Overnight, the US stock market shifted from euphoria to panic, with the dramatic reversal of the three major indices from high openings to low closings reflecting the intense collision between macro policies and micro performances.

At 12:00 AM on November 21, 2025, Beijing time, the US capital market experienced a thrilling night. Nvidia delivered what was called the "most impressive" earnings report in history, and the non-farm employment data appeared strong on the surface, yet failed to prevent the dramatic reversal of the three major US indices from high openings to low closings.

The Nasdaq index soared 2.18% during the day but plummeted 2.16% by the close. The S&P 500 index also shifted from a peak increase of 1.4% to a closing drop of 1.56%. Nvidia's positive earnings report was short-lived, with its stock price dropping 3% after initially rising over 5% in pre-market trading. This night revealed the complex challenges facing US assets amid the intense collision of macro policies, industry narratives, and market sentiment.

1. Nvidia Earnings Report: The AI Myth Meets the Macro Iron Fist

As investors hoped Nvidia's strong earnings report could reverse the market's downturn, the data, despite being impressive, led to a stunning market reversal.

Record Performance

● Nvidia's revenue for the third quarter of fiscal year 2026 reached $57.01 billion, a year-on-year increase of about 62%, exceeding analysts' expectations of $55.19 billion. This revenue growth rate accelerated from 56% in the previous quarter, marking the first acceleration in two years.

● The data center business performed particularly well, with revenue of $51.2 billion, a year-on-year increase of 66%, accounting for nearly 90% of the company's total revenue.

● Even more encouraging, Nvidia provided a strong outlook for future performance, expecting fourth-quarter revenue to reach $65 billion, far exceeding analysts' expectations of $61.98 billion.

Market Unimpressed

● However, the capital market reacted coldly. Nvidia's stock price reversed from an initial rise of over 5% in pre-market trading to a 3% drop at the close. This "good news turns into bad news" reaction pattern exposed the market's deep skepticism about the sustainability of the AI narrative.

● The Philadelphia Semiconductor Index also suffered a heavy blow, shifting from a significant morning rise to a nearly 4.8% drop at the close. Stocks related to the AI ecosystem, such as AMD and Broadcom, initially received a boost but subsequently fell back with the market.

Bubble Controversy Resurfaces

During the earnings call, Nvidia CEO Jensen Huang attempted to dispel market concerns about an AI bubble.

● He emphasized, "The computational demands for training and inference continue to accelerate, both growing exponentially. We have entered a virtuous cycle of AI." However, this defense was likened by some market observers to being a "shovel seller in a gold rush," suggesting that as the largest beneficiary, Nvidia would not acknowledge the existence of an AI bubble.

● Investors' concerns about an AI bubble are not focused on this quarter or the next few quarters, but rather on whether capital expenditures can continue to grow in one or two years.

2. Non-Farm Data: Contradictory Signals in the Job Market

The non-farm employment report released last night for September is arguably one of the most confusing economic data in recent years, with strong surface figures hiding concerning structural issues.

Strong Surface vs. Structural Concerns

● The US added 119,000 non-farm jobs in September, far exceeding the expected 51,000, marking the highest increase since April. But the devil is in the details—the data for the previous two months was significantly revised down, with August's job numbers adjusted to -4,000.

● This indicates that the US job market showed signs of contraction during the summer, and the growth momentum is not as strong as it appears on the surface. More worryingly, the unemployment rate unexpectedly rose to 4.4%, the highest level since October 2021.

Concerns Over Data Quality

The "strong" performance of this report largely relies on an unusual seasonal adjustment factor. If calculated based on historical adjustment ranges, the real employment growth reflected by the raw data could be very weak, even negative.

● Job quality is also alarmingly low. New jobs were mainly concentrated in leisure and hospitality (+47,000) and education, healthcare, and social services (+57,000), which are low-paying sectors.

● Meanwhile, key sectors such as manufacturing, construction, transportation and warehousing, wholesale and retail, finance, professional and business services, and information technology all showed zero or negative growth.

Impact on Monetary Policy

This contradictory report puts the Federal Reserve in a dilemma: facing the reality of declining job quality while needing to be wary of the deflationary risks posed by a slowdown in wage growth to 0.2%.

● The CME FedWatch tool shows that market expectations for a rate cut in December have fluctuated. For the Federal Reserve's decision on whether to cut rates in December, the unemployment rate is a relatively "real" data point, while new job additions may still be subject to revision, making them relatively "virtual."

3. Rate Cut Expectations: The Federal Reserve's Tough Choice

As market fantasies about easing policies are gradually shattered, the Federal Reserve faces an unprecedented policy dilemma.

Expectation Reversal

● Market expectations for a Federal Reserve rate cut have significantly cooled. The probability of a rate cut in December has dropped from nearly 90% a month ago to a range of 32%-40%. This change reflects the market's realization of serious internal divisions within the Federal Reserve regarding whether to cut rates further.

Internal Divisions at the Federal Reserve

The October meeting resulted in a 10 to 2 vote to cut rates by 25 basis points.

● Meeting minutes revealed that several officials expressed a preference to keep rates unchanged, believing that current data is insufficient to justify another rate cut.

● Due to the government shutdown causing delays in key data, they are unable to fully understand the economic situation, leading to hesitation in making rate decisions.

Uncertain Future Path

● Doves still dominate the voting committee for the December meeting, with CITIC Securities continuing its previous view that December may be a "close call" for a rate cut of 25 basis points. The September non-farm report is not the last data point regarding the US job market before the December meeting.

● Weakness in the job market will continue to be reflected in subsequent economic data, including the Federal Reserve's Beige Book on November 26, and the ISM Manufacturing PMI and Services PMI released on December 1 and 3, respectively.

4. Chain Reaction from US Stocks to Crypto Assets

As a barometer of market risk appetite, cryptocurrencies have suffered greatly in this round of sell-offs, with traditional risk assets and the crypto market both facing difficulties.

US Stocks High Open Low Close

● Last night, US stocks experienced a typical "high open low close" trend. Boosted by the "goldilocks" non-farm data and Nvidia's strong earnings report, the three major indices opened significantly higher.

● However, after lunch, the situation took a sharp turn, with Bitcoin dropping below the $90,000 mark during US trading, triggering a sell-off of high-risk assets.

● Meanwhile, Federal Reserve Governor Cook warned that risks in the private credit market could spread to the entire financial system.

● Well-known financial journalist Nick Timiraos, dubbed the "new Federal Reserve correspondent," wrote that the September non-farm employment report is unlikely to help the Federal Reserve reach a consensus on whether to pause rate cuts next month. The optimistic sentiment quickly turned, leading to a dramatic reversal in US stocks.

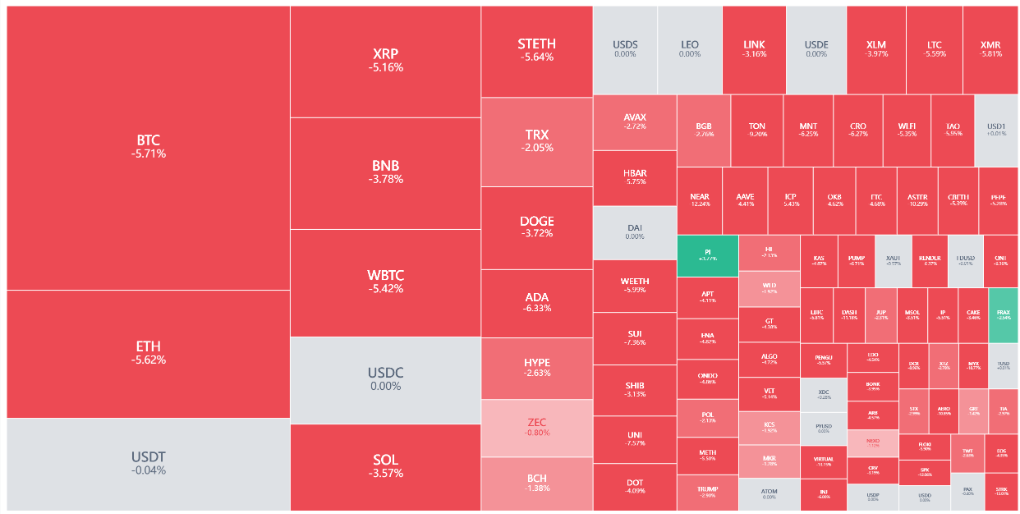

Crypto Market Catastrophe

● The cryptocurrency market faced a brutal sell-off. Bitcoin crashed from a high of $93,000 to below $87,000, plummeting over $5,000 in a single day. The total liquidation amount across the network reached $814 million, plunging the market into a state of "extreme fear."

● This crash occurred against the backdrop of Bitcoin's correlation with the Nasdaq index rising to 0.80, exposing it completely to the volatility risks of traditional financial markets. When tech stocks face sell-offs, cryptocurrencies no longer possess independent safe-haven attributes.

Market Logic Transformation

● The crypto asset market is shifting from "narrative-driven" to "value and adoption-driven."

● The era where narratives could drive dozens of times in price increases is over; institutional entry no longer means unconditional rises but pulls crypto assets into a pricing framework closer to traditional finance.

● In this new framework, events like "ETF launches" and "regulatory optimizations" are more foundational engineering rather than triggers for price surges. The market is transitioning from "story-driven" to "model-driven," where positive news needs cash flow validation, adoption requires data support, and user growth must be real and observable.

5. Reconstruction of Risk Asset Pricing Logic

This dramatic reversal is not caused by a single factor but is the result of multiple negative sentiments resonating, potentially marking a fundamental shift in market logic.

Policy Path Dependence

● The Federal Reserve is struggling to balance between combating inflation and preventing recession, with any policy misstep potentially triggering severe market volatility.

● Internal divisions within the Federal Reserve are intensifying; Goldman Sachs believes that if the unemployment rate continues to worsen, the probability of a rate cut next year still exists; however, institutions like Morgan Stanley are betting on maintaining the current rates in December.

Asset Price Restructuring

● The market is shifting from "narrative-driven" to "substantive verification," with AI companies needing to prove the sustainability of their profits.

● Cryptocurrencies need to break through liquidity constraints: the Federal Reserve not cutting rates means high financing costs, suppressing speculative demand. When the market begins to be indifferent to even the most favorable news, it often signifies the beginning of an adjustment period.

Investment Logic Shift

● For tech stocks, investors need to distinguish between companies investing in AI and those that can turn AI into products that users are genuinely willing to pay for.

● For crypto assets, the industry will enter a new decade, where the winners will no longer be L1/L2 but rather the "user aggregation layer"—platforms that can embed crypto capabilities into real-world scenarios.

● Simply relying on selling "chain speed and capacity" will struggle to maintain premiums, while products and platforms that can aggregate large-scale users and make the chain "invisible" will be the value center of the next decade.

When even Nvidia's brilliant earnings report cannot restore market confidence, when the surface gloss of non-farm data cannot hide structural cracks, and when the Federal Reserve's rate cut expectations are completely overturned, what investors witness is not just a single-day fluctuation but a fundamental shift in asset pricing paradigms.

From "narrative-driven" to "substantive verification," from "liquidity euphoria" to "fundamental testing," this market strangulation occurring in the deep autumn of 2025 marks the beginning of a new investment era.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。