原文标题:The Hitchhiker』s Guide to Agentic Payments

原文作者: @13yearoldvc

编译:Peggy,BlockBeats

编者按:我们正站在一个新的临界点。智能代理(Agentic Payments)正在重塑交易的基本逻辑。从 ChatGPT 内部结账,到代理之间的微支付,再到机器为内容付费的网络新秩序——「代理经济」的图景正在逐步成型。

如果你关心 AI 与区块链的融合、下一代支付协议的落地路径,或正在思考未来商业的自动化趋势,这篇文章值得你花时间细读。

以下为原文。

前言

这是一篇篇幅较长的文章,但绝对值得一读。它汇集了多位前沿构建者的洞见,他们正在塑造智能支付(Agentic Payments)的未来。我们将探讨他们真正试图解决的问题、这些技术在实践中的可能实现方式,以及背后真正的瓶颈所在。

你可以把它看作是一场引导式的前沿之旅。十页内容,涵盖创意、实验与经验,来自那些正在为机器经济搭建基础设施的人。准备好出发吧。

作为 ERC-8004 的协调员,以及以太坊基金会去中心化 AI(dAI)团队的 AI 顾问,我在过去几个月里与构建者、研究人员和协议团队密切合作,专注于稳定币、去中心化基础设施与 AI 的交汇点。这让我得以近距离观察这些技术的实时演进。这篇文章不仅是研究成果的呈现,更是来自智能经济构建者的真实语境。

特别感谢以下人士的审阅与讨论(按姓氏字母顺序排列):

@louisamira(ATXP)、@RkBench(Radius)、@DavideCrapis(Ethereum Foundation)、@nemild(Coinbase/x402)、@Cameron_Dennis_(Near Foundation)、@marco_derossi(Metamask)、@dongossen(Nevermined)、@jayhinz(Stripe/Privy)、@sreeramkannan(EigenCloud)、@kevintheli(Goldsky)、@MurrLincoln(Coinbase/x402)、@benhoneill(Stripe/Bridge)、@programmer(Coinbase/x402)、@FurqanR(Thirdweb)、@0xfishylosopher(Pantera Capital)。

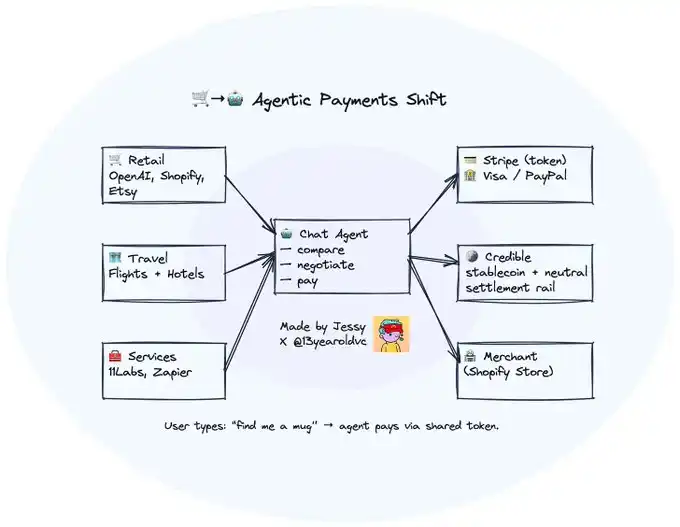

智能支付的转变

一个月前,Stripe 和 OpenAI 推出了一个可能会改变线上购物方式的新功能:你现在可以直接在 ChatGPT 里买东西。没有表单、没有跳转、没有结账页面。只需一句话:「帮我找一个手工陶瓷杯」,系统就会通过 Stripe 的「共享支付令牌」自动完成付款。

这个流程看起来非常顺畅,甚至有点神奇,但它背后是高度中心化的架构,可能会限制未来真正创新的空间。支付令牌、结算通道,甚至用户身份都由 OpenAI 和 Stripe 这两个平台控制。在这种模式下,智能代理虽然方便,但无法自由组合,只能在特定生态系统内运作。这既展示了未来的可能性,也提醒我们:如果没有开放标准和中立的结算层,智能支付将被平台锁定,难以真正释放潜力。

与此同时,这种新的支付流程也标志着一个更大的转变:现在真正进行交易的,已经不再是用户本人,而是「代理」。我们输入的界面,已经开始代替我们进行比价、协商甚至付款。商业正在逐步被「智能代理式商业」所吞噬。

目前,似乎有三件事正在同时发生:代理开始代替人类进行交易;这些交易很可能会在加密网络上结算,而不是传统金融系统;这或许会成为区块链与人工智能真正结合的突破性应用场景。

为什么是稳定币和区块链?因为这些交易的形态,已经完全不同于 Visa 或 PayPal 所设计的模式。智能代理经济充满了小额、条件触发、可组合、高频率的支付——速度快、颗粒细、范围广。

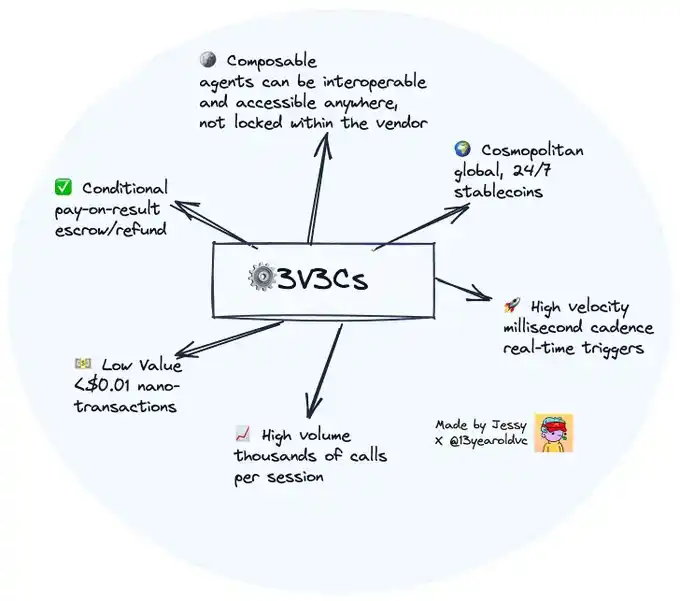

在与 Radius 的 Robert Bench 交流后,我们发现「3V3C」是一个非常贴切的描述模型:高速度(Velocity)、高频率(Volume)、低金额(Value)、条件触发(Conditional)、可组合(Composable)、全球化(Cosmopolitan)。

我们观察到三种正在浮现的行为模式:

1、人类向代理支付(2C、2B、复杂优化场景);

2、代理向其他代理或人类支付

3、代理向整个网络支付

这三种行为都打破了传统支付系统的基本假设。

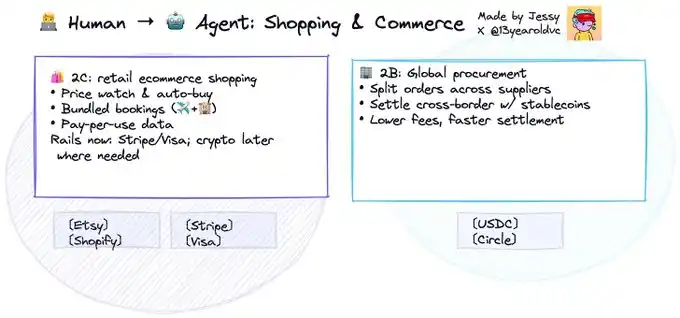

1、人类 → 代理

聊天界面正在悄然成为新的消费者入口。过去在浏览器中发起的交易,现在正在对话中完成。

你已经可以通过 ChatGPT 的「即时结账」功能直接购买 Etsy 商品,未来 Shopify 也将接入这一流程,背后由 Stripe 提供支持。Google、Amazon 和 Perplexity 也在测试类似的购物模式,让 AI 助手在聊天窗口中帮助用户发现并购买商品。

这些 AI 前端正在变成数字商店,尤其是在零售电商(2C)场景中——商品发现、比价、购买都在一个流程中完成。随着时间推移,人们将越来越依赖自己的 AI 代理,作为私人导购、旅行规划师或预订助手。

有趣的是,这些代理的行为方式与人类不同:它们可以实时监控价格,在出现优惠时自动下单;协调多方交易(比如同时预订机票和酒店);按需支付数据或服务费用,而不再依赖订阅制(这一点我们将在「代理 → 网络」部分详细讨论)

短期内,这些支付流程大多仍会通过 Stripe 或 Visa 等传统通道完成——这没问题。对于零售电商(2C)来说,现有基础设施已经足够支持「人类 → 代理」的接口,至少目前如此。

加密支付真正发挥作用的地方,是在全球采购(2B)环节。

许多海外商家和制造商仍面临结算延迟和高昂成本的问题,原因是他们难以接入 SWIFT 或传统的代理银行系统。比如在中国义乌这个全球最大的小商品批发市场,大多数小型商户至今还没听说过稳定币。但一旦监管环境成熟,这将成为一个天然的应用场景。

稳定币可以实现跨境价值的即时、低成本、透明流通——就像加密汇款已经在某些地区超越了西联汇款一样。

无论是消费端还是企业端,我们都将看到一些过去无法实现的新型用户行为:复杂、条件触发、符合「3V3C」模型的交易,由代理在后台自动完成。尤其是当大语言模型(LLM)变得更智能、运行成本进一步降低时,这些交易节省的成本将远远超过所需的代币费用。

比如:

一个采购代理可以同时监控多个跨国供应商,自动将订单拆分给最便宜的制造商,并在预算范围内协商运费;

一个创意代理可以打包多个 SaaS 工具的订阅,根据使用情况动态续订或取消服务。

这也意味着代理必须具备「可组合性」:一个代理的输出可以成为另一个代理的输入,形成复杂的多步骤工作流(比如代理集群或跨模型的思维链)。过去我们讲「资金乐高」,现在也需要「代理乐高」。

在实际操作中,「可组合性」意味着需要标准化的 API、消息格式和权限管理。如果没有这些,代理就像没有 API 的应用程序一样,彼此孤立,无法协同。

因此,这些交易太复杂、太高频、太依赖组合与协同,不适合人类或传统支付系统来协调——但对于运行在可编程支付系统上的代理来说,却是轻而易举的事。

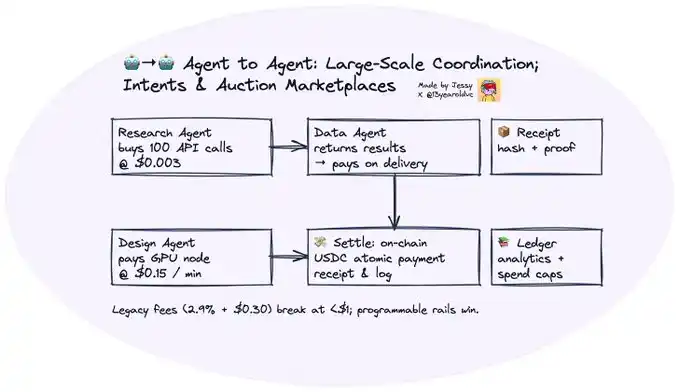

2、代理 → 代理

未来,代理将需要「雇佣」其他代理——甚至是人类——来完成任务。

现有的商业模式(订阅、授权、付费墙)并不适用于自主软件之间的交互。代理之间的支付往往是按调用次数、按代币数量、按推理次数计费,金额可能低至几美分甚至更少。

想象一下,一个研究代理向数据代理购买 100 次 API 调用;一个设计代理向计算节点支付 GPU 使用时间。这些都是机器与机器之间的交易,频率高、金额小。

比如,一个代理需要支付另一个代理 0.003 美元以获取 100 次 API 调用,或支付 0.15 美元用于 GPU 运算,甚至每次推理仅需 0.0001 美元。

传统支付系统无法处理这种规模的交易——信用卡每笔交易都要收取固定费用(如 2.9% + 0.30 美元),在这种场景下根本无法运作。

不过从用户体验角度来看,这些交易未必以「高频小额」的形式结算。例如在 OpenRouter 等平台上,企业每月发送数百万次 API 调用,结算方式是通过稳定币充值积分,这种方式比每次交易都走支付流程更高效。

更具未来感的场景是:如果每个机器人都配有一个代理,负责任务、数据和操作(可能也是通过预付积分)。比如,一架无人机可能需要为天气数据、导航更新或临时使用某条私人配送路线支付费用。

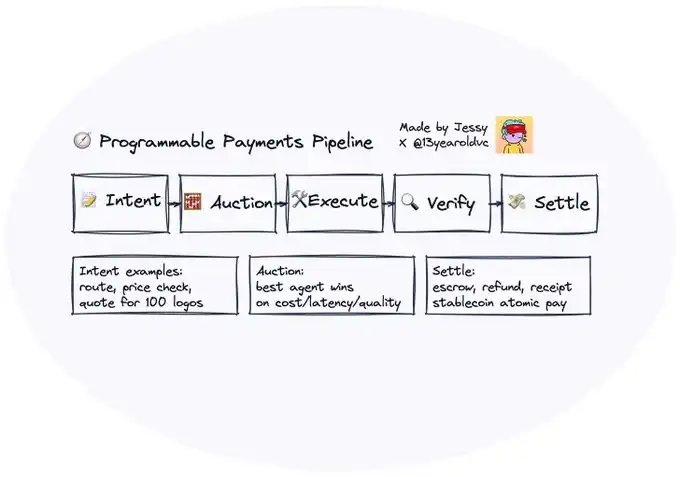

这就是为什么我们需要一种新的可编程支付结构。代理应该能够:设定预算和规则;预付费用;在任务完成后即时结算,并附带工作证明。

换句话说,加密支付让自主实体之间的「原子支付」成为可能。

随着时间推移,代理的支付行为将不再局限于 AI 服务之间。它们可能会直接「雇佣」全球的人类贡献者,尤其是在稳定币已经具备实际支付能力的国际市场中。这一趋势并不遥远——我们在与构建者的交流中已经看到相关实验,未来一到两年内就可能迎来大规模应用。

这种模式与汇款的逻辑非常相似。想象一个面向代理的自由职业平台,类似于 Fiverr:

一个营销代理可以自动委托东南亚地区的数十位微型网红,在他们的互动数据达到预设门槛后自动付款;

一个数据标注代理可以招募来自肯尼亚或孟加拉国的标注员,按任务实时支付微额报酬,而不再依赖批量发票结算。

一旦代理能够即时、全球地转账,劳动本身就开始像一次 API 调用。

从市场设计的角度来看(这是加密系统的独特优势),当全球有数十万个由人类与代理共同组成的自主实体时,另一种趋势也将浮现:意图与竞价市场。代理之间将围绕任务请求展开竞争。

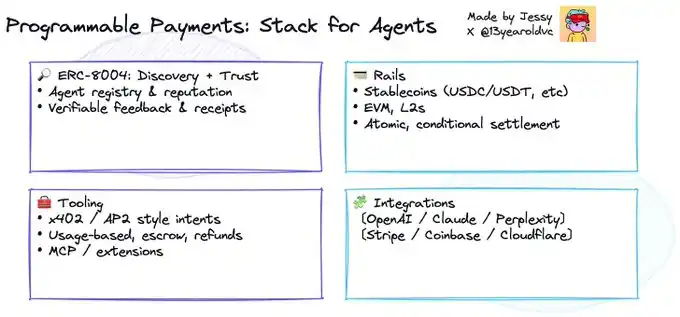

表现最好的代理将获得奖励(如稳定币、声誉评分或链上信用额度);表现不佳的代理则可能失去押金或声誉。这正是我们在 ERC-8004 中所设想并希望构建的愿景。

一个初步的模型可能包括:

1、意图层:一个共享的代理注册系统(如 ERC-8004),用于发布结构化请求并验证代理身份;

2、竞价层:通过荷兰式或英式拍卖等机制完成任务分配;

3、评估层:由群众、其他 AI 代理或预言机验证任务完成情况,并自动分发奖励;

4、结算层:通过稳定币支付,并在 ERC-8004 上更新声誉与质押状态。

过去,去中心化常被认为效率低下——部分原因是人类行动缓慢,协调成本高。但现在,代理正在消除这些瓶颈:它们可以持续评估谁最适合执行任务、什么价格合理、哪些数据值得信任。

区块链在这里扮演的是「状态协调层」的角色——一个不可篡改的共享记忆系统,用于记录结果、押金和积分;而稳定币则是实时价值交换的微支付通道(按回答付费、按操作付费)。

这种复杂的「代理 ↔ 人类」协作场景,正是区块链与稳定币最适合解决的问题。

互操作性让代理之间能够沟通,可组合性让它们能够协同合作。

3、代理 → 网络

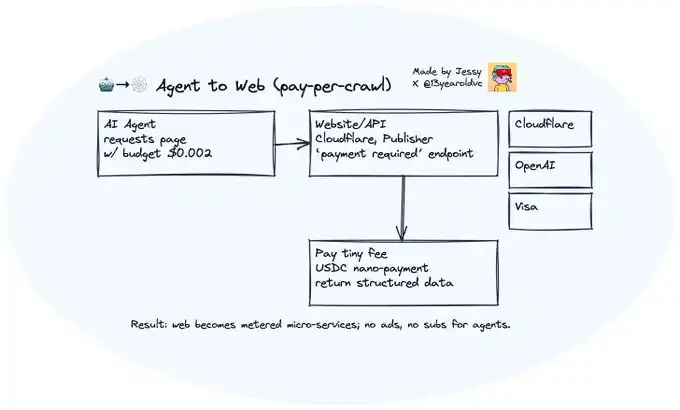

另一个值得关注的趋势是:网络的使用者不再只是人类,越来越多的内容正在被 AI 代理爬取、读取和交互,未来甚至可能由代理主导。这意味着,网站将不再只向人类收费,而是开始向机器收费——我们称之为「按爬取付费」(pay-per-crawl)。

例如,出版商正在反击无限制的内容抓取行为。Anthropic 最近支付了 15 亿美元,以解决与作者之间的版权诉讼——这是多个案例之一,正在测试 AI 公司是否可以自由使用受版权保护的内容。OpenAI、微软、Meta 等也都卷入类似争议。最终的合理结果可能是:训练数据和内容使用将采用「按访问付费」的模式。

与此同时,Cloudflare(据称约 20% 的网页请求通过其网络)已经在尝试一种新模式:网站可以向代理收取纳米级费用(甚至低于微支付),以允许其访问数据。他们最近还推出了自己的稳定币——NET Dollar。

这正是加密支付再次发挥作用的地方。

网站和 API 可以开放一个「需要支付」的接口,代理只需支付几美分甚至更少的金额,即可读取、查询或消费内容,无需订阅或广告。这将网络转变为一个由微服务组成的系统,价值流动不再依赖月度账单周期,而是实时发生。

如果你对互联网早期的「402 状态码」以及 Andreesen 等人的相关讨论感兴趣,Pantera Capital 的 Jay Yu 写过一篇很好的文章,深入探讨了这一演变过程。

想象一下 1950 年代的邮件室,人们正在把账单和发票一封封装进信封。这种低效的流程,正是我们最终采用「净 30 天付款条款」(Net 30)的原因之一。

现实中,「按爬取付费」(pay-per-crawl)的经济模型将呈现出幂律分布。只有少数高流量或高价值的网站——那些拥有代理真正需要的数据——才会主动集成这类变现逻辑。对于大多数网站来说,计量、收费和结算代理流量的成本将远高于收益。换句话说,我们认为最终只有少数大型出版商会获得大部分收入,而长尾网站仍将保持开放访问或无法实现变现。

这正是像 Cloudflare 这样的中介平台可能改变曲线的地方。如果 Cloudflare 能让网站通过一个开关就「启用代理支付」——并通过 x402 或 Web Bot Auth 等协议处理身份验证、计量和结算——那么接入门槛将大幅降低。

Cloudflare 可以自动识别经过授权的代理请求,代表网站收取纳米级费用,并自动分发收入。

在这种模式下,开放网络本身将获得一个原生的机器商业层:任何网页都可以变成一个可计费的 API,任何代理都可以在浏览、爬取或学习的过程中无缝支付。

这种趋势不仅限于数据访问。几乎所有可以按次使用的在线服务,未来都有可能转向「按需付费」模式。在与 ATXP 联合创始人 Louis Amira 的交流中,我们探讨了企业如何通过代理支付开辟新的收入渠道,举几个例子:LegalZoom 可以为一份 NDA 收取 2 美元;如果支付体验足够顺畅,Netflix 可以按集收费,每集 0.5 美元;Replit 可以按代币数量计费,让你无限「vibe-code」,每百万个 token 收费 1.23 美元;PitchBook 或 Bloomberg 可以让代理一次性拉取估值模型,收费 0.25 美元;医院可以按记录收费,提供匿名癌症扫描数据用于模型训练。

Louis 曾开始截图记录那些他遇到的「强制升级」或「无谓付费墙」场景——这些公司本可以采用按次计费的方式,让他成为客户。

在理想状态下,企业开发者可以快速上线临时 API 接口,按次计费而非按月订阅;写作者或研究者可以按查询出售单段文字、图表或数据集。

反之,代理也可以按请求访问非公开数据 API,查询那些网页无法爬取的供应商数据,使用预付微额请求。这种模式非常适合长尾 API 和企业数据集。

Coinbase 的 CDP 团队已经在 Payments MCP 上做了早期尝试,让 LLM 无需 API 密钥即可使用链上工具,如钱包和支付功能。

互联网开始不再是订阅捆绑的集合,而更像一个「实时计费系统」——每一次交互都有定价、支付和结算,价值在持续流动。

我们还在早期,但整合正在发生。

在完成一轮完整的研究后,我们的结论是:虽然智能代理支付的想象空间巨大,但目前仍处于早期阶段。最大的挑战之一是支付本身是互联网中监管最严格、权限最复杂的领域之一。其落地往往不取决于技术可行性,而是取决于能否与大型企业和金融网络实现集成与互操作。这使得进展本质上是缓慢的。

对初创公司来说,即使底层技术已经存在,没有银行、卡组织或主流支付处理商的接入权限,也几乎无法进行有意义的实验。

未来很可能会出现面向企业级、合规级的解决方案。因此,像 Catena Labs 这样的团队正在构建 Agent Commerce Kit,专注于代理身份验证、人与代理之间的支付交互,并面向持牌金融机构、监管合规和企业级应用场景。PayPal 很可能也会尝试类似的方向。

我们离真正的智能支付还有多远?

目前,大多数所谓的「代理」其实还只是半自主系统。从技术上讲,它们更像是复杂的工作流自动化工具,而不是能自主购物或谈判的智能体。正如 Goldsky 的 Kevin Li 所说:「你现在还不能真正销售『全自动商业』,大多数 AI 公司仍在做工作流自动化。」

短期内的机会在于「半自主中间地带」:由人类发起的行为触发 API 级别的按次结算,通过稳定币通道完成。这些流程虽然还不完全是智能代理行为,但已经在使用相同的基础设施——低延迟的可编程钱包、按调用计量、即时结算——这些正是未来真正「代理 ↔ 代理」商业所依赖的核心组件。

与此同时,底层区块链也需要进化。智能支付要求稳定币通道具备高吞吐量、低延迟、隐私保护等特性。下一代支付型公链正在被各大玩家探索,比如 Stripe 的新链 Tempo、Circle 的原生链,我们也期待更多专注于代理与稳定币的团队在以太坊 L2 生态中涌现(如 Thirdweb)。这些都表明:可编程货币的基础设施正在从零开始重建,以支持每秒数百万笔微支付和纳米支付。

此外,可编程钱包和服务端架构也必须同步升级。如果钱包仍然假设由人类保管助记词,那这一切都无法实现。智能商业需要的是基于策略的服务端托管——具备可编程预算、速率限制、支出范围、多签/TEE 控制和可审计的授权机制。

这正是可编程钱包的意义所在:它们提供代理可调用的密钥管理与策略执行能力,而无需「持有助记词」。正如 Privy 的 Jamie Hinz 所指出的,四年前我们可能还在尝试把 Fireblocks 或 MetaMask 改造成这种形态;而今天,整个技术栈正在为代理量身打造,使其能在策略框架下完成交易,而不是依赖密码——安全性与自动化开始融合,而不再对立。(如果你想深入了解,推荐阅读 Privy 关于自然语言控制与策略执行的文章。)

更重要的是,这一趋势已经开始显现。连 Visa 和 Mastercard 都在调整其网络以适应智能代理商业,推出了基于 Web Bot Auth 的 Trusted Agent 和 Agent Pay 协议——这表明身份验证、授权与结算正在快速融合,无论是在区块链还是传统支付通道中。

我们可能只差一两个关键突破,就能真正实现这一愿景。

一旦支付变得可编程,互联网的行为方式也将随之改变。每一个动作都可以被定价、支付并实时结算。每一个代理,无论是模型还是人类,都可以因其贡献而获得即时报酬。

随着基础设施逐步完善,两个关键标准正在浮现:ERC-8004 提供信任层,让代理之间可以在无需中心化中介的情况下发现并协作;x402 实现代理之间的即时、无摩擦支付。

它们共同构成了智能代理经济的底层管道。

我们相信一个未来:代理 A 通过 ERC-8004 注册表找到代理 B,协商服务内容,然后通过像 x402 这样的智能支付协议即时完成支付,结算在以太坊这一中立金融层上。

要实现真正的代理协作,它们必须具备互操作性——能够通过共享协议发现彼此、沟通并交换数据;同时也要具备可组合性——能力可以在彼此基础上叠加。

正如 Coinbase 的 Lincoln Murr 所说:「机器之间的支付如果由稳定币通道主导,可能会推动稳定币在整个互联网的广泛接受。虽然 Visa 和 Mastercard 在面向人类的支付上仍占据主导地位,但代理将成为推动加密支付普及的『特洛伊木马』」

互联网从网页到应用用了 20 年,从应用到平台又用了 15 年。而代理将压缩这个周期。商业将不再是你「主动去做」的事情,而是变成一种「自动发生」的过程——安静地、持续地、无处不在。

[原文链接]

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。