On Wednesday, the Bitcoin network registered a 2.37% dip in mining difficulty, trimming the metric from 155.97 trillion to 152.27 trillion. With bitcoin ( BTC) prices dragging and mining revenue trailing levels from 30 days ago, this latest adjustment is likely a welcome shift for miners.

The hashprice — the estimated worth of a single petahash per second (PH/s) of SHA256 hashrate — has fallen 11.17% since Oct. 13. At that point, 1 PH/s carried a value of $47.89, compared with $42.54 today. Fee revenue is also subdued, accounting for an average of just 0.57% of the block subsidy’s total value based on current data from hashrateindex.com.

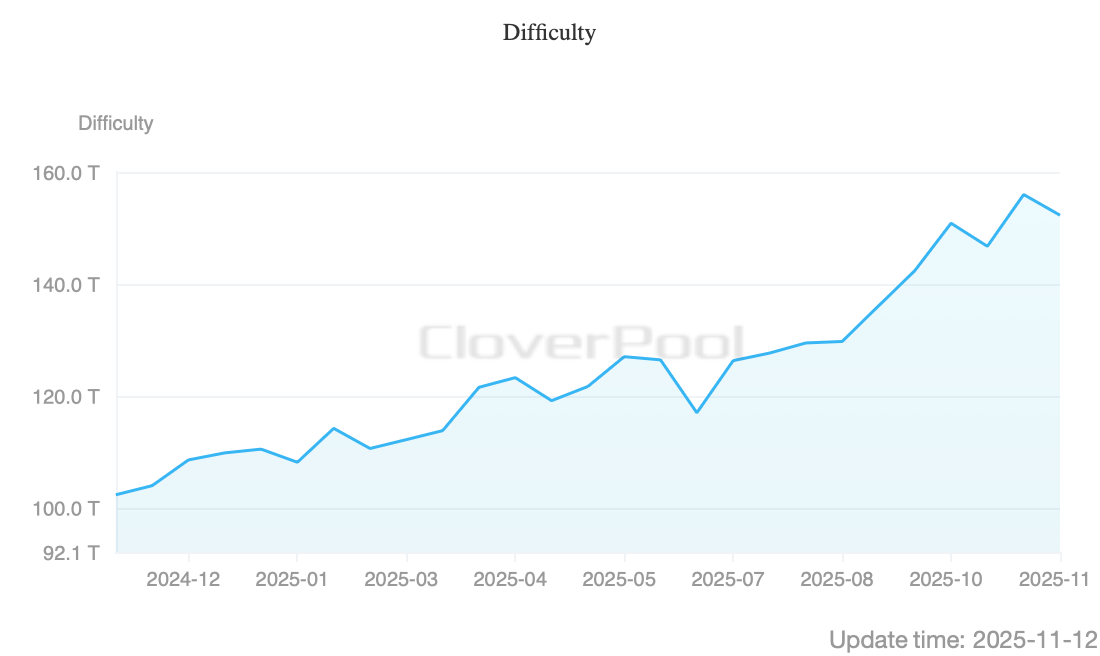

Difficulty metric over the past 12 months via cloverpool.com data.

Additionally, the global hashrate has slipped to 1,085 exahash per second (EH/s). Since Oct. 17, more than 72 EH/s has vanished from the 1,157 EH/s peak recorded that day. With difficulty now lower, block intervals — the pace at which new blocks are discovered — have dipped below the ten-minute norm. As of 9:45 a.m., the average block time sits at 9 minutes and 23 seconds.

Also read: Under 10 Joules per Terahash: Auradine Unleashes High-Efficiency Teraflux Miners With 50% Power Boost

Bitcoin’s latest difficulty adjustment arrives at a moment when miner income is strained, hashprice has cooled, and network strength has eased from last month’s highs. The modest reduction offers temporary breathing room, trimming operational pressure as block times quicken. Whether this relief proves fleeting or sets the stage for steadier conditions will depend on price action, transaction demand, and how miners recalibrate in the weeks ahead.

- How much did Bitcoin mining difficulty fall?

Difficulty decreased by 2.37%, dropping from 155.97 trillion to 152.27 trillion. - Why does the difficulty change matter for miners?

Lower difficulty briefly reduces operational strain and can improve the odds of earning block rewards. - How is miner revenue trending right now?

Hashprice and fee revenue remain subdued, reflecting weaker overall mining income.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。