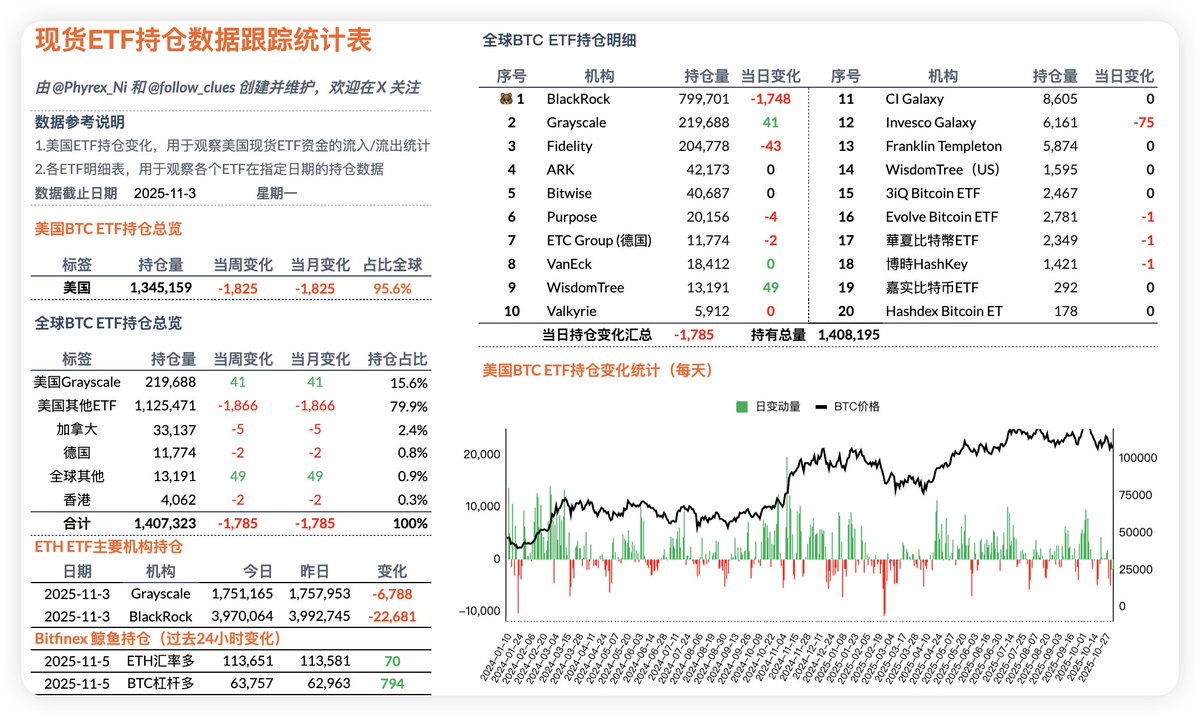

Starting Monday, the price of $BTC began to decline, so it is very normal for spot ETFs to experience sell-offs. However, from the data, it appears that the main outflows are still primarily from BlackRock's investors, but the outflow did not exceed 1,800 Bitcoin. In the short term, this has not caused panic among investors, and most investors are still maintaining a calm attitude.

Of course, from a god's-eye view, we already know that on Tuesday, BlackRock's investors began to sell off more aggressively. This is mainly due to the government shutdown reaching a historic high, causing investors to worry about systemic risks, leading them to hold positions in dollars and U.S. Treasuries, while selling off risk assets, including gold.

This situation is likely to only be resolved after the shutdown ends.

This article is sponsored by @Bitget | Save the most on fees, receive the most gifts, and become a VIP at Bitget

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。