撰文:ChandlerZ,Foresight News

10 月 30 日凌晨,美联储公布最新利率决议,如期降息 25 个基点,将联邦基金利率区间下调至 3.75% – 4.00%,并宣布自 12 月 1 日起停止资产负债表缩减。消息公布瞬间,市场反应平淡,标普 500 指数和纳指 100 小幅上扬,黄金与比特币一度收窄跌幅。但数分钟后,美联储主席鲍威尔在新闻发布会上表示,12 月是否继续降息「并非板上钉钉」,委员会内部存在明显分歧。

这一表态迅速改变市场情绪。美股、黄金、比特币、美债四大类资产同步下挫,美元独涨。

31 日这一情绪持续蔓延,比特币从 11.15 万美元附近跳水至 10.6 万美元,以太坊跌幅更深,最低跌破 3700 美元,SOL 跌破 180 美元。据 CoinAnk 数据,过去 24 小时全网爆仓 10.35 亿美元,多单爆仓 9.23 亿美元,空单爆仓 1.11 亿美元。其中比特币爆仓 4.16 亿美元,以太坊爆仓 1.93 亿美元。

另一边,截至美股收盘,美股三大指数全线下挫,纳指领跌。加密货币相关股票更是普跌,其中 Coinbase(COIN)跌幅为 5.77%、Circle(CRCL)跌幅为 6.85%、Strategy(MSTR)跌幅为 7.55%,Bitmine(BMNR)跌幅为 10.47%、SharpLink Gaming(SBET)跌幅为 6.17%、American Bitcoin(ABTC)跌幅为 6.02% 等等。

在经历月初的热闹后,市场从「涨」切换为「修整」模式。资金期待已出、叙事未续、套利空间减少。对于多数持币者而言,这种节奏意味着涨幅兑现与防守逻辑优先。

加密市场连环受挫,黑天鹅阴影未散

事实上,本轮震荡早有征兆。自 10 月 11 日「黑天鹅暴跌」以来,比特币的走势一直未能完全修复。短短 72 小时内,市值蒸发近 400 亿美元,全网爆仓规模超 110 亿美元,恐慌指数一度跌至 22。此后数日的反弹在 11.6 万美元遇阻,直到本周鲍威尔讲话引发新一轮恐慌。

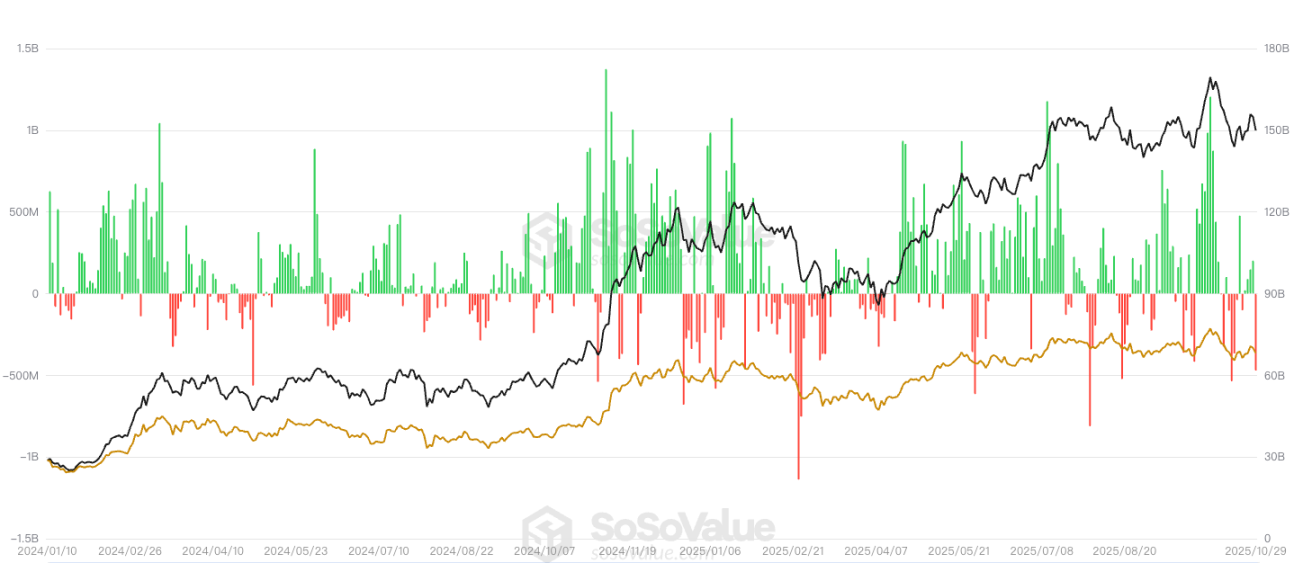

ETF 资金流方面,据 SoSoValue 数据,比特币现货 ETF 昨日总净流出 4.88 亿美元,十二支 ETF 无一净流入。单日净流出最多的比特币现货 ETF 为贝莱德 (Blackrock) ETF IBIT,单日净流出为 2.91 亿美元,目前 IBIT 历史总净流入达 650.52 亿美元。其次为 Ark Invest 和 21Shares 的 ETF ARKB,单日净流出为 6561.93 万美元,目前 ARKB 历史总净流入达 20.53 亿美元。

以太坊现货 ETF 总净流出 1.84 亿美元,九支 ETF 无一净流入。单日净流出最多的以太坊现货 ETF 为贝莱德(Blackrock) ETF ETHA,单日净流出为 1.18 亿美元,目前 ETHA 历史总净流入达 142.06 亿美元。其次为 Bitwise ETF ETHW,单日净流出为 3114.43 万美元,目前 ETHW 历史总净流入达 3.99 亿美元。

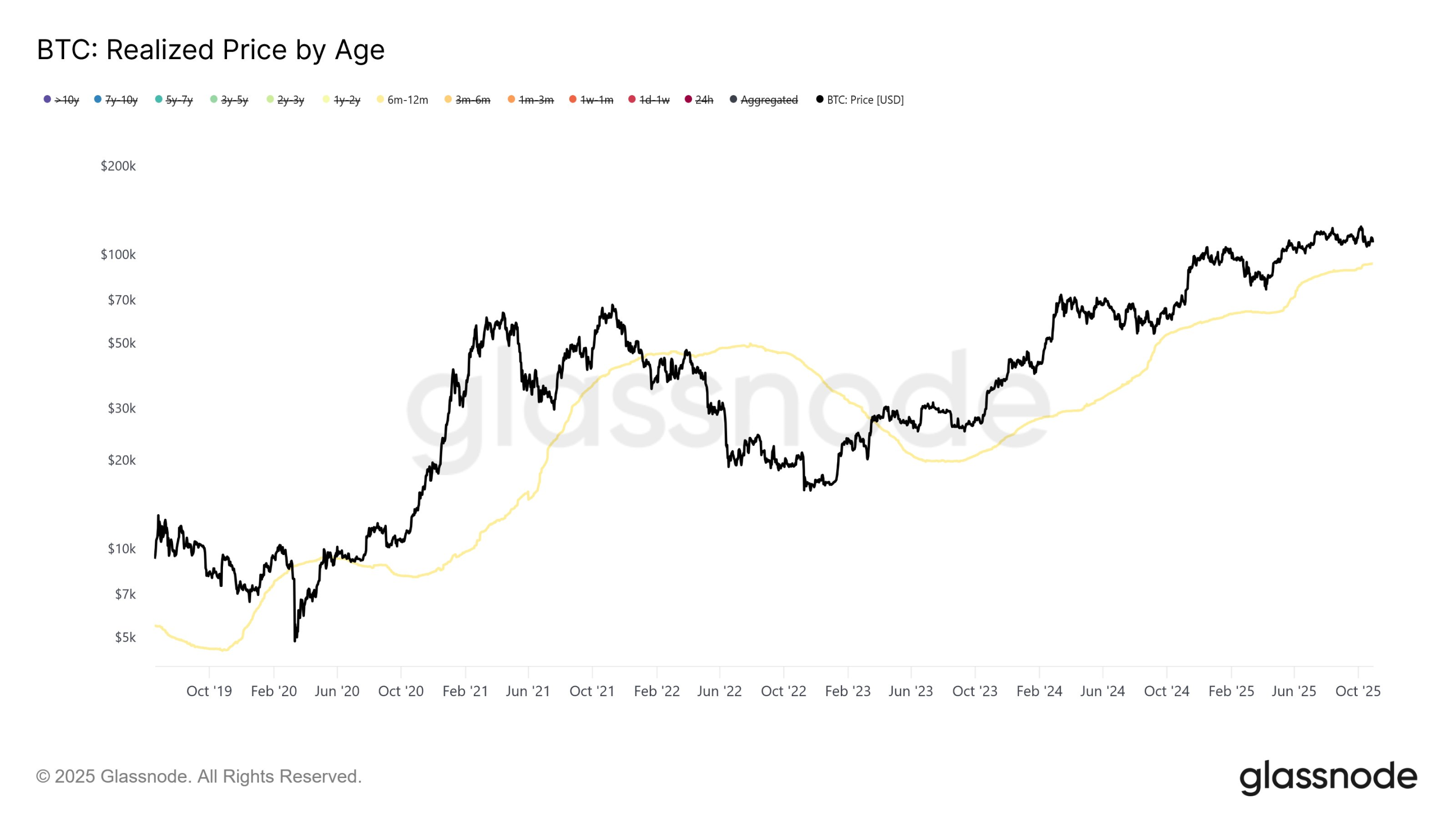

据 Glassnode 分析,自 7 月中旬以来,比特币长期持有者持续保持稳定的抛售压力,施加持续的抛售压力,将市场限制在 12.6 万美元以下。数据显示,长期持有者的日均抛售从 7 月中旬的约 10 亿美元(7 日移动平均)增长至 10 月初的 20-30 亿美元。与本轮牛市中先前的高抛售阶段不同,当前的分配模式呈现出渐进且持续的特点,而非剧烈的短期抛售。

进一步按持有时间分析显示,持有期为 6-12 个月的投资者贡献了超过 50% 的近期抛售压力,尤其在价格顶部形成的后期阶段最为明显。在比特币创下 12.6 万美元历史新高附近,这一群体的日均抛售达到 6.48 亿美元(7 日移动平均),较 2025 年早期基准水平增加了 5 倍以上。

数据还揭示,这些投资者主要在 2024 年 10 月(美国大选期间)至 2025 年 4 月期间大量积累比特币,其成本基础在 7 万美元至 9.6 万美元之间,平均约为 9.3 万美元。分析师指出,若比特币价格跌破 9.3 万 -9.6 万美元区间,将对这一群体造成最大损失压力。

市场部分人士认为,10 月 11 日的暴跌及其后续回调已构成一个「小周期顶部」,而本周鲍威尔的发言则强化了短期防守逻辑。

流动性重新定价

黑天鹅暴跌之后,加密市场进入了一种深度重构期。过去几年支撑山寨币繁荣的两条主线,散户的高频博弈与机构的投机承接正在同时瓦解。做市商在去杠杆,VC 暂停一级市场的投放,散户经历连续爆仓后撤出场外,市场的活水几乎干涸。

比特币与以太坊重新成为流动性的主导资产,长尾代币的价格发现机制失效,市值和叙事被迫退场。除了极少数有真实现金流和用户基础的基础设施项目,比如稳定币发行、RWA 资产映射或支付结算系统,其余山寨币都处于长期筹码稀释与买盘枯竭的状态。山寨退潮的背后,是整个资金逻辑的收缩。市场从故事定价过渡到现金流定价,资本不再为概念买单。代币的价值失去了持续增长的理由,叙事成为少数核心项目的专属特权。

此外,今年上半年盛行的 DAT 模式,本质是一种以币换股的结构融资。它的可行性依赖一个前提,即二级市场有人愿意承接。当增量流动性枯竭,这个闭环随即崩塌。项目方仍想募资,FA 仍在撮合交易,但买方消失。Strategy 公布 2025 年第三季度财报。其中净利润为 28 亿美元;BTC 持仓从 597,325 枚增加至 640,031 枚;但股价在同期下跌近 14%,其相对于 BTC 持仓的市场溢价收窄。

长尾 DAT 几乎没有成交,新的融资都变成链上币权对账面股权的对冲。例如纳斯达克上市的莱特币财库公司 Lite Strategy 宣布其董事会已批准一项规模达 2500 万美元的股票回购计划,回购时间和具体回购股份数量将视市场情况而定。对于项目方和早期投资人,这意味着短期募资仍可完成;对于二级市场的投资者,则意味着几乎没有退出路径。缺乏现金流支持、缺乏审计托管、缺乏回购机制的 DAT,正逐步暴露出空转与循环质押的特征。

从更深层看,这场泡沫的破裂是加密一级与二级市场之间的信用断裂。没有了真实买盘,所谓链上财库估值失去了意义。资本的耐心在消耗,代币不再具备融资功能,DAT 从创新转向风险。

短期震荡,长期宽松格局难改

加密市场的波动正处在重新定价的过程之中。鲍威尔的讲话令市场短线情绪急转,但这种冲击更像是一场预期修正,而非趋势反转。巴克莱的最新报告也印证了这一判断:鲍威尔的真正意图在于打破市场对必然降息的过度预期,而不是回到鹰派立场。宏观数据事实上仍在为继续宽松提供条件,劳动力需求持续放缓,核心通胀回落接近 2% 目标,经济动能降温已成为共识。

从周期角度看,美联储的政策空间正在重新打开。当前利率区间 3.75%–4.00% 已显著高于核心通胀水平,意味着货币政策依旧偏紧;而在全球经济普遍放缓的大背景下,维持过高利率的边际收益正在减弱。接下来的问题,不是是否降息,而是何时重启更强力度的宽松。随着资产负债表缩减在 12 月正式结束,美联储回到量化宽松的可能性将逐步上升。

对于加密市场而言,这意味着中期的流动性环境依旧友好。短期波动虽然剧烈,但市场的流动性锚仍指向宽松。美元流动性改善将推升风险偏好,资产定价重心将再次向上修正。历史经验显示,每一轮宽松周期开启后,比特币通常会在滞后 1 至 2 个季度后迎来趋势性回升。当前的调整,更可能是为下一段行情积蓄空间。

从资金结构来看,机构仍在等待宏观确认,即通胀稳定在目标区间、就业显著降温、美联储释放降息信号。一旦这一组合出现,ETF 流入与期货多头重建的节奏将重新启动。对于散户和中小资金而言,真正的机会并不在短线恐慌之中,而在宽松周期确立后的第二波流入期。

无论是美联储的政策重心,还是机构的资产配置逻辑,都正在从加息末期向宽松初期过渡。短期震荡难免,但长期的流动性回归已经成为大势所趋。对仍然留在场内的投资者而言,最重要的不是预测底部,而是确保自己能熬到量化宽松重新启动的那一天。届时,比特币与整个加密资产市场,将在流动性复苏中迎来新一轮定价周期。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。