原文标题:The Perp DEX Wars of 2025: Hyperliquid, Aster, Lighter, and EdgeX

原文作者: @stacy_muur

编译:Peggy,BlockBeats

编者按:去中心化永续合约交易(Perp DEX)赛道在过去一年经历了剧烈变革:从 Hyperliquid 的绝对统治,到 Aster、Lighter、EdgeX 的崛起,市场格局正在重塑。

本文从技术架构、核心指标、风险事件到长期可行性等角度,深度解析四大平台,旨在帮助读者看清「数据背后的真相」,而非仅凭交易量排名做判断。

以下为原文:

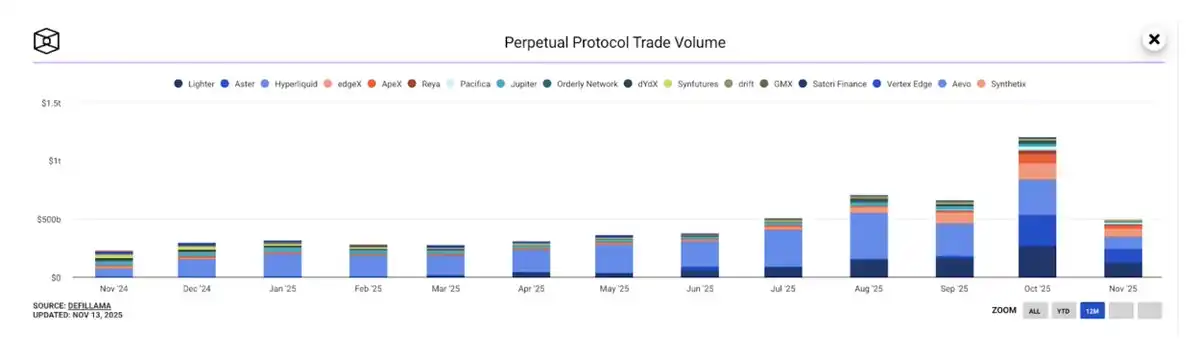

2025 年,去中心化永续合约(perp DEX)市场迎来爆发式增长。2025 年 10 月,永续合约 DEX 的月度交易量首次突破 1.2 万亿美元,迅速吸引了散户交易者、机构投资者和风投基金的高度关注。

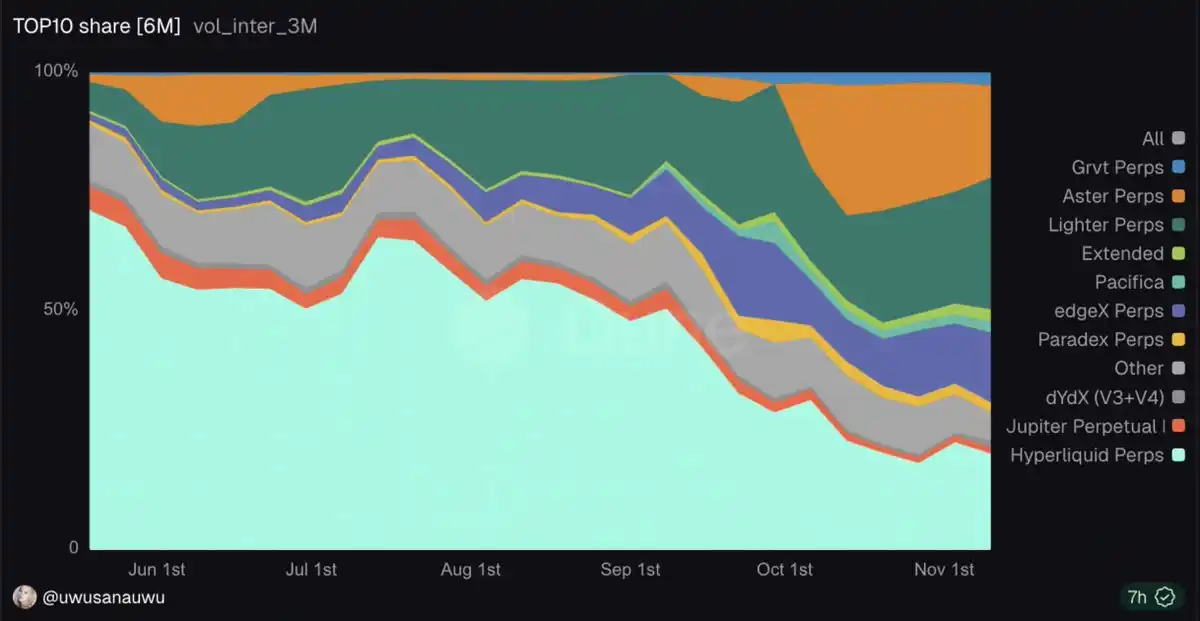

过去一年,Hyperliquid 几乎独占鳌头,在今年 5 月达到巅峰,占据链上永续合约交易量的 71%。然而时间来到 11 月,其市场份额已骤降至 仅 20%,新兴竞争者正在迅速抢占地盘:

- Lighter:27.7%

- Aster:19.3%

- EdgeX:14.6%

在这个高速发展的生态中,四大主导玩家已然崭露头角,正为行业霸主地位展开激烈竞争:

@HyperliquidX——链上永续合约的资深王者

@Aster_DEX——交易量庞大、争议不断的「火箭」

@Lighter_xyz——零手续费、原生 zk 的颠覆者

@edgeX_exchange——低调却与机构深度契合的「黑马」

这篇深度调查旨在拨开迷雾,剖析每个平台的技术实力、核心指标、争议焦点及长期可行性。

第一部分:Hyperliquid,无可争议的王者

为什么 Hyperliquid 能称霸?

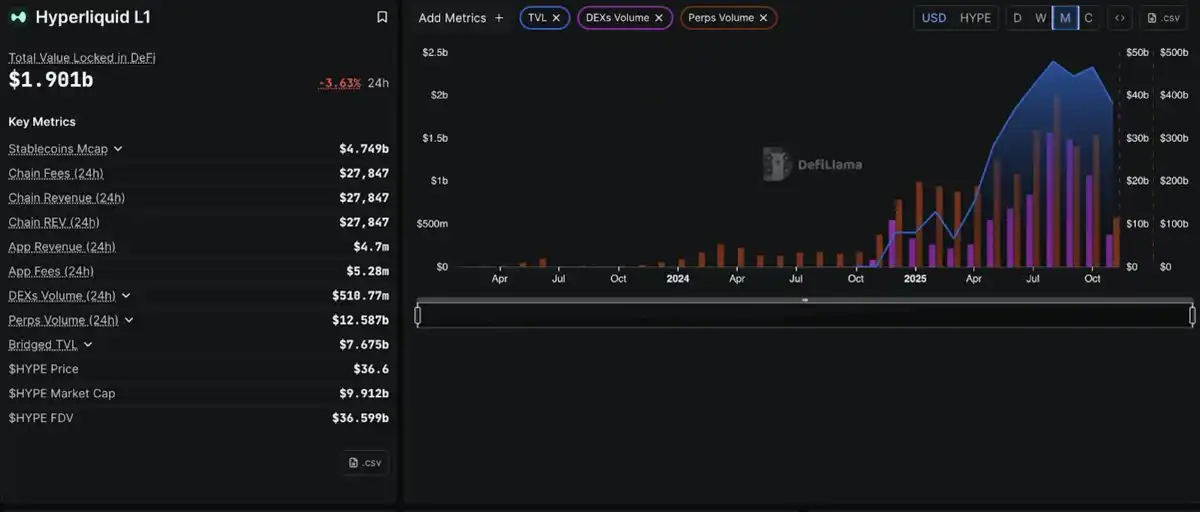

Hyperliquid 已确立其作为行业领先的去中心化永续合约交易平台的地位,巅峰时期市场份额超过 71%。尽管竞争对手曾凭借爆炸式的交易量增长抢占头条,Hyperliquid 仍是整个永续合约 DEX 生态的结构性支柱。

技术基础

Hyperliquid 的优势源于一个革命性的架构决策:打造专为衍生品交易设计的定制 Layer 1 区块链。其 HyperBFT 共识机制实现亚秒级订单确认,并支持每秒 20 万笔交易,性能媲美甚至超越中心化交易平台。

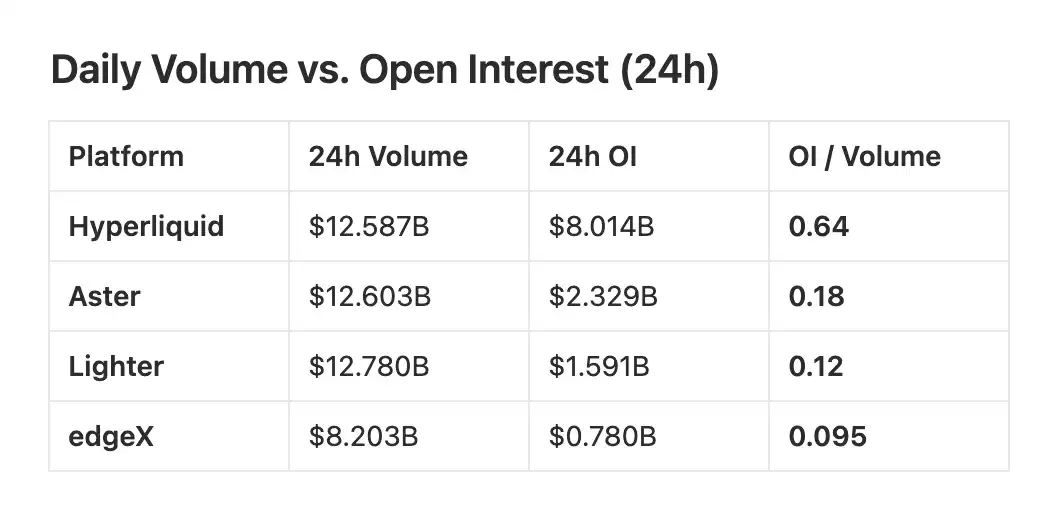

未平仓量的真相

竞争对手常以惊人的 24 小时交易量吸引眼球,但真正揭示资金部署情况的指标是 未平仓量(Open Interest,OI),即所有仍在持仓的永续合约总价值。

交易量显示活跃度,未平仓量显示资金承诺。

根据 21Shares 数据,2025 年 9 月:Aster 占据约 70% 总交易量;Hyperliquid 一度跌至约 10%

但这只是交易量上的优势,而交易量是最容易通过激励、返佣、做市商频繁交易甚至「刷量」行为来操纵的指标。

最新 24 小时未平仓量数据显示:

-Hyperliquid:$8.014B

-Aster:$2.329B

-Lighter:$1.591B

-edgeX:$780.41M

前四平台总 OI:$12.714B

Hyperliquid 占比:约 63%

这意味着,Hyperliquid 持有的未平仓头寸接近整个市场的三分之二,超过 Aster、Lighter 和 edgeX 三者总和。

未平仓量市场份额(24 小时)

-Hyperliquid:63.0%

-Aster:18.3%

-Lighter:12.5%

-edgeX:6.1%

该指标反映的是交易者愿意隔夜留存资金,而非单纯为了刷激励或频繁交易。

Hyperliquid:高 OI/交易量比率(约 0.64),显示大量交易流量转化为持续持仓。

Aster & Lighter:低比率(约 0.18 和 0.12),表明交易频繁但资金留存少,典型的激励驱动行为,而非稳定流动性。

完整图景

交易量(24h):显示短期活跃度

未平仓量(24h):显示风险资金留存

OI/交易量比率(24h):揭示真实交易 vs 激励驱动交易

从所有 OI 相关指标来看,Hyperliquid 是结构性领导者:未平仓量最高;承诺资金占比最大;OI/交易量比率最强;OI 总量超过后三个平台之和

交易量排名会波动,但未平仓量揭示真正的市场领导者,而这个领导者就是 Hyperliquid。

实战验证

在 2025 年 10 月的清算事件中,$190 亿头寸被清算,Hyperliquid 在处理巨量交易峰值时保持 零宕机。

机构认可

21Shares 已向美国 SEC 提交 Hyperliquid(HYPE)产品申请,并在瑞士证券交易平台上市了受监管的 HYPE ETP。这些进展(包括 CoinMarketCap 等平台的报道)显示机构对 HYPE 的接入正在增加。HyperEVM 生态也在扩展,尽管公开数据尚未验证「180+项目」或「$4.1B TVL」的确切说法。

结论

基于当前的备案、交易平台上市情况以及生态增长,Hyperliquid 展现出强劲势头和日益增强的机构认可,进一步巩固其作为领先 DeFi 衍生品平台的地位。

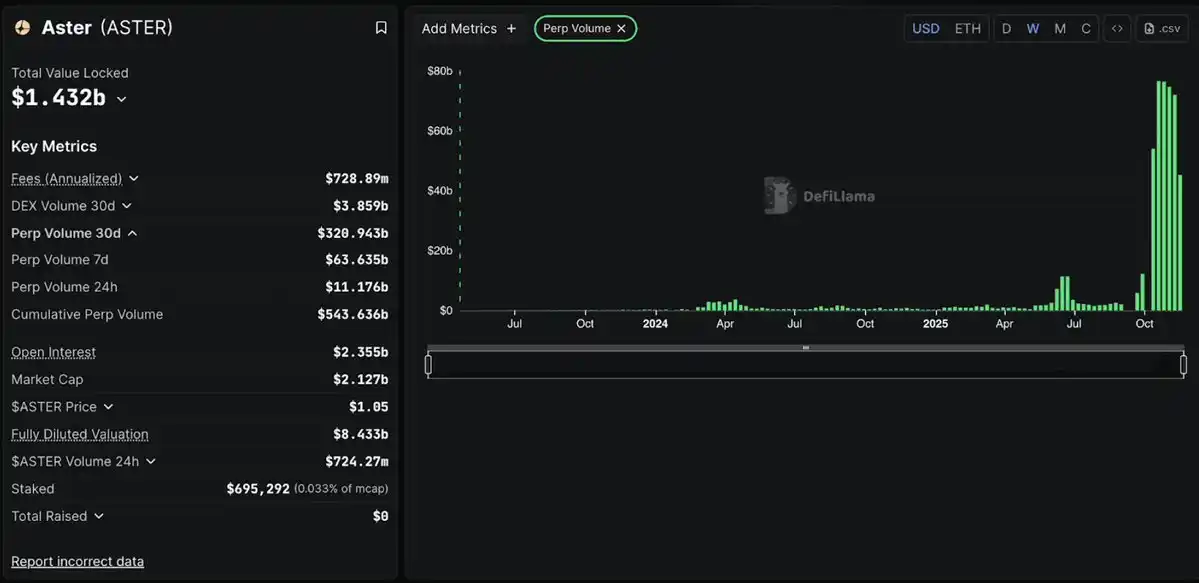

第二部分:Aster,爆炸式增长与丑闻并存

Aster 的定位

Aster 是一家多链永续合约交易平台,于 2025 年初上线,目标明确:在 BNB Chain、Arbitrum、Ethereum 和 Solana 等网络上,为用户提供高速、高杠杆的衍生品交易,而无需跨链转资产。

该项目并非从零开始,而是源于 2024 年底 Asterus 与 APX Finance 的合并,结合了 APX 成熟的永续合约引擎与 Asterus 的流动性技术。

爆炸式崛起

Aster 于 2025 年 9 月 17 日以 $0.08 上线,仅一周便飙升至 $2.42,涨幅高达 2800%。日交易量在峰值时突破 $700 亿,一度主导整个永续合约 DEX 市场。

这枚「火箭」的燃料?CZ。币安创始人通过 YZi Labs 支持 Aster,并亲自发推助力,令代币直线拉升。上线首 30 天,Aster 累计交易量超过 $3200 亿,短暂占据 50% 以上 市场份额。

DefiLlama 下架事件

2025 年 10 月 5 日,作为加密行业最受信任的数据源,DefiLlama 删除了 Aster 的数据,原因是其交易量与币安的交易量几乎 完全一致(1:1 相关性)。

真实交易平台会呈现自然波动,而完美相关只意味着一件事:数据造假。

证据包括:

-交易量模式与币安完全同步(XRP、ETH 等所有交易对)

-Aster 拒绝提供交易数据,无法验证交易真实性

-96% 的 ASTER 代币集中在 6 个钱包

-交易量/OI 比率高达 58+(健康水平应低于 3)

ASTER 代币立即暴跌 10%,从 $2.42 跌至当前约 $1.05

Aster 的辩解

CEO Leonard 声称,这种相关性只是「空投用户」在币安对冲。但如果属实,为什么拒绝公开数据证明?

数周后 Aster 重新上架,但 DefiLlama 警告:「仍是黑箱,我们无法验证数据。」

它真正提供的功能

公平而言,Aster 确实有一些技术亮点:1001 倍杠杆;隐藏订单;多链支持(BNB、Ethereum、Solana);可生息抵押品

此外,Aster 正在构建基于零知识证明的 Aster Chain,以实现隐私保护。但再好的技术也无法掩盖虚假指标。

结论

证据确凿:

-与币安完美相关 = 刷量交易

-拒绝透明 = 隐瞒事实

-96% 代币集中 = 高度中心化

-DefiLlama 下架 = 信誉崩塌

Aster 借助 CZ 的热度和虚假交易量攫取了巨大价值,却未能建立真实的基础设施。或许因币安支持而存活,但信誉已永久受损。

对交易者: 高风险,你押注的是 CZ 的叙事,而非真实增长。请设置严格止损。

对投资者: 避免,风险信号过多,市场上有更好的选择(如 Hyperliquid)。

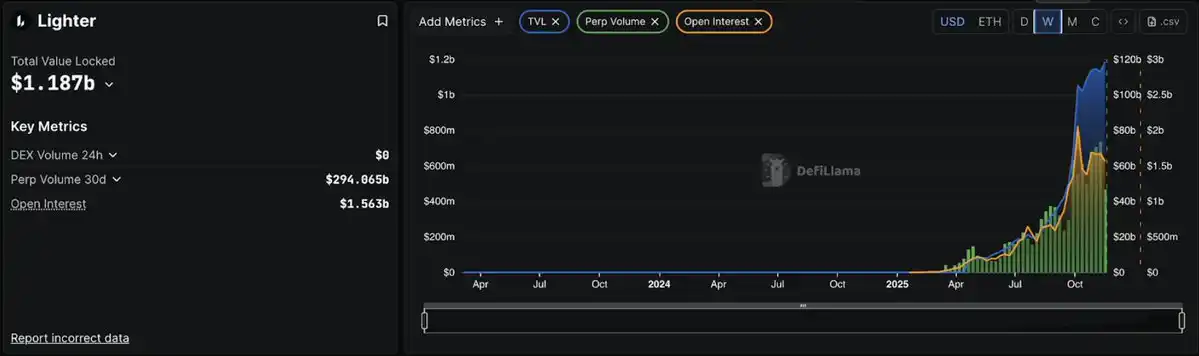

第三部分:Lighter,技术亮眼,指标存疑

技术优势

Lighter 与众不同。由前 Citadel 工程师创立,并获得 Peter Thiel、a16z、Lightspeed 支持(融资 $6800 万,估值$15 亿),其核心技术是利用 零知识证明(ZK)对每笔交易进行加密验证。

作为 以太坊二层(L2),Lighter 通过「逃生舱」机制继承以太坊安全性——即使平台故障,用户仍可通过智能合约取回资金。而应用链 L1 则没有这种安全保障。

Lighter 于 2025 年 10 月 2 日上线,数周内 TVL 突破$11 亿,日交易量达 $70-80 亿,用户超过 56,000 人。

零手续费 = 激进策略

Lighter 对挂单和吃单均收取 0 手续费,彻底颠覆了对手续费敏感的交易者选择。

策略很简单:通过不可持续的经济模式抢占市场份额,建立用户忠诚度,后续再实现盈利。

10 月 11 日压力测试

主网上线 10 天后,加密市场遭遇史上最大清算事件,$190 亿头寸被清算。

好消息:系统在 5 小时混乱中保持运行,LLP 在竞争对手撤退时提供流动性。

坏消息:数据库在 5 小时后崩溃,平台宕机 4 小时。

更糟糕:LLP 亏损,而 Hyperliquid 的 HLP 和 EdgeX 的 eLP 却盈利。

创始人 Vlad Novakovski 解释:原计划周日升级数据库,但周五的剧烈波动提前击垮了旧系统。

交易量问题

数据强烈暗示 刷分行为:

-24 小时交易量:$127.8 亿

-未平仓量(OI):$15.91 亿

-交易量/OI 比率:8.03

-健康水平 = 低于 3,超过 5 即可疑,8.03 极端异常。

对比:

Hyperliquid:1.57(自然)

EdgeX:2.7(中等)

Aster:5.4(令人担忧)

Lighter:8.03(刷分严重)

交易者每部署$1 资金,就制造$8 交易量——频繁翻仓刷分,而非真实持仓。

30 天数据验证:$2940 亿交易量 vs $470 亿累计 OI = 6.25 比率,仍远高于合理水平。

空投疑问

Lighter 的积分计划极具攻击性。积分将在 TGE(预计 2025 年 Q4/2026 年 Q1)兑换为 LITER 代币。OTC 市场对积分报价 $5-100+,潜在空投价值数万美元,爆炸式交易量也就不难理解。

关键问题:TGE 后会发生什么?用户会留下还是交易量崩塌?

结论

优势:

顶尖技术(ZK 验证有效)

零手续费 = 真正竞争优势

继承以太坊安全性

顶级团队与资本支持

隐忧:

8.03 交易量/OI 比率 = 刷分严重

LLP 在压力测试中亏损

4 小时宕机引发质疑

空投后用户留存未验证

与 Aster 的关键区别:没有刷量交易指控,没有 DefiLlama 下架。高比率反映的是激进但暂时的激励,而非系统性造假。

底线判断:Lighter 拥有世界级技术,却被可疑指标包裹。能否将刷分用户转化为真实用户?技术说「可以」,历史说「可能不行」。

对刷分用户:TGE 前机会不错。

对投资者:等待 TGE 后 2-3 个月,观察交易量是否存续。

概率判断:40% 成为前三平台,60% 沦为又一个「刷分农场」,只是底层技术更好。

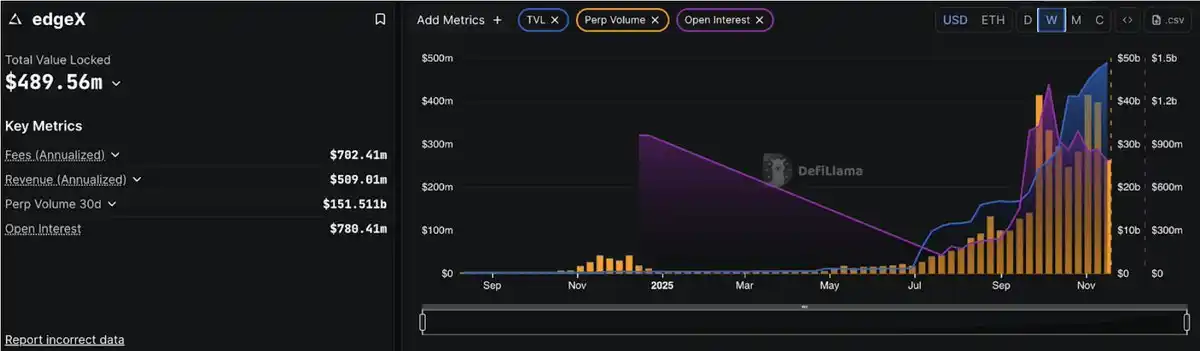

第四部分:EdgeX,机构级专业玩家

Amber Group 的优势

EdgeX 的运作方式与众不同。它诞生于 Amber Group 的孵化器(管理资产规模达 $50 亿),团队成员来自 摩根士丹利、巴克莱、高盛、Bybit。这不是「加密原生」在学习金融,而是传统金融(TradFi)专家将机构级经验带入 DeFi。

Amber 的做市基因直接赋能 EdgeX:深度流动性、紧密价差,以及媲美中心化交易平台的执行质量。平台于 2024 年 9 月上线,目标明确:在不牺牲自托管的前提下,实现 CEX 级性能。

基于 StarkEx(StarkWare 成熟的 ZK 引擎),EdgeX 每秒可处理 20 万笔订单,延迟低于 10 毫秒,速度与币安相当。

费用低于 Hyperliquid

EdgeX 在手续费上全面优于 Hyperliquid:

吃单费:EdgeX 0.038% vs Hyperliquid 0.045%

挂单费:EdgeX 0.012% vs Hyperliquid 0.015%

对于月交易量 $1000 万 的交易者,每年可节省 $7000-$10000,且在零售级订单($600 万)上,EdgeX 提供更好的流动性、更紧的价差和更低的滑点。

真实收入,健康指标

不同于 Lighter 的零手续费模式或 Aster 的可疑数据,EdgeX 创造了真实、可持续的收入:

TVL:$4.897 亿

24 小时交易量:$82 亿

未平仓量(OI):$7.8 亿

30 天收入:$4172 万(环比 Q2 增长 147%)

年化收入:$5.09 亿(仅次于 Hyperliquid)

交易量/OI 比率:10.51(看似糟糕,但需深入分析)

乍看 10.51 很高,但背景重要:EdgeX 上线初期采用激进积分计划引导流动性,随着平台成熟,该比率正在稳步改善。更关键的是,EdgeX 在此期间保持了健康收入,证明有真实交易者,而非纯刷分用户。

10 月压力测试

在 10 月 11 日的市场崩盘($190 亿清算)中,EdgeX 表现出色:

零宕机(Lighter 宕机 4 小时)

eLP 金库保持盈利(Lighter 的 LLP 亏损)

流动性提供者年化收益率 57%(行业最高)

eLP(EdgeX 流动性池)在极端波动中展现了卓越的风险管理能力,盈利而竞争对手却陷入困境。

EdgeX 的差异化优势

多链灵活性:支持 Ethereum L1、Arbitrum、BNB Chain;抵押品支持 USDT 和 USDC;可跨链存取款(Hyperliquid 仅限 Arbitrum)。

最佳移动体验:官方 iOS 和 Android 应用(Hyperliquid 无),界面简洁,便于随时管理仓位。

亚洲市场战略:通过本地化支持和参与韩国区块链周,积极布局亚洲市场,抢占西方竞争对手忽视的区域。

透明积分计划:60% 交易量、20% 推荐、10%TVL/金库、10% 清算/OI

明确声明:「不奖励刷量交易」,且指标验证了这一点——交易量/OI 比率在改善,而非恶化。

挑战

市场份额:仅占永续合约 DEX 未平仓量的 5.5%,要增长需更激进的激励(风险刷分)或重大合作。

缺乏「杀手级功能」:EdgeX 各方面表现稳健,但没有颠覆性创新,是「商务舱」选项,专业但不惊艳。

无法在费用上与 Lighter 竞争:零手续费让 EdgeX 的「低于 Hyperliquid」优势显得不够吸引。

TGE 时间较晚:预计 2025 年 Q4,错过首批空投热潮。

结论

EdgeX 是专业用户的选择——稳健胜过浮华。

优势:

Amber Group 机构支持

年化收入$5.09 亿

压力测试中金库盈利,APY 高达 57%

手续费低于 Hyperliquid

无刷量丑闻,指标干净

多链支持 + 最佳移动体验

隐忧:

市场份额小(5.5% OI)

交易量/OI 比率仍高(但在改善)

缺乏独特卖点

零手续费竞争压力

适合人群:

需要本地化支持的亚洲交易者

机构用户,重视 Amber 流动性

保守型交易者,优先考虑风险管理

移动端优先用户

寻求稳定回报的 LP 投资者

底线判断:EdgeX 有望在亚洲市场、机构和保守交易者中占据 10-15% 市场份额,不会威胁 Hyperliquid 的霸主地位,但它不需要——它正在构建一个可持续、盈利的细分市场。

把它看作「永续合约 DEX 中的 Kraken」:不是最大,不是最炫,但稳健、专业,深受重视执行质量的成熟用户信赖。

对刷分用户:机会中等,竞争不如其他平台激烈。

对投资者:适合小仓位分散投资,低风险、低回报。

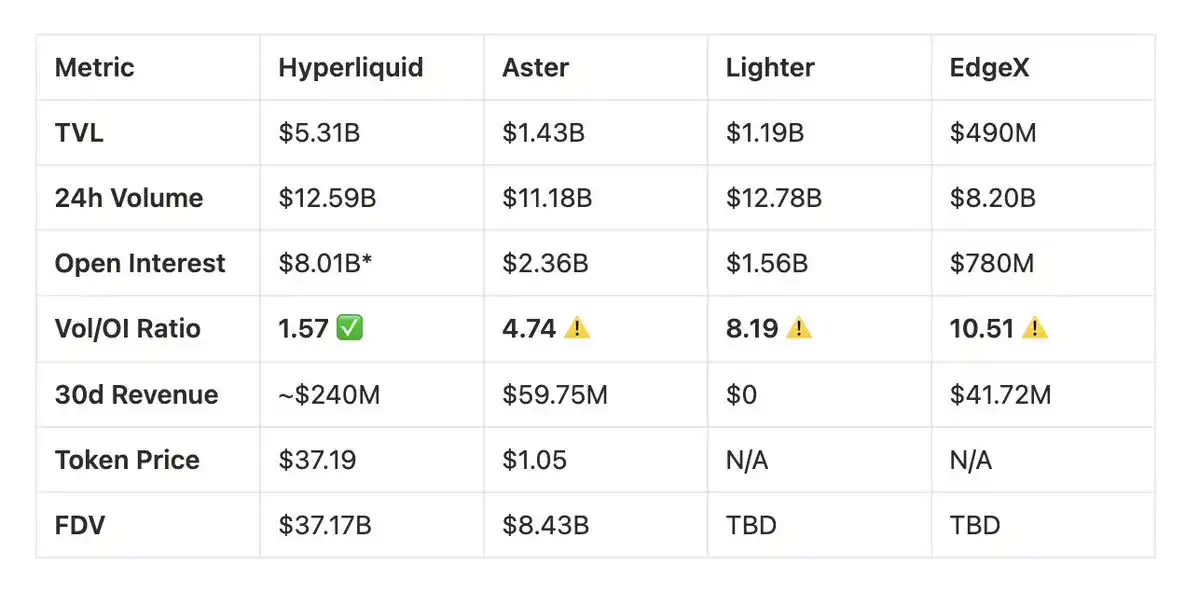

比较分析:Perp DEX 战争

交易量/未平仓合约(OI)分析

行业标准:健康比率 ≤ 3

Hyperliquid:1.57 ✅ 表示强劲的有机交易模式

Aster:4.74 ⚠️ 偏高,反映出大量激励活动

Lighter:8.19 ⚠️ 高比率暗示以积分驱动的交易

EdgeX:10.51 ⚠️ 积分计划影响明显,但有所改善

市场份额:未平仓合约分布

总市场:约 $13B 未平仓合约

Hyperliquid:62% - 市场领导者

Aster:18% - 强劲的第二梯队

Lighter:12% - 持续增长

EdgeX:6% - 专注细分市场

平台概况

Hyperliquid - 资深领导者

占据 62% 市场份额,指标稳定

年化收入 $2.9B,活跃回购计划

社区所有制模式,业绩可靠

优势:市场主导地位,可持续经济模型

评级:A+

Aster - 高增长,高疑问

强力整合 BNB 生态,CZ 背书

曾在 2025 年 10 月面临 DefiLlama 数据质疑

多链策略推动采用

优势:生态支持,零售用户覆盖

关注点:需监控数据透明度问题

评级:C+

Lighter - 技术先锋

零手续费模式,先进 ZK 验证

顶级投资方(Thiel、a16z、Lightspeed)

TGE 前阶段(2026 Q1),性能数据有限

优势:技术创新,Ethereum L2 安全性

关注点:商业模式可持续性,空投后用户留存

评级:未完成(等待 TGE 表现)

EdgeX - 机构导向

Amber Group 背书,专业级执行

年化收入 $509M,金库表现稳定

亚洲市场策略,移动优先

优势:机构信誉,稳健增长

关注点:市场份额较小,竞争定位

评级:B

投资考量

交易平台选择:

Hyperliquid:最深流动性,可靠性验证

Lighter:零手续费,适合高频交易者

EdgeX:手续费低于 Hyperliquid,移动体验优秀

Aster:多链灵活性,BNB 生态整合

代币投资时间表:

HYPE:现已可用,$37.19

ASTER:交易价 $1.05,需关注后续发展

LITER:TGE 2026 Q1,评估上线后指标

EGX:TGE 2025 Q4,观察初期表现

关键结论

市场成熟度:Perp DEX 赛道差异明显,Hyperliquid 通过可持续指标和社区协同确立主导地位。

增长策略:各平台针对不同用户群体——Hyperliquid(专业)、Aster(零售/亚洲)、Lighter(技术)、EdgeX(机构)。

指标关注:交易量/OI 比率和收入生成比单纯交易量更能反映表现。

未来展望:Lighter 和 EdgeX 的 TGE 后表现将决定长期竞争力;Aster 的未来取决于能否解决透明度问题并维持生态支持。

[原文链接]

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。