原文作者:Eric,ForesightNews

2025 年 11 月 17 日晚间,陪伴了行业近 8 年的 DappRadar宣布将逐步关停服务,不再继续追踪区块链与 DApp 的数据。

都说「时代的一粒沙落在个人身上就是一座山」,用来形容 DappRadar 再恰当不过。这个诞生于或许是「区块链已死」论调最喧嚣年代的产物,陪伴着 Web3 从蹒跚学步一路来到舞勺之年,却终还是没能熬过改朝换代的阵痛。类似这样刻印着时代标记产品的离场,让我想到了 11 年前,诺基亚 CEO 在被微软收购的发布会结尾说的话:

「我们并没有做错什么,但不知为什么,我们输了。」

那些年,我们一起用的数据网站

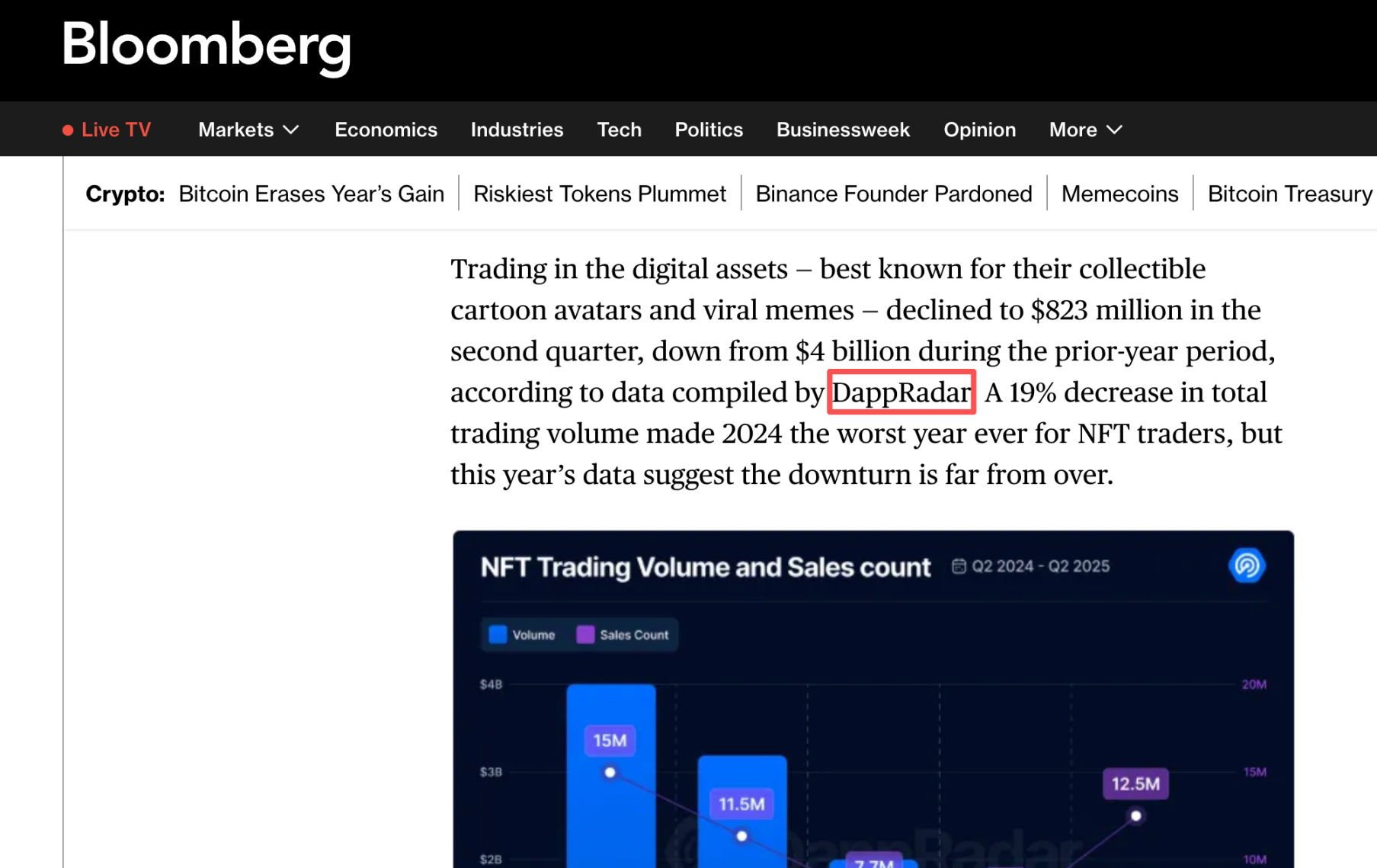

很多 Web3 行业新人或许不清楚,DappRadar 曾经是一个非常重要且权威的数据来源。除了诸如 CoinDesk 和中文 Web3 媒体的引用,包括彭博社、《福布斯》、BBC 等传统欧美主流媒体也曾多次引用 DappRadar 数据。

之所以说权威,是因为在专业数据网站(例如 Nansen、Arkham、DefiLlama 等)以及专业的 Web3 营销工具(例如 Cyber、Kaito 等)未大行其道之前,DappRadar 早期几乎是所有 DApp 必须登陆的门户网站,项目的齐全使得其数据的完整度和可信度无可比拟,几乎成为了当时想要快速了解新项目基本信息的唯一最好的方式。

DappRadar 的联创 SkirmantasJanuskas 来自立陶宛。与很多行业大佬身兼数职不同,从 2018 年 2 月至今,他就只专心在 DappRadar 上。而在此之前他也只短暂地在 NFQ 做软件开发工作。另一名联创 DunicaDragos 早年曾是美国游戏大厂 EA 的运营,也同样在创立 DappRadar 之后一心再无二用。

DappRadar 曾经获得过两轮投资。2019 年 9 月的种子轮融资中,DappRadar 获得了 Naspers、BlockchainVentures 和 AngelInvestBerlin223 万美元的投资。其中 Naspers 正是在 2001 年斥资 3200 万美元从李泽楷、IDG 等手中买入腾讯 46.5%股份的南非跨国传媒集团。随后的 2021 年 5 月,DappRadar 在 A 轮融资中获得了 Blockchain.comVentures、ProsusVentures 和 NordicNinjaVC494 万美元的投资。

笔者找到了 SkirmantasJanuskas 在 2019 年完成融资之后接受采访的记录,彼时正值 Web3 的至暗时刻,而 Skirmantas 却对行业充满着信心,认为只要解决使用体验和寻找用户需求的问题,「中心化应用将成为过去式」。

在 2019 年,这个怀揣着一腔热血的「愣头青」就发表了对 DeFi、游戏等赛道的见解,而这些领域也最终在 2021 年迎来了爆发。虽然 DeFi 数据的蛋糕大多被 DefiLlama 抢了去,但就数据全面性以及对 NFT、GameFi、元宇宙等新兴概念的深耕,也让其在巅峰时期拥有百万级别的用户量。有些推特账号都找不到的小项目,你都能在 DappRadar 上看到 DAU 在 0 到 3 之间反复横跳。

专业,成了最大的原罪

如果一定要总结出一个 DappRadar 失败最大的原因,那只能是过于 cryptonative 而忽略了商业化的重要性。

时至今日,当翻开 DappRadar 的主页,你会发现它所展示的分类除了从诞生之初就坚持做到现在的游戏、DeFi、NFT、博彩,以及新加入的 AI、RWA、社交,但看不到诸如 meme 之类的热门主题。所以为什么叫 Skirmantas 愣头青,连 NFT 这样的赛道都还在坚持每个季度出一篇详细的报告,也还在追踪着犄角旮旯的空投,却几乎与所有的热点失之交臂。

DappRadar 在近两年可以说是唯一一个覆盖了 Web3 所有长尾领域赛道和项目的平台,但问题是它似乎只关注尾巴。

这种钻牛角尖的专业性确实能为彭博社和《福布斯》提供一篇报道的优质素材,但毫无商业价值。在 2021 年融资后推出的 RADAR 代币,除了订阅 Pro 服务、质押、投票之外似乎也没见到更好的应用场景,还把最优质的订阅收入来源给堵死了。

早期依靠全面性树立的形象在后期逐渐变成了桎梏。DeFi 的专业性比不上 DefiLlama,代币信息似乎也不如 CMC,研究的深度也到不了 Bankless 的程度,唯一做的最好的 NFT 赛道一潭死水。不过相信 DappRadar 自身更早就意识到了这些问题,所以也在商业化上进行了提速,包括通过 API 提供优质数据以及提供广告位等。

在 2021 年的融资之后,DappRadar 还撑了 4 年,除了融资本身肯定也通过流量变现带来了一些收入,但显然这些收入与提供指数级增长的海量数据所需要付出的成本相比还是有差距。再加上 2023 年以来,虽然行情持续向上但真正预算充足的项目并不多,有限的预算也更多花在了 KOL、交易所以及一些新兴的平台上,被拍在沙滩上的 DappRadar 老本吃的日渐捉襟见肘。

就如之前所说,它的覆盖面太长尾了,尾得项目方可能根本无从判断究竟什么样画像的用户会在什么情况下再去参考 DappRadar 的信息。在蛮荒时代 DappRadar 提供了了解新项目的渠道,但大浪淘沙之后,了解为数不多的「优质项目」的渠道日渐广泛,前朝遗老不再是唯一最好的选择。

与两三年前简洁的网站相比,现在的 DappRadar 包罗万象但显得杂乱无章,这就是在商业化上用力过猛,也就是告别信中「穷尽所有可能」的体现。对于 DappRadar 来说,没有持续的资助也没有多到花不完的融资钱,就需要在网站上展示出对内容的取舍和对广告展示的克制。而 DappRadar 对专业或者说「正统性」的过分坚持,以及后期意识到不对后堆砌内容与广告的做法让其运营能力的不足暴露无遗。

除了自身的不足,Web3 数据和信息平台本身就是一门难做的生意。现今多链数据爆炸,索引和服务器的成本水涨船高,市场对优质数据有很高的需求但缺乏匹配的付费能力。如果没有其他的收入来源,仅凭广告和出售 API 必然会面对竞争,低溢价能力的平台为了生存提高广告浓度降低了用户体验,走向衰败似乎是一个定局。

DappRadar 的七年轨迹浓缩了这类项目常见的商业化难题:高价值、低付费、成本刚性、叙事迭代快。它的关停为后来者留下一个鲜明启示:如果商业模式不能从第一天就闭环,再权威的数据也阻止不了「失血而亡」。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。