原文作者:Rubin,知势榜经济与管理领域影响力榜答主

律动注:本文精选自知乎和律动 BlockBeats 联合主办的圆桌活动「穿透稳定币」。该圆桌自上线以来累计浏览量已突破 2600 万,广泛引发行业内外关注。活动旨在以更直观、系统的方式,向大众呈现稳定币的最新进展、关键机制与未来趋势。

圆桌入口: https://www.zhihu.com/roundtable/stablecoin

以下为原文内容:

Circle 本季度像是在高利率风口上飞得很高的 猪,但市场担心风向会变:

利差收窄、成本上升、盈利业务单一、监管不确定性;

这几股风一来,飞得高的公司可能也容易跌得快。

想象股票市场是一场「马拉松式赌局」,在昨天选手 Ciecle 冲过了一个中间补给站(Q3),拿到了一个好的盈利成绩。然而投资者们看完报告后,认为接下来的坡度、选手配速和补给不太能够持续,于是抛售造成股价下跌。

1) 投资者更看「未来」

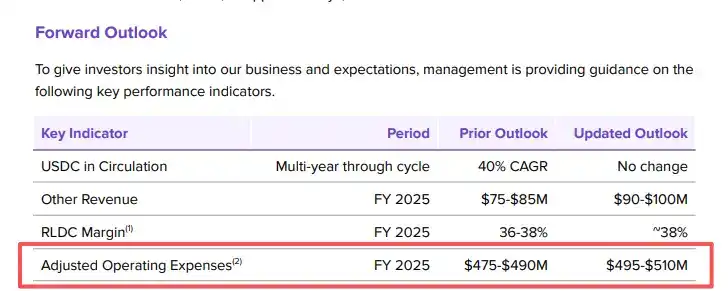

虽然 Circle 公司在 Q3 大超预期,但同时上调了全年运营开支预测($495–510M),这意味着未来该公司利润增速可能被「吃掉」,没办法再获得高额的利润。

2) 储备收益率在下滑

Circle 之类的稳定币公司,赚钱很大一部分都是靠:

发行稳定币,用户买入稳定币,企业获得美元去购买国债/短期票据等保守资产投资

通过这种不需要支付利息的方式来拿利差(reserve income)。

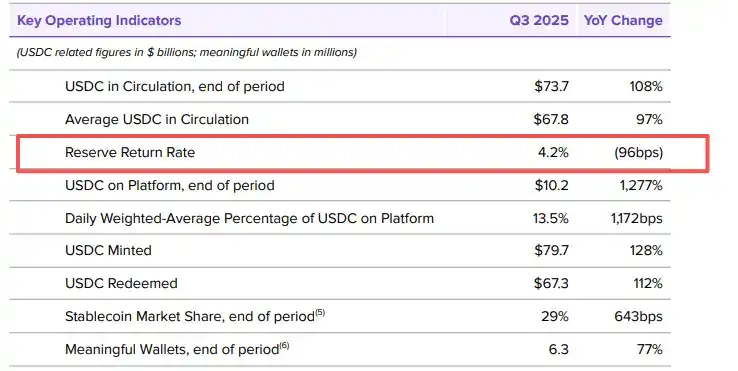

报告显示虽然储备收益总额大,但储备的单利回报率下降了约 96 bps。

如果市场利率走低或短期收益率压缩,未来这种盈利方式会显著萎缩,直接冲击盈利。

3) 收入高度依赖「储备收益」

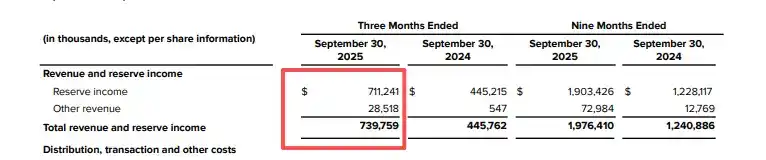

Q3 的 $740M 中,绝大部分来自储备收益($711M),而「其他收入」(订阅、服务、交易等)只有 $29M。

也就是说,Circle 目前的业务更像一家不需要给用户支付利息的大型资金管理公司(treasury),而非传统 SaaS 或支付公司;

当市场担心利差收窄或监管冲击时,这种单一收入模式会被打折。

4) 监管与政策风险

稳定币与储备资产密切相关,任何监管(如美国国会/监管对稳定币的严格规则)或对储备资产(例如对持有国债/短期票据的限制)都会影响收益预期。

当监管不确定时,投资者往往要求更高的风险溢价,因此会抛售导致股价下挫。

实际上,Circle 目前正处在一个微妙的阶段:

它的盈利模式健康、合规基础扎实,但增长故事讲不下去了。

或许在很多传统投资人的眼中,它更像是一家「美元基金公司」,赚的是安全但没想象力的钱。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。