Crypto ETFs Close the Week Mixed: Solana Up, Bitcoin and Ether Down

The week’s final session painted a familiar picture: red across bitcoin and ether ETFs, green for solana. Investors showed renewed caution heading into November, pulling hundreds of millions from the leading crypto ETF pairs even as solana’s momentum continued to impress.

Bitcoin ETFs saw $191.60 million leave across four major funds, ending the week’s rollercoaster on a sour note. Blackrock’s IBIT took the biggest hit with a $149.33 million outflow, wiping away much of its early-week gains. Ark & 21Shares’ ARKB followed with $19.30 million in redemptions, while Bitwise’s BITB and Fidelity’s FBTC logged $17.88 million and $11.97 million exits, respectively. The lone bright spot came from Grayscale’s GBTC, which managed a $6.88 million inflow. Despite steady trading activity of $4.25 billion, total net assets dropped to $147.71 billion.

Ether ETFs mirrored the downtrend, registering $98.20 million in outflows across five funds. Blackrock’s ETHA led with $38.63 million exiting, followed by Fidelity’s FETH with $27.12 million. Grayscale’s ETHE and Ether Mini Trust added further pressure with $13.73 million and $12.07 million in redemptions, while Bitwise’s ETHW shed $6.65 million. Total value traded came in at $1.61 billion, keeping net assets stable at around $26.02 billion.

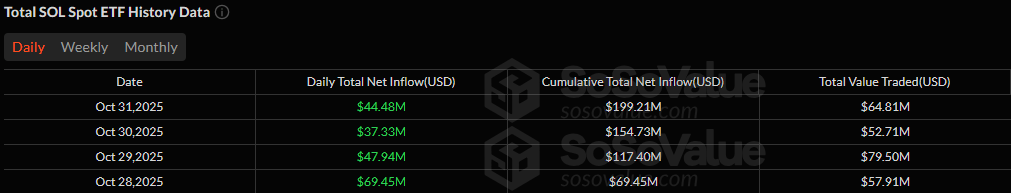

Solana ETFs were the standout performers with an all green week. Source: Sosovalue

Meanwhile, solana ETFs remained the market’s unexpected success story. Bitwise’s BSOL drew the entire $44.48 million inflow, supported by solid investor interest and sustained trading activity of $64.81 million. Net assets surged past the half-billion mark to $502.04 million, cementing solana’s growing footprint in the ETF landscape.

Bitcoin and ether stumbled to the week’s finish line, but solana’s rise offered a glimmer of optimism, proof that investor enthusiasm for emerging crypto assets remains very much alive.

FAQ💸

- Why did bitcoin and ether ETFs end the week lower?

Investors pulled over $290 million from bitcoin and ether ETFs as risk sentiment cooled heading into November. - Which funds saw the biggest outflows?

Blackrock’s IBIT led bitcoin outflows with $149 million, while Blackrock’s ETHA topped ether redemptions at $39 million. - Why did solana ETFs buck the trend?

Bitwise’s BSOL attracted $44 million in new capital, reflecting strong confidence in solana’s growth and utility. - What does this mean for crypto ETF sentiment?

While bitcoin and ether cooled, solana’s resilience signals growing investor appetite for next-generation crypto assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。