The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome everyone's attention and likes, and refuse any market smoke screens!

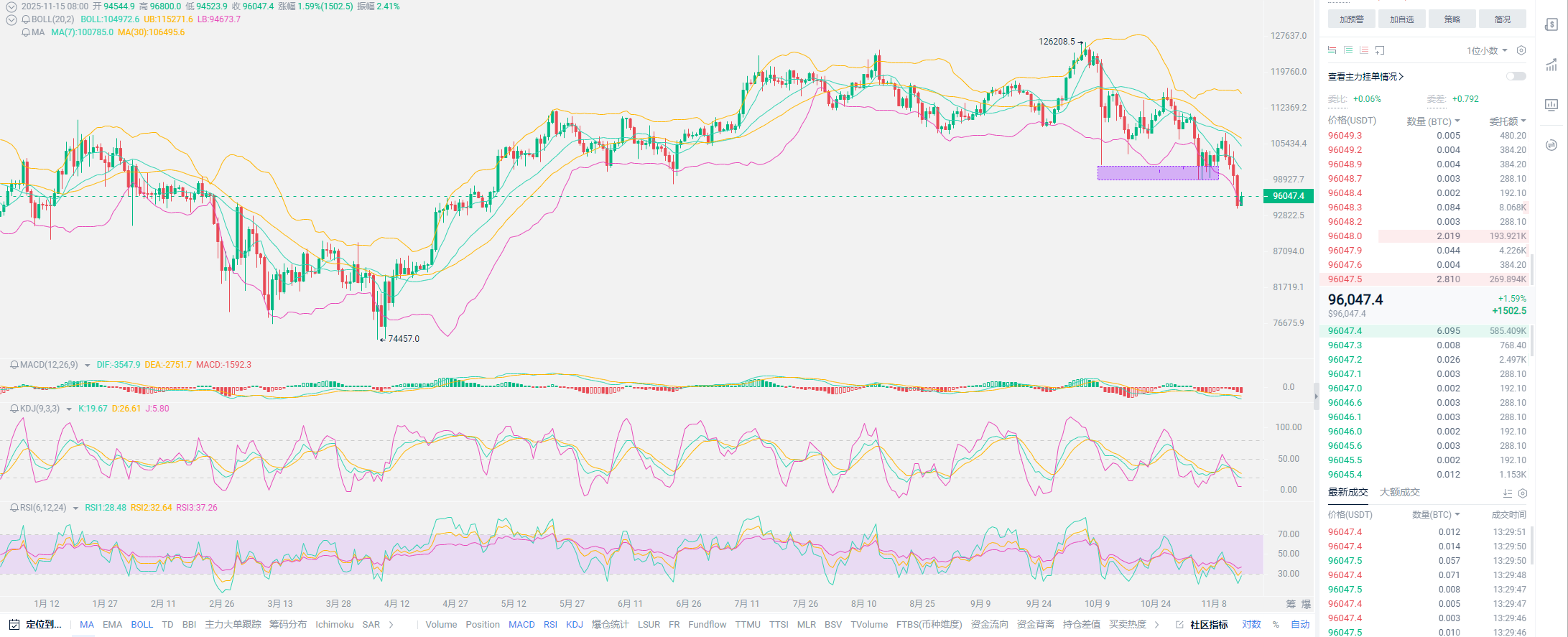

Bitcoin has hit a new low again. With the delay of CPI data, it has even gained some attention. Perhaps the data for October will not be released, leading all financial markets to decline across the board. Bitcoin's new low has appeared, and although the short-term outlook is bearish, I did not expect it to be so rapid. I also had personal matters to deal with yesterday, so I paused for a day. Bitcoin also set a new low at the 93955 position yesterday, with a price difference of 32253 points from the highest point of 126208. The momentum from this surge seems to be cooling down. Many friends are concerned about the real reasons behind this. At the end of October, I also made predictions for November's market. The current price has become a new low for the second half of the year, and there are many reasons contributing to the bearish market. The end of October has seen the tapering pushed back to December, insufficient expectations for interest rate cuts, and the attitudes of other countries towards Bitcoin, even the newly introduced stablecoin legislation has had some impact.

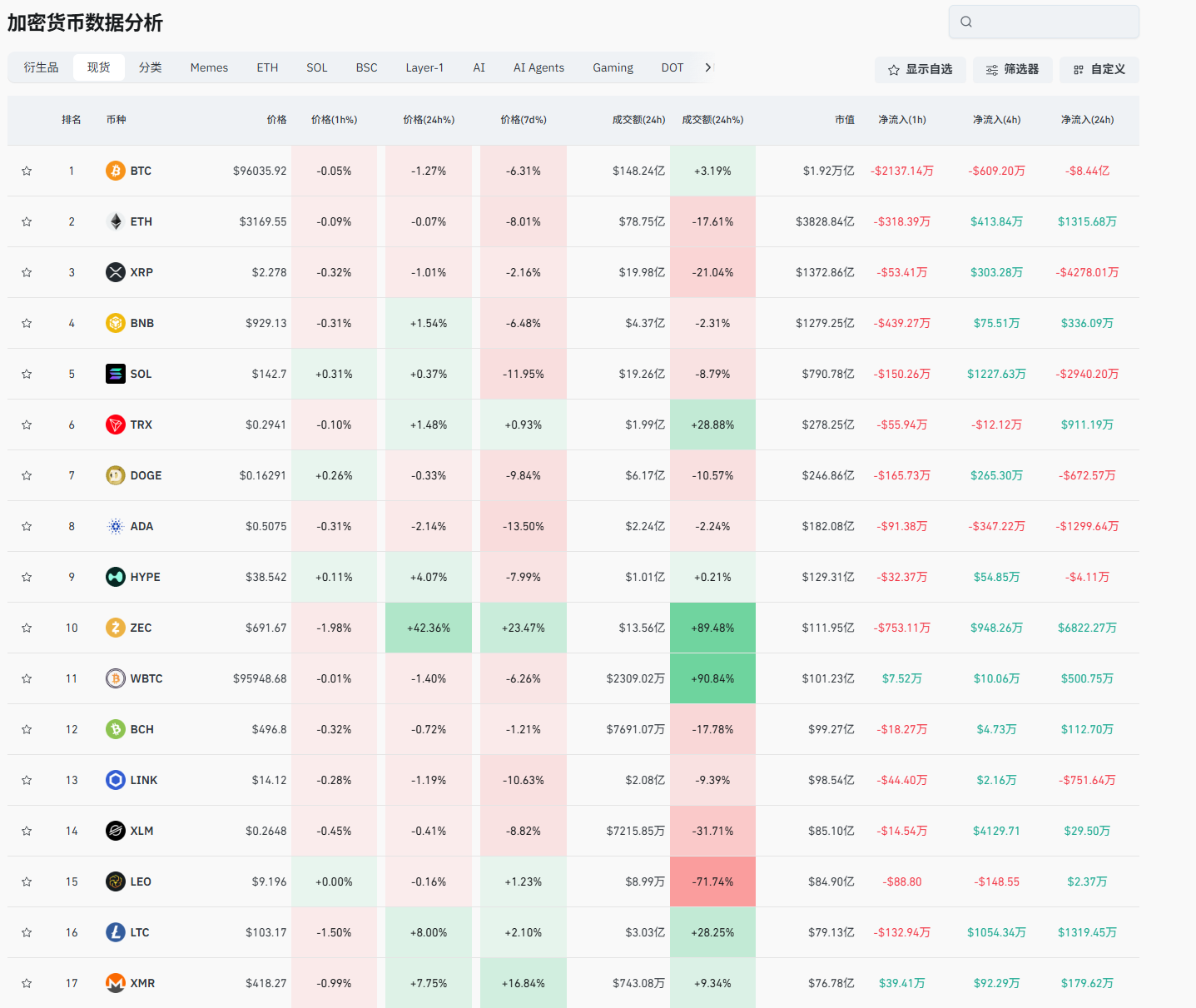

If we talk about the biggest factor, it is the insufficient market competitiveness leading to capital outflow. The crazy rise of gold, and even the antics of the US stock market, with tech companies buying over 500 billion in market value, are supported by a massive amount of capital. There are also the impacts of tariffs; the cash in the hands of the giants is not circulating, and the root causes have not been resolved. Under these various factors, how can we talk about Bitcoin's growth? All in all, Bitcoin has evaporated trillions, and the entire cryptocurrency market has evaporated nearly 1.5 trillion, and it is still in a downward state at this stage. After understanding these factors, what you need to judge is when the turning point will come. There is no need to solve so many problems; for the cryptocurrency market, it only needs to solve the issue of capital, and the rest is not important. Where will the capital come from? Perhaps it will be from American pensions, or perhaps it will be from the liquidity after the tapering ends, or it could be a sudden strategy proposed by Trump.

Although I made a correct assessment of November's market at the end of October, most friends did not take preventive measures. At that time, I mentioned that everyone should short to hedge against spot losses, but most friends did not take it to heart. Now, this has resulted in the current situation, and all we can do is pray for a market reversal. The judgment in the cryptocurrency market, the inflow of funds, and the on-chain data have not shown any major issues. On the contrary, it has been reported today that JPMorgan may cooperate with Alibaba to jointly launch a tokenized payment system. The liquidity in the cryptocurrency market has seen some growth this year, and I will not look too deeply into this downward trend. At least I do not believe that Bitcoin will return to the 60,000 mark. If Bitcoin is in the 13-15 range and the lower 60,000 mark, I am more inclined to believe it will go up first and then down; this thinking will not change for now.

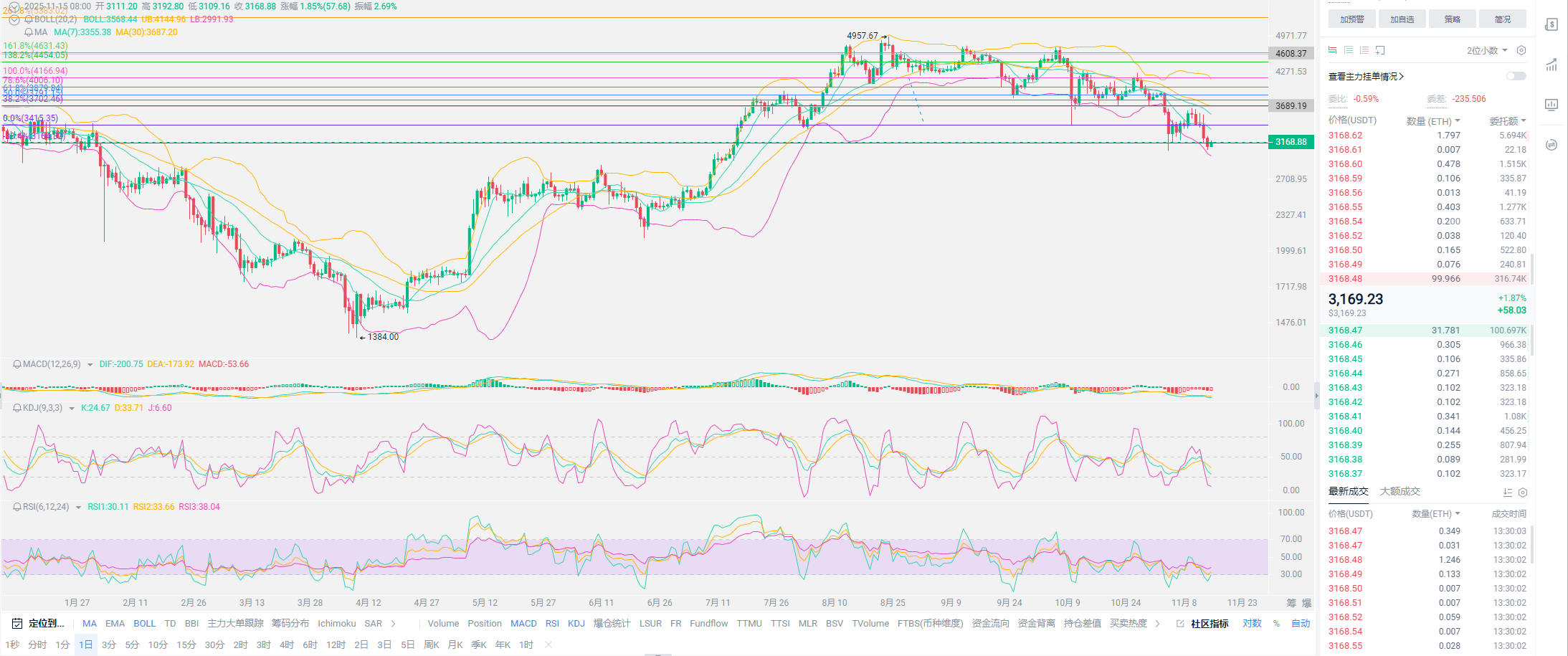

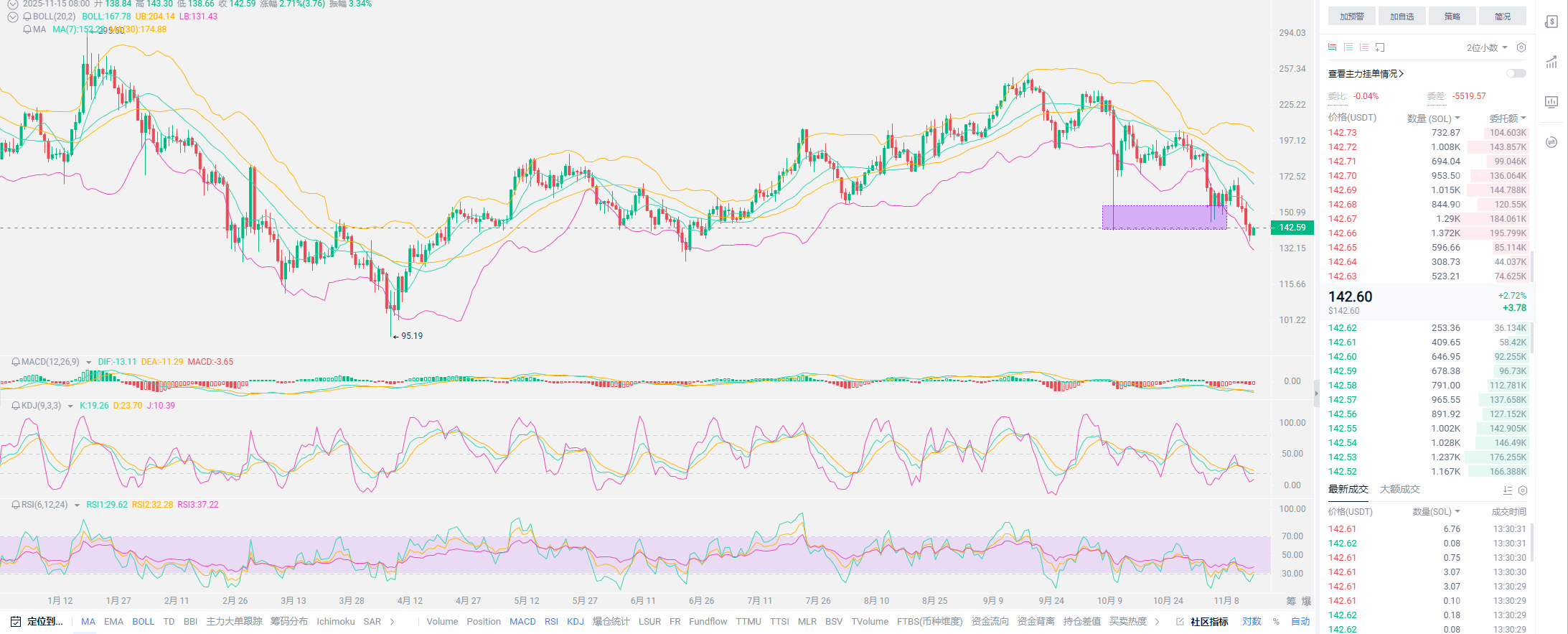

Especially as we approach the end of the year, major investment banks' financial reports need some embellishment. Companies that have invested in Bitcoin will further drive the market to make the data look good, so I am bullish for December. Regarding SOL, I did not advise everyone to hold around 160, not because there is a problem with this cryptocurrency, but because 160 is a critical level. Once it falls below, it will inevitably lead to a downward trend. If there are lower positions, why not wait for the right entry point? Discussing December is still too far away; in the short term, as long as there is no significant capital inflow, it will remain in a downward state, and a fundamental reversal cannot occur. At the same time, do not think that going long will definitely lead to losses; this clearly low position can be a good opportunity to bottom fish, especially since the current 94,000 mark seems to have held. If it breaks down further, it will definitely head towards 90,000. If this depth can hold, then the market will reverse.

The reversal date is not too far away; we are already in mid-November, and the announcement of the interest rate decision will also happen in early December. The closer we get to December, the more cautious we need to be. For contract users, if you simply want to trade contracts without the hassle of holding spot, try to find low points to go long to prevent issues from a market reversal. Users holding spot can only hedge with short positions. Do not think about profiting from both long and short; often, such excessive thoughts will only lead to more losses. Once the long position in contracts is successfully chosen, the gains from this wave will be infinitely magnified, while being stuck in a short position is hard to resolve. The subsequent trend, the 94,000 position is crucial; of course, being stuck at this level is not a big problem, but being stuck in a short position is extremely dangerous. As long as we are close to the support position below, everyone should avoid entering the market easily and focus on waiting with no positions.

Lao Cui's summary: The overall market news is an extremely exhausting matter. In a downward state, it is nothing more than Trump being unable to generate more ideas for the cryptocurrency market; the remaining energy is mostly consumed on tariffs. Everyone needs to be patient in observation; it is difficult for funds to intervene in November, relying on the remaining funds in the cryptocurrency market to hold on, the lows will keep getting lower. I won't say much about contracts; on the spot level, if you believe there is still a bull market coming, you could have already acted on the market. The holding time is December of this year, and if there is a rate cut in January 2026, there may be another opportunity. These two time points are extremely important. It is unlikely for me to predict an absolute high point. Currently, I can only say that the market in December should be at least higher than the current level, and everyone must seize the opportunity. For entering contracts, be sure to consult me; what is being tested now is the combination of position and experience! Everyone should pay attention to the risks with BNB!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, feel free to contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on individual pieces or positions, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short, only seeking short-term gains, resulting in frequent troubles.

This material is for learning reference only and does not constitute trading advice. Trade at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。