【编者按】:2025 年以来,W Labs 接触了一些中资背景的大机构,行业包括基建、能源、奢侈品等,有的还是国字头的国有机构,要求我们提供关于国内外 RWA的研究分析和应用实例,到了年底了我们就把这一年来可以公开的一些研究所得和瓜友们做个分享。

这一系列文章内容很多,我们且不去给 RWA 下定论是否可以成为加密行业在未来出圈的主方向,也不去判定 RWA 是“画蛇添足”还是“挂羊皮卖狗肉”,更多的是把我们看到的和想到的写出来,让大家可以多琢磨一些行业的未来走势。

在全球金融技术浪潮席卷之下,真实世界资产代币化(Real World Assets, RWA)已成为 Web3生态与传统金融(TradFi)交汇的核心焦点。从贝莱德在以太坊主网上发行 BUIDL 基金( TVL 超 5 亿美元),到香港金管局 Ensemble 沙盒处理 RWA 规模 5 亿美元,RWA 正重塑资产流动性、融资效率与全球结算格局。

香港作为“东方 RWA 枢纽”,尤为引人注目:2025 年《稳定币条例》落地后,短短半年内涌现超 50 个合规项目——HashKey Exchange 的 GF Token (1.5 亿美元货币市场基金)、蚂蚁数科的朗新充电桩 RWA (1亿元新能源资产),乃至 Asseto 的 DeRings Tower 物业代币化(5000 万港元)。这一热潮不仅吸引中资巨头出海,更桥接“一带一路”供应链与全球资金。然而,近期内地监管指导意见暂缓部分跨境 RWA 试点,虽短暂冷却市场热情,却无法阻挡 RWA 在中美欧监管沙盒与机构入场中的结构性崛起——正如 FIT21 法案与 GENIUS 法案所示,稳定币 + RWA 已成为大国博弈的“数字布雷顿体系”。

本系列文章系统剖析 RWA 全景,从金融本质、核心技术、合规模操、全球项目矩阵,到未来趋势与创业路径,提供一站式研究框架。该系列文章一共分成四篇长文,第一篇主要用于普及基本 RWA 知识,第二篇将聚焦 RWA 全球监管实践和代表项目,第三篇专注中国及香港监管现状及代表项目,第四篇进一步结合当前环境阐述 RWA 可行实操路径以及未来行业趋势,争取让读者阅读本系列长文后,做到一册在手,洞悉 RWA 万亿赛道。无论机构投资者、传统企业,还是 Web3 创业者,我们将为您解锁战略制高点,推动中国资产全球流通与数字出海。

什么是 RWA

RWA(Real World Assets,现实世界资产)指存在于现实世界中具有价值的资产,例如房产、企业贷款、政府债券、艺术品、碳排放权、石油,甚至限量版威士忌等。这些资产通过区块链技术“代币化”,转化为数字资产,可像加密货币一样在全球范围内自由交易、流通和组合。在传统金融体系中,这些资产往往面临高参与门槛、流动性差、地域限制等问题。而代币化后,它们成为“链上资产”,打破了传统壁垒,具备以下特点:

-

支持快速交易,投资者可像买卖股票一样操作;

-

可用作抵押获取贷款;

-

可组合成多样化的投资“篮子”;

-

持有者可获得租金、利息等收益分配;

-

实现全球化流通,不受国界或时间限制。

RWA 的代币化不仅提升了资产的流动性和可访问性,还为用户提供了更灵活的投资方式,降低了参与门槛,推动了金融市场的创新与普惠化。通过区块链技术,RWA为传统资产注入了数字化活力,成为连接现实与数字经济的重要桥梁,广泛应用于金融、艺术、能源等多个领域。

为什么现在爆发

实物资产(RWA)代币化热潮在现阶段的爆发源于技术进步、监管优化、机构参与和市场需求的多重驱动。技术层面,以太坊、Polygon等区块链平台日趋成熟,智能合约和预言机技术提升了链上资产的安全性与扩展性,链上身份认证降低传统金融的信任成本。

监管环境逐步明朗,美国的监管节奏放缓,政策更清晰;香港金管局推出数字资产“监管沙盒”,新加坡支持链上债券和基金项目,为RWA发展提供合规土壤。传统金融巨头如贝莱德、摩根大通、花旗的入场,带来资金、资源和合规经验,推动RWA从区块链极客圈走向主流金融市场。

市场需求方面,全球高利率环境和传统资产收益下滑促使投资者寻求新资产配置,RWA通过代币化提供高流动性与全球参与机会,满足了这一需求。此外,区块链技术已从“技术爱好者”阶段迈向“实用主义者”大规模采用期,稳定币在跨境电商、自由职业者结算、全球支付等场景中融入现实经济,RWA作为区块链基础设施的角色日益凸显。

市场规模与增速

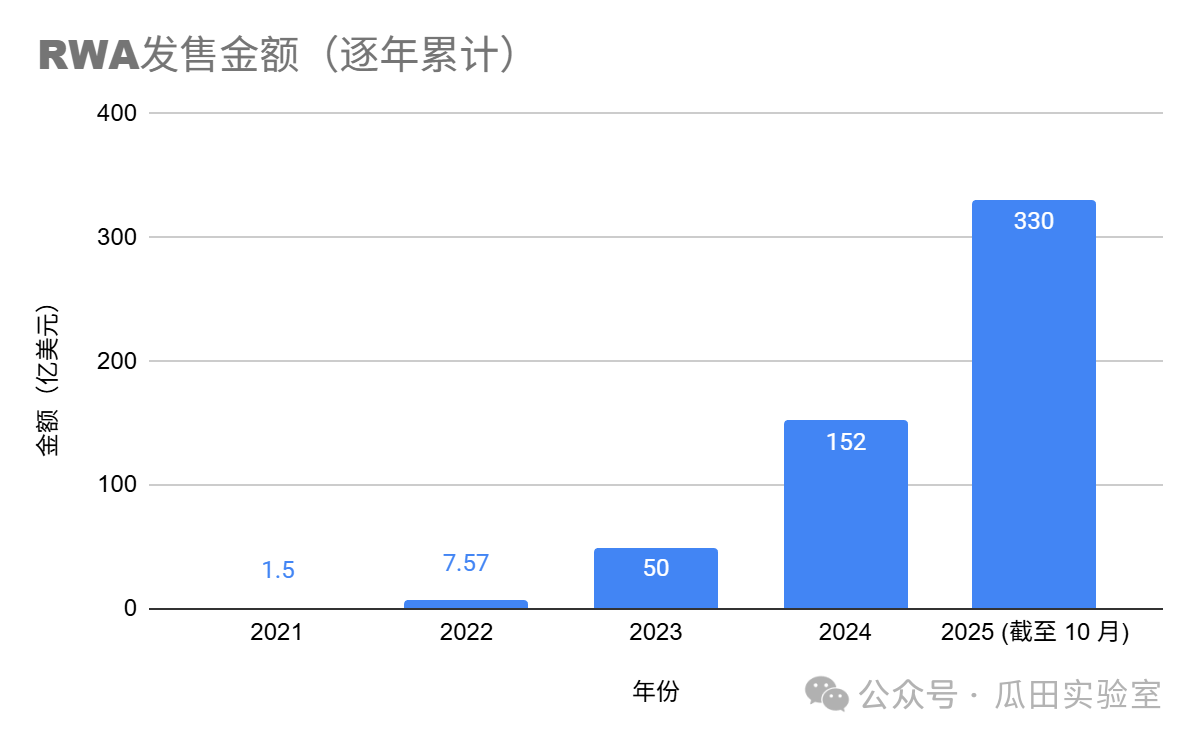

RWA 的全球探索正从香港到欧洲、迪拜到北美迅速升温,展现出制度设计、技术路径和商业模式的多样化趋势。截至目前,全球 RWA 资产总值已达 330 亿美元。而各大咨询和金融机构也对 RWA 的未来增长与规模做了大胆预测:

-

波士顿咨询集团预测,到 2030 年,RWA 市场规模可能达到 16 万亿美元,到 2033 年链上 RWA 资产规模或增至 18.9 万亿美元,未来 8 年复合年均增长率约为 53%。

-

德勤则预计,到 2035 年,房地产代币化市场将达到 4 万亿美元,年均增长率约 27%。

-

根据麦肯锡预测,到 2030 年,全球约 16 万亿美元的资产将通过 RWA 实现链上流通,其中 20%-30% 可能来自中国资产,凸显巨大潜力。麦肯锡 2024 年报告进一步指出,全球金融资产代币化市值有望在 2030年 达到 2-4 万亿美元。

-

贝莱德 CEO Larry Fink 多次强调,RWA 是区块链最具变革性的应用之一,有望重塑全球资产管理行业。他在年度股东信中表示:“代币化将是金融资产的下一阶段,每只股票、每只债券都将在统一账本上运行。”

而在稳定币方面,2024 年基于稳定币的支付清算总额已达 16.16 万亿美元,超过 VISA 与 Mastercard 的总和,标志着一个独立于传统银行和 SWIFT 网络的新支付体系的形成。传统跨境支付流程复杂,需多个中介参与,耗时可达两周,成本高昂。而稳定币凭借价格稳定机制和链上实时结算功能,实现点对点、无需信任的交易,理想情况下几秒即可完成,无需依赖传统清结算系统。

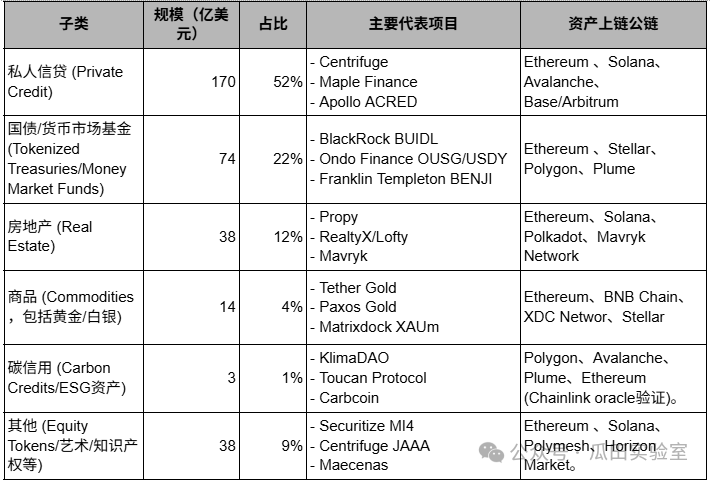

目前,RWA 主要集中于流动性较高的固定收益工具,房地产、股票、艺术品和基础设施等领域的潜力尚未充分挖掘,显示市场仍处于早期阶段。机构参与是 RWA 市场增长的核心动力,受监管的机构与 DeFi 原生协议共同推动市场供给,主要参与者包括贝莱德、富兰克林邓普顿等资管公司,摩根大通、花旗、渣打等银行,纽约梅隆银行等托管机构,以及 Maple、Centrifuge、Ondo Finance 和 MakerDAO 等 DeFi 协议。这些机构的加入表明 RWA 正从加密领域迈向主流金融。例如,欧洲投资银行已在以太坊上发行数字债券。

根据最新 RWA.xyz 和 CoinGecko 的数据,RWA 发行总量(截至 2025 年 9 月)已达到 330 亿美金,其中占比最大的类别是私人信贷、国债、商品,而相较于传统金融和实体资产规模,房地产、股票、艺术品和基础设施等领域的潜力尚未充分挖掘。

RWA 能解决什么问题?

RWA 是 Web3、传统金融和现实世界的一个跨界综合领域,它的出现,对于这三个领域都有一定的积极作用。

1. 解决web3领域的问题

-

流动性不足:Web3 资产(如 NFT 和部分代币)常因市场碎片化而流动性较低。RWA 将高价值现实资产(如国债、房地产)引入链上,增加流动性和交易深度。例如,代币化国债(如 BlackRock 的 BUIDL)可在 DeFi 协议中用作抵押品,提升资金效率。

-

资产单一:过去,DeFi 生态中的资产类别相当有限,几乎完全由加密货币构成。这些资产,例如以太坊、美元稳定币和比特币,不仅价格波动剧烈,而且彼此之间存在高度的联动性,导致整个金融体系显得同质化。引入现实世界资产有效缓解了这一问题,它显著扩充了资产类型,并增强了整体的稳定性。

-

真实收益的缺失:许多 DeFi 协议的收益来源依赖于内部的投机循环,例如通过借贷进行流动性挖矿,缺乏实体经济的支撑。相比之下,现实世界资产能够产生租金收入、债券利息以及大宗商品升值等收益,这些都由实体经济活动所驱动,因此具备更强的可持续性。

-

价值锚定不稳定:许多加密资产波动性高,缺乏稳定价值基础。稳定币(如 USDT、USDC)作为 RWA 的代表,通过锚定法币提供稳定价值,增强 Web3 生态的可信度和实用性。

-

用户采用受限:Web3 应用常局限于技术爱好者。RWA 引入熟悉的资产类别(如股票、债券),降低普通用户进入门槛,促进大规模采用。

2. 解决传统金融的问题

-

交易效率低下:传统金融中,资产交易(如房地产、债券)涉及多方中介,结算周期长(T+2 或更长)。RWA 利用区块链实现实时结算(T+0),如通过智能合约自动化债券利息支付,降低成本和时间。

-

准入门槛高:许多高价值资产(如私募基金、房地产)对散户投资者有高资金门槛。RWA 通过碎片化所有权(如代币化房产份额)降低投资门槛,扩大市场参与度。

-

透明度不足:传统金融市场常缺乏实时透明度。RWA 借助区块链的公开账本,提供资产所有权和交易历史的透明追踪,提升信任。

3. 解决现实世界的问题

-

资产流动性差:现实世界中的非流动性资产(如艺术品、私人信贷)难以快速变现。RWA 通过代币化(如在以太坊上发行艺术品 NFT)将这些资产引入全球市场,提升流通性。

-

金融包容性不足:全球范围内,许多人无法获得银行服务或投资机会。RWA 借助去中心化平台(如 Polygon、Stellar)允许无国界参与,赋能新兴市场投资者。

-

环境与社会问题:碳信用等 RWA 的代币化(如 Toucan Protocol)促进碳排放交易的透明性和效率,支持可持续发展目标。

4. 中国国情的解决方案

中国的房地产市场已步入“存量竞争”阶段。在这一趋势下,如何盘活闲置的存量资产、推动资本更高效地分配,成为行业探索新发展路径的核心议题。RWA (真实世界资产)的兴起为地产金融开辟了创新解决方案,它不仅限于“将房产数字化上链”,而是通过重新设计权益结构,利用区块链和智能合约等技术,将原本难以分割、交易流程繁琐、信息不对称的大额资产,转化为可组合、可管理、可流通的数字化权益单元。智能合约内嵌规则,明确权责与现金流的对应关系,同时二级市场为价格发现和退出机制提供了支持。

相较于传统资产数字化,RWA 从根本上重新定义了资产权益的构成。凭借区块链的不可更改特性和智能合约的自动化执行功能,高价值、低流动性的实体资产能够被分割为可自由交易的小额权益单位,从而显著增强资产的流动性和市场深度。例如,一栋价值 1000 万元的商业物业通过RWA代币化,可被拆分为 1 万份代币,每份代表万分之一的产权,投资门槛从 1000 万元降低至 1000 元,且能在二级市场自由交易。

企业类型对 RWA 认知程度有明显影响,金融系地产资管公司和领先开发商在 RWA 理解上占据优势。克尔瑞调查显示,60% 的受访者认为 RWA 的核心价值在于“提升资产流动性”,20% 关注“降低投资门槛”,约 15% 看重“拓宽融资渠道”,而对“提高透明度”和“优化运营效率”的重视程度相对较低。然而,智能合约的自动执行、区块链的透明化管理以及精细化运营能力,实际上能为运营效率、风险管理和资产管理模式带来深刻变革。

RWA 代币化的优势与价值

RWA(真实世界资产)代币化利用区块链技术将股票、债券、房地产、黄金等传统资产转化为数字代币,提升流动性、透明度和全球可访问性,为金融创新注入活力。其核心技术优势主要包括:

-

智能合约的自动化、透明性与高效率智能合约自动执行交易条款,确保无人工干预的透明操作。代码不可篡改,结合去中心化节点验证,消除信任风险,提升安全性。例如,资产价格达标时,合约自动触发转移或清算。同时智能合约的自动化分配,将大大提高资产管理效率。

-

超额抵押机制的稳定性RWA 代币化将资产转为可交易代币,作为抵押品支持稳定币发行。智能合约根据资产价值自动清算,保障平台流动性和偿债能力,防止超发风险。

-

预言机的实时数据保障预言机桥接链上与链下,实时传输资产价格、所有权等数据,聚合多源信息确保准确性,并支持法律合规数据,保障交易合法性。

-

全球流通:链上资产支持 24 小时全球交易,简化跨境投资流程,提升市场多样性和流动性。

-

用户赋能:通过“用户即股东”模式,RWA 整合营销与融资,增强用户忠诚度和品牌曝光。

-

供应链支持:RWA 打造生态闭环,优化供应链金融,助力企业资金沉淀和生态流转。

以上的技术优势结合金融,也给 RWA 发行方带来了以下额外好处:

-

增效盈利:新增资金用于扩大生产、开拓市场,提升利润。

-

解决流动性:通过碎片化提前释放高价值资产的潜力。

-

融营销一体:用户参与投资,增强共识与销售渠道。

-

品牌曝光:RWA 项目自带流量,提升品牌知名度。

-

管理便捷:优化资产管理,推动轻资产模式和境外资产转化。

-

生态创新:支持供应链金融闭环,缓解现金流压力。

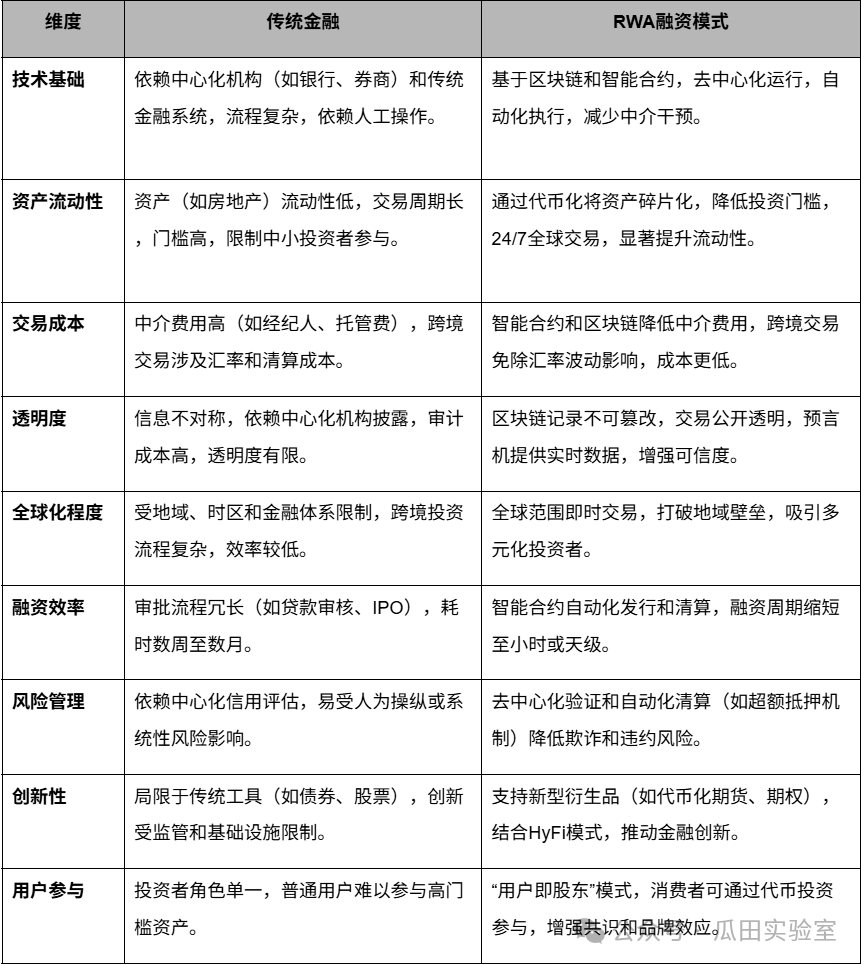

RWA 与传统金融模式对比

RWA(真实世界资产)融资模式与传统金融在目标上均致力于为企业和项目提供资金支持,依托实体资产确保价值支撑,并需遵守监管要求。然而,二者在技术、效率和创新性上差异显著。传统金融依赖中心化机构,流程复杂、中介费用高,资产流动性低,跨境交易受地域和汇率限制,适合成熟市场但全球化效率有限。RWA 融资模式基于区块链和智能合约,通过资产代币化实现碎片化交易,降低投资门槛,支持 24/7 全球流通,显著提升流动性。智能合约自动化执行减少中介成本,区块链的不可篡改性增强透明度和可信度,预言机提供实时数据支持。RWA 还推动新型衍生品和“用户即股东”模式,促进金融普惠和品牌效应。尽管面临监管和技术安全挑战,RWA 在融资效率、全球化程度和创新性上远超传统金融,展现了 Web3 时代金融体系的颠覆性潜力,特别适用于盘活低流动性资产和优化供应链金融。

RWA 在技术层面面临的问题:

RWA(真实世界资产)代币化作为桥接传统金融与Web3的创新路径,在技术层面仍面临多重严峻挑战。这些问题不仅制约了 RWA 的规模化落地,还可能引发系统性风险。根据 Chainlink & ConsenSys(2025)的《 RWA 技术挑战报告》,2024 年全球 RWA 项目中,35% 因技术故障暂停,损失超 8 亿美元。主要痛点集中于预言机可靠性、链下执行限制、隐私与透明矛盾、标准化不足及安全风险五大领域,亟需系统性解决方案。

-

预言机问题:区块链无法直接获取链下数据,依赖预言机提供资产价值、状态等信息。单一或中心化预言机易被攻击,导致智能合约错误,需确保数据源真实性,解决“信任转移”难题。

-

链下执行限制:智能合约仅限链上逻辑,违约需依赖传统法律体系,造成执行延迟,削弱自动化优势。

-

隐私与透明矛盾:区块链公开性便于审计,但可能泄露商业或个人敏感信息。零知识证明虽可保护隐私,但增加技术复杂性和成本。

-

标准化不足:不同代币标准和合规框架导致资产流动性分散,形成“孤岛”,阻碍全球价值流转。

-

技术不成熟与安全风险:区块链在用户体验、安全性和合规性上仍不完善,私钥管理、智能合约漏洞、钓鱼攻击、跨链桥攻击、预言机操纵及监管套利等均可能引发系统性风险。若忽视技术细节,业务战略和生态规划易因用户投诉、合规事故或安全事件崩溃。

为了解决以上技术问题,我们可以在短期内聚焦可数字化资产,完善预言机、合规框架和隐私技术,增强市场信任。而长期结合物联网和AI,开发高级预言机,自动监控非标准化资产(如房地产、艺术品),逐步将物理世界融入数字生态。

可通证化的资产类别

说回可通证化的底层资产类别,理论上任何现实世界的资产都可以被通证化并发行RWA,但具备以下特征的实物资产更有优势:

-

价值可量化:

- 资产需有透明、公开的定价机制,易于通过权威数据源(如交易所、官方数据库)获取实时价值。

- 例:黄金、国债价格由市场公开报价,适合预言机喂价。

-

现金流规则清晰:

- 资产的收益(如利息、股息、租金)需有明确的计算和分配规则,便于智能合约编码自动化执行。

- 例:国债的利率和付息日固定,易于链上分配。

-

低链下执行需求:

- 资产所有权变更应主要通过数字记录完成,减少对物理交割或复杂法律执行的依赖。

- 例:ETF份额交易通过数字记录,无需物理交付。

-

高度标准化:

- 资产需遵循统一规范(如标准合约条款),便于批量处理和跨平台互操作,防止“资产孤岛”。

- 例:黄金期货合约有标准化的到期日和交割规则。

-

合规性支持:

- 资产代币化需符合当地监管要求(如证券法、反洗钱法规),确保合法流通。

- 例:美债代币化需遵守美国证券交易委员会(SEC)规定。

-

技术可行性:

- 需可靠的预言机提供链下数据(如价格、状态),区块链平台需支持智能合约和安全机制,防范漏洞、攻击或数据篡改风险。

- 例:Chainlink预言机为DeFi协议提供可靠价格数据。

现在市场上具体有哪几类已经或正在实现通证化的资产呢?常见的包含以下几种:

-

大宗商品:黄金等贵金属通过代币化结合区块链,增强流动性与运营效率。2022 年大宗商品代币市值达 11 亿美元,占法币稳定币 0.8%。黄金因其避险属性和稳定增值,尤为适合作为代币化锚定资产,助力全球储备与投资。

-

货币:稳定币(如USDT、USDC)将美元、美债等法币资产与 DeFi 挂钩,市值从 2020 年的 52 亿美元激增至当今的超过 3000 亿美元。央行数字货币(CBDC)作为国家发行的数字法币,提供法定流通保障,区别于加密货币。

-

房地产:RWA 代币化将不动产碎片化为可交易代币,增加所有者资本流动性,降低投资门槛,使普通人也能参与商业或住宅地产投资。

-

艺术品与收藏品:通过 NFT 提供不可篡改的权益证明和溯源,FT 则支持艺术品碎片化众筹,降低门槛、提升透明度与收益分配效率,增强投资普惠性与体验。

-

知识产权(IP):代币化简化版权、专利等 IP 的确权与追踪,防止剽窃,提升交易透明度,如戴尔“按需组装”专利的保护。

-

股票、债券与证券:代币化降低资本市场进入壁垒,允许小额投资美国国债等资产,克服传统交易成本高、周期长(T+1)问题,实现 24/7 实时清算,促进全球资金流动。

-

碳信用与绿色金融:碳减排凭证代币化后可在链上交易或销毁,支持透明、防伪的全球碳市场,契合 ESG 与可持续发展趋势,为 DeFi 引入绿色金融产品。

小结

本文主要探讨了 RWA(Real World Assets,现实世界资产)的概念、发展背景、技术优势、应用潜力及挑战。RWA作为区块链与传统金融的融合创新,正重塑全球资产管理格局。它将房产、债券、艺术品等现实资产代币化,注入数字化活力,打破地域壁垒和准入门槛,实现 24/7 全球交易、碎片化所有权和智能合约自动化收益分配。当前热潮源于技术跃进(如 Ethereum 扩展)、监管绿灯(美欧沙盒)和巨头涌入(贝莱德 BUIDL 基金 29 亿规模),市场从2023年8.6亿飙至 2025 年 330 亿,私人信贷、国债主导,预计2030 年达万亿级,稳定币支付更将远超传统体系。

RWA 的多维价值显而易见:在 Web3 中注入真实收益和稳定性,缓解 DeFi 投机循环;在传统金融中加速T+0 结算、提升透明,降低中介成本;在现实世界中赋能新兴市场、金融包容,碎片化高价值实物资产降低投资门槛。与传统模式对比,RWA 的去中心化、全球化远胜中心化的低效,助力“用户即股东”生态和供应链闭环。然而新实物总是面临挑战:预言机数据篡改、链下执行依赖、隐私-透明悖论及标准化缺失,导致大量 RWA 项目故障。需解决这些挑战,短期应完善合规模块、长期要融合 AI、IoT 等相关领域。总的来说,RWA 不仅是技术工具,更是普惠桥梁,连接实体经济与数字未来,推动金融从“信任中介”向“代码自治”转型,潜力无限。

下一篇文章我们将探讨全球 RWA 监管框架,并详细分析一些国际主流 RWA 发行/交易平台和案例,欢迎大家持续关注。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。