撰文:Hazeflow

编译:Glendon,Techub News

代币化现实世界资产(RWAs)如今已成为华尔街和加密货币圈的热门词汇。尽管媒体对「代币化资产」规模高达数十亿美元的报道铺天盖地,但真实情况是,链上 RWA 的实际交易量依旧有限,目前约为 170 亿美元(此数据不包含稳定币,稳定币规模已达到约 3000 亿美元)。这些数字可能看起来较低,且存在关于静态/未部署 RWA 资本的争论,实际规模可能更大,更高数值约为 360 亿美元。但即便作为代币化领域的旗舰类别「代币化美国国债」,其管理的资产规模也不过几十亿美元,而传统国债市场规模约为 20 万亿美元。

这些统计数据并非是对代币化发展前景的否定,而是凸显了该行业目前还处于早期阶段。

目前大多数机构 RWA 产品都聚焦于「范围狭窄」且常见的证券类型(如高等级债券、基金、货币市场等价物等),这仅占现实世界数千亿美元资产价值的一小部分。但所有主要资产管理公司都预测,到 2028 年,代币化 RWA 的规模将大幅增长至 2 万亿到 16 万亿美元。

RWA 在区块链上的当前局限性

迄今为止,大多数代币化工作都集中在简单的金融产品上,因为它们拥有清晰的法律框架和现有市场。但这些常见的资产仅占全球财富的一小部分。现实世界非常庞大,真正的机遇存在于各类有形和复杂的资产中。例如:

- 房地产:商业、住宅和农业地产。

- 基础设施:收费公路、桥梁、机场、发电厂等。

- 大宗商品和自然资源:农作物、石油和天然气、矿产、木材。

- 设备及库存:工业机械、车辆、运输集装箱。

- 知识产权(IP)与合同:专利、音乐或电影版税、长期服务协议。

- 收藏品和奢侈品:艺术品、老爷车、葡萄酒收藏。

- 环境资产:碳信用额、水权、可再生能源证书。

每个类别均蕴含数万亿美元的潜在价值,但大多数仍处于流动性低、不透明且无法实时定价的状态。根本原因在于它们目前还无法以连续、可机器验证的数据形式呈现。

与金融证券(其整个生命周期都数字化,并可使用 Chainlink 等预言机将其部署到区块链上)不同,这些资产在现实世界中运作,其状态(产出、利用率、位置、状况)的数据要么未被记录,要么被困在孤立的系统中。如果没有可靠的结构化遥测数据流,区块链就无法评估或执行此类资产的底层经济权益。简而言之,无法被量化的资产便无法被代币化。

这正是物联网预言机发挥作用的前提。

预言机 2.0

现实世界资产(RWA)依赖于客观事实,而区块链本身无法在没有可靠链下数据的情况下执行合约。传统金融依赖法律和托管中介(审计师、检查员、托管方)来验证租金支付、生产里程碑或抵押品状态等事项。

链上 RWA 必须用代码取代这些保证,这意味着它们必须有一个通往现实世界的可信桥梁。

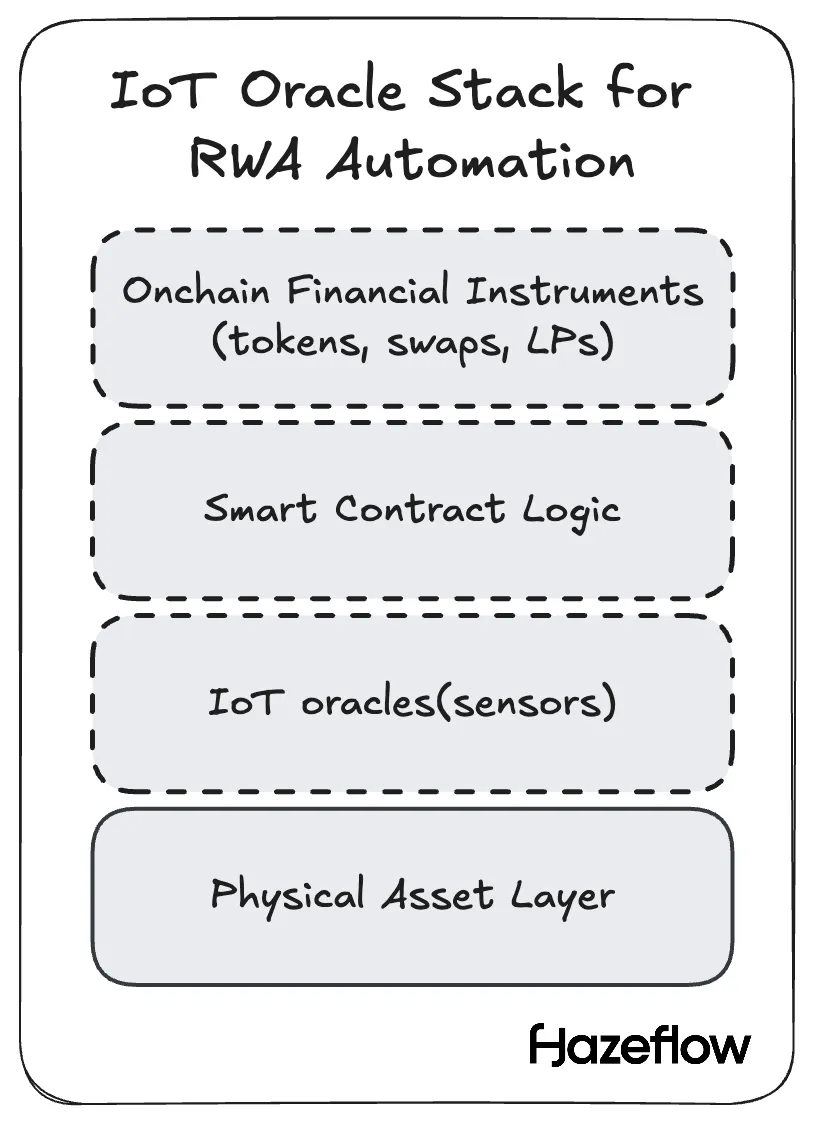

通过将传感器、计量器和智能设备直接嵌入物理环境,物联网预言机将把现实世界活动转化为区块链可信的、经过认证的实时数据流。

物联网预言机将流式传输几乎所有可测量的数据:运行时间、作物湿度、GPS 位置或能源产量,这些数据可以被传输、哈希并在链上验证,从而使智能合约能够自动触发支付、保险结算或所有权转移。

通过持续向代码中馈送经过验证的指标,它们将静态资产转化为可编程的数字代币资产,这些资产会随着现实世界条件的变化而演变、增值或履行义务。

简而言之,任何能够被持续监测的资产都可以进入链上世界,一旦实现,市场就可以开始直接对其表现进行定价和交易,从而为下一波金融创新奠定基础。

利用真实世界数据创造新市场

物联网预言机最强大的影响之一在于,任何可测量的事件都可以成为一个可交易的数据点。通过将现实世界数据发布到区块链上,全新的市场可以由此诞生。

例如:

- 在医疗保健领域:如果医院床位可用性、设备使用情况和手术价格被实时输入链上预言机,各方可以跨地区套利成本差异、实时预订未充分利用的资源,或围绕使用指标创建保险池。

- 在农业领域:经物联网验证的作物产量或天气数据可以支撑新的期货或保险合约。

- 在制造业和物流领域:机器正常运行时间或集装箱位置可以被代币化为与收入挂钩的证券。

- 在能源领域:太阳能发电场或电网的持续遥测数据可以推动动态电力交易市场。

在每种情况下,一个曾经被隐藏或孤立起来的物理事件,都变成了一个金融原语。

可组合金融

一旦资产被代币化并在链上可验证,它们就成为构建全新金融产品的基石。智能合约并不关心一个代币代表的是比特币还是一桶石油,它们可以将各种不同的资产组合成复杂的结构。想象一下,在一个无需许可的环境中,任何人都可以:

- 将代币化的 GPU 计算租赁作为抵押品,以对冲不断上涨的 AI 训练成本。

- 做多或做空与物联网(IoT)相关的天气衍生品,例如对驱动作物保险的降雨量进行押注。

- 将比特币(或稳定币)兑换成代币化的养老基金现金流或其他收入流,作为一个整体进行交易。

这些跨资产产品在传统金融中由于数据孤岛和不同的监管而难以实现,但链上协议使其变得简单。物联网预言机提供了所需的连接组织:通过实时验证每个资产的性能,让这些多样化的 RWA 代币能够在机构级条件下进行交互。

去中心化传感器网络(通常被称为 DePIN,即去中心化物理基础设施网络)的出现,已经为物联网预言机驱动的市场奠定了基础。IoTeX、Helium、Chirp、WeatherXM、Geodnet 和 DIMO 等项目展示了物理数据收集本身如何实现在链上去中心化、验证和奖励。每个网络都专注于不同的传感垂直领域,例如连接性、移动性、环境数据或地理定位,但它们都共享一个共同的架构:个人部署传感器或网关,将经过认证的数据流传输到网络,并通过对共享数据层的贡献来赚取代币。

实际上,这些系统将世界变成了一个活生生的预言机,其中位置信息、温度读数和能源输出等数据直接流入数字市场。随着这些网络的成熟,它们将为人工智能和自主代理提供基础设施,未来超过 99% 的互联网流量将由人工智能和自主代理使用,用于获取来自物理世界的无需信任的实时数据,并在无需人工中介的情况下在链上进行交易,这将成为即将到来的机器经济的真正基础。

未来前景

代币化的最终演进将把实物资产、物联网设备和可编程合约融合到一个单一的实时经济体中,在这个经济体中,每一项可衡量的活动都将成为金融信号,以下是一些示例:

按使用付费与机器经济

企业将不再直接购买机器,而是通过区块链合约租赁机器,这些合约通过物联网传感器直接计量使用量情况。

一台数控机床或太阳能逆变器可以将数据流传输至智能合约,该合约可以计算运行时间并自动以稳定币结算付款。供应商保留所有权,用户只需为实际消耗的使用量付费。

电力、带宽与无形 DePINs 的崛起

在所有行业中,电力行业是应用这一系统最成熟的领域。电力是一种无形资产,已通过智能电表实现数字化和计量。物联网预言机可以将这些数据输入区块链系统,从而实现微结算、需求响应拍卖或去中心化能源交易。

类似的逻辑也支撑着 Helium 等网络,在这些网络中,带宽(另一种无形资源)被代币化。然而,电力期货或电价对冲等衍生品交易目前仍主要在链下进行。随着数据可靠性的提高,这些高价值的衍生品市场将迁移到链上,从而创建透明、可组合的对冲和收益工具。

代币化服务合同与自动化执行

除了商品和能源之外,服务本身也可以被代币化。建筑项目、云计算租赁或数据中心 GPU 租赁都可以用代币表示,其现金流取决于物联网验证的里程碑事件。智能合约可以根据预言机确认任务完成情况逐步拨付资金。执行方式也从人工转向算法:未付款项可以触发自动抵押品扣押或禁用物联网连接设备,类似于如今车辆上的远程关闭开关,但所有操作都在链上透明执行。

审计和合规也将实现自主化:每一条数据流馈送都会留下不可篡改的痕迹,从而无需人工文件即可实现实时 ESG 或监管证明。

结论:从被动资产到可编程资产

将现实世界资产代币化仅仅是第一步。要真正释放其价值,这些数字代币必须具备可编程性,并能对现实世界做出响应。物联网驱动的预言机基础设施正是连接链上资产与现实世界的桥梁。通过持续提供可信的实时数据,预言机将数字代币锚定于现实世界,从而实现自动支付、动态定价、嵌入式合规以及跨资产 DeFi。

对于机构而言,结论很明确:那些能够构建坚如磐石的物联网预言机层的平台将占据优势,因为这些基础设施将决定我们能否真正通过代码解锁数万亿美元的现实世界价值。

现实世界充满价值,但只有在其变得可见且可验证时才能实现流动性,而物联网预言机能够实现这一飞跃。全球金融的下一个发展阶段将取决于资产是否真正实现可编程和互操作,并以现实世界数据为核心。如果没有这一基础,链上 RWA 的承诺将变得遥不可及。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。