Written by: Sumanth Neppalli, Decentralised.co

Translated by: Glendon, Techub News

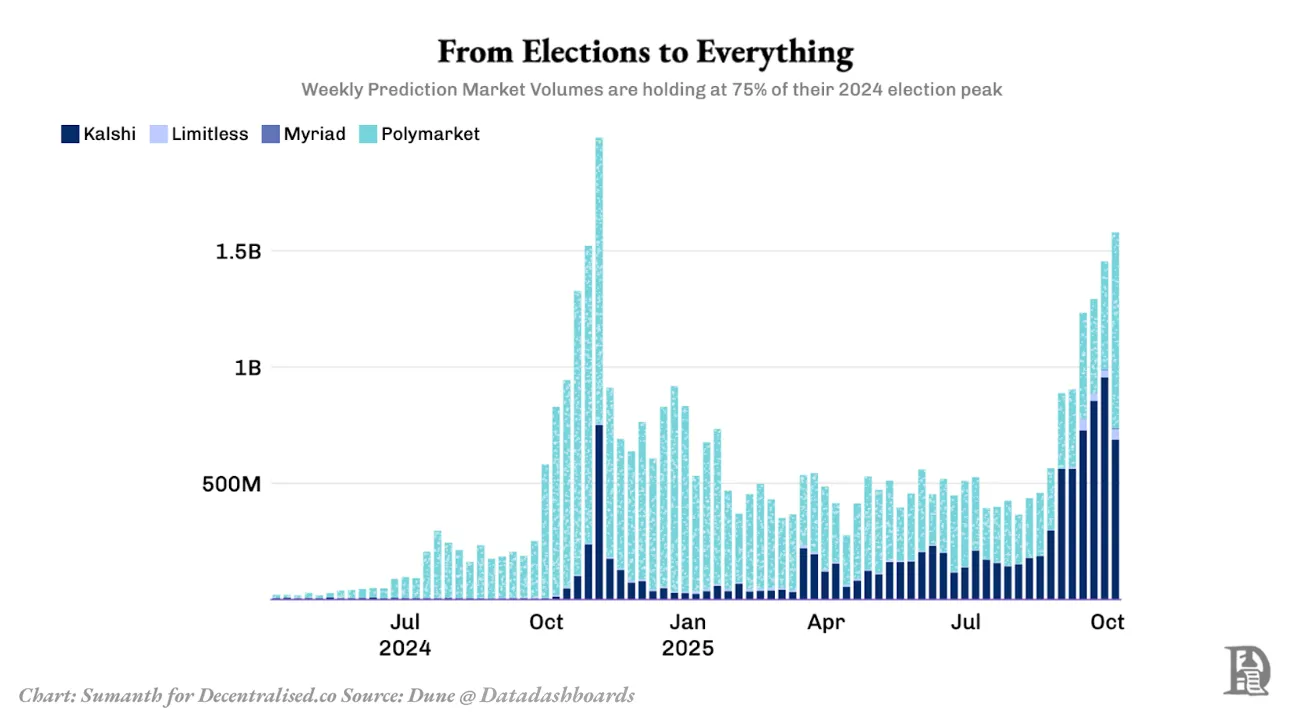

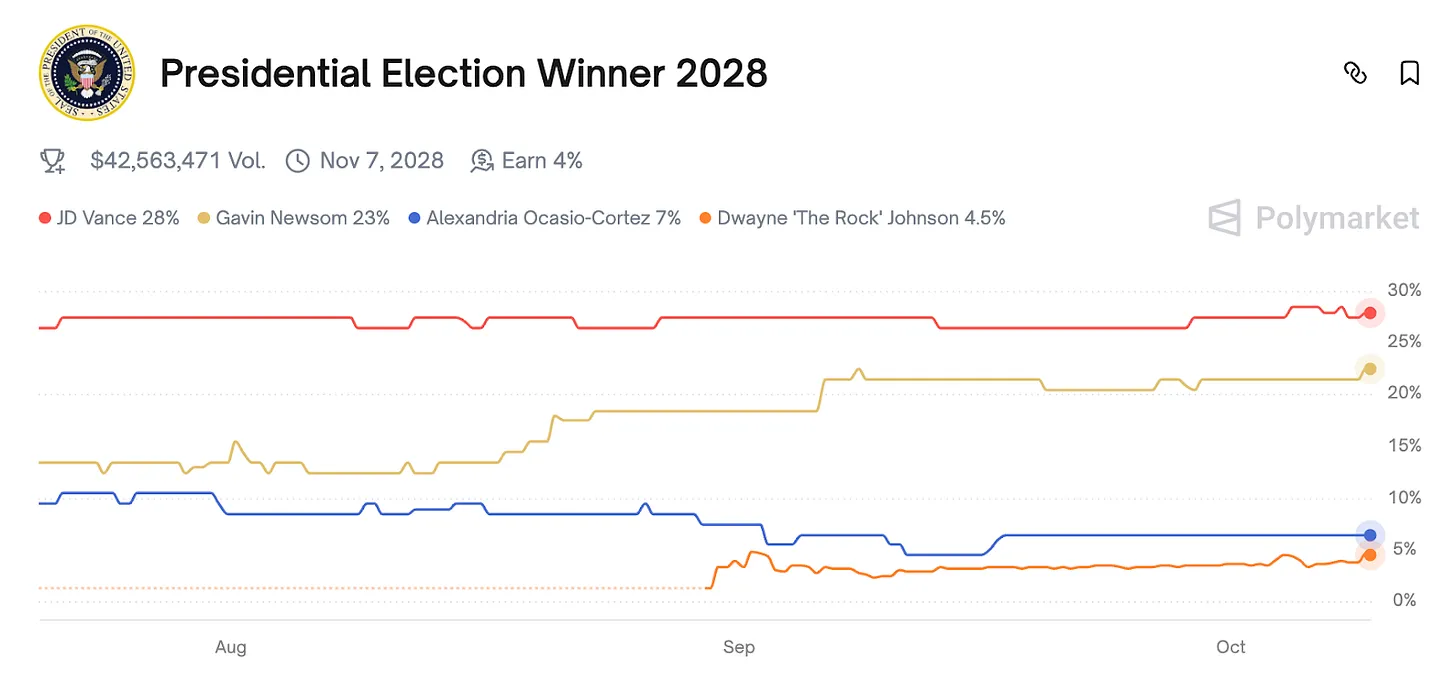

On the night of the 2024 election, while television commentators misjudged the situation, the prediction market Polymarket displayed clear confidence. Hours before major television networks announced the election results, the market indicated a 58% probability of Trump winning. When the results were officially announced, Polymarket's trading volume had reached $3.2 billion, confirming a long-held belief: markets can aggregate information more effectively than experts.

This is not the first time Polymarket has gained recognition, but it is the most notable instance. Throughout 2024, the platform has become the preferred source for real-time probability predictions on various events, from Federal Reserve interest rate decisions to Supreme Court rulings: political analysts cite its predictions in their columns; traders use it for hedging; and the general public follows it as closely as they would a weather forecast. After years of regulatory stalemate and numerous failed attempts, prediction markets have finally seen a glimmer of hope.

In just a few months, the legal fog surrounding prediction markets began to lift. A ruling from the D.C. Circuit Court of Appeals allowed Kalshi to list congressional control contracts under the oversight of the Commodity Futures Trading Commission (CFTC).

For years, prediction markets faced a variety of restrictions—banned in most states in the U.S., tolerated in others, and some markets operating overseas to serve U.S. users, despite technically violating relevant terms. However, this ruling established a clear regulatory path for event prediction markets.

Exchanges under CFTC supervision can now list event contracts nationwide, replacing state regulation of sports betting. Polymarket acquired a CFTC-licensed venue in early 2025, allowing it to return to the U.S. market after operating overseas.

Today, funding and licensing are gradually catching up. Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, invested $2 billion in Polymarket, bringing its post-money valuation close to $10 billion, which also enables ICE to distribute event-driven data to Wall Street clients. Additionally, Kalshi raised $300 million from investors such as Andreessen Horowitz (a16z), Sequoia Capital, and Paradigm, achieving a valuation of $5 billion. This indicates that "probability as a data source" is transitioning from a novelty in the cryptocurrency space to institutional applications.

The market being built far exceeds the political realm. The global sports betting market has an annual value of up to $140 billion. Coupled with financial event prediction contracts—Federal Reserve decisions, GDP data, corporate earnings, etc.—the market size exceeds $200 billion. If we also include cultural prediction markets such as entertainment, social trends, and product launches, the potential market size approaches $500 billion. Anything uncertain and of interest to people could become a tradable market.

As the legalization of prediction markets increases, they could potentially become the very entities they initially aimed to disrupt. Polymarket theoretically requires no license but is, in practice, centralized. The company controls the order book, decides which markets can be listed, and can freeze accounts or block specific regions at will. It supports cryptocurrencies, allowing users to deposit assets and participate in trading, but these markets are not on-chain transactions. Kalshi is also a centralized prediction market and is currently expanding its cryptocurrency team to accelerate on-chain trading.

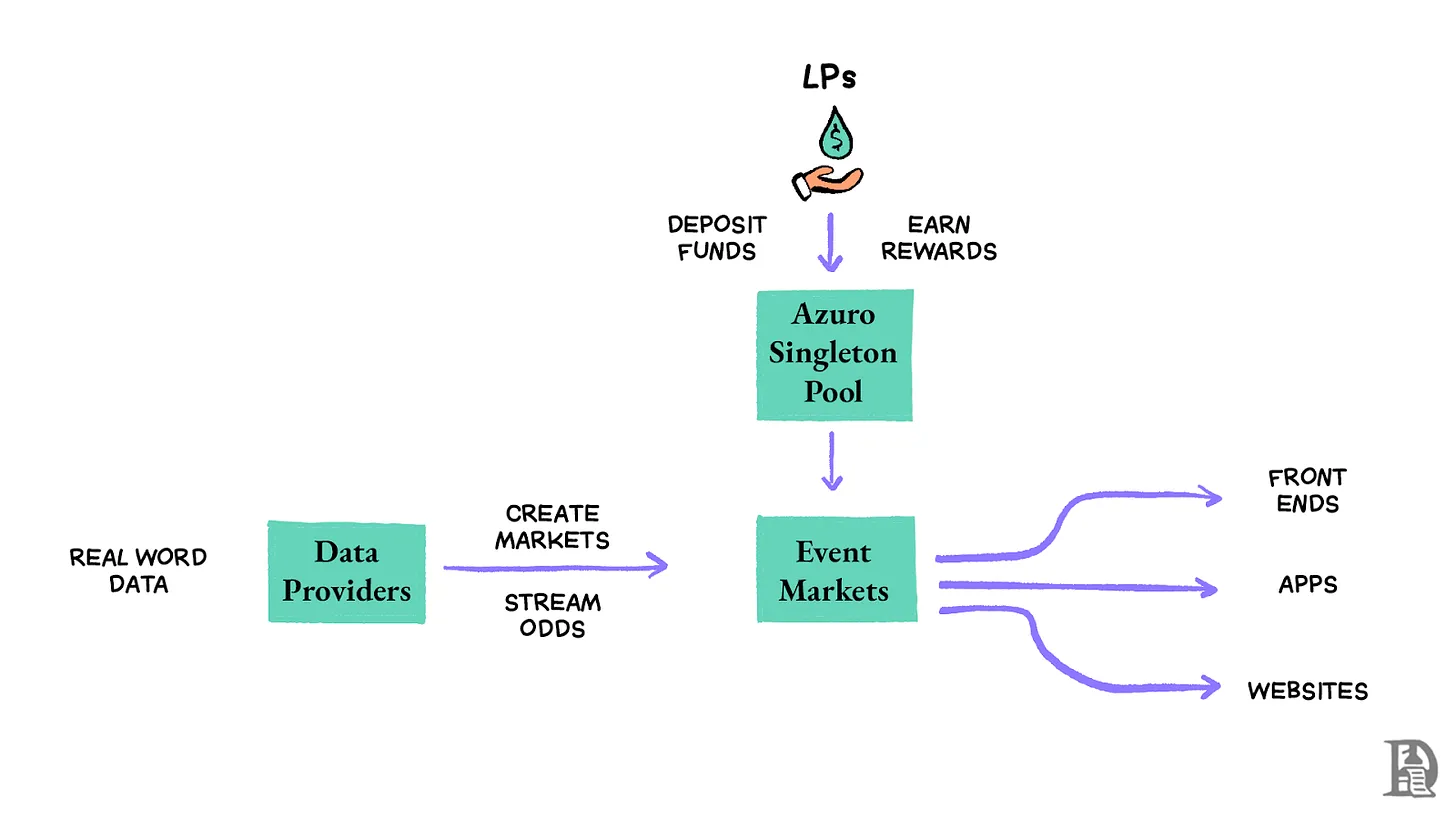

This is why introducing liquidity into on-chain infrastructure protocols is crucial. Azuro's protocol combines traditional odds-making mechanisms with automated market makers (AMM) and completes all settlements on-chain. Azuro does not control the user experience but facilitates it, providing a single centralized liquidity pool that any front end can access, connecting professional data providers to create markets, and offering developers permissionless access. This architecture addresses several long-standing issues in prediction markets, including high fees, geographic restrictions, and opaque odds-making processes.

This article will explore how Azuro is building a more efficient and user-friendly prediction market through a single centralized liquidity pool, professional data providers, and permissionless front ends. The following sections will delve into its core mechanisms, analyze its evolving ecosystem, and assess whether Azuro can achieve its vision: to create a new market for attention.

How Prediction Markets Work

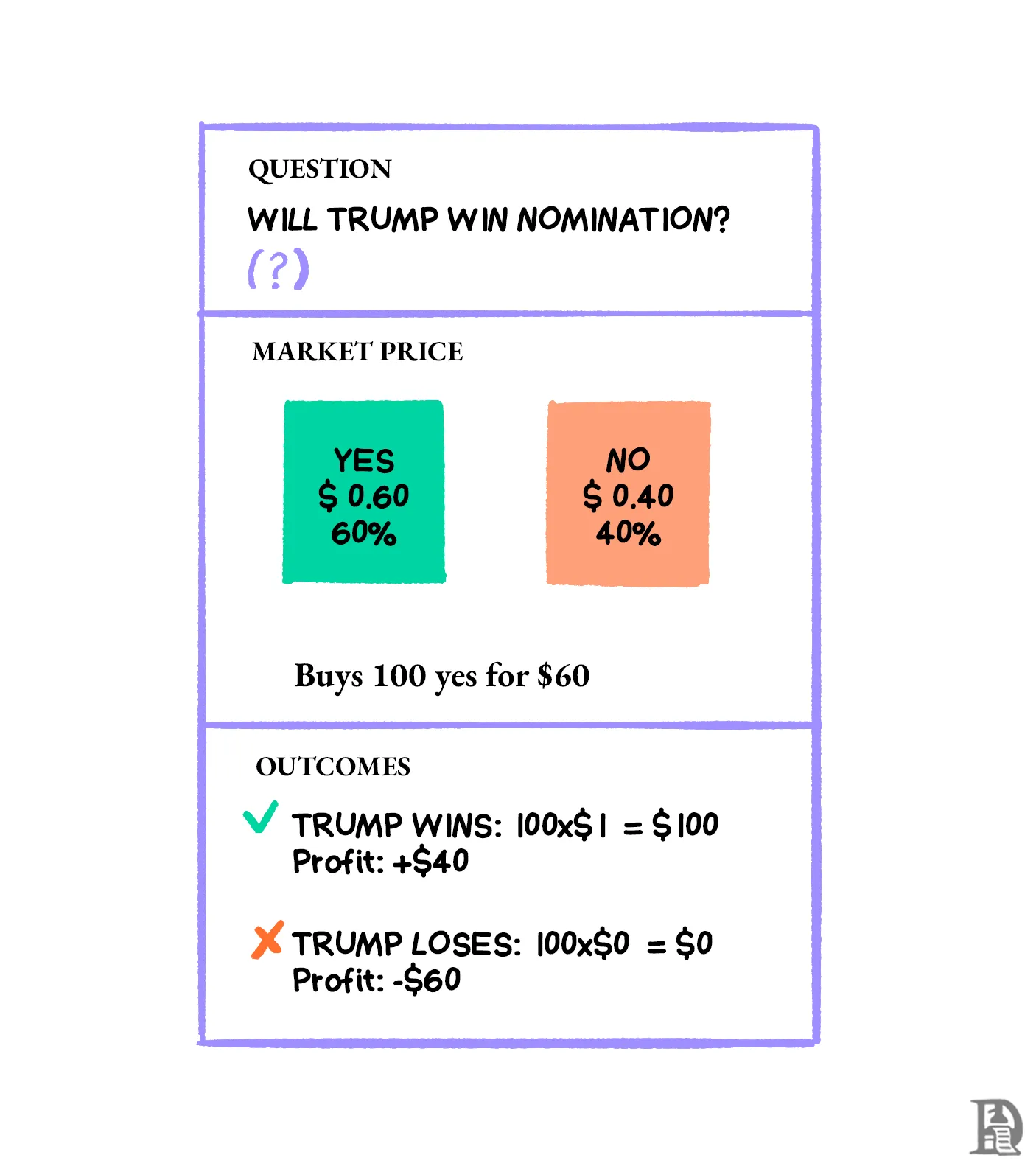

Prediction markets are a coordination mechanism, powerful in how they match people with differing beliefs. Those closely following polling data may believe that a 60% chance of Trump winning is underestimated and will continue to buy until the price reflects their view; conversely, those who think the market is too optimistic will choose to sell.

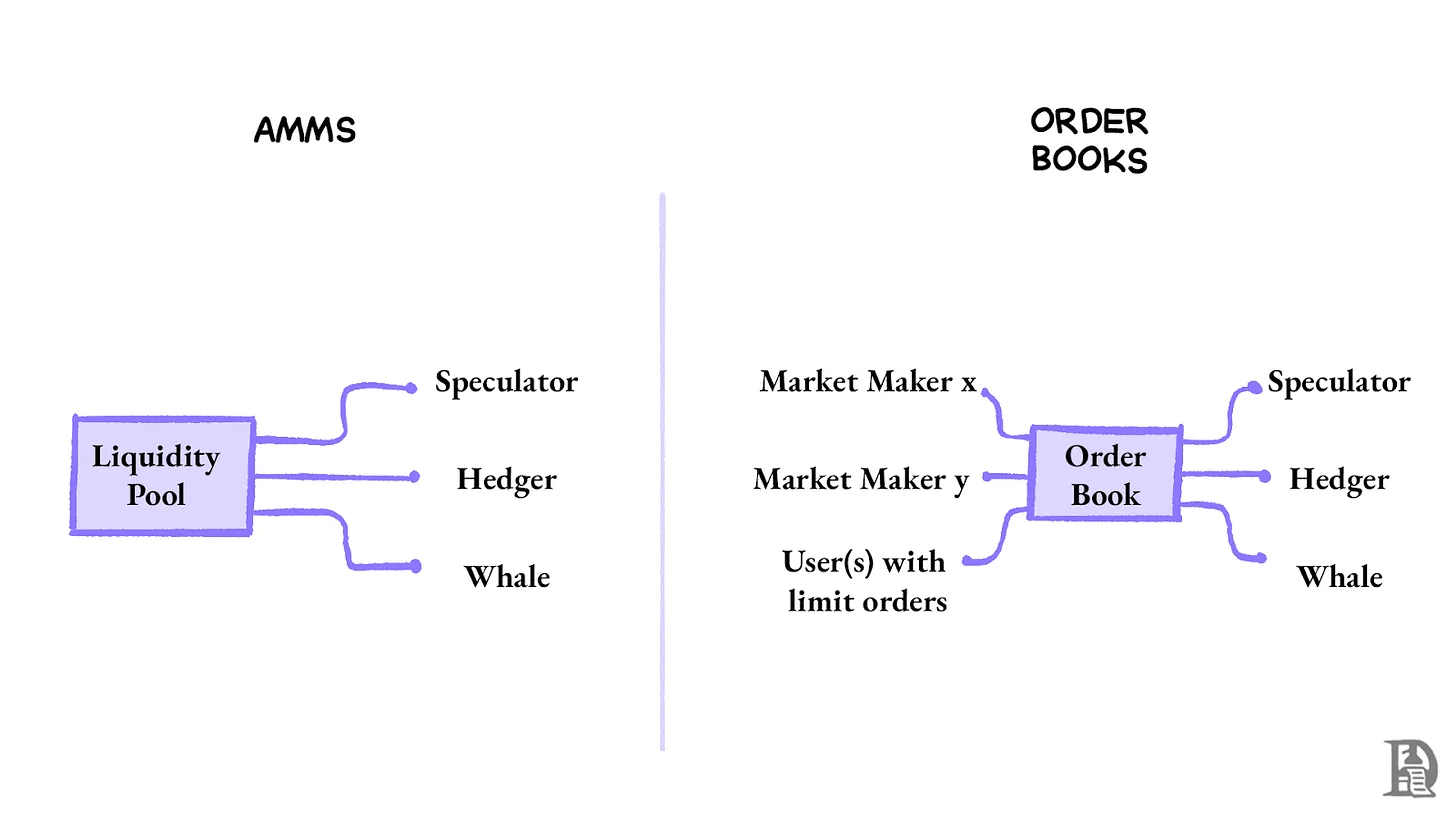

Those who make the correct judgment will win everything; it is a zero-sum game. But how can we ensure that there is always someone on the other side of the trade? Currently, there are two architectures with different trade-offs—order books and automated market makers (AMM).

Order books are the oldest and most well-known trading method. They operate similarly to exchanges: users post buy and sell prices, such as "I buy Yes at $0.58" or "I sell Yes at $0.62." Trades are executed when the buy and sell prices match. Prices naturally form through the competition between buyers and sellers. When liquidity is ample, the spread narrows to below one cent. During election week, political trading markets typically operate this way, with a large number of orders and minimal spreads. Market makers also intervene to provide liquidity and earn commissions by facilitating trades. It is the same mechanism that allows Hyperliquid to operate with extremely low spreads.

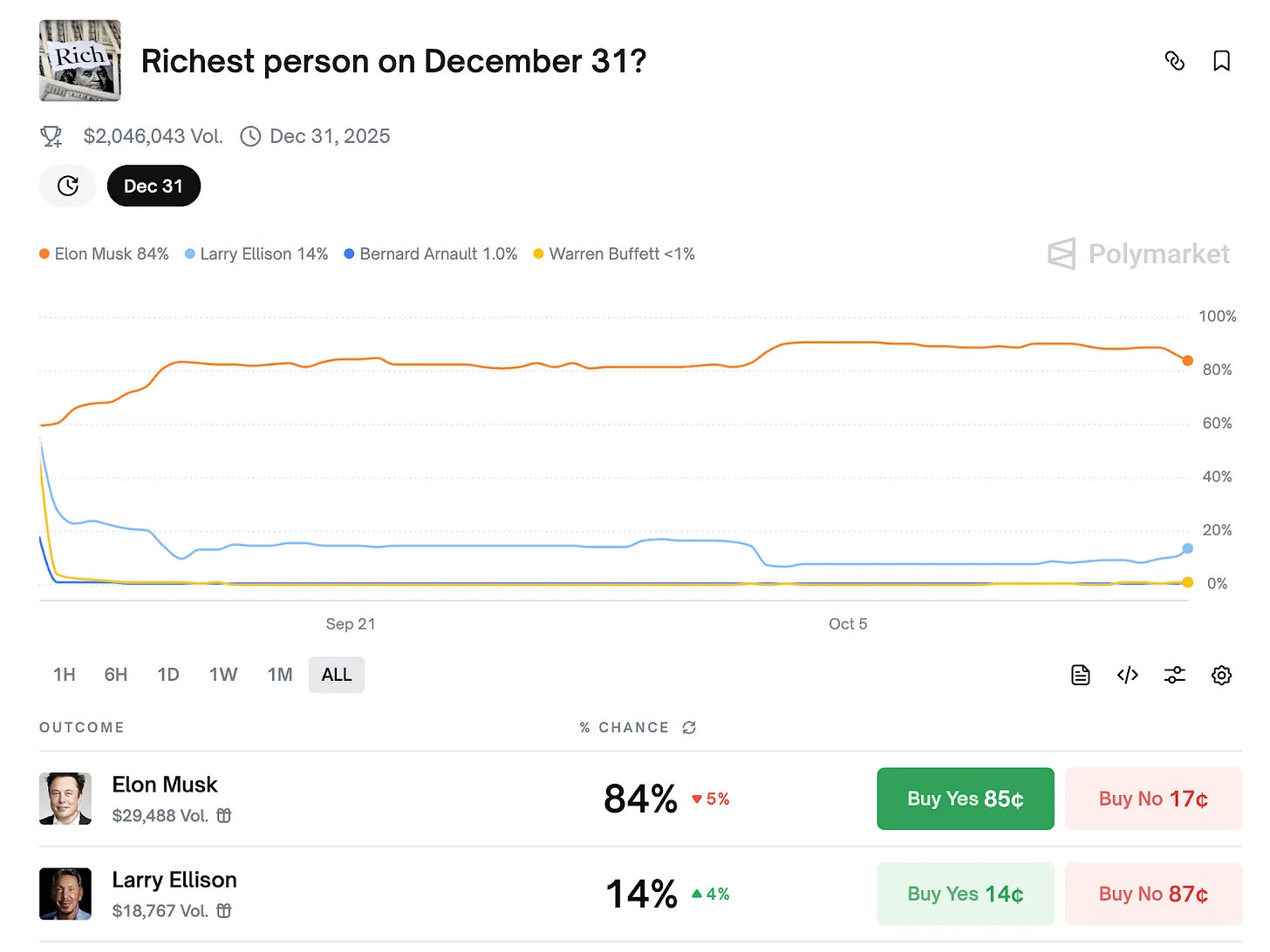

The problem lies in fragmented liquidity. Each market requires its own active buyers and sellers to maintain two-way pricing. A market on "Will the Federal Reserve raise interest rates in October?" may have 5,000 active traders providing liquidity with a volume of $70 million. However, a market on "Who will be the richest on December 30?" may only have 20 traders with a volume of $2 million. Markets with insufficient liquidity have larger spreads and are effectively untradeable. Moreover, as we recently saw with the $19 billion liquidation event, market makers may also exit during market turbulence.

The automated market maker (AMM) model addresses this issue through liquidity pools. Users no longer trade peer-to-peer but trade with liquidity pools controlled by mathematical curves. The more Yes tokens purchased, the higher the price becomes. The most well-known version is the constant product market maker (CPMM) used by Uniswap, which ensures that liquidity is always available.

AMMs are flexible and open, capable of instantly creating new markets without waiting for counterparties to establish. However, this flexibility comes at the cost of precision. To achieve the same trading depth as an order book, AMMs need to lock up more capital. The result is the slippage problem— a $10,000 trade might move the market price from $0.60 along the curve to $0.65, while on an order book, a trade of the same size could be completed at $0.61.

The Problem with Sports Betting

When you focus on sports events, the current limitations of prediction markets become evident. Elections or policy events develop slowly, and probabilities change as new information emerges. In contrast, sports events are fast-paced; a goal, a red card, or a momentary VAR decision can cause odds to fluctuate by up to 50%. Existing systems suitable for macro predictions simply cannot operate in this rapid environment.

In the 2022 World Cup final, after Mbappé scored his second goal, France's winning probability surged from 5% to 60% in less than two minutes. Any market maker holding an order book would face catastrophic losses as their outdated orders would be instantly targeted.

Traditional sports bookmakers utilize complex trading systems to cope with such rapid fluctuations, adjusting odds within microseconds to protect their interests. However, we cannot expect retail users to monitor every game and cancel and re-place orders within seconds of a goal. After a few instances of being outbid by competitors, rational liquidity providers will stop posting orders in the sports betting market.

Compared to political events, the odds fluctuations in sports events are much faster

The scale issue exacerbates the situation. A typical Polymarket election market may have thirty to forty active contracts at the same time. In contrast, a single sports betting platform covers thousands of events. Every game, every goal, every corner kick, and every red card requires real-time pricing. All these markets need active liquidity to remain tradable. Mathematically, this does not work. Fragmented liquidity means that without significant capital investment, it is impossible to provide deep and responsive odds.

Despite these issues, prediction markets are still focused on the $140 billion sports betting industry due to the advantages they offer. Traditional sports bookmakers operate like black boxes, maintaining profit margins of 5% to 8% on regular bets, arbitrarily refusing payouts, freezing accounts without explanation, and banning winning players at will. Users have no recourse other than contacting customer service or hiring a lawyer.

However, at present, prediction markets cannot scale to fill this gap. Kalshi and Polymarket currently have a monthly trading volume of about $1 billion, while global sports bookmakers exceed $20 billion in trading volume during the same period. Polymarket's trading volume throughout the election year is only equivalent to the total of DraftKings, Bet365, and FanDuel during a busy weekend.

In their current form, prediction markets rely on liquidity providers to intervene. It is estimated that liquidity discrepancies during peak trading periods lead to about a 15% price deviation, eroding user profits. Therefore, more sophisticated liquidity management solutions are needed to improve the user experience in on-chain prediction markets. In this context, Azuro has emerged.

Azuro

On a cold morning in 2012, in Yerevan, the capital of Armenia, Paruyr Shahbazyan built a simple website with a $50 template. His goal was both ambitious and straightforward—to bring transparency to the murky world of sports betting. As a professional bettor, he was well aware of the industry's pain points: bookmakers refusing to pay out winnings, accounts being frozen for no reason, and odds that always seemed to be stacked against the winners.

Through his betting platform Bookmaker Ratings, he helped affected bettors recover over $12 million in losses and built deep trust within the community. However, as cryptocurrency payments began to flow into betting sites and blockchain technology matured, Shahbazyan saw an opportunity to fundamentally address these issues. Thus, he founded Azuro, aiming to create an on-chain betting protocol that would make intermediaries a thing of the past.

The core idea of Azuro is to restructure the operational mechanism of sports betting into a public infrastructure. Azuro abandons the practice of each market maintaining its own liquidity pool and instead operates a shared single fund pool. This fund can be dynamically allocated to thousands of different events. The protocol functions like a financial grid: when liquidity demand surges during the World Cup, funds that were previously idle in esports or regional events can immediately flow into European markets. Conversely, when European events are in the off-season, this liquidity can be reallocated to events in the Americas.

The Azuro ecosystem consists of three interrelated main participants:

Data Providers are the core of the system, functioning similarly to traditional odds providers like Sportradar. They create betting markets, provide real-time odds, and determine match outcomes.

Front-end Applications are the consumer-facing interface layer that players interact with directly. Azuro does not build betting interfaces itself but allows anyone to create applications that utilize its liquidity and markets.

Liquidity Providers are the funding engine of the platform. By depositing funds into Azuro's single fund pool, they can participate in all betting markets on the platform. They can be seen as "bookmakers," but they do not need to engage in complex trading operations; they simply provide funds and earn returns.

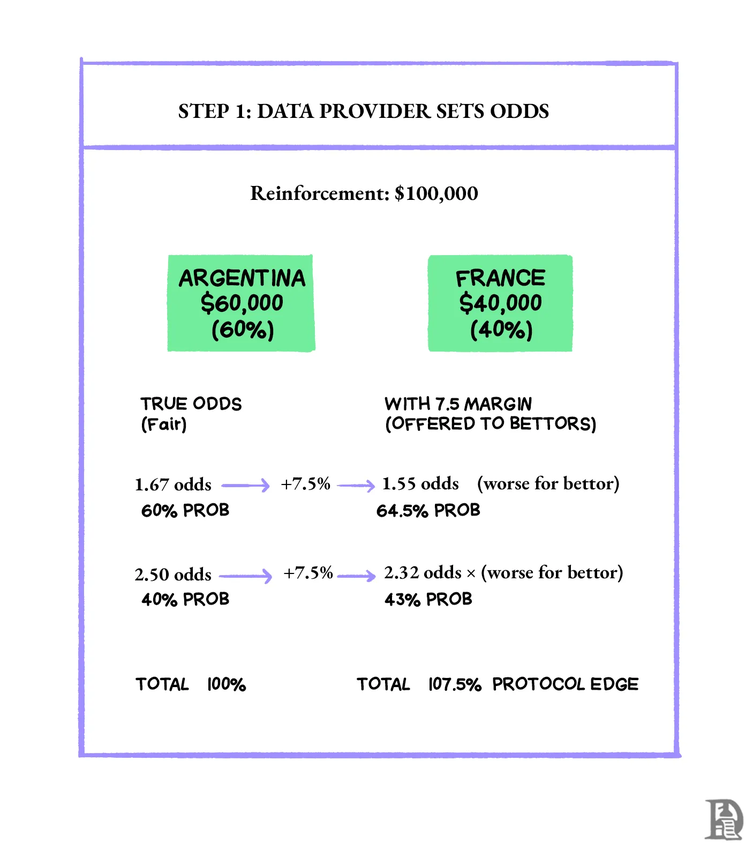

When data providers create a new market, they specify a value called "Reinforcement," representing the maximum potential loss the fund pool may face due to that specific market. Importantly, the fund pool does not actually lock up the entire amount but uses a virtual funding system to track real-time liquidity needs.

Data providers allocate this reinforcement effect to two possible outcomes based on their analysis:

Argentina wins: payout $60,000 → odds 1.67 (probability 60%)

France wins: payout $40,000 → odds 2.50 (probability 40%)

The protocol does not actually provide these "real" odds to bettors. Instead, it increases each probability by 7.5%, thereby adding a 7.5% profit margin, resulting in slightly lower odds:

Argentina wins: 1.55 (instead of 1.67)

France wins: 2.32 (instead of 2.50)

Azuro ensures long-term profitability through this margin—similar to how traditional bookmakers charge commissions, with the key difference being transparency. Azuro's profit margin is fixed and publicly visible, contrasting sharply with the often hidden and variable profit margins in traditional betting odds.

Case Study

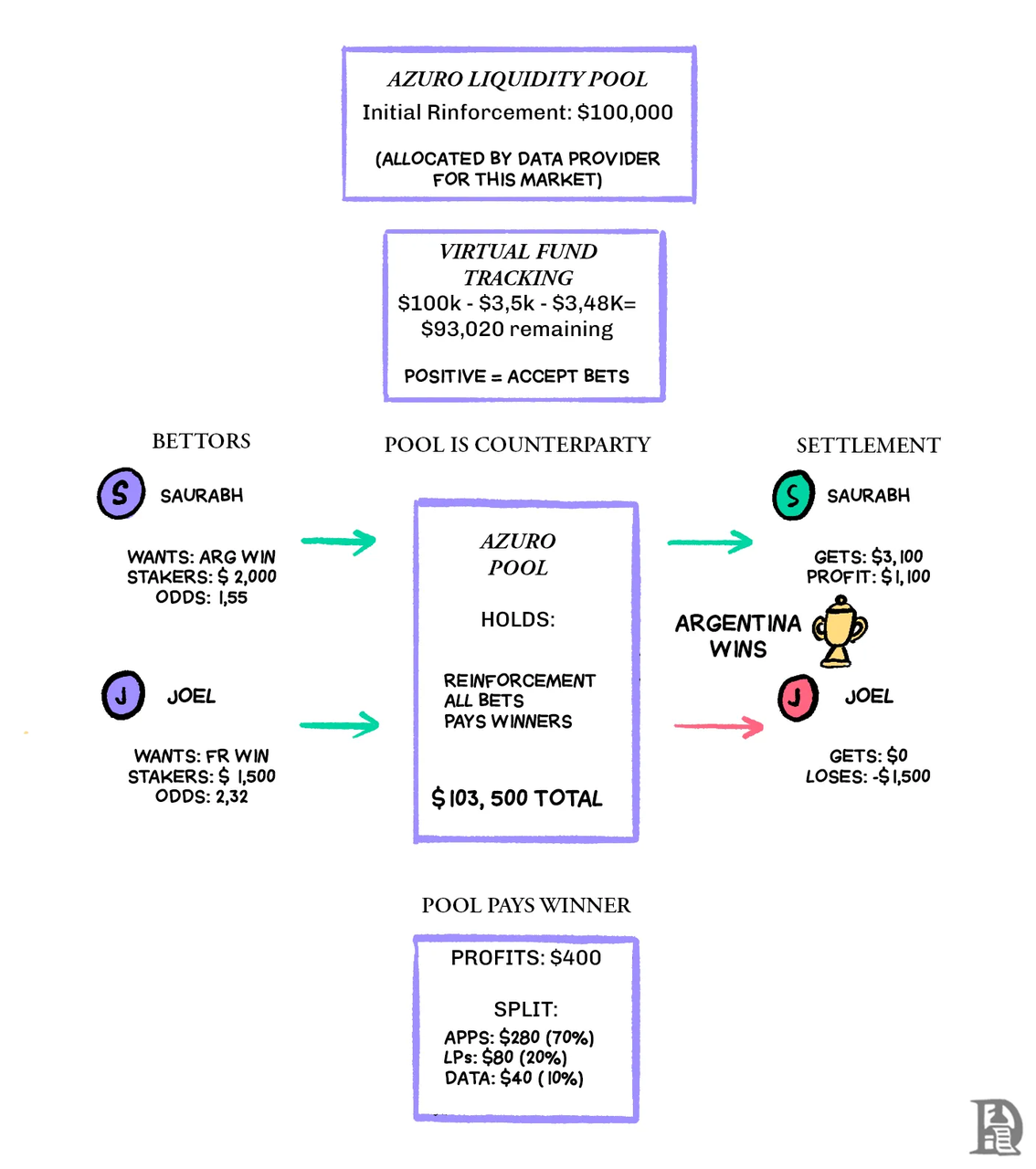

As pre-match betting heats up, bets begin to flow. Saurabh firmly believes in Messi's prowess and bets $2,000 on Argentina at odds of 1.55. Joel supports the defending champions and bets $1,500 on France at odds of 2.32.

The virtual fund of a market is calculated as follows: reinforcement amount minus total bets minus maximum potential payout. In other words, it tracks the protocol's maximum liability in the worst-case scenario. In our example, after both participants place their bets, the virtual fund becomes:

Initial fund: $100,000

Total bets: $3,500 ($2,000 + $1,500)

Maximum potential payout: $3,100 (if Argentina wins)

Pool profit including 7.5% slippage: Joel's $200 + Saurabh's $200

Virtual fund = 100,000 - 3,500 - 3,100 = $93,400

When Messi scores in the 23rd minute, the data provider temporarily pauses market trading while updating the odds. The new odds trigger an automatic recalculation of the virtual fund. If the virtual fund remains positive, betting continues. If any virtual fund approaches zero, that specific outcome will stop accepting bets until existing positions are settled or more liquidity becomes available.

If there is any dispute regarding the outcome, AzuroDAO will act as the final arbiter through on-chain voting, with voting power corresponding to the number of AZUR tokens staked and the duration of the stake.

This "fund pool" structure pairs with a Liquidity Tree mechanism that tracks every active bet and reallocates virtual funds to maintain solvency across all outcomes. Liquidity providers can access the overall cash flow of the entire protocol. It’s like being the bookmaker for every betting company simultaneously, but equipped with algorithmic risk management and transparent accounting systems.

This architecture is particularly effective for what the industry calls "long-tail events" (i.e., events or tournaments with lower betting volumes). Traditional bookmakers typically avoid these markets entirely, as maintaining independent liquidity pools is economically unfeasible. However, Azuro's single pool mechanism can utilize the same infrastructure as the World Cup final to support matches in Bulgaria's second division football league. The protocol allocates smaller funds to these markets while maintaining an efficient capital utilization rate across the entire system.

Becoming a Bookmaker

As long as organized betting activities exist, the status of "bookmaker" has always been enviable. William Hill started as a small bookmaker in 1934 and has since grown into a multi-billion-pound enterprise. Bet365 began as a simple house in Stoke City and is now valued at over £7 billion. In the betting industry, bookmakers almost always profit.

Azuro democratizes this position through its liquidity provision mechanism. No longer do the William Hill family or the Coates family of Bet365 monopolize all profits; anyone can become a partial owner by depositing funds into the protocol's single fund pool.

The mechanism is straightforward: deposit assets into the fund pool, and you can start earning a share of the profits from all market betting activities supported by the protocol. You can think of it as buying shares in a global sports betting company, but with liquidity that is almost instantaneous and without bearing the operational costs of the company. For example, when the protocol generates $400 in profit from Saurabh and Joel's bets during the World Cup final, liquidity providers collectively receive $80—20% of their revenue share. If this model is scaled to thousands of bets daily, these seemingly small profit shares can ultimately accumulate to an average annual percentage yield (APY) of 15-20%.

This accounting system operates similarly to other DeFi treasury models (such as Hyperliquid's LP treasury or GMX's GLP pool). Users' deposits grant them a corresponding share of the net asset value of the treasury. As trades settle, profits and losses flow in real-time, adjusting the positions of all participants.

This is not a completely risk-free fund. When liquidity providers first deposit funds, they must adhere to a mandatory 7-day lock-up period. This prevents seasoned traders from frequently buying and selling around major sporting events, thereby manipulating the market. In the initial week, and sometimes extending to the first month, positions may often show negative returns.

This is intentional: the protocol's accounting system requires time to accurately allocate profits and losses among all LP participants.

These protective mechanisms are equally sophisticated. Remember how data providers pause the market during sudden events? For instance, when Mbappé scores two goals? This also protects LP capital from severe fluctuations. The protocol even implements automatic "stop-loss" thresholds, pausing market trading once potential losses approach dangerous levels.

Application Directions

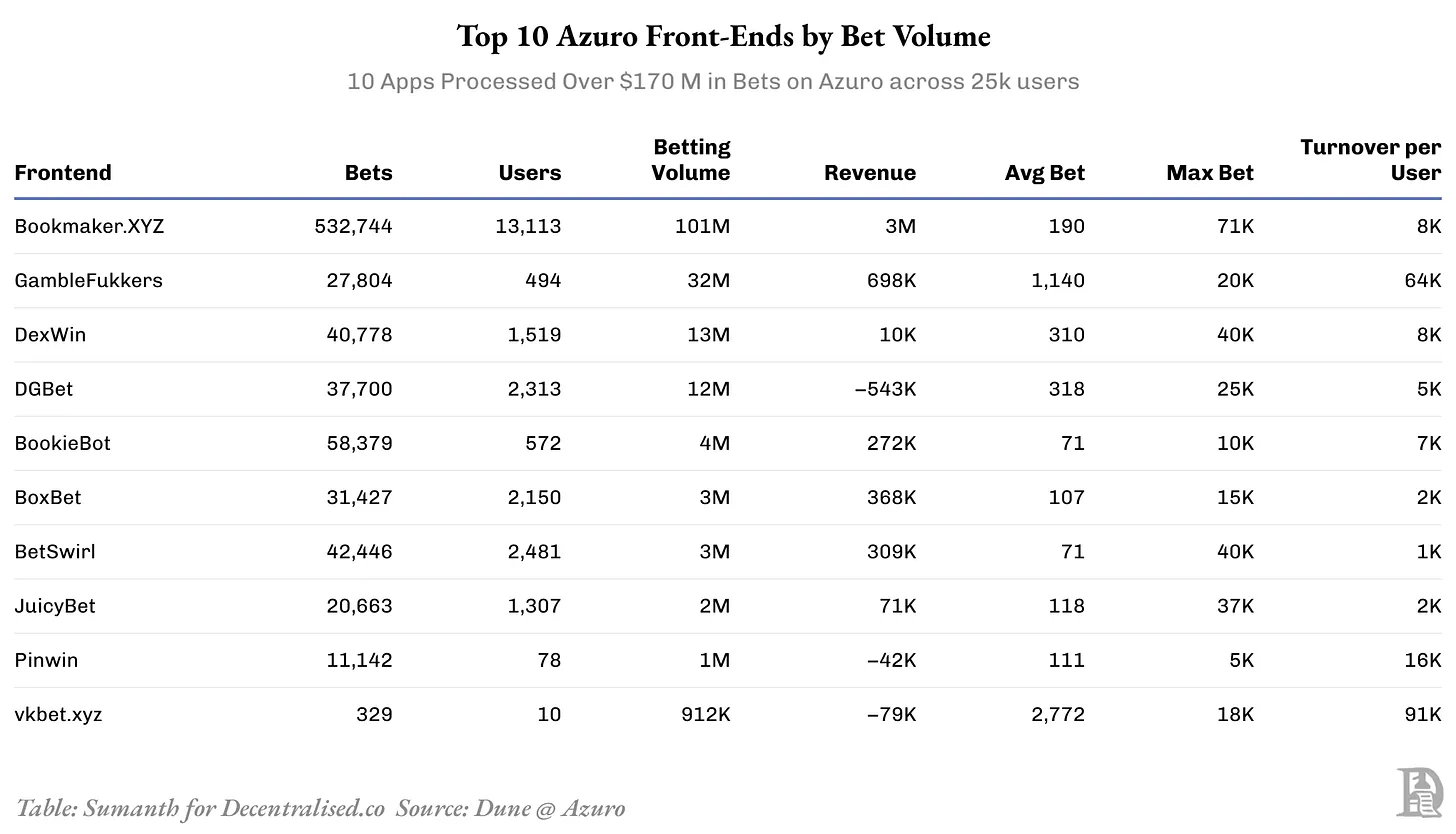

Azuro has processed $361 million in bets across 44 front-end applications. Its trading activity has steadily increased, with peak monthly trading volumes exceeding 23 million transactions. The protocol has attracted over 34,000 independent users, who demonstrate high engagement, with an average bet size of $5,000.

Single bets constitute the bulk of the activity, with a betting volume of $170 million, while parlay bets attracted nearly 250,000 transactions worth $13 million. Azuro's growth is particularly notable in regions where traditional betting faces significant challenges. The protocol has gained substantial adoption in areas like Latin America and Turkey, which have vibrant sports cultures but complex relationships with the betting industry.

In Turkey, for example, sports betting is technically legal but is effectively restricted to a state monopoly. Coupled with strict capital controls and a volatile currency, millions of sports fans are effectively shut out of the global betting market. Meanwhile, the chaotic regulatory landscape across Latin America and the limitations of international payment systems create similar barriers.

Azuro handles all backend operations, providing strong incentives. For instance, a developer in Vietnam discovered that local football fans struggled to use English betting sites, so he could build an interface that aligns with local culture, supporting local languages, regional payment methods, and Vietnam-specific markets. Another team might focus on creating a seamless mobile experience for African users, while a third team could integrate betting plugins directly into football statistics websites. The protocol's liquidity pool can be instantly accessed for any event.

For users in these regions, decentralized betting can simultaneously address multiple issues. They can access the global betting market without worrying about currency restrictions or complex KYC verification requirements. More importantly, they can be assured that they will receive payouts after successful bets, which is a concerning issue when using other betting methods.

From Sports to Attention

Prediction markets are diversifying into various niches, covering sports, politics, culture, and finance. But at their core, they have never truly been tradable: attention. The internet found a way to price clicks decades ago but has never managed to find a method to price the scarce attention that determines trends, product sales, or the spread of ideas.

Social platforms have around 5 billion users, and the information flow acts like a 24/7 global attention trading platform. Brands and content creators have been paying for this through advertising, sponsorships, and collaborations. Meta's advertising business generated $160 billion in revenue, accounting for about 98% of its total revenue. This is more than twice the global newspaper revenue.

Our existing tools can measure attention but cannot allow you to trade it. Google Trends shows which topics are experiencing a surge in search interest. In 2023, searches for "Ozempic" increased by 300%, while searches for "Strava" decreased by 40%. However, you cannot bet on this shift based on the stock changes of "Novo Nordisk" in the six months prior.

Social media analytics platforms, such as Brandwatch and Sprinklr, track brand mentions and "share of voice" across platforms, providing data to Fortune 500 companies to help them understand their competitive advantage in conversations. News organizations use tools like CrowdTangle to discover in real-time which news stories are spreading rapidly, while Nielsen's social content ratings measure what Americans are watching on television.

Brands currently use these descriptive tools to make decisions. They look at Google Trends to see if a topic is trending. They use platforms like HypeAuditor or Social Blade to catalog top creators by follower count and engagement rates. They focus on metrics—followers, likes, comments, shares—and collaborate with those who have the highest numbers. A brand launching an energy drink might want to partner with a fitness influencer. The return on these deals is calculated based on follower counts and the average engagement rate per follower.

However, this system is inverted. It measures what has already happened (years of accumulated followers, past interactions) and assumes this can predict what will happen in the future (the performance of future events). Yet, attention does not operate this way.

A creator with 5 million followers may be facing a decline in influence, while a creator with 500,000 followers may be experiencing rocket-like growth in their career. Follower count is a lagging indicator; the momentum of attention growth is what matters.

Santiment has done something similar in the cryptocurrency space. The platform tracks social volume, sentiment scores, and development activity of cryptocurrency assets, with data sourced from thousands of Telegram channels, Reddit posts, Twitter accounts, and GitHub repositories. Traders use it to detect narrative shifts before prices reflect them. When social mentions of "Bitcoin ETF" surged in December, users saw the formation of the narrative weeks before formal approval.

Kaito makes it easier to track the attention of trending topics and identify which creators are driving market trends. You can see that "stablecoins" are heating up while the trend for "AI agents" is slowing down. However, this is limited to the cryptocurrency space. You cannot use it to compare whether "Barbie" or "Oppenheimer" is more popular, or whether people are more interested in the new iPhone or OpenAI's new video model.

The natural evolution is to trade narrative momentum across fields, treating it as an industry index rather than picking individual stocks. For example, if you believe AI will dominate search, you can go long on "AI search engines." You are betting on the shift in discourse rather than trying to predict which will win between Perplexity's Comet or ChatGPT.

What is currently lacking is a clear, tradable index that allows you to go long when a trend is forming and short when the trend begins to stale, without the need to issue tokens or engage in media buys.

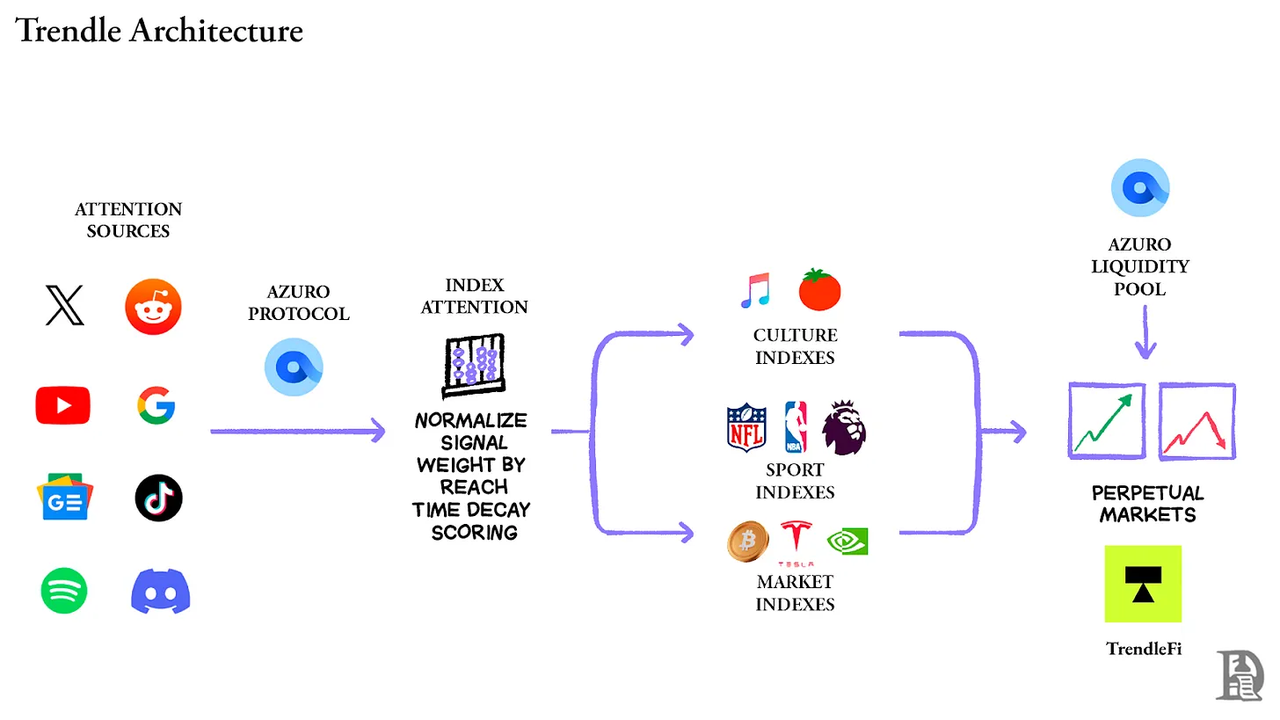

This is where Trendle comes in. It leverages Azuro's platform, applying the same liquidity logic used in sports betting to the most ubiquitous commodity on the internet: user attention.

Trendle: Trading Conversations

If prediction markets price answers to questions, then attention contracts price the discussions themselves. You choose a globally trending topic, and if you believe attention will rise, you bet "up"; if you believe attention will fall, you bet "down." If your confidence is high enough, you can use the Boost feature for up to 5x leverage.

From an underlying architecture perspective, Azuro's algorithm is more precise than "just counting mentions." Its protocol aggregates signals from multiple platforms, including Twitter, Reddit, and YouTube. Data for each topic is continuously extracted from these platforms, and due to the scale differences among platforms, each raw signal is adjusted to a common baseline.

This means that the difference between thousands of posts on Reddit and billions of views on YouTube is standardized, and the system aggregates all activity into a single value, aligning data from each platform onto the same time grid.

These participating signals are transformed through a time decay function, giving more weight to recent activity. Ultimately, a comprehensive attention index is generated that reflects momentum rather than raw volume. The final step is to measure the change in this index over a seven-day memory period. This allows Trendle to capture sudden spikes (like a viral tweet) and persistence (when a narrative lasts for several days).

These indices focus not on precise counts but on signal momentum: is the attention index rising or falling over the set period? It bets on momentum rather than absolute transaction volume.

The system is also designed with anti-manipulation mechanisms: it cross-validates activity across platforms, flags anomalies in participation rates, and limits the contribution weight of any single entity or channel. In the future, Trendle can add more data sources (like Discord, Spotify, and Google Search) to expand its coverage.

Additionally, prediction markets typically have strict deadlines, but trends do not. Topics can rapidly explode or fade within hours. Trendle does not seek precise outcomes but employs directional analysis: the question is not "what is the exact score?" but "is attention rising or falling during the observation period?"

Sports betting has taught Azuro how to handle fragmented, volatile markets. Attention behaves similarly. It splits into thousands of micro-topics that emerge in different time zones and quickly fade away. Most of these markets have liquidity that is too thin to support an order book, so launching a new pool for each market would only leave capital idle.

This is where perpetual contracts are more suitable. The Azuro team has built a product called Trendle that provides perpetual contract support for these cultural indices. Funding rates ensure balance between long and short positions.

Similarly, prediction markets settle on specific deadlines, but trends do not. Attention on the internet is volatile. Sports events end at a specific time: a 90-minute game divided into four quarters, concluded by a final whistle. On the internet, however, a topic can peak and crash within hours.

Perpetual contracts can handle this situation. Obvious issues will be resolved quickly, and disputes will only escalate when data sources conflict or methodologies are flawed. Governance processes should remain separate from normal trading processes but should be available when needed.

Since these infrastructures are permissionless, front-end interfaces can be specialized for different users. Creator tools can integrate the same markets into publishing calendars and fan analytics. Brand planners can oversee funding pools through pre-testing dashboards and activity windows. A native crypto interface can express relative bets between different narratives. Different interfaces share the same liquidity and settlement mechanisms.

The distribution layer can continuously experiment, but the market infrastructure remains unchanged. In fact, Trendle turns the information flow of the internet into a perpetual price discovery machine.

Why Attention is More Important than Equity

Markets price stories before pricing cash flows, and traders are well aware of this. Tetlock proved in 2007 that negative media sentiment can predict next-day earnings reversals. Subsequent research extended this logic to Google search volume—when a stock's search volume surges, its short-term volatility and trading volume also rise. Retail investors commonly chase "meme stocks," those that make headlines or appear on CNBC's hot list.

Today, if you believe an event will quickly gain traction, you can only express that view indirectly by buying the underlying stock or trading options. Attention contracts allow you to trade the drivers rather than the surface: if you expect a news cycle to develop, go long; if you think it will be short-lived, go short, without actually touching the stock.

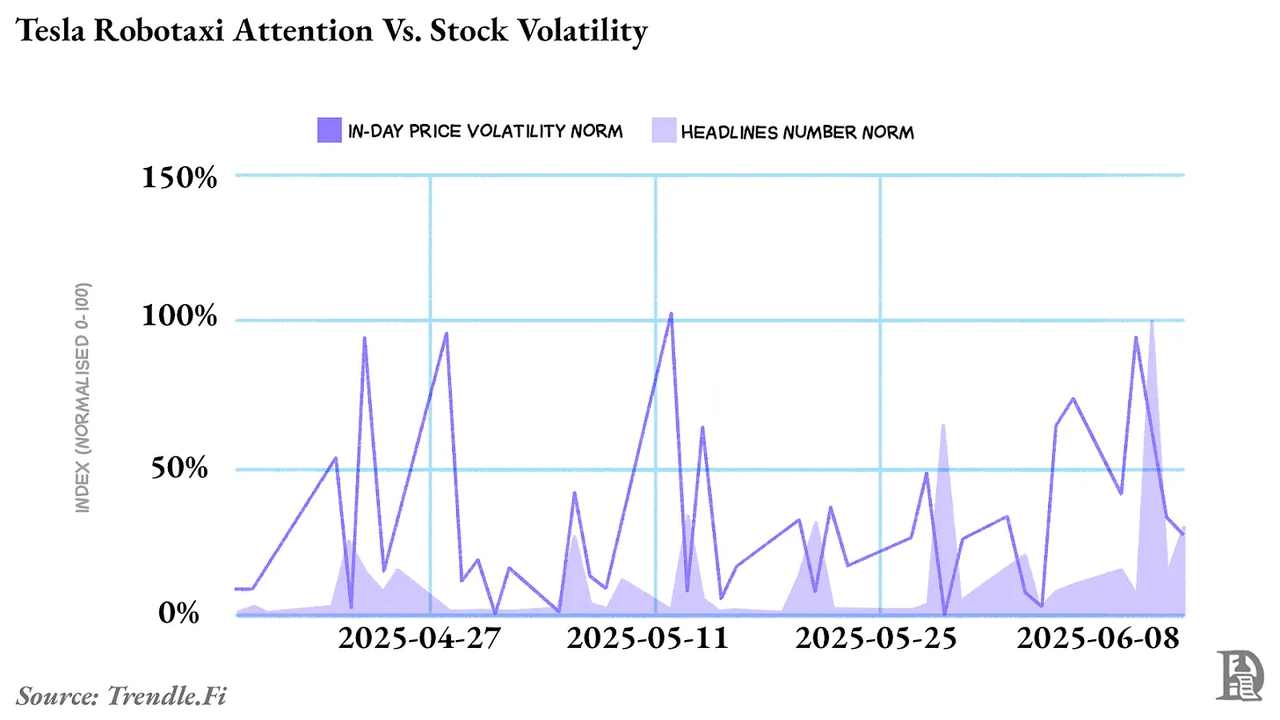

The chart below overlays two standardized sequences: the intensity of news headlines about "Tesla's autonomous taxi" and the intraday volatility of Tesla's stock price during the same period. The surge in Tesla's stock price coincides with the increase in the number of news headlines mentioning Tesla's autonomous taxi.

If you anticipate that a company is about to become the center of public attention, directly trading that stock seems too simplistic. You are buying the implied value of the stock, which includes fundamentals, macroeconomic factors, and positions. What you are really confident about is the change in attention over the next few days.

This is a whole new way to express a viewpoint. In the past, people had to consider the secondary effects of "trends" and choose the tools that best reflected their views on "how the trend would evolve." Each step toward that tool added a layer of uncertainty. But when you trade attention directly, you no longer have to face these concerns.

New financial instruments typically enhance market efficiency in two ways: 1) providing new channels for expressing viewpoints; 2) making viewpoint expression more precise. VIX futures (launched in 2004) and credit default swaps (CDS) belong to the former, while Bitcoin ETFs belong to the latter.

Before the advent of CDS, if you wanted to short a company's credit quality, you could only short its bonds, which required an understanding of concepts like interest rates, liquidity, duration, and credit risk. Even if your judgment about the company's credit was correct, you could still incur losses due to other factors. CDS allows you to trade default risk purely. Michael Burry wanted to short subprime mortgages, but shorting mortgage bonds was cumbersome and expensive. CDS provided him with a straightforward tool to express the view that "these mortgages will default."

Attention contracts isolate the layer of attention and settle in a structure similar to options. For example, a "rise" contract priced at $0.42 per week. If attention rises, you will receive $1; if attention falls, it goes to zero.

You spend $42 to purchase 100 contracts. If you correctly judge the popularity of Robotaxi, you will recover $100, resulting in a profit of $58 (a 138% return). If you are wrong, you will lose $42.

In contrast, trading Tesla stock (TSLA) is entirely different. To achieve the same return, Tesla's stock price would need to rise by 138% in just one week, which is nearly impossible. You would need to buy short-term options, and a negative news story about Musk could wipe you out, even if Robotaxi's attention is indeed rising. Instead of using Tesla as a proxy for the view that "more people will talk about Robotaxi" and bearing risks such as Musk's tweets, macroeconomic conditions, and Tesla's production, it is better to directly bet on the discussion heat of Robotaxi in the attention market.

This is precisely where the contract structure is key. Weekly attention itself is highly volatile, and binary directional settlement transforms narrative heat into a clear profit and loss line: you profit if you correctly judge the direction of the conversation, and it goes to zero if you are wrong. You do not have to worry about whether the stock has digested the cycle in a single day, whether macro news has offset the impact, or whether market timing has truncated volatility. Since the amount of a single contract in prediction markets is usually small ($10, $25, $50), you can diversify your viewpoints across multiple narratives, allowing the law of large numbers to accumulate small advantages rather than placing a single bet on one target.

How to Achieve Scalability

The front-end interface can be specialized for different user groups and create new attention markets.

A music dashboard can monitor attention changes in real-time during album releases, similar to tracking streaming data. When Taylor Swift announces a new album, attention does not explode instantly but accumulates gradually through lyric easter eggs, mysterious social media posts, surprise singles, etc., peaking on the release day. Fans can go long on attention two weeks after the marketing campaign starts and short after the initial wave of heat fades (three days post-release). Additionally, record companies can compare two potential comeback concepts for K-pop groups before finalizing their plans.

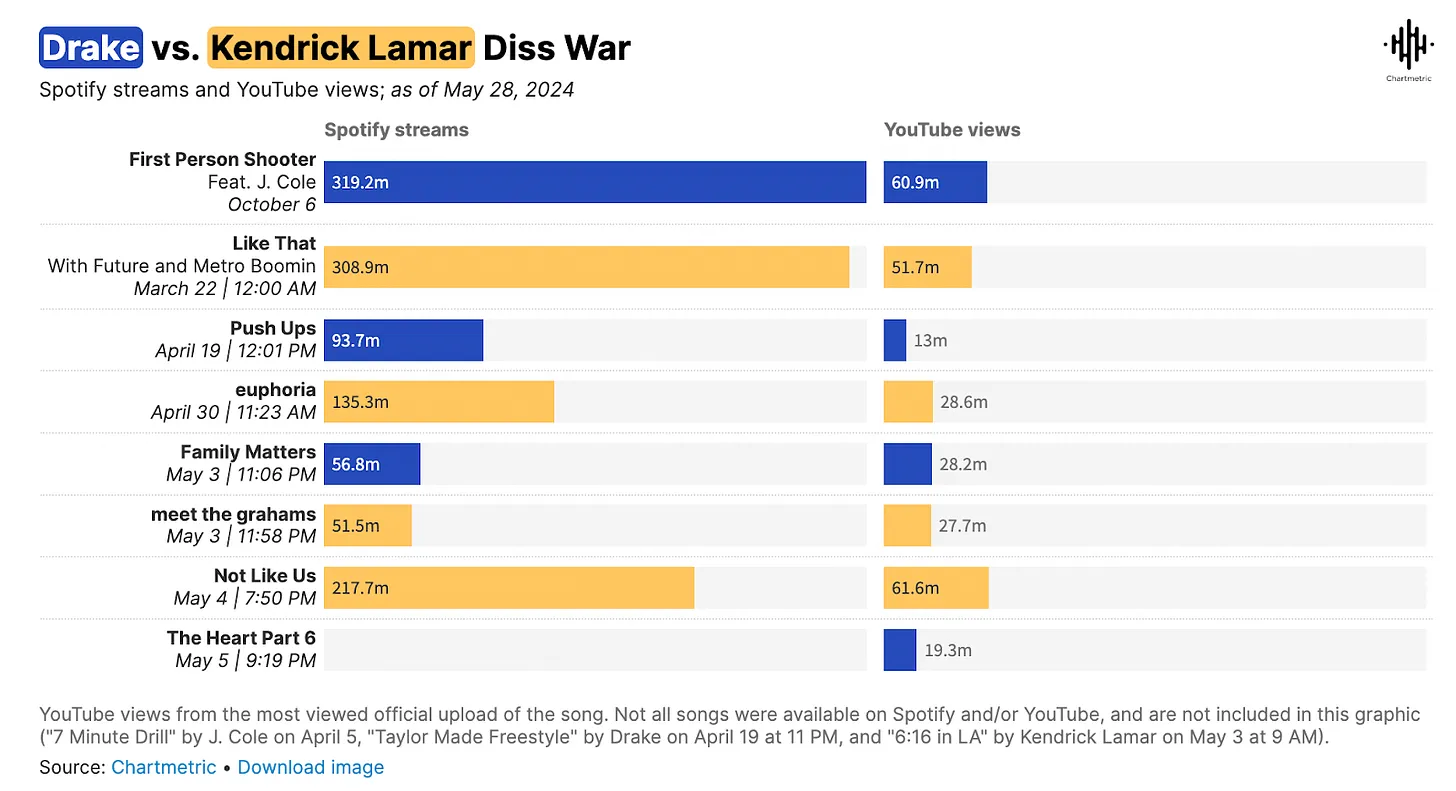

This approach is superior to traditional methods because it provides real-time feedback with financial backing. Focus groups can only tell you what people claim to care about, while attention markets reveal what people are willing to bet real money on. For example, in the feud between Kendrick Lamar and Drake, public attention swings between the two as they each release diss tracks. Record companies thus gain genuine market signals to determine which content truly breaks through.

Moreover, record companies can test some unconventional concepts in the attention market before investing millions of dollars in production budgets. For instance, they could use a $100,000 budget to test ten outlandish ideas in the attention market and then concentrate a $1 million production budget on the two ideas that perform best.

Brands can do the same. Digital advertising is a massive $700 billion industry but still relies on A/B testing, surveys, and focus groups. Focus groups once predicted that New Coke would dominate the market. Market research also thought the iPhone was overpriced. Attention markets disrupt this model: they do not ask what people claim to care about but measure what they are willing to bet on.

Suppose Nike wants to test two creative concepts. They can create attention markets for each concept, invest a moderate budget, and then observe which concept the public finds more appealing. This method is faster and cheaper than focus groups. Coca-Cola can test its slogans "Taste the Feeling" and "Open Happiness." Let the market decide how to allocate the $100 million media budget.

Each front-end interface can use different languages: a dashboard for agents, a mobile interface for fans, and candlestick charts for speculators. But the underlying architecture remains unified. To this end, the Azuro protocol abstracts the complex parts, allowing developers to focus on product experience.

Future Outlook

For centuries, price has been the best measure of truth, reflecting the public's perception of the value of something at a specific point in time. Prediction markets extend this truth-seeking mechanism into the future, while attention markets expand it into culture itself.

In the 1990s, online brokerages allowed retail investors to access stocks. By the late 2010s, decentralized finance (DeFi) breathed new life into foundational financial areas. Today, Azuro's infrastructure and Trendle's model are bringing this transformation to the information domain. Every refresh of the information flow, every viral post, and every creator's release becomes a data point in a continuously running collective intention oracle.

However, Azuro also faces challenges that need to be addressed: a compromise by a data provider could threaten the entire protocol, so it is essential to ensure multi-source input and assess the reliability of data sources. Traditional bookmakers have insurance and balance sheets to absorb shocks, while Azuro's funding pool depth depends solely on the deposits of liquidity providers, and black swan events could trigger runs and liquidity death spirals.

At the same time, attention markets introduce new attack surfaces. During low liquidity windows, coordinated manipulation of activities on Twitter, Reddit, and YouTube could affect outcomes, especially in niche topics where information verification is scarce. The protocol assigns weights to multiple information sources to prevent single-platform manipulation, but theoretically, a loyal fan base could mobilize attention across enough platforms to influence the final outcome.

Attention markets sit upstream of stocks, derivatives, and token markets, capturing the real drivers of these variables: will the world's discussion of something this week exceed last week's? Trendle makes this betting possible, while Azuro provides scalability, neutrality, and sustainability.

If you are a consumer application developer: Azuro's permissionless model means you can launch betting or attention trading interfaces in weeks rather than years, without building liquidity from scratch or negotiating with odds providers. Just create the best user experience for your market and integrate with existing infrastructure.

If you are a trader: Attention markets offer new advantages that traditional finance cannot provide. You have been informally tracking narrative momentum, and now you can express those views with leverage and clear risks.

If you are a liquidity provider: You are betting on whether people will continue to bet on the future—this has been going on for 2,500 years and will continue for another 2,500 years.

If culture begins with the information flow, then price discovery should also start there.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。