原创|Odaily 星球日报(@OdailyChina)

作者|Wenser(@wenser 2010)

11 月 8 日,Coinbase 官方发文暗示或将推出 Launchpad 平台,矛头直指部分 Launchpad 平台收取上币费、KOL 解锁更早及内幕代币等业内焦点话题;昨日晚间,谜底终于揭晓——Coinbase 代币销售平台上线,首期项目为将于 11 月 17 日启动的 Monad,且面向美国投资者开放。与此同时,美国财政部长贝森特今天发布了“美财政部与国税局公布《加密货币交易所交易产品新指南》”的消息,两条消息结合来看,CEX 行业竞争即将全面打响,而美国市场将成为众多交易所的“兵家必争之地”。

Odaily星球日报 将于本文对以上事件予以简要分析,供读者参考。

“蓝毯计划”之后,Coinbase 开启 Launchpad 代币公售

一直以来,市场对 Coinbase 系的动态就颇为关注,究其原因,一方面,是因其“加密交易所第一股”和美国头部 CEX 的行业独特地位;另一方面,则是其某种层面而言称得上是“美国加密风向标”。

此前,Odaily星球日报曾在《Coinbase 推出“蓝毯计划”,上线 BNB 是争夺 CEX 现货流动性的第一步吗?》一文中针对 Coinbase 上线 BNB 及推出蓝毯计划进行了详细介绍及分析。彼时,我们就指出,面对日益激烈的行业竞争,Coinbase 不得不绞尽脑汁争夺圈内的资金流动性,且需要通过造富效应来推动平台的扩张增长。代币销售 Launchpad 平台的推出无疑也是以上核心目标的具体举措。

当然,在业内交易所、加密项目 Launchpad 机制无比成熟的当下,Coinbase 推出的 Launchpad 既能够“摸着币安过河”,同时也能够通过技术手段以及机制规则来寻找“弯道超车”的机会。

预热视频内容截图

详解《Coinbase 代币销售指南》:每月一次,算法分配,项目方6个月禁止卖币

正如昨晚《华尔街日报》披露信息提到的,“Coinbase 代币销售平台将每月进行一次代币销售,并且通过算法来决定如何将代币分配给投资者,力求实现广泛而公平的分配,投资者可以在一周内提交购买申请,投资者必须信誉良好,并在 Coinbase 完成注册且遵守相关规定才能使用该平台。此外,代币购买将支持 USDC 支付。该代币销售平台将在上线初期面向全球大部分地区的个人投资者开放,未来计划进一步扩展。”

随后,Coinbase 官方发布的《Coinbase 代币销售理想状态指南》也对具体规则进行了进一步阐释,其中提到:

- 其代币销售平台不会采用先到先得模式,而是采用“自下而上填充”算法,旨在促进更广泛的分配,并限制资产集中于大额买家手中,这通常会使请求金额最小的参与者获得更充分的分配,同时逐步满足金额较大的请求,直至代币份额耗尽。

- 在申请窗口方面,Coinbase 平台上的代币销售将持续一段时间(例如一周),用户可以在窗口期内的任何时间提交代币申请。窗口关闭后,算法将决定最终的代币分配方案。

- Coinbase 代币销售平台将允许选定的投资者群体新项目代币在其主交易所开放交易之前获得抢先访问权,但该平台目的是限制资产集中在大型购买者手中,代币发行方及其关联方将被禁止出售其持有的代币,期限为六个月。

- Coinbase 代币销售平台旨在推动公平的代币销售,如果在代币发布后一个月内出售其代币的个人接收者,在未来的发行中获得的分配额可能会降低。

- Monad 代币销售时间为 11 月 17 日至 11 月 22 日。

看得出来,区别于币安、OKX 等 CEX 的 Launchpad 机制,Coinbase 试图通过 2 种手段来维持上币项目的价格表现和市场表现:

1 是通过算法分配,鼓励小散用户的参与,一定程度上利于公平分发,避免出现巨鲸操纵或内幕抢跑现象;

2 是通过对项目方和用户的时间限制来进行一定的价格维护,避免上线代币遭遇“出道即巅峰”的情况。

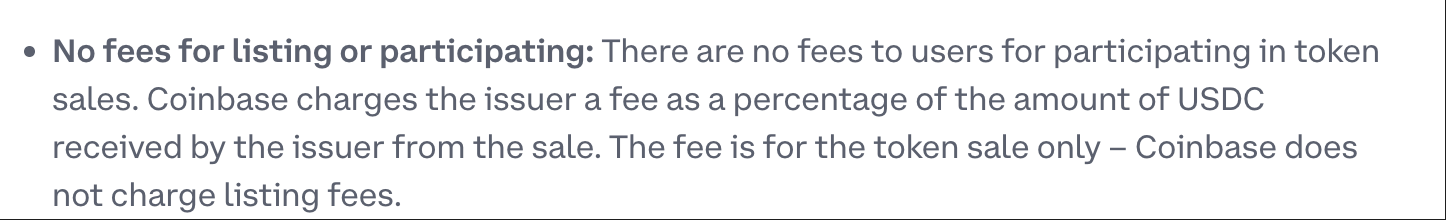

此外,关于一直以来引发市场讨论和关注的“上币费”问题,文档里也给出了对应说明:“代币上线或参与不收取任何费用: 用户参与代币销售不收取任何费用;Coinbase (仅)向发行人收取费用,占发行人从销售中收到的 USDC 金额的一定百分比。该费用仅用于代币销售——Coinbase 不收取上币费。

简而言之,Coinbase 不收项目方代币作为上币费,但收取代币销售资金中的一部分作为类似国内互联网平台所谓的“技术服务费”的钱。

代币销售指南细节

最为重要的是,这次 Monad 的代币销售将面向包括美国用户在内的全球多个地区的用户开放。

Coinbase 打新:时隔 7 年,美国散户再次允许参与代币销售,美加密市场回春

正如前面代币销售文档所指出的那样,“Coinbase 在推出(代币销售平台)时为全球大多数地区的零售社区提供访问权限,并计划在未来进行扩展。自 2018 年以来,美国用户现在将首次能够广泛参与——这对美国加密经济来说是一个巨大的胜利。”

这一标志性事件及巨大影响也得到了 Coinbase CEO Brian Armstrong 的强调,他表示:“代币发行不应该只让鲸鱼、内部人士和投机者受益,Coinbase 的代币销售平台上的代币将分发给社区。”

结合美国财政部长贝森特今日发文,看起来颇为耐人寻味。

美财长发文内容

根据美国国税局更新指南信息来看,“如果加密信托在国家证券交易所交易,仅持有现金和单一类型数字资产的单位,由托管人管理,并解决特定的投资者风险,则可以进行质押。”

Consensys 高级法律顾问 Bill Hughes 评论道,这一发展预计将对质押的采用产生重大影响,安全港为加密 ETF 和信托等机构工具提供了期待已久的监管和税收清晰度,使它们能够在保持合规性的同时参与质押。这有效消除了之前阻止基金发起人、托管人和资产管理公司将质押收益率纳入受监管投资产品的重大法律障碍。

此外,根据加密记者 Eleanor Terrett 披露,《美国两党加密市场结构讨论草案》也已出具,其中的 103(d)条款强调自我托管保护,即“保障个人直接持有和交易数字资产的权利,而无需依赖中介机构,以使用此类钱包出于合法目的直接与他人进行点对点交易,前提是:交易对手不是美国法律规定的金融机构且交易不涉及受制裁或冻结的财产。”而关于“DeFi ”的整个部分都是“寻求进一步的反馈”。

换言之,美国用户的个人投资参与权得到了阶段性的草案认可,这或许也是 Coinbase 于当下推出代币销售平台的直接利好诱因。

Coinbase 打新注意事项:Coinbase One 会员福利及 Monad 代币经济模型信息

前脚 Coinbase 官方公布 Monad 打新,后脚其就发起了 Coinbase One 会员周,相关用户可进行免费交易。除此以外,据本末社区主理人超级君发文透露,(Monad 打新)秘籍是购买 Coinbase one 会员,最高可以解锁 50 万美元的认购额度;没有 one 会员最高仅有 10 万美元的认购额度。

更多关于 Coinbase 打新信息,可参考《打到就能赚到?盘点近期 8 大热门打新项目》一文相关信息。

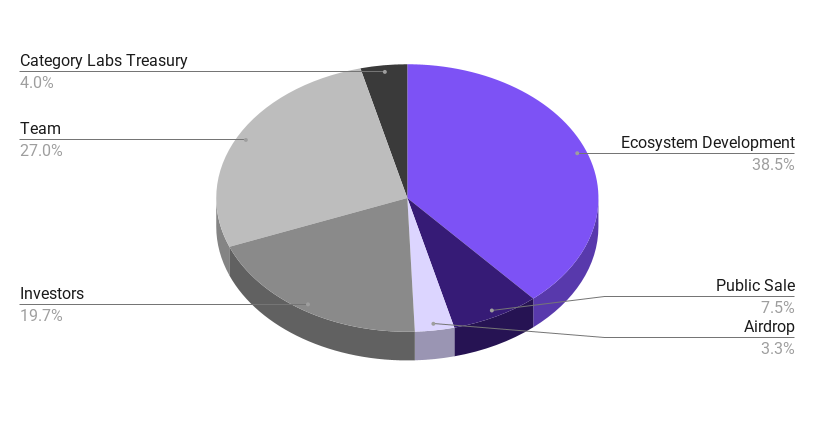

另附 Monad 代币经济模型说明。据官方信息,代币供应量 1000 亿枚,其中:

Monad 代币经济模型饼状图

· 生态发展:38.5%

· 团队:27.0%

· 投资者:19.7%

· Category Labs 金库:4.0%

· 公募:7.5%

· 空投:3.3%

代币销售时间为美国东部时间 11 月 17 日上午 9 点持续至 11 月 22 日晚上 9 点,据悉投资者、团队及 Category Labs 金库的代币在主网上线首日均被锁定,按既定规则逐步释放以确保长期利益协同。这些代币最低锁定一年(至 2026 年 11 月),具体释放节奏因群体而异。主网上线时,506 亿枚 MON(50.6%)处于锁定状态。

Monad 公售细节说明

不得不说,以目前信息来看,Monad 开盘 FDV 与实际流通市值差额会相对较大,且卖盘相对有限,散户需要注意套保爆空的风险。

结语:Coinbase 打响美国 CEX 市场争夺战第一枪

最后,Coinbase 上线代币打新平台也带动了股价上涨,昨晚美股开盘涨幅一度突破 3%;而在明确打新项目将以一月一次的频率进行下,尽管 KYC 条件严格,但仍将吸引不少用户参与。

在美 SEC 发起“Crypto Project”之后,Coinbase 已然成为了美国加密市场开拓的排头兵,而币安、OKX 等头部交易所如何应对,或许将会是美国加密市场关注的下一个焦点。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。