Author: Nancy, PANews

As November begins, the cryptocurrency market is experiencing significant turbulence. In the early hours of November 5, Bitcoin fell below the critical psychological level of $100,000, reaching a new low in nearly five months. Altcoins followed suit, collectively plunging, and market panic quickly escalated.

Bitcoin Faces Capital Withdrawal, Long-term Holders Significantly Reduce Holdings

The weak performance of Bitcoin is not solely due to macroeconomic uncertainties; the key factor is the shift in capital dynamics.

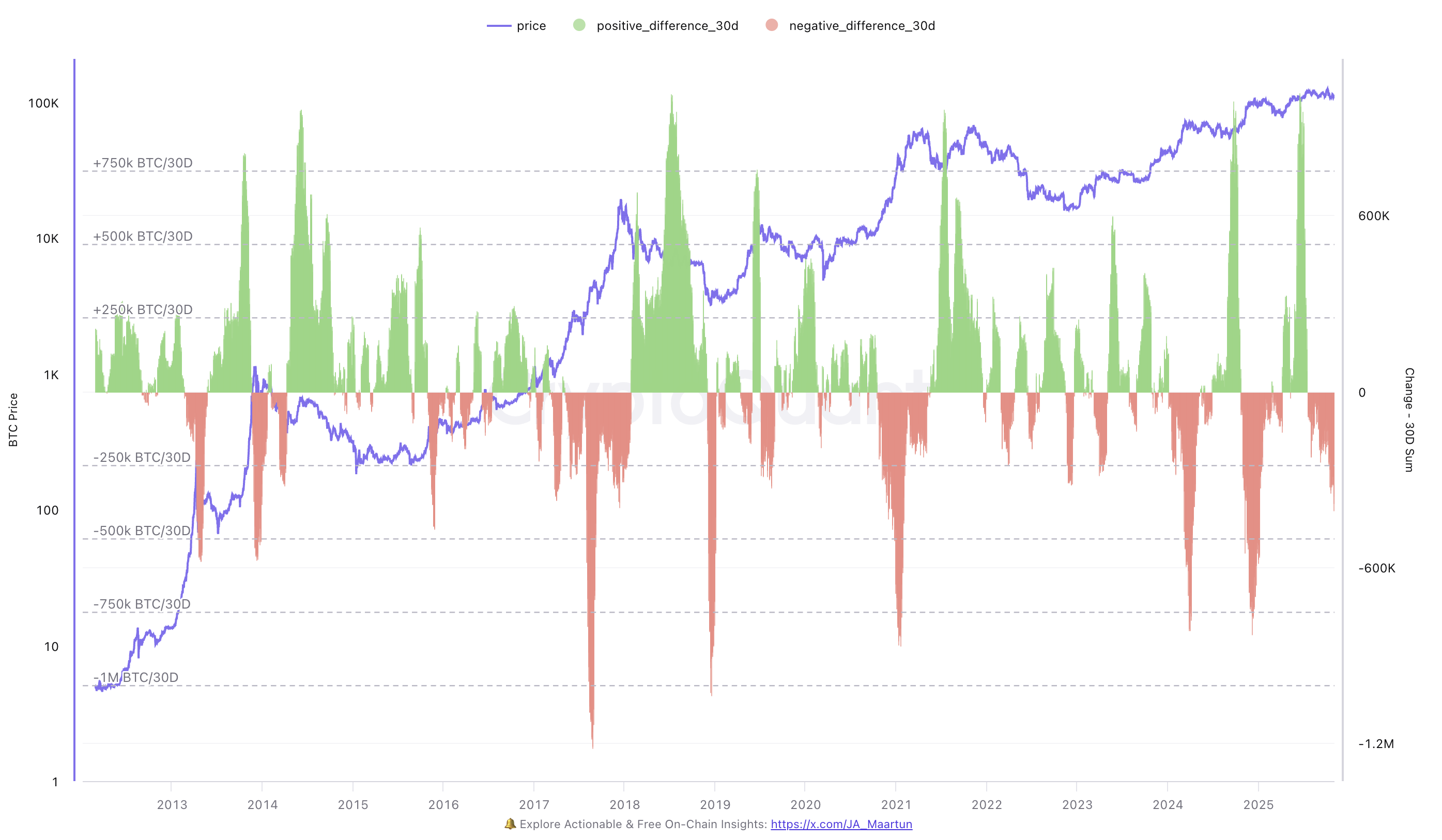

According to CryptoQuant data, in the past 30 days, long-term Bitcoin holders have sold over 327,000 BTC. Since early October, there has been a continuous net outflow of funds, with selling pressure from long-term holders stabilizing around 300,000 BTC, reflecting weak market confidence and liquidity pressure. Although Bitcoin attempted to rebound several times in mid to late October, each upward movement was accompanied by significant capital outflows, indicating a lack of new funds to support the rebound and insufficient buying momentum in the market.

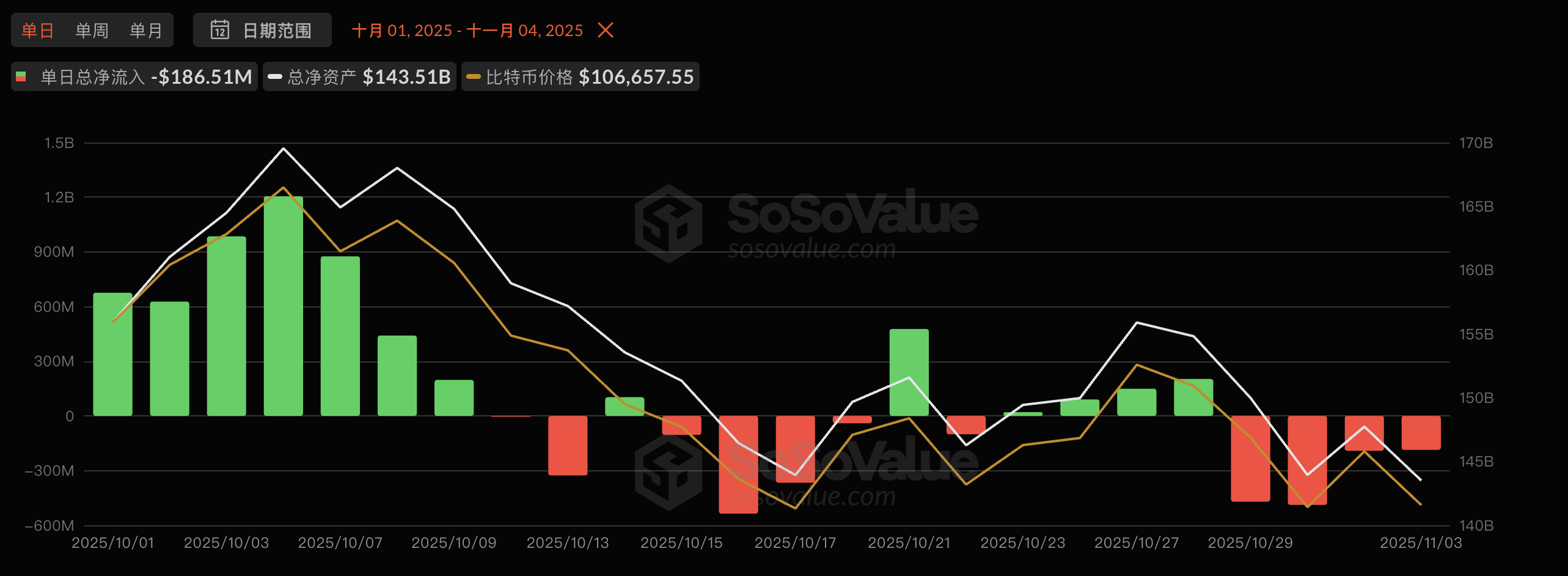

At the same time, the capital dynamics in the ETF market have also shown subtle changes. According to SosoValue data, in October, the U.S. Bitcoin spot ETF saw a cumulative net inflow of $3.42 billion, which provided strong support for Bitcoin's spot price at the beginning of October. However, by the end of the month, the situation reversed, with a net outflow of $1.33 billion in just four days. Among these, the most attractive BlackRock IBIT saw a single-day redemption amount reaching $291 million, marking the largest single-day outflow since early August. Changes in ETF capital are often seen as a "thermometer" of institutional sentiment, and the current capital changes indicate that institutional investors have clearly shifted to a cautious stance, leading to a cooling of market optimism.

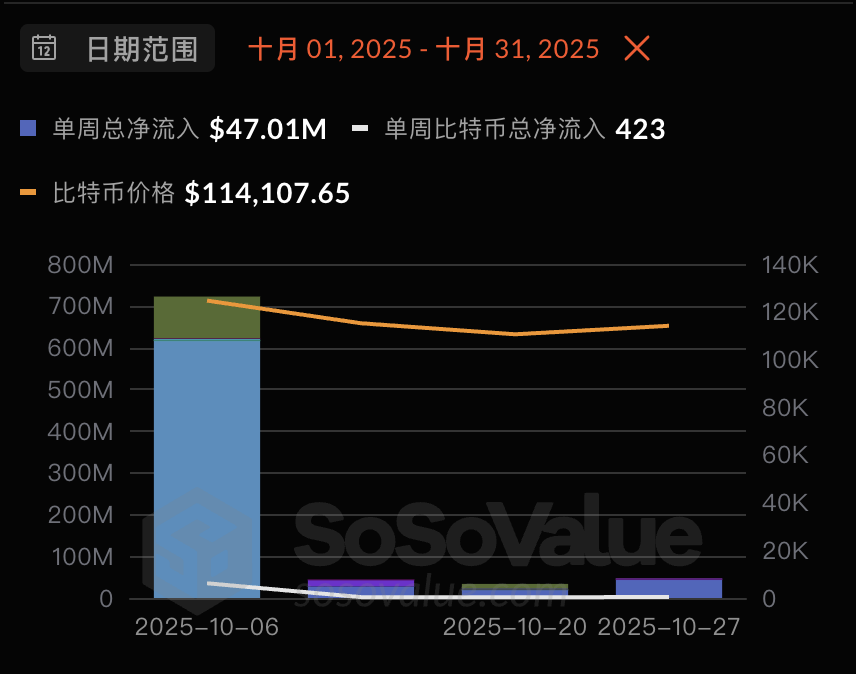

Similar signs are also evident at the corporate level. SosoValue data shows that in October, global listed companies (excluding mining companies) net bought about 7,251 BTC. However, behind this seemingly robust number lies a structural change, with approximately 85.1% of the buying concentrated in the first week of the month, followed by a significant decrease in buying momentum. Major buyers, including Strategy and Metaplanet, have generally slowed their purchasing pace.

From this perspective, the current scale and sustainability of new capital for Bitcoin are insufficient to offset the ongoing selling pressure from long-term holders, leading to a phase of structural imbalance in the market's supply and demand.

Mining Companies and Institutions Under Pressure, Market Enters Cost Game

The recent price movements of Bitcoin have once again put the market on edge. As Bitcoin fell below the $100,000 mark, the pressure on the market's bulls is gradually becoming apparent. Although there has not yet been a panic sell-off in the overall market, multiple signals indicate that Bitcoin is at a critical stage of cost line games and structural testing.

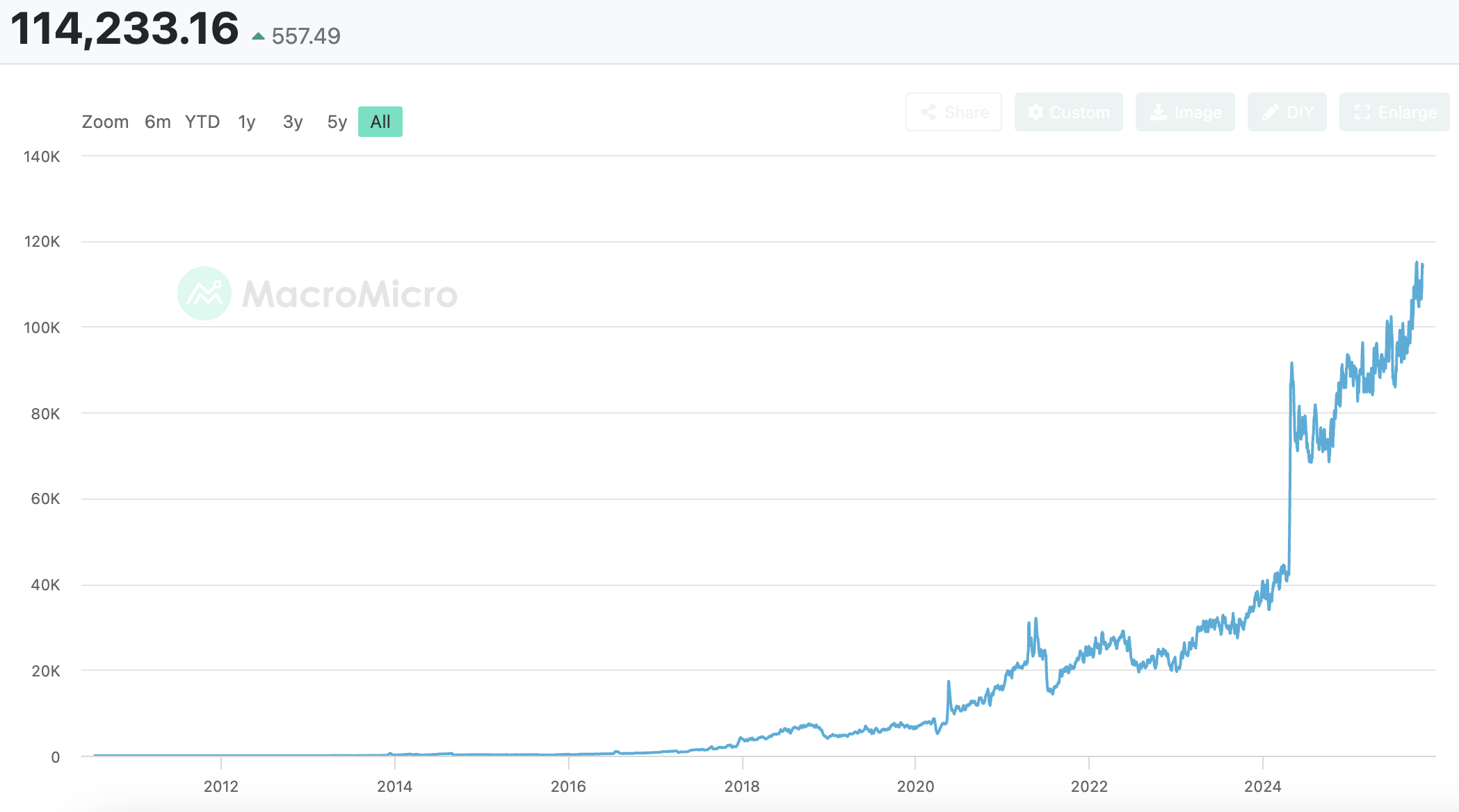

According to MarcoMicro data, as of November 4, the average production cost of Bitcoin has risen to about $114,000. This means that the mining costs for most mining companies are now above or close to the market price. At the current price level, many mining companies are not only facing a sharp decline in mining profits but also have to deal with additional cost pressures from sales, administration, and energy, making cost reduction the primary task for mining companies to maintain operations. If market demand continues to shrink, some mining companies are beginning to seek business diversification to hedge against cyclical risks, including shifting towards AI infrastructure construction and computing power leasing.

Institutional holders are also under significant pressure. SosoValue data shows that among the 38 listed companies holding Bitcoin globally, at least 24 have seen their holding prices fall below the cost line, including Metaplanet, Bullish, Galaxy Digital, and Next Technology. Even leading industry institutions are struggling to maintain paper profits in the current range, and some smaller DAT companies have initiated sell-offs due to liquidity pressures, such as the U.S. listed BTC treasury company Sequans confirming it has sold 970 BTC to reduce debt.

From a technical perspective, several industry insiders believe that the market still faces further downside risks in the short term. Katie Stockton, founder of Fairlead Strategies, pointed out that Bitcoin has fallen below the critical 200-day moving average (approximately $109,800). The 200-day moving average is one of the most widely watched indicators for defining long-term trends and serves as a support level for Bitcoin. This may indicate that the cryptocurrency will decline further, with the next target potentially at $94,200; Markus Thielen, CEO of 10x Research, recently stated that Bitcoin is approaching the support line since the crash on October 10. If it falls below $107,000, it may drop to $100,000; Matrixport analysis indicates that Bitcoin is currently close to the 21-week moving average, which has historically served as a reversal signal. Although there may be further downside potential in the current trend, it does not mean the market is over. This reminds investors that rather than being disturbed by short-term market fluctuations, it is better to refer to time-tested indicators as a stable basis for decision-making.

Structural Adjustment of Bitcoin Supply and Demand, Opportunities for Patient Investors Begin to Emerge

In terms of market sentiment, it is not entirely pessimistic. Glassnode data analysis indicates that Bitcoin has maintained a range-bound trend this week, with market momentum improving, although capital inflows are slowing. The outflows from ETFs and declining profitability indicate that the market is in a sustained consolidation phase under relatively balanced conditions. Since July, Bitcoin has repeatedly faced resistance at the holding cost line of high-position buyers, indicating heavy selling pressure above, and it may retest the critical support area of about $104,000 in the short term. Historically, the phase when short-term holders are under pressure or capitulate often provides attractive entry opportunities for patient investors.

Wintermute noted that global liquidity is expanding, but funds have not flowed into the cryptocurrency market. ETF inflows have stagnated since the summer, with BTC ETF assets under management hovering around $150 billion, and DAT activity has also dried up. The four-year cycle concept is no longer applicable to mature markets; the current market structure is healthy, leverage has been cleared, positions are orderly, and liquidity is the key factor driving performance. Close monitoring of ETF capital inflows and DAT activity will be important signals for liquidity returning to the cryptocurrency market.

Bitwise Chief Investment Officer Matt Hougan stated that although Bitcoin has fallen below $100,000, reaching a new low since June, raising concerns about a crypto winter, he believes the current market is closer to a bottom rather than the beginning of a new long-term bear market. Retail investors are currently in a state of extreme despair, with frequent liquidations of leverage and market sentiment hitting new lows; however, institutional investors and financial advisors remain bullish, continuously positioning in Bitcoin and other crypto assets through ETF channels. Institutions are becoming the main driving force in the market. The selling pressure from retail crypto investors is nearing exhaustion, and he believes that the bottom for Bitcoin prices is about to appear, and the timing will be sooner than expected. He sees the potential for Bitcoin to reach new highs this year, with prices possibly rising to the range of $125,000 to $130,000, and if the trend is favorable, it may even touch $150,000. As institutional buying continues to grow, the next phase of the crypto market will be driven by more rational capital.

BitMEX founder Arthur Hayes published a lengthy article stating that the U.S. Treasury and the Federal Reserve are brewing a "Stealth QE," which could be a key catalyst for a new round of increases in Bitcoin and the crypto market. Currently, U.S. government spending is expanding, leaning towards issuing debt rather than raising taxes. Foreign central banks are more inclined to buy gold due to the risks associated with dollar assets, and the U.S. private savings rate is insufficient to support government bond issuance, while the four major commercial banks have only absorbed a small portion of the new debt. "Relative value hedge funds" have become marginal buyers of U.S. debt, relying on repurchase agreement leverage to finance bond purchases. The U.S. Treasury is expected to issue about $2 trillion in new debt annually to cover the deficit. During times of liquidity tightness, the Federal Reserve injects funds into the market through the standing repurchase mechanism, equivalent to "de facto QE." As the usage of this mechanism increases, global dollar liquidity rises, effectively functioning like QE. Hayes predicts that this will reignite the bull market for Bitcoin and the crypto market. Currently, government shutdowns and bond auctions are causing short-term liquidity tightening, and he advises investors to preserve capital and wait for opportunities, stating that once "Stealth QE" is initiated, the market will rebound strongly.

From the perspective of on-chain funds and holding structures, the current Bitcoin market is undergoing a structural test of supply and demand imbalance. On-chain data analyst @Murphy pointed out that Bitcoin is currently experiencing a "structural test" of supply and demand imbalance, with long-term holders continuously selling large amounts recently, while market demand is insufficient to fully absorb this selling pressure. The reason these holders are selling is that they still have high profits, but as prices fluctuate and pull back, their profit margins are being compressed. Historically, when the average daily distribution volume of long-term holders falls below 15,000 BTC, the market usually stabilizes again. They have already seen their profit-loss ratio drop below the "warning line," and the motivation for selling will significantly weaken, alleviating market pressure. According to past rhythms, this adjustment period may last another 1 to 2 months, during which there may be opportunities for trend trading to enter.

CryptoQuant CEO Ki Young Ju pointed out that the unrealized profits of whales are currently not high, indicating that the market has not yet entered a frenzy stage, or it may be difficult to replicate high profit margins due to the expansion of the Bitcoin market scale. At the same time, Bitcoin's hash rate continues to hit new highs, and mining companies are still expanding, showing clear long-term bullish signals. Current demand mainly comes from ETFs and Strategy, but buying from both has recently slowed; if growth resumes, market momentum may restart. Short-term whales (mainly ETFs) are approaching breakeven, while long-term whales are profiting about 53%. The traditional four-year cycle pattern is weakening, making future sources and scales of liquidity harder to predict. Additionally, the average holding cost of Bitcoin is about $55,900, with holders averaging a profit of 93%. On-chain capital inflows remain strong, but the main reason for the price stagnation is weak demand, not selling pressure.

Crypto investment firm QCP Capital pointed out that the recent sell-off lacks obvious macro-driven factors, even as other risk assets perform well under favorable policies. In the past month, the market has absorbed about 405,000 BTC from OG holders, and the price has not fallen below $100,000. Although there has been a slowdown in buying from listed companies and some small digital asset reserve companies have sold off, the spot price remains supported. Currently, long-term holders are taking profits, while institutional capital inflows and application promotions are solidifying the market's foundation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。