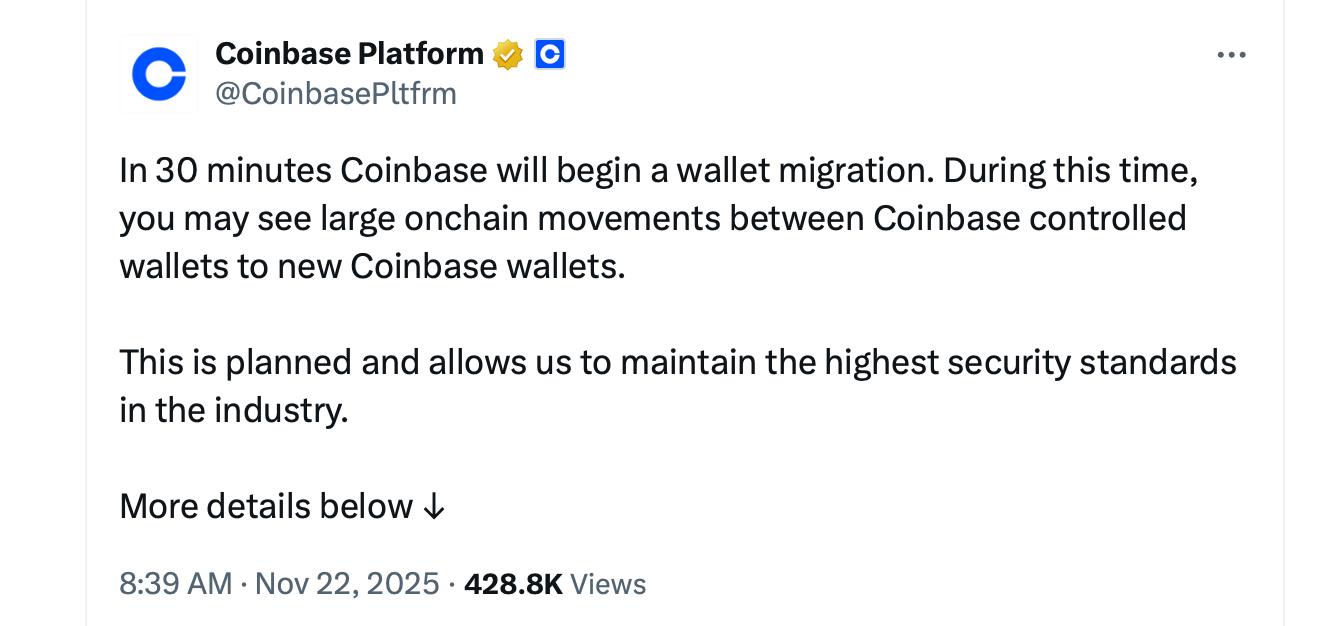

Coinbase explained in a blog post that it was carrying out an onchain fund migration that involved shifting both BTC and ETH. The company emphasized nothing prompted the move and that the migration was “planned well in advance.”

Statistics from btcparser.com show that among all addresses holding more than 1,000 BTC moved to the new format, the total exceeds 785,000 bitcoins. Timechainindex.com’s Sani broke it down on X, noting that Coinbase transferred 798,636.80107189 BTC between block heights 924641 and 924784.

Sani added that his data shows 0.31236970 BTC—around $26,500—in onchain fees were paid to miners for the migration. “This indicates significant consolidation, reducing the number of outputs held in these addresses by over 97%, which will lower future transaction fees and streamline wallet management,” Sani explained.

Read more: Why the United States Could See a New Political Party by 2026

Naturally, a few fools on X tried spinning conspiracy tales about whales plotting to pump bitcoin, and—shockingly—none of it holds water. While Coinbase’s own explanation leaves wiggle room, Sani’s breakdown checks out. It’s also possible Coinbase shifted funds from P2PKH wallets to P2WPKH addresses due to rising concerns around quantum computing.

That theme has been consistent throughout 2025 as growing fears about quantum threats to P2PKH wallets and older formats like P2PK (Pay-to-Public-Key) have prompted dormant wallets and major holders to adopt more advanced address types.

Coinbase’s action stands out because it reflects a major custodial player proactively modernizing its internal infrastructure at an enormous scale—something few entities can execute without rattling the market. Bitcoin’s price remained steady and unfazed throughout the entire process, even as a few foolish X posts tried—and failed—to stir up drama.

- What did Coinbase do?

Coinbase migrated nearly 800,000 BTC—about 4% of bitcoin’s circulating supply—to new internal wallets. - Why did the migration happen?

The exchange said the move was an internal upgrade planned in advance, not triggered by any external event. - Did this impact bitcoin’s price?

Bitcoin’s price stayed steady throughout the migration despite misleading chatter on X. - Why does this move matter?

The shift highlights ongoing upgrades toward newer, more efficient wallet formats and growing concern over future-proof security.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。