The romance between AI and Wall Street is quickly turning sour and bitcoin is paying the price. Multiple AI-focused tech stocks plunged into the red on Thursday, as murmurings of an AI bubble dragged down shares of firms such as Palantir, Nvidia, Meta, and Advanced Micro Devices (AMD). Palantir (Nasdaq: PLTR), which had already been struggling all week despite beating earnings estimates, tumbled 6%. Bitcoin fared better, but still shed roughly 3% and slid back into $100K territory.

The world’s largest tech companies have all plowed hundreds of billions into their AI programs. Alphabet and Meta announced $93 and $72 billion in AI investment for 2025 respectively. Microsoft spent $35 billion on AI in its first quarter, which ended on September 30. From a stock valuation perspective, price-to-earnings (P/E) ratios have skyrocketed. Palantir’s trailing P/E ratio currently stands at 623.50. P/E ratios are not the be-all and end-all, but they do give an indication of how much investors are currently paying for each dollar of earnings, and in Palantir’s case, it’s $623.50 for each buck it generates.

| Company | Ticker | Approx. Trailing P/E Ratio |

| NVIDIA Corporation | NVDA | ~ 50-60× |

| Advanced Micro Devices, Inc. | AMD | ~ 90-150× (range varies) |

| Microsoft Corporation | MSFT | ~ 36.7× |

| Alphabet Inc. | GOOGL | ~ 23.7× |

| Meta Platforms, Inc. | META | ~ 31.5× |

| Palantir Technologies Inc. | PLTR | ~ 600-700× (very high) |

“The two biggest narratives about AI right now are that (1) it’s a massive bubble (i.e. totally fake) and (2) about to give rise to superintelligence (i.e. totally real),” said White House AI and Crypto Czar, David Sacks. “Both narratives can be fake (which is what I believe) but it’s very unlikely that both can be true.”

Read more: Bitcoin Nosedives as a Socialist Prepares to Take Over New York City and Fears of an AI Bubble Spark a Sell-Off in Stocks

But AI isn’t the only catalyst depressing markets today. The Federal government shutdown entered its 37th day, making it the longest shutdown in U.S. history. The previous Trump administration presided over the 35-day shutdown of 2018-19, which, according to the Congressional Budget Office, torched $3 billion in gross domestic product (GDP). To add insult to injury, CNBC reported on Thursday that U.S. job cuts in October reached 153,074, the highest level in 22 years. All of these factors seem to have conspired to trigger a bloodbath in both stock and crypto markets.

“Some industries are correcting after the hiring boom of the pandemic, but this comes as AI adoption, softening consumer and corporate spending, and rising costs drive belt-tightening and hiring freezes,” said Andy Challenger, workplace expert and chief revenue officer at human resources firm Challenger, Gray & Christmas. “Those laid off now are finding it harder to quickly secure new roles, which could further loosen the labor market.”

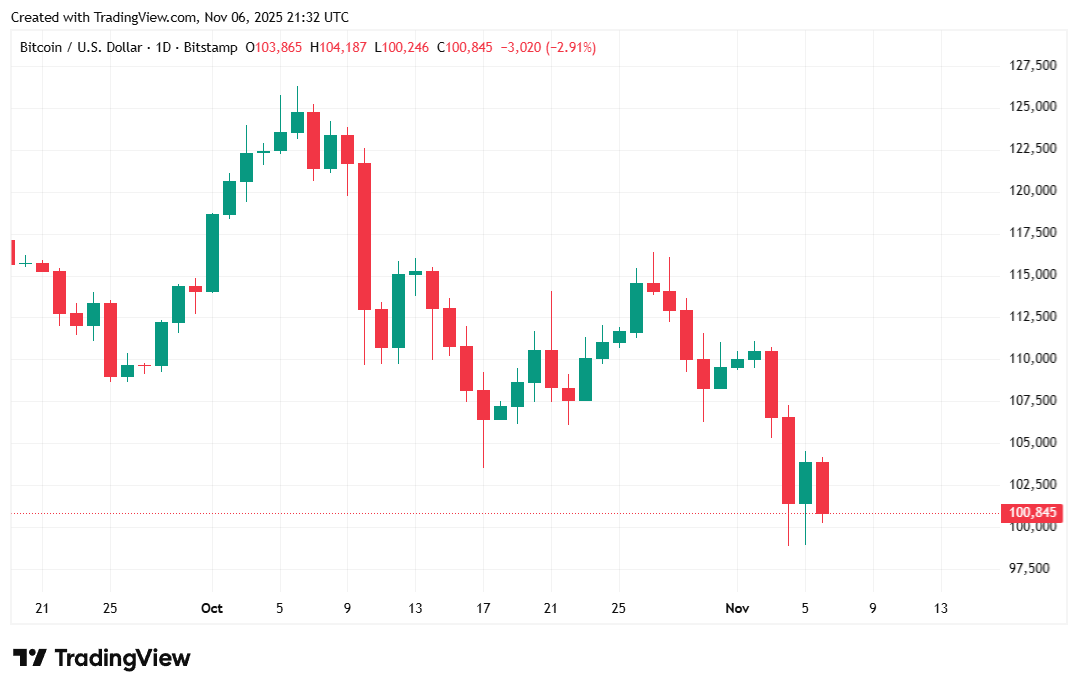

Bitcoin was down 2.68% on Thursday and was trading at $100,850.72 at the time of writing, according to data from Coinmarketcap. The digital asset traded as high as $104,147.30 but also fell as low as $100,336.87 over the past 24 hours. Bitcoin is now down 6.22% for the week.

( Bitcoin price / Trading View)

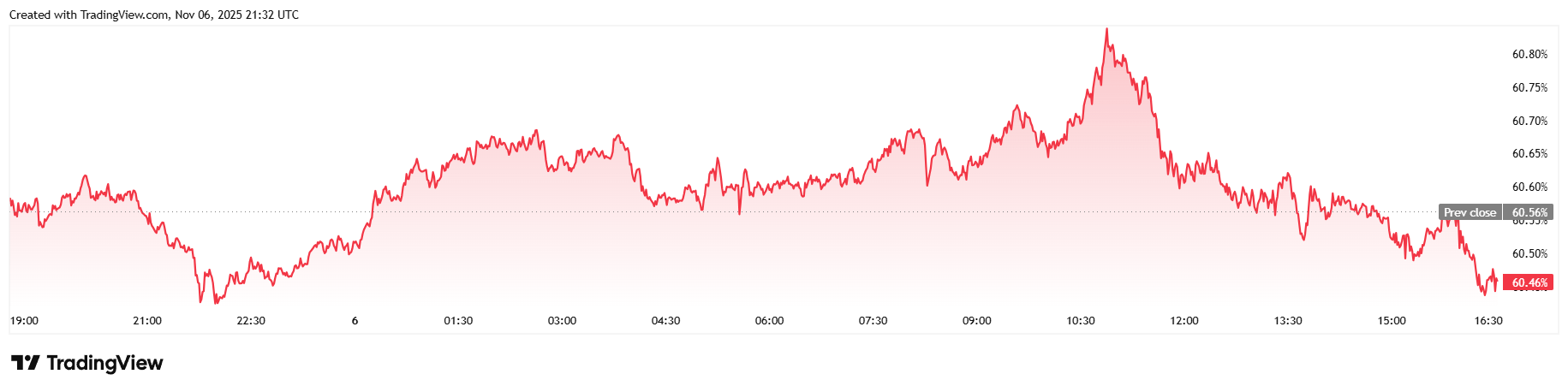

Twenty-four-hour trading volume fell 28% to $61.36 billion, and market capitalization slipped to $2.01 trillion. Bitcoin dominance eased 0.19% to 60.43% at the time of reporting.

( Bitcoin dominance / Trading View)

The total value of bitcoin futures open interest fell 2.84% to $67.61 billion, as per Coinglass. Liquidations remained high, much like yesterday, coming in at a grand total of $231.96 million. Long investors were the losers once again, getting wiped out to the tune of $189.81 million. The remainder came from bearish short sellers who lost $42.15 million in liquidated margin.

- Why did bitcoin fall again this week?

Renewed fears of an AI stock bubble triggered a broad market selloff that dragged bitcoin back down to $100K. - Which AI stocks were hit hardest?

Shares of Palantir, Nvidia, Meta, and AMD all plunged, with Palantir tumbling 6% despite solid earnings. - How extreme have AI stock valuations become?

Palantir’s trailing P/E ratio now sits around 623.50, a sign investors may be overpaying for future growth. - What other factors worsened the selloff?

The record 37-day U.S. government shutdown and the biggest wave of job cuts in 22 years deepened the market slump.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。