撰文:叶桢

来源:华尔街见闻

美联储如期降息,但鲍威尔在会后新闻发布会上发出的鹰派信号,给市场对年底前再次降息的普遍预期泼了一盆冷水。

有「新美联储通讯社」之称的华尔街日报记者 Nick Timiraos 在最新文章中表示,鲍威尔罕见地强硬表态,不仅凸显了 FOMC 内部日益加剧的分歧,也表明在经济数据「盲飞」的背景下,未来货币政策的路径充满了高度不确定性。

当地时间周三,美联储宣布将基准利率下调 25 个基点,将联邦基金利率目标区间降至 3.75% 至 4%,为三年来最低水平,这是连续第二次会议降息。然而,发布会上的焦点迅速转向了鲍威尔对未来政策的看法。他明确反驳了市场认为 12 月降息已是「板上钉钉」的观点,直言这一前景「远非确定」。

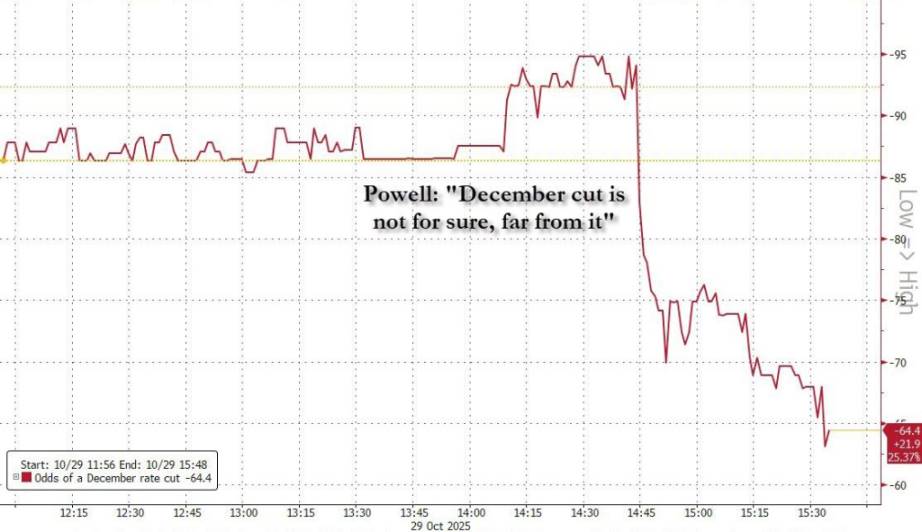

鲍威尔的言论立竿见影,扭转了市场的乐观情绪,12 月降息的概率从 95% 暴跌至 65%。道琼斯工业平均指数和标普 500 指数抹去日内涨幅,最终道指收跌 0.2%,标普 500 指数微跌。对利率前景最为敏感的 2 年期美国国债收益率飙升 0.092 个百分点至 3.585%,创下自 7 月初以来的最大单日涨幅。

Timiraos 分析称,鲍威尔的讲话清楚地表明,随着他口中「越来越多的官员」对进一步降息的必要性提出质疑,本轮宽松周期中最轻松的部分可能已经结束。与此同时,随着每一次降息的推进,何时停止降息的问题也变得愈发紧迫。

内部分歧显现,决策投票「三向撕裂」

最新的利率决议以 10 票赞成、2 票反对的结果通过,投票细节暴露了委员会内部观点的严重分化。堪萨斯城联储主席 Jeffrey Schmid 投下反对票,他倾向于维持利率不变;而美联储理事 Stephen Miran 则持不同意见,他主张进行更大幅度的 50 个基点降息。

这一「三向撕裂」的投票格局印证了鲍威尔所说的,委员会内部存在「强烈不同的观点」。鲍威尔在发布会上承认,决策者中存在一个「日益壮大的合唱团」(growing chorus),他们对是否需要进一步放松政策持怀疑态度。

尽管在 9 月份的经济预测中,微弱多数官员预计今年还将有两次降息,这使得市场倾向于认为 12 月降息的可能性较大。但当时已有相当一部分官员认为,在 9 月降息之后不应再有更多动作。这些官员更担心通胀问题——在过去几年中,通胀率一直高于美联储 2% 的目标,并且在今年停止了下降趋势,部分原因是特朗普加征关税推高了商品价格。

鲍威尔的强硬立场让此前高度预期 12 月降息的市场感到意外,分析师们对后续路径的看法也出现分歧。

纽约梅隆投资管理公司首席经济学家、前美联储高级顾问 Vincent Reinhart 认为,鉴于数据真空的状况,「数据必须证明进一步宽松是不合理的,这是一个很高的门槛」,因此他补充说,「他们(美联社)在 12 月不降息真的很难。继续下去比停下来更容易。」

然而,普渡大学商学院院长、前圣路易斯联储主席 James Bullard 则认为,12 月降息的前景「比市场目前认为的要微妙一些」。他指出,强劲的消费者支出和经济增长,加上近期的通胀挫折,可能成为放缓降息步伐的理由。「你把太多的赌注押在了非农就业报告的放缓上,」Bullard 说。他还质疑,政策制定者是否真正适应了每月新增 5 万个就业岗位就「完全可以接受」的新常态。

政府停摆致数据「盲飞」,不确定性加剧降息难度

让决策变得更加棘手的,是因政府停摆导致的经济数据真空。鲍威尔指出,如果数据缺失导致官员们对经济前景面临「非常高的不确定性」,这本身就可能成为「支持谨慎行事」的理由。

通常情况下,会议间的经济报告有助于弥合官员们的分歧。但如今,尤其是关键劳动力市场指标的缺失,使他们失去了解决分歧所需的信息。

Timiraos 文章援引耶鲁大学管理学院教授、前美联储高级顾问 William English 表示,数据缺失意味着「自 9 月以来他们学到的东西不多,这使得他们的立场可能与 9 月时相近,但围绕这一点的不确定性范围更广了」。

对此,华尔街见闻此前提及,美国银行推演了几种可能的情景:

情景一: 若政府在 11 月底前重开,市场能在 12 月会前看到一份「过时」的 9 月就业报告。一份疲软的报告或能降低鹰派反对的风险,但即便数据强劲,也可能因其「过时」而难以说服鲍威尔暂停降息。

情景二: 若政府在 11 月初结束停摆,使劳工统计局能在会前发布 9 月和 10 月两份报告。在此情况下,如果失业率保持平稳且经济活动稳健,那么 12 月「暂停降息」将成为一个真实的选项。

情景三: 最理想情况下,若政府迅速重开,劳工统计局在会前发布 9 月、10 月和 11 月全部三份就业报告。美银提出了一个决策「经验法则」:11 月失业率低于或等于 4.3%,美联储或将按兵不动;若高于或等于 4.5%,则将促使其降息;若失业率为 4.4%,决策将是一次「势均力敌的抉择」。

通胀担忧与就业放缓的权衡博弈

Timiraos 文章指出,目前,美联储的政策辩论核心在于如何在控制通胀与应对经济放缓之间取得平衡。一方面,部分官员不希望过度降息,以免刺激经济过热,导致通胀持续高于目标。近期股市在降息预期的推动下屡创新高,也增加了他们对金融稳定的担忧。

另一方面,其他官员则担心,不应忽视贸易政策变化以及过去加息的滞后效应对住房等利率敏感部门的冲击,这些因素正在挤压低收入消费者和小型企业的支出。最近几周,美国几家大型雇主已宣布计划裁减白领员工。

就业市场是这场辩论的中心。尽管通胀读数略显坚挺,但今年夏季的劳工报告显示就业增长急剧放缓,这促使美联储重回降息轨道。数据显示,截至 8 月的三个月里,月均新增就业人数约为 2.9 万人,远低于去年同期的 8.2 万人。政策制定者正试图厘清,就业增长放缓究竟是由于进入美国求职的人数减少,还是劳动力需求下降。

Timiraos 表示,在没有明确数据显示就业市场出现实质性恶化的情况下,很难为超过 25 个基点的降息幅度争取到足够支持。与此同时,随着每一次降息的推进,何时停止降息的问题也变得愈发紧迫。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。