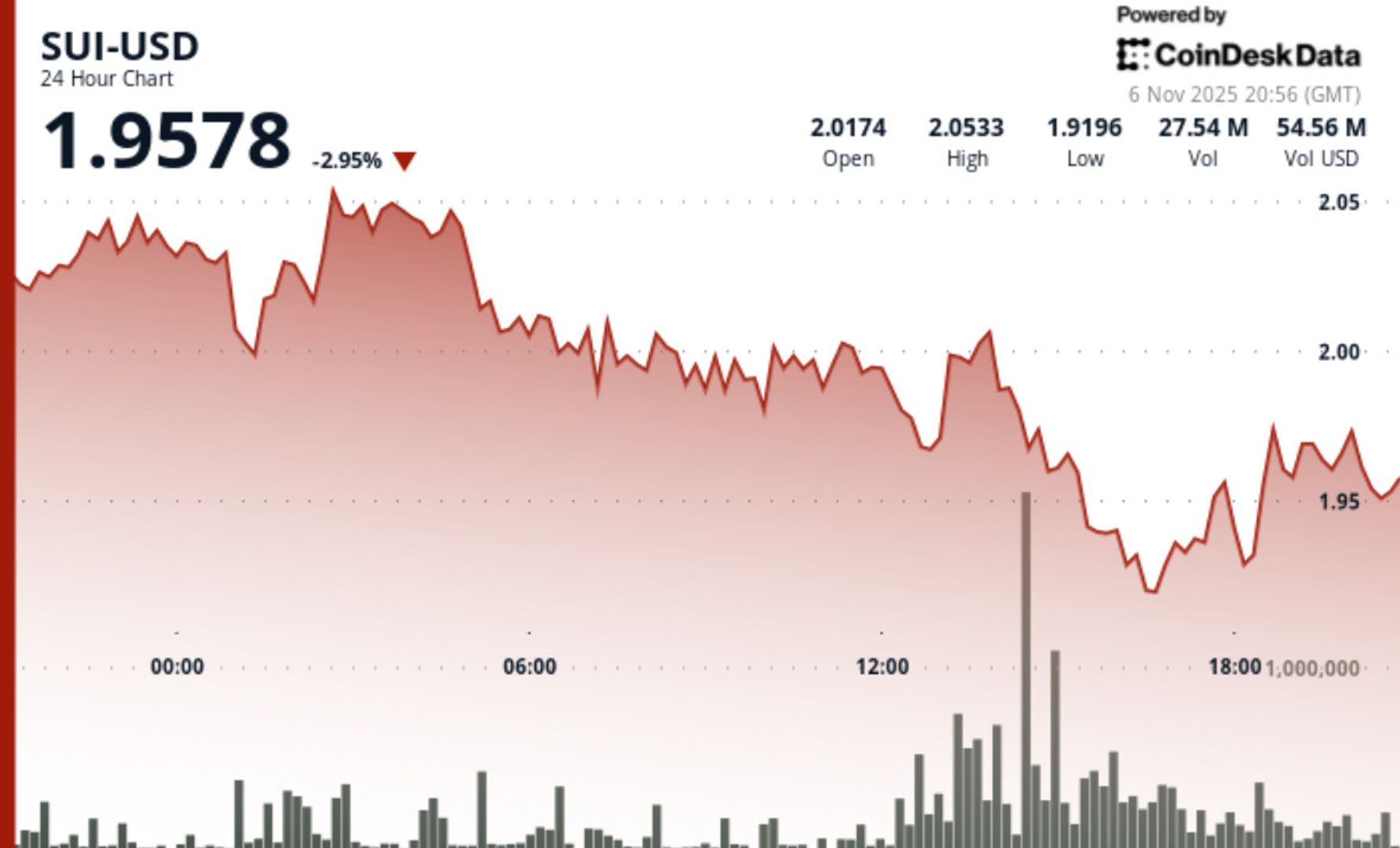

SUI, the native token of the Layer-1 blockchain Sui, dropped 2.5% to $1.98 on Thursday, slipping below the $2.00 level that had acted as a key psychological and technical support.

The move came amid heightened volatility and a notable spike in trading volume, pointing to growing institutional activity near critical price levels.

The token's price fell from an intraday high of $2.03, forming a series of lower highs across a $0.15 range. Trading volume surged to 31.18 million tokens — about 180% higher than the daily average — during a failed bounce attempt at the $1.96 mark. That bounce coincided with strong resistance at $2.05, which was tested and rejected several times.

This activity, especially during the midday selloff, suggests that larger players may have been actively repositioning during the weakness. Institutional volume can often intensify moves near support or resistance, which appeared to be the case here.

Still, shorter time-frame data showed signs of a possible turnaround. A double-bottom pattern formed near $1.952 on the 60-minute chart, followed by a rally to $1.978. A breakout above $1.970 triggered another spike in volume — 641,000 tokens — indicating renewed buyer interest into the close.

The $1.93–$1.96 zone now serves as near-term support, while $2.05 remains the next upside target. If buyers can sustain momentum above $1.970, SUI may attempt to retest that level. A break below $1.93, however, could accelerate losses and lead to a deeper correction. For now, the chart suggests short-term consolidation, with bulls and bears battling for control near a critical technical threshold.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。