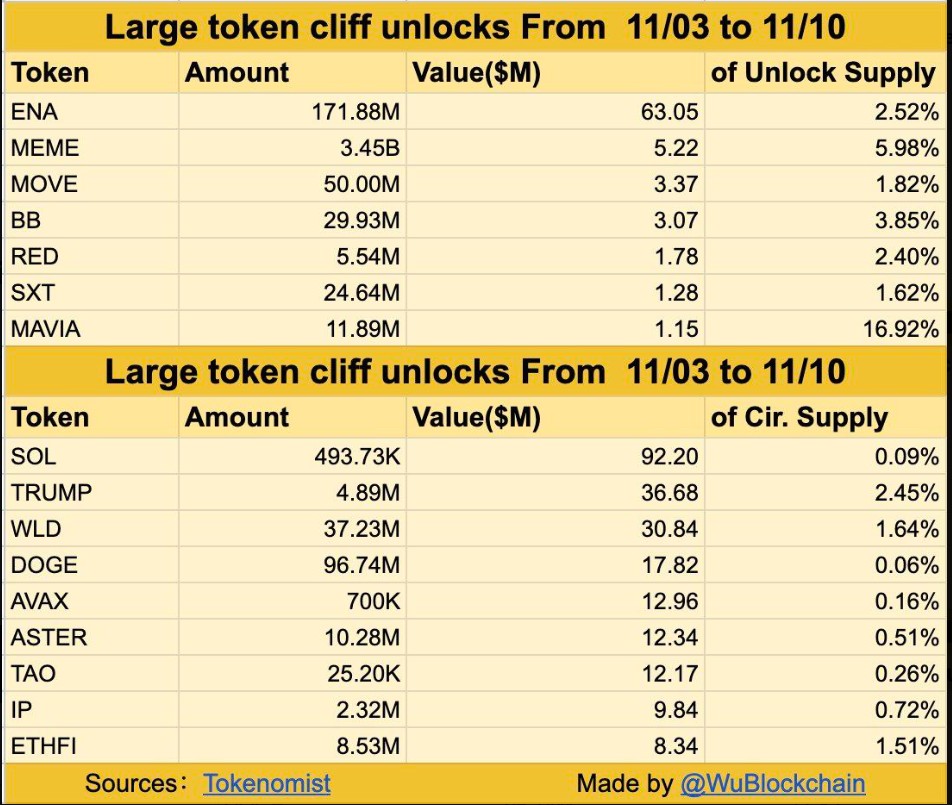

Massive $312M in Token Unlocks Hit This Week

About $312M in Token Unlocks are set to this week. Big one-time cliffs and steady daily drips could change short-term liquidity and spark price swings across several markets.

Massive Token Unlocks Ahead: Big Week for ENA, MEME, and SOL

According to Wu blockchain and Wise Advise reporting this week brings roughly $312Million in scheduled token unlocks between Nov 3–Nov 10. Some releases are one-time cliff drops, others are steady daily vesting. The biggest releases are SOL and ENA, while very large token counts come from memes and gaming coins. Where vesting coins go — to exchanges, staking or treasury — will decide the real market effect . Stay alert to on-chain transfers and exchange inflows as the week unfolds.

Source : X

Key Cliff Unlocks: ENA and MEME Lead the Charge in November Unlock Wave

Ethena’s $63M Unlock Could Test Market Liquidity and Trader Nerves : ENA (Ethena) — Exact release: 171.88M ENA ≈ $63.05Million This is a large, single tranche tied to prior allocations. If much moves to exchanges fast, expect short selling and higher volatility . If the tokens go to staking or project use, price impact will be smaller. Watch large wallet movements in the first hours.

Memecoin’s 3.45 Billion Token Drop — High Volume, Low Value, Big Speculation : MEME (Memecoin) — Exact release: 3.45B MEME ≈ $5.22Million. The token count is huge but the dollar value is low. That can mean big percentage swings on small order books. Many of these tokens may be claimed by community addresses, which could slow selling if claims are staggered. Track claim contracts and transfers to centralized venues.

MOVE Token Cliff Adds Moderate Pressure — Investors Watch Liquidity Tighten : MOVE — : 50.00Million MOVE ≈ $3.37Million (~1.82%). A moderate cliff from project or investor allocations. On thin markets, even a few million dollars can push price down quickly. Check liquidity on main trading pairs before taking new positions.

Heroes of Mavia Faces 16.92% Unlock — Gaming Token Volatility Looms : MAVIA (Heroes of Mavia) — Exact unlock: 11.89M MAVIA ≈ $1.15M, shown as 16.92% of circulating supply. That percentage is high and could cause outsized moves if some unlocked tokens hit exchanges. Follow transfer destinations closely to judge potential selling pressure.

Daily Linear Unlocks: SOL, TRUMP, WLD, DOGE, and AVAX Add Steady Supply Pressure

Large projects are also releasing tokens daily rather than in one big drop. Notable figures from the schedule: SOL 493.73K (~$92.20M, 0.09% circ), TRUMP 4.89Million (~$36.68M, 2.45%), WLD 37.23Million, DOGE 96.74 Million and AVAX 700K . Linear releases tend to spread selling over time, which lowers single-day shocks but still adds meaningful weekly supply that buyers must absorb.

Market Context: How Previous Crypto Vesting Have Shaped Price Trends

In past weeks and months, scheduled unlocks have sometimes caused quick dips when large tranches flowed into exchanges. However, markets often price known unlocks in advance. What matters now is speed and destination, tokens moving into exchange wallets are the clearest sign of potential downward pressure, while tokens staying in staking contracts or treasury addresses usually cause less immediate impact.

In the Short-term period expect pockets of volatility, especially for coins with high unlock percentages (like MAVIA) and low liquidity (like many meme or gaming tokens). While in mid-term if demand holds, prices can recover fast.

Investor Strategy: How to Navigate High-Volume Token Unlock Weeks

Investors should monitor on-chain flows, keep allocation sizes sensible, use stop limits, and avoid over-leveraging. For long-term holders, consider whether fundamentals still support holding through short dips.

Conclusion

This week’s $312M vesting schdule mixes high releases with huge coin counts. This week’s mix of cliff and linear unlocks is notable mainly for concentrated ENA and SOL value along with large nominal MEME and MOVE releases. Traders should watch on-chain flows, exchange deposits, and order-book depth rather than counts alone — coin value and distribution destination determine real market impact.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。