原创 | Odaily 星球日报(@OdailyChina)

作者 | 叮当(@XiaMiPP)

ZEC 月涨幅 137% 已经不够看了,ORE 的月涨幅高达 5063%。这个从 10 美元暴涨至 540 美元、市值从 400 万美元飙升至 2 亿美元的项目,几乎一夜间闯入主流视野。我们不禁要问,这到底是一个怎样的项目,爆发力的根基在哪?

项目起源:把比特币精神移植到 Solana

ORE 是 Solana 链上的 PoW 挖矿协议,其核心理念是将比特币的“公平发射、无预挖、无分配机制”移植到高性能的 Solana 网络中,打造真正的“数字黄金”。项目由创始人 Hardhat Chad 匿名开发,这种匿名、低调和理想主义似乎都在力争契合加密原教旨主义精神。

ORE 实际并非今年启动的新项目,而是 2024 年 Solana Renaissance 黑客松获奖项目。

2024 年 4 月,ORE 首次尝试在 Solana 上实现 PoW 挖矿。理论上,矿工需不断提交哈希以竞争奖励;但在高 TPS 环境中,这种“无上限提交”机制带来了灾难性后果。为了提高中奖率,专业矿工疯狂发送交易,加之当时 Solana 正处于 Meme 热潮期,双重压力导致网络严重拥堵。

ORE 相关交易一度占 Solana 网络承载的 25%以上,导致整个网络交易掉包(dropped)、延迟、失败率飙升至 75%。于是,项目在上线仅 2 周后,创始人于 2024 年 4 月 16 日宣布暂停挖矿。

这次失败,反而成了 ORE 的“转折点”。它意识到,在高速链上复刻比特币式公平是不可能的,因为链本身的算力资源并非无限——因此,ORE 的第二次重启,更像是一场经济游戏的重生。

玩法重构:从 PoW 到“链上彩票”

2024 年 8 月,ORE 以 V2 版本重启,并于 10 月 22 日推出全新协议。它彻底放弃了传统 PoW 竞争,转向了 “每分钟一轮”的链上彩票机制。

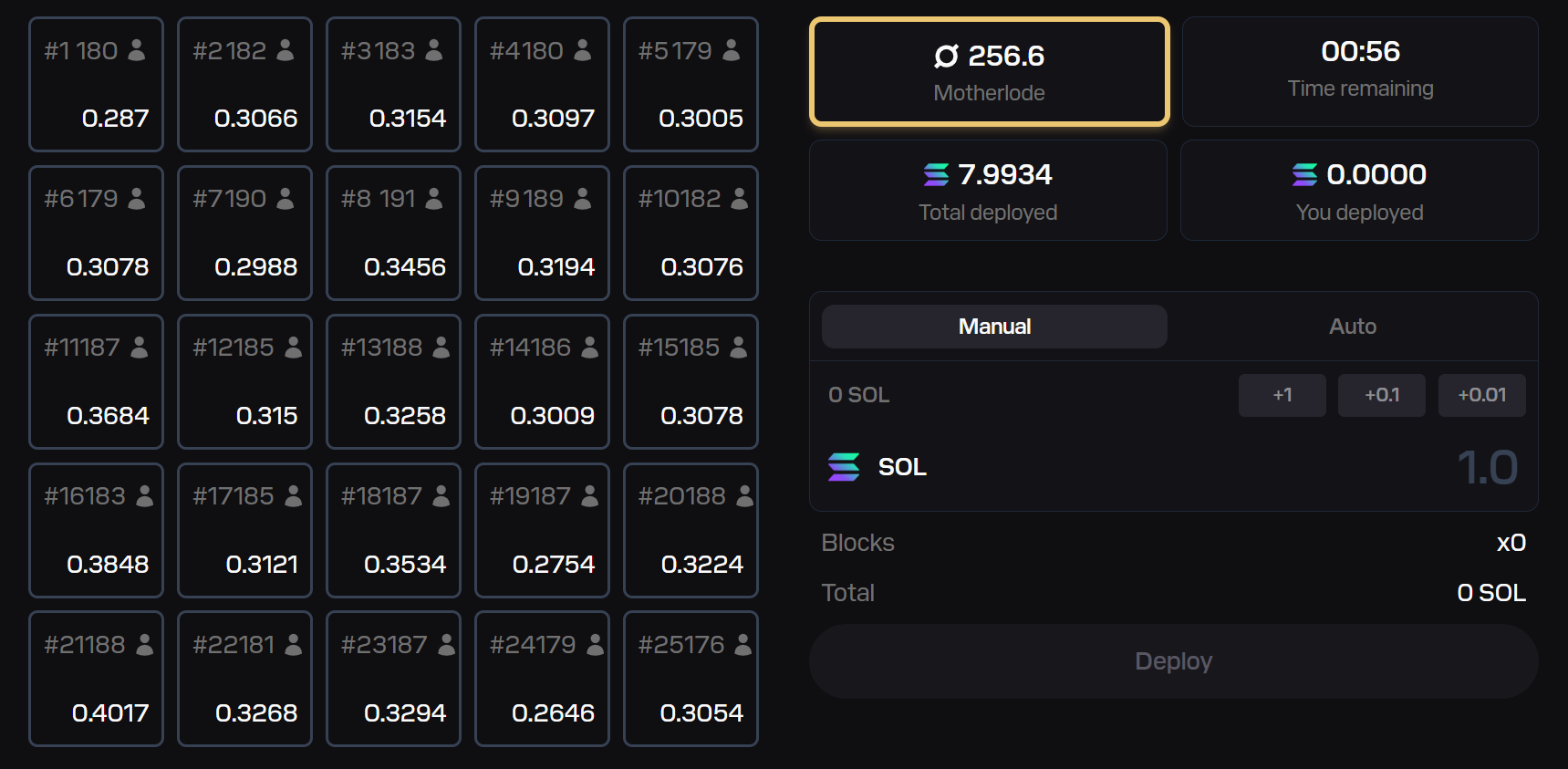

基本玩法是,有一个 5×5 网格共 25 个格子,矿工用 SOL 当赌注,在格子上“prospect”(占领空间),可多格、可重复(最低 0.1 SOL/格)。每轮结束时,系统用 Solana 官方 VRF(可验证随机函数) 随机抽出一个“中奖格子”。中奖格子的所有矿工按比例瓜分本轮所有失败格子的 SOL + 1 个新发行的 ORE。其中约一半轮次,系统会通过加权随机选出 1 名矿工独得整个+1 ORE,其余中奖者只分 SOL。

要特别注意的是,协议会收取本轮总投注 SOL 的 10%作为手续费,这 10%全部用于从市场中回购 ORE,其中 90%直接烧毁,10%分配给 ORE 质押者,从而奖励长期持有者。

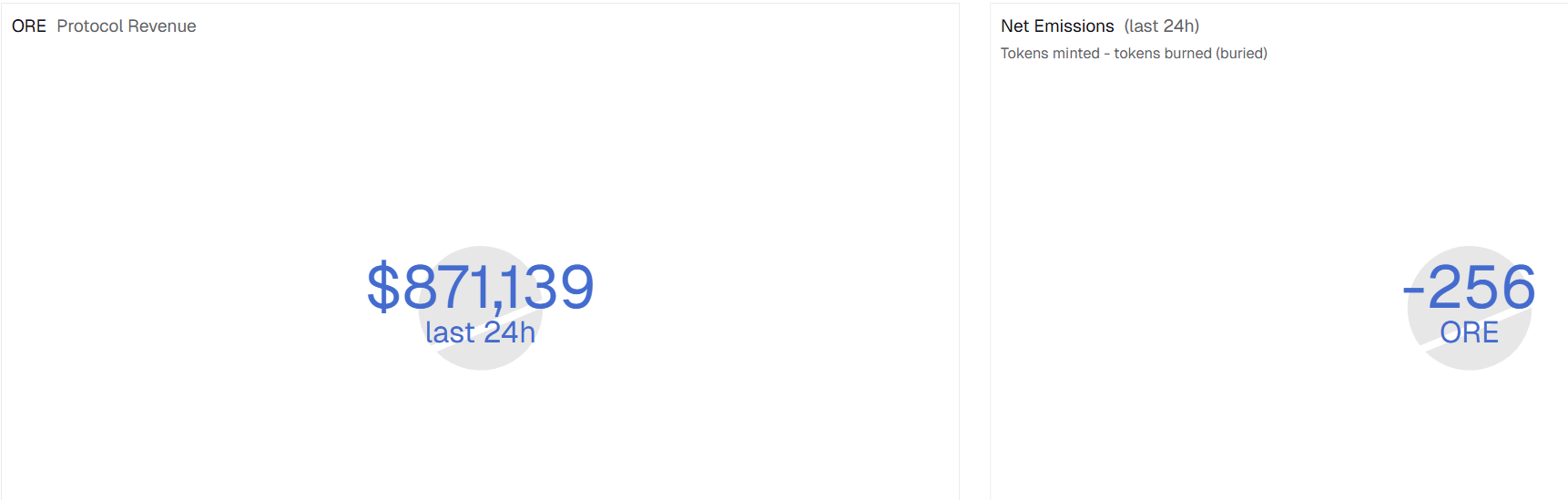

除此之外,协议还增加了 Motherlode(母矿脉)玩法。每轮固定铸造并添加+0.2 ORE 到 Motherlode 奖池;开奖时有 1/625 概率(平均每 3 轮一次)触发 Motherlode,触发后中奖格子的所有矿工按占领空间比例平分整个奖池;未触发则继续累积(当前奖池已累积 256 ORE,按照当前 380 美元的价格计算,价值约 9.7 万美元)。

另外,所有挖矿奖励 ORE 默认为 unclaimed,所以,Claim 时还需收取 10%的手续费,且费用重分给其他未 Claim 的矿工。这也就意味着越早卖越亏,越晚卖越赚。

而且,如果你持有 ORE 还可以去官网质押,质押数量决定你的挖矿乘数(下注权重),最高是 2x,强化囤币正反馈。

从机制上来看,ORE 在行为金融层面进行了多层设计,它将“延迟满足”“群体激励”“通缩叙事”三者结合,让代币持有者与赌徒形成同一心理闭环。

代币经济:通缩与稀缺性叙事

ORE 代币最大供应上限为 500 万枚,当前流通量为 41.2 万枚,流通占比约 8.2%,所有代币的铸造均由 Solana 区块链上的智能合约以程序化方式控制,没有预挖或者预分配,回归比特币原始公平分配的愿景。这在百亿供应泛滥的时代,稀缺性反而成了独特的叙事武器。

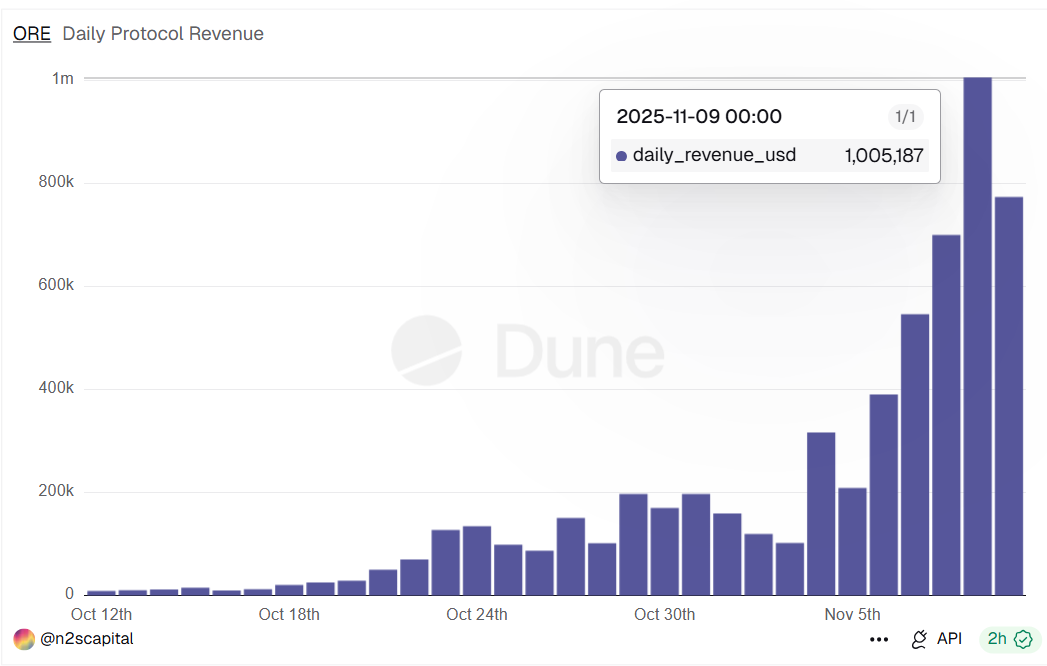

更关键的是 10%协议收入全回购烧毁,形成“玩的人越多、烧得越多、越稀缺”的飞轮。根据 Dune 数据,自其协议上线以来,收入逐渐攀升。11 月 9 日,更是凭借日入百万美元的战绩跻身 Solana 网络收入榜第二,仅次于 Pump.fun。

我们可以看到,过去 24 小时,ORE 协议日收入 87 万美元,代币净供应(新铸造代币-销毁代币)减少了 256 枚。按照当前的协议收入,代币日通缩价值约 9.7 万美元。

这意味着,ORE 实际上构建了一种“内循环通缩机制”:协议越热、投机越强,回购越多,价格预期越高——从而引导更多投机者涌入。通缩不再只是货币属性,而是一种情绪驱动的价格叙事。

飞轮模型:赌博、通缩与生态绑定

从经济逻辑的角度看,ORE 的本质是一个将 “赌徒冲动 + 通缩预期 + Solana 原生需求” 紧密绑定的系统。

飞轮的第一步,是点燃“赌徒的冲动”。从上面的数据,我们可以看到,11 月 5 日之后,ORE 的协议收入突然暴增。直接导火索是其移动端应用 Solana Mobile Seeker 的上线——用户不再需要电脑或命令行,而是可以用手机“一键挖矿”。门槛的骤降带来了爆发式增长:矿工数量激增十倍以上,每轮投注量从几 SOL 飙升至六十 SOL 以上。

当矿工基数扩大后,协议收入迅速攀升。根据机制设计,每轮投注的 10% 会被抽取用于市场回购并销毁 ORE。由于代币总量仅有 500 万枚,流通量不到 8%,每天净销毁上百枚 ORE,形成强烈的稀缺预期。这也是飞轮的第二层动力:通缩叙事的共识化。在“玩的人越多、烧得越多、越稀缺”的模型中,稀缺本身成为了参与的理由。

第三层动力则来自生态绑定。ORE 的所有下注均以 SOL 计价,这意味着每一次“赌注”都在推高 SOL 的使用需求与链上活动。随着交易增多,Solana 网络的手续费与验证者收入同步提升,从而在更大范围内形成一种生态正反馈。某种意义上,ORE 不只是一个独立协议,而是一种通过“链上行为金融”方式放大的生态加速器。这也正是 Solana 生态目前所期待的。

此外,Motherlode 奖池与质押加权机制的存在,又进一步强化了投机的正反馈。前者提供“突发大奖”的 FOMO 刺激,后者用质押倍数奖励长期囤币者,使短线卖出行为受到心理与收益双重压制。于是,赌徒的贪婪、通缩的信仰与生态的共振交织成了一个看似完美的闭环。

现在 ORE 的日收入已经能吊打大部分 L1,但是流通盘却只有 8%,只要矿工还愿意用 SOL 赌明天更贵,这个飞轮就会继续加速。但飞轮的魅力,也正是它的脆弱之处。因为 ORE 协议本身不产生价值,只是通过机制设计让参与者自愿“生产稀缺”。但是,一旦大户集体止盈或 Motherlode 长时间不触发,FOMO 情绪冷却,飞轮就会被瓦解。

ORE 的故事,或许还远未结束。在某种意义上,ORE 的暴涨,不仅仅是机制的胜利,更是人性的胜利。它在“复刻比特币精神”的叙事外壳下,构建了一个融合挖矿、彩票、通缩与 FOMO 的复杂系统。

但就像所有依赖情绪驱动的飞轮一样,它既能让人兴奋,也可能在一夜之间崩塌。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。