Recent news shows that the fee structure of mainstream Layer 1 blockchains has completely changed:

- The former king fades: Solana, which held over 50% of the market share at the beginning of the year, has seen its share plummet to just 9%.

- A new king rises: Hyperliquid, which was relatively unknown at the beginning of the year, has skyrocketed to over 40% market share, becoming the largest single chain, alongside BNB Chain, which holds 20%, together dominating 60% of the market's fee revenue.

In the elite-filled fintech field, how does a mini team of just 11 people shake traditional financial giants? The answer lies in Hyperliquid's "open platform" strategy—they do not operate a bank but create a pathway for the future of finance.

1. Counterattack Achievements:

Small size ignites great energy. While traditional exchanges rely on teams of thousands, Hyperliquid has created an industry miracle with just 11 people:

Cumulative trading volume reached $2.77 trillion, with a single-month peak trading volume of $398 billion, capturing 5.1% of the global perpetual contract market.

Even more astonishing, this public chain currently consumes over 40% of the total network's fee revenue, becoming the most dominant blockchain by 2025.

2. Team DNA:

Minimalist structure creates extreme efficiency. In contrast to the bloated structures of traditional financial institutions, Hyperliquid adheres to a "special forces" model:

- Zero middle management: The 11-person team includes core developers and protocol experts, resulting in a very short decision-making path.

- Fully remote collaboration: Breaking geographical limitations, gathering top cryptographic talent from around the world.

- Focus on underlying protocols: All resources are dedicated to optimizing the HyperCore trading engine. This minimalist structure allows their development efficiency to reach 10 times that of traditional institutions, completing protocol upgrades in just 3 months that would take traditional teams 2 years.

3. Core Ace:

Building the "Android system" of finance. Hyperliquid's disruptive innovation lies in its builder code system, which operates like an app store in the financial sector:

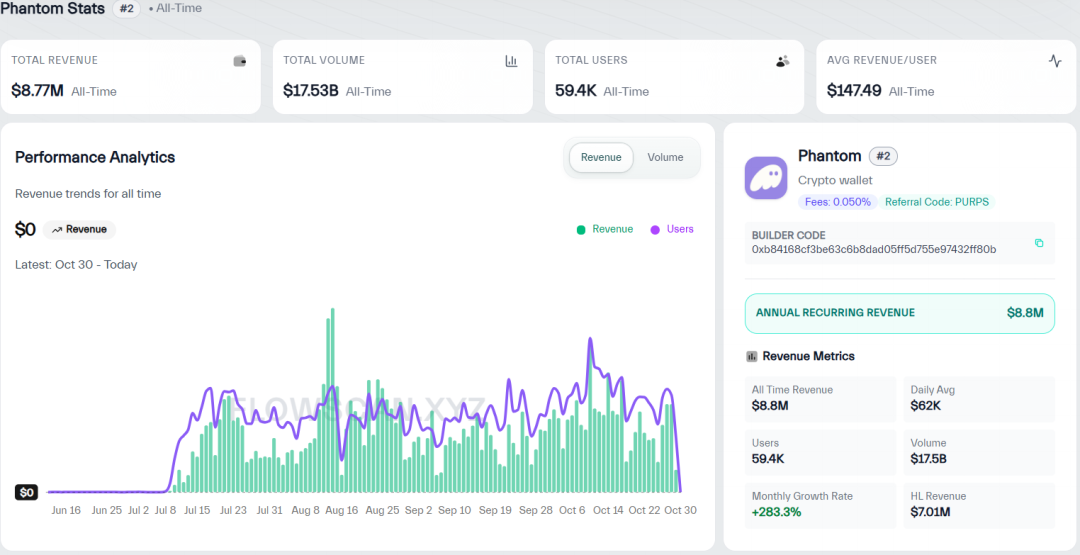

Through this system, the Phantom wallet added perpetual trading functionality in just 3 weeks, generating $17.53 billion in trading volume. This "platform as a service" model allows Hyperliquid to expand itself by empowering others, much like Amazon Web Services in the financial domain.

4. Value Foundation:

99% revenue buyback mechanism. What shocks the traditional financial world the most is its economic model:

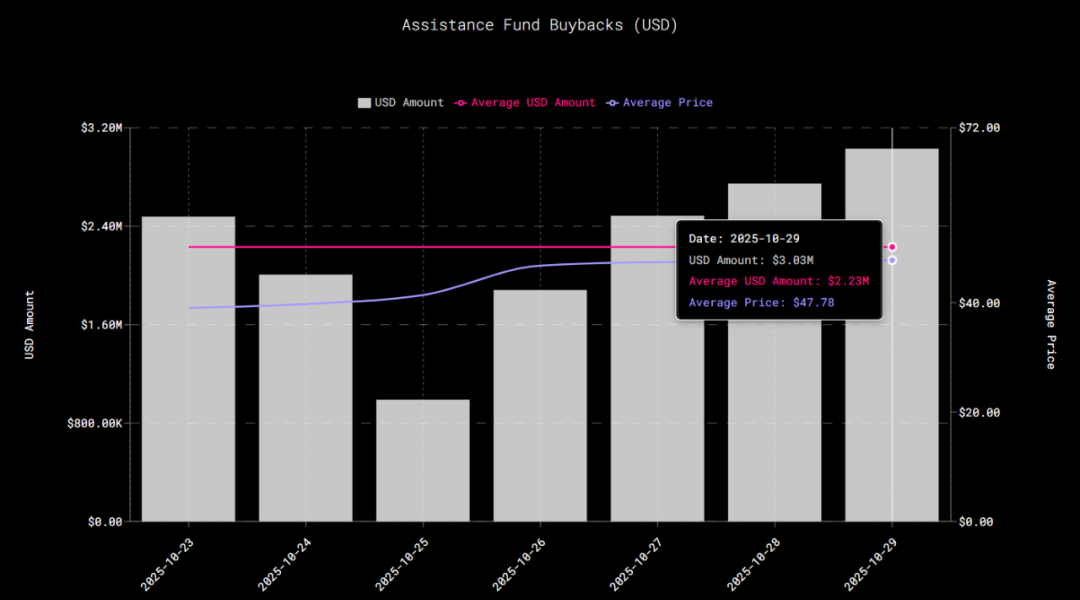

The platform automatically buys back tokens daily through an aid fund, using 99% of its revenue. This mechanism creates a value closed loop:

- Daily generating $2.23 million in stable buy orders.

- Buyback tokens permanently exit circulation, creating a deflationary effect.

- Makes HYPE the first crypto asset that can be valued using traditional price-to-earnings ratios.

5. Ecological Expansion:

From trading platform to financial infrastructure. The open platform model has spawned a rich ecosystem of applications:

- Ventuals: Creating a pre-IPO stock trading market through the HIP-3 protocol.

- HyperUnit: Achieving 1:1 mapping of cross-chain assets, handling over $718 million in cross-chain assets.

- USDH stablecoin: Returning 50% of treasury bond yields to the protocol, building a new revenue model.

Conclusion:

The dimensionality reduction strike of the open platform. While traditional financial giants are still building higher walls, Hyperliquid chooses to dismantle the walls and lay down tracks.

The counterattack of its 11-person team proves: In the digital economy era, "connecting value" is more important than "occupying resources."

This open platform model is reshaping the underlying logic of the financial industry—the future winners will not be the largest banks, but the most prosperous financial ecosystems.

(This article's data comes from public market information and does not constitute investment advice. The market has risks; decisions should be made cautiously.)

Join the community for more insider news

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。