Solana Keeps Climbing as Bitcoin and Ether ETFs Log 6th Straight Day of Outflows

It was another choppy day for crypto exchange-traded funds (ETFs), one that teased a turnaround but ended up deepening the losses. Bitcoin and ether funds saw inflows across multiple issuers, yet outsized redemptions from their market leaders kept the streak of net outflows alive. Meanwhile, solana’s ETFs continued to chart their own course, building on a week-long pattern of steady growth.

Bitcoin ETFs offered early signs of recovery with inflows across five major funds, but the optimism didn’t hold. Fidelity’s FBTC led the day with $113.30 million in fresh capital, followed by Ark & 21Shares’ ARKB at $82.94 million. Grayscale’s Bitcoin Mini Trust added $21.61 million, Bitwise’s BITB brought in $16.97 million, and Vaneck’s HODL chipped in $3.68 million.

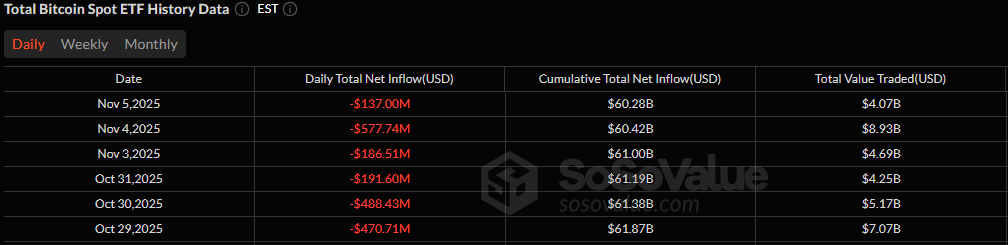

However, a crushing $375.49 million outflow from Blackrock’s IBIT single-handedly erased the gains, leaving bitcoin ETFs with a net $137.00 million outflow, their sixth straight day in the red. Trading volume hit $4.07 billion, with net assets sliding to $139.15 billion.

Bitcoin ETFs have seen outflows worth $2.05 billion over the past six days. Source: Sosovalue

Ether ETFs fared no better. While Grayscale’s Ether Mini Trust saw an inflow of $24.06 million, and Fidelity’s FETH and 21Shares’ TETH added $3.45 million and $518,000, the tide turned red once again. A hefty $146.61 million exit from Blackrock’s ETHA overwhelmed the gains, leading to $118.58 million in total outflows. The day’s trading value reached $1.79 billion, with net assets closing at $22.74 billion.

Solana ETFs, however, continued their quiet momentum. Bitwise’s BSOL pulled in $7.46 million, while Grayscale’s GSOL added $2.24 million, totaling $9.70 million in inflows. With $50.81 million traded, net assets for solana ETFs climbed to $531.35 million, another green mark in an otherwise red day for crypto funds.

As bitcoin and ether ETFs struggle to find their footing, solana remains the unexpected bright spot in a turbulent ETF market.

FAQ📉

- Why are bitcoin and ether ETFs still seeing outflows?

Heavy redemptions, led by Blackrock’s flagship funds, wiped out gains from smaller issuers. - How much did investors pull from bitcoin and ether ETFs?

Bitcoin funds lost $137 million, while ether ETFs saw $119 million in outflows on the day. - Why is solana standing out amid the downturn?

Solana ETFs attracted $10 million in fresh inflows, extending a week-long streak of growth. - What does this mean for the crypto ETF market?

Despite broader weakness, solana’s steady inflows highlight shifting investor interest beyond bitcoin and ether.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。