比特币再次回落至90,000美元以下,所谓的“纸手”投资者纷纷逃离。至少这是加密市场分析公司Glassnode在周三的博客中透露的。

“这次下跌标志着自2024年初以来,价格第三次跌破短期持有者成本基础模型的下限,”该公司解释道。“然而,这次顶级买家的恐慌程度显著更高。”

(几乎所有在过去155天内购买比特币的短期持有者都处于亏损状态,这种情况导致了恐慌抛售,Glassnode表示。/ Glassnode)

换句话说,在过去155天内购买比特币的投资者和交易者,或者说在6月17日及之后购买的,都是处于亏损状态。当时比特币的交易价格大约为104,000美元,比今天的价格高出约15,000美元。

阅读更多: 是的,比特币下跌了,但“抛售已经结束,”渣打银行表示。

但恐慌抛售并不是导致加密货币下跌的唯一因素,Glassnode还指出,需求疲软、高额ETF流出、波动性加大以及从投机转向对冲,都是该资产下跌的关键因素。

根据Sosovalue.com的数据,比特币ETF在本月的净流出接近30亿美元。比特币衍生品的投机活动枯竭,取而代之的是寻求对冲风险而非追求利润的焦虑交易者。波动性飙升,尤其是在比特币跌破90,000美元之后。“隐含波动性现在接近10月10日清算事件期间的水平,显示出交易者如何迅速重新评估近期风险,”Glassnode表示。

在所有这些因素对比特币施加负面压力的情况下,谁能责怪“纸手”人群跳船呢?如果不久后没有变化,生态系统可能会迅速滑入熊市区域。

“必须出现更强的需求来吸收困境中的卖家,”Glassnode解释道。“否则,市场将需要更长、更深的积累阶段才能恢复平衡。”

根据Coinmarketcap的数据,比特币在撰写时下跌4.45%,报89,106.70美元,这意味着七天内下降了12.17%。在过去24小时内,这种数字资产的最低交易价格为88,760.35美元,最高为93,549.36美元。

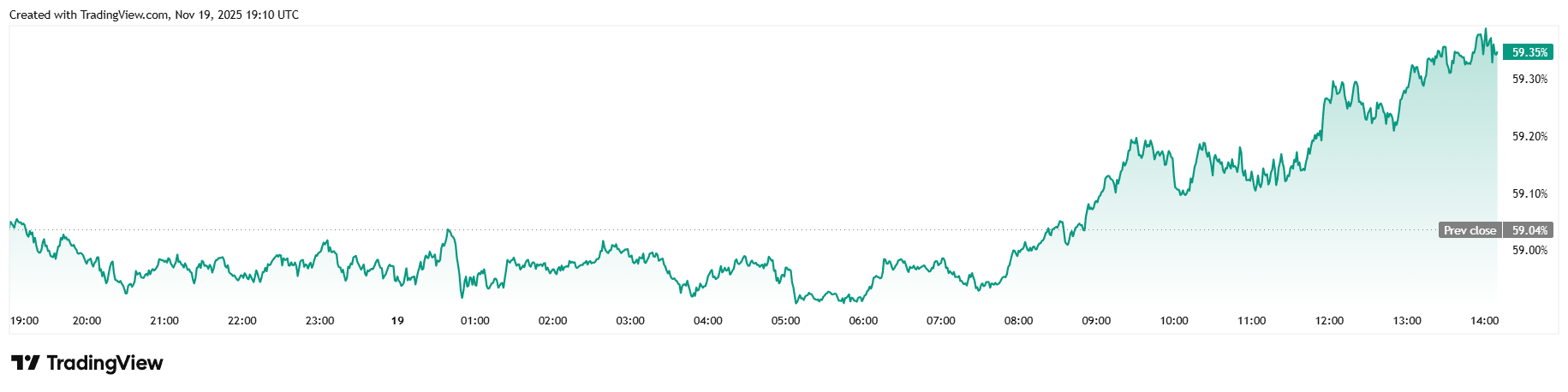

(比特币价格 / Trading View)

每日交易量下降了36.54%,降至736.8亿美元。市场总市值降至1.87万亿美元,但比特币的主导地位上升了0.51%,达到59.35%,这表明比特币的表现优于许多其他加密货币。

(比特币主导地位 / Trading View)

根据Coinglass的数据,未平仓比特币期货合约的总价值下降了1.16%,降至657.7亿美元。清算最终减弱,自昨天以来为1.446亿美元。多头投资者仍然承受了大部分损失,达到1.2482亿美元,但这与周二的3.5912亿美元相去甚远。空头卖家的清算特别低,仅为1978万美元。

- 为什么比特币再次跌破90,000美元?

Glassnode表示,需求疲软、ETF流出和波动性上升的混合因素使比特币再次大幅下跌。 - 在下跌期间谁在抛售?

短期持有者;那些在过去155天内购买的人,随着价格跌破其成本基础而恐慌抛售。 - ETF和衍生品市场发生了什么?

比特币ETF在本月的流出接近30亿美元,而交易者在波动性飙升时从投机转向对冲。 - 比特币要恢复需要发生什么?

Glassnode表示,必须出现更强的需求来吸收困境中的卖家,否则比特币可能面临更长的积累阶段。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。