加密经济在新一周的第二天深陷红色,市场上空头情绪蔓延。根据Coingecko的数据,24小时内总加密市场市值下降了3.2%,降至3.55万亿美元,广泛的协调恐惧、不确定性和怀疑(FUD)声称旨在打压市场。

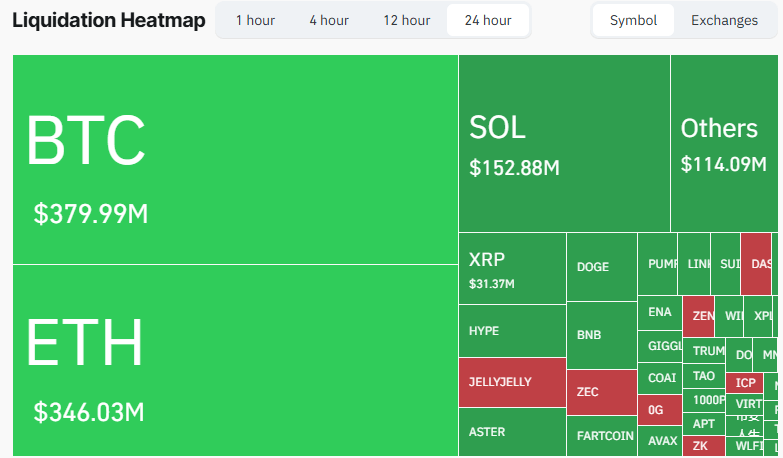

比特币(BTC)急剧下跌,从刚刚超过107,000美元降至104,200美元,时间不到两个小时。这次闪电崩盘导致BTC的市场市值滑落至2.1万亿美元以下,并在四小时内触发了1.27亿美元的多头清算。截至11月4日东部时间凌晨1:55,约3.75亿美元的BTC多头头寸被清算。

山寨币也未能逃脱卖压,许多币种在24小时内录得大幅下跌:以太坊(ETH)短暂跌破3,500美元,七天损失达到13.3%。这个水平上次出现在8月2日。ETH的暴跌单独触发了3.17亿美元的多头清算。XRP从超过2.40美元跌至2.28美元,这是10月10日最后观察到的价格水平。BNB在10月13日触及1,369美元的历史高点后,遭受更大损失,跌至952美元。

市场的普遍下跌导致超过13.2亿美元的杠杆多头和空头头寸被清算。根据Coinglass的数据,最大的单笔清算订单发生在HTX,涉及价值4787万美元的BTC/USDT交易对。

市场的下跌促使加密行业的知名人士警告用户不要做出冲动的举动。币安创始人赵长鹏(CZ)公开表示市场上有“很多随机的FUD”,并敦促他的追随者“学会验证”新闻后再采取行动。

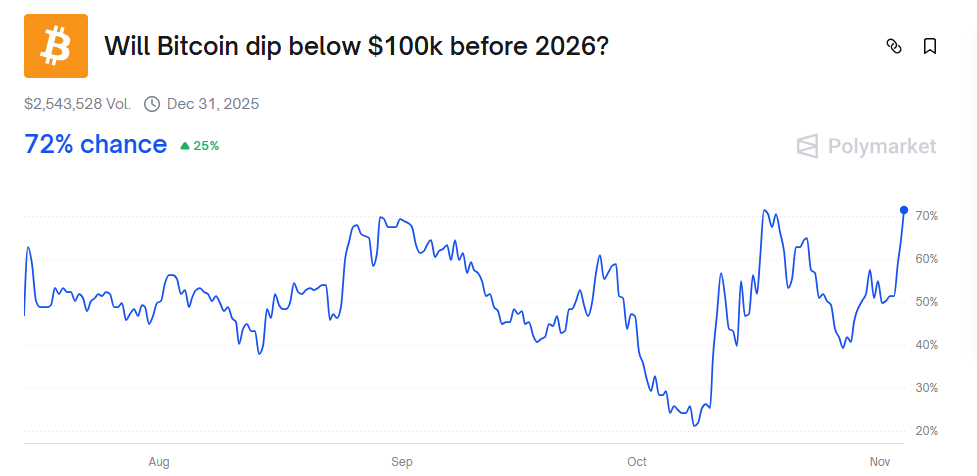

尽管有这些警告,所谓的FUD似乎正在获得关注:像Kalshi和Polymarket这样的预测市场数据显示,BTC跌破100,000美元的可能性超过50%。其他分析师预测,山寨币在接下来的几周内可能会相对于BTC再下跌30%。

- 为什么加密市场急剧下跌? 一波空头情绪和所谓的协调FUD触发了3.2%的市场市值下降。

- 比特币下跌了多少,影响是什么? BTC跌至104,200美元,导致超过3.75亿美元的多头清算。

- 哪些山寨币在抛售中受到重创? ETH、XRP和BNB遭遇大幅损失,ETH触发了3.17亿美元的清算。

- 专家对崩盘有什么看法? 行业领袖警告不要恐慌,并敦促用户在反应之前验证新闻。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。