在11月7日,比特币(BTC)在一周内第二次跌破$100,000,降至$99,376,市场普遍猜测长期持有者——通常被称为OG鲸鱼——正在抛售他们的资产。这一下降使比特币的市值进一步远离$2万亿的标志,并导致加密经济的总价值大幅下跌,降至略高于$3.4万亿。

尽管BTC随后反弹至$100,000以上,但未能重新夺回$105,000以上的水平,进一步加强了市场对牛市可能接近尾声的看法。自10月6日首次突破$126,000以来,比特币在10月10日的闪崩之前仅在$120,000以上维持了四天——这一闪崩最初与唐纳德·特朗普总统对中国的惩罚性关税威胁有关——导致价格暴跌。

尽管BTC经历了部分反弹,但整体趋势仍然向下,受到多种因素的影响,包括美联储主席杰罗姆·鲍威尔暗示12月可能不会降息的评论,以及对潜在的AI驱动市场泡沫的日益担忧。缺乏积极消息进一步打击了投资者情绪。

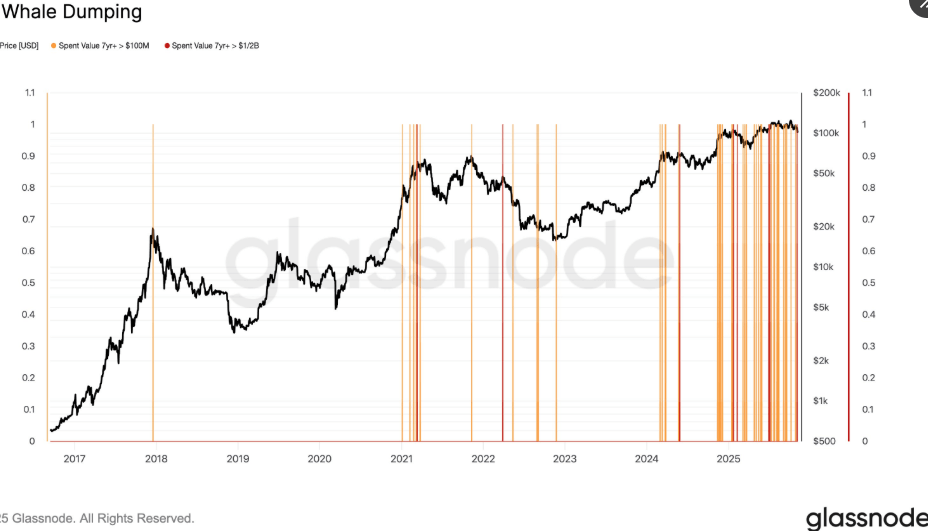

在社交媒体平台X上,“比特币做空”开始成为热门话题,悲观情绪主导了讨论。关于超级鲸鱼抛售价值数亿的BTC的报道为这一叙述增添了火力。投资者和基金经理查尔斯·爱德华兹分享了一张图表,显示长期持有者的显著抛售。

“OG比特币鲸鱼正在抛售。这张图很好地展示了有多少超级鲸鱼正在兑现比特币。这里的所有线条都是来自2018年前OG比特币持有者的7年以上链上支出,”爱德华兹说。

11月7日的突然下跌和反弹引发了杠杆头寸的大规模清算。根据Coinglass在东部时间上午10:30的数据,近$1亿的空头合约在24小时内被清算,以太坊(ETH)、Zcash(ZEC)和BTC占总清算金额的80%以上——分别为$3750万、$2921万和$1564万。

然而,多头头寸承受了大部分损失,占24小时内总清算金额$7.65亿的超过一半。

- 为什么比特币在11月7日跌破$100K? BTC因OG鲸鱼抛售长期持有的资产而跌至$99,376。

是什么触发了更广泛的加密市场下跌? 比特币的下跌使加密经济的价值降至略高于$3.4万亿。

是什么因素推动比特币的下行趋势? 降息猜测、AI泡沫担忧和疲弱的情绪正在压制BTC的复苏。

在11月7日的波动中清算了多少? 超过$7.65亿的杠杆头寸被清算,主要来自多头合约。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。