Author: Dilip Kumar Patairya

Source: Cointelegraph

Translation: Shaw Golden Finance

Key Points Summary

The Federal Reserve's meeting on December 9-10 carries unusual weight, as the market eagerly awaits whether there will be another rate cut before Christmas, which will impact bonds, stocks, and cryptocurrencies.

After two rate cuts in 2025, rates currently remain between 3.75%-4.00%. A weak labor market and slowing inflation support further easing policies, but officials remain divided as inflation risks have not been fully eliminated.

The cooling job market, slowing inflation, and the end of quantitative tightening may provide grounds for another rate cut, aligning with year-end liquidity demands.

Persistently high inflation, a government shutdown leading to missing economic data, and internal disagreements within the Federal Reserve may prompt policymakers to keep rates unchanged this December.

On December 9-10, the Federal Reserve will hold a meeting to decide on interest rates, which will not just be a routine meeting. The market is closely watching what policymakers will choose. Will the Federal Reserve cut rates again before Christmas? If a rate cut occurs on Christmas Eve, it could stir waves in the bond, stock, credit, and cryptocurrency markets.

This article explains the significance of the Federal Reserve's meeting before Christmas and outlines the factors supporting or opposing a potential rate cut. It also highlights what to watch for in the coming weeks and how the Federal Reserve's actions may impact cryptocurrencies and other financial markets.

Background for December Rate Cut

Typically, central banks lower interest rates when inflation slows, economic growth decelerates, or financial conditions become overly tight. In late October, the Federal Reserve lowered rates by 25 basis points, setting the federal funds rate target range at 3.75%-4.00%, the lowest level since 2022. Previously, the Federal Reserve also cut rates by 25 basis points in September 2025, marking the second rate cut this year.

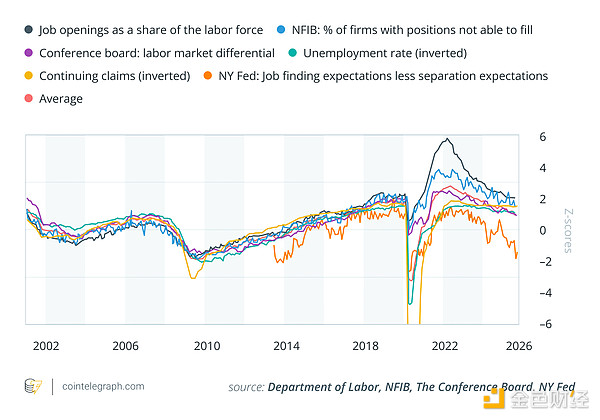

This move comes as the labor market shows clear signs of cooling. Multiple labor market reports indicate that the number of layoffs in October reached one of the highest levels in over twenty years, heightening concerns about the worsening employment situation. The Federal Reserve's statement in October also confirmed this trend, noting that while inflation remains high, employment risks have increased.

In a press conference, Federal Reserve Chairman Jerome Powell emphasized that a rate cut in December is "not a done deal." However, economists at Goldman Sachs still expect a rate cut, pointing out clear signs of a weak labor market. There remains a divide among Federal Reserve officials, with some emphasizing inflation risks and limited room for further easing.

A rate cut in December is possible, but not guaranteed.

Factors Supporting a Potential Rate Cut

The Federal Reserve may decide to cut rates for several reasons:

Cooling Labor Market: Private sector data shows a slowdown in hiring, an increase in layoffs, and a slight rise in the unemployment rate.

Slowing Inflation: While the inflation rate remains above target levels, it is consistently declining, giving the Federal Reserve greater flexibility in easing policies.

End of Quantitative Tightening: The Federal Reserve announced it will stop reducing the size of its balance sheet starting December 1.

Timing of Rate Cut Before Holidays: A rate cut would align with year-end liquidity demands and help set expectations for 2026.

Reasons for the Federal Reserve to Delay a Rate Cut

Several factors suggest that the Federal Reserve may delay a rate cut for some time:

Persistently High Inflation: According to the Federal Reserve's latest statement, the inflation rate remains at a "relatively high" level.

Data Vacuum: The U.S. government shutdown has delayed the release of key employment and inflation reports, making policy assessment more difficult.

Internal Disagreements: There are divisions among Federal Reserve officials regarding the future direction, prompting a more cautious approach.

Limited Easing Space: After multiple rate cuts this year, some analysts believe that current policy is nearing a neutral level.

What to Watch Before December

The following factors may influence the Federal Reserve's upcoming decision on rate cuts:

Non-Farm Payrolls and Unemployment Rate: Is the job market continuing to slow?

Inflation Data: Any unexpected rise in inflation would lower market expectations for easing policies.

Financial Conditions and Market Signals: Are credit spreads widening, and is overall market liquidity tightening?

Internal Communication within the Federal Reserve: Disagreements within the Federal Open Market Committee (FOMC) may affect the final outcome.

External Shocks: Trade conditions, geopolitical risks, or sudden supply disruptions could alter the Federal Reserve's strategy.

How Federal Reserve Rate Cuts Affect Cryptocurrencies

A Federal Reserve rate cut would increase global liquidity and typically prompt investors to turn to higher-risk assets like cryptocurrencies in search of better returns. Bitcoin and Ethereum often benefit from increased risk appetite and inflows of institutional capital. Lower decentralized finance (DeFi) lending rates would also encourage more leverage and trading activity. The use of stablecoins in payments may become more widespread, but their yield advantage would diminish as rates decline.

However, if a rate cut is interpreted as a signal of economic recession, the cryptocurrency market may experience volatility similar to the stock market. The market may initially rise due to increased liquidity, followed by a pullback influenced by macroeconomic concerns. Conversely, if the global financial environment becomes more accommodative, it could further support demand for cryptocurrencies.

Lower borrowing costs make it easier for individuals and institutions to take on investment risks, which may attract more attention to digital assets. As more capital flows into the space, cryptocurrency companies can develop better tools and services, helping the entire industry connect more smoothly with other parts of the financial system.

Impact of Federal Reserve Rate Cuts on Other Financial Sectors

Here are the potential impacts of Federal Reserve rate cuts on major asset classes:

Bonds and Yields: As the market adjusts expectations, short-term yields may decline. If long-term yields are more stable than short-term yields, the yield curve may steepen, indicating confidence in future economic growth. If a rate cut is seen as a signal of recession risk, long-term yields may also decline, leading to a flatter or even inverted yield curve.

U.S. Dollar and Global Currencies: Rate cuts typically weaken the dollar as interest rate differentials narrow. This often benefits emerging markets and commodity-exporting countries. If the rate cut is due to concerns about economic growth, safe-haven demand may temporarily boost the dollar.

Stock Market: If investors view a rate cut on Christmas Eve as a sign of confidence in a soft landing for the economy, it could trigger a rebound in the U.S. stock market. A soft landing refers to a scenario where inflation cools while the labor market remains stable. However, if the rate cut is due to concerns about economic growth, corporate earnings may face pressure, and defensive sectors may outperform cyclical sectors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。