The Federal Reserve's interest rate decision and Powell's hawkish statements have simultaneously dropped a bombshell in both traditional financial markets and the cryptocurrency world.

At 12:00 AM on October 30, Eastern Time, the Federal Reserve announced a 25 basis point reduction in the target range for the federal funds rate to 3.75%-4.00%. This marks the second consecutive rate cut following the September reduction and the fifth cut since September 2024.

At the same time, the Federal Reserve also decided to end quantitative tightening (QT) on December 1. However, what surprised the market the most was Powell's "hawkish" stance on the possibility of a rate cut in December.

1. Detailed Explanation of the Rate Decision

The Federal Reserve's monetary policy meeting passed the decision to cut rates by 25 basis points with a 10-2 vote, presenting a rare "hawk-dove" scenario.

● Kansas City Fed President George supported maintaining rates, while Fed Governor Waller advocated for a 50 basis point cut. This dual divergence marks the third time since 1990 that policymakers have expressed differing opinions on both easing and tightening monetary policy in the same meeting.

● The Federal Reserve stated in its announcement that "available indicators show that economic activity is expanding at a moderate pace," while also acknowledging that "job growth has slowed this year, the unemployment rate has risen slightly," and "inflation remains relatively high." The committee believes that "the downside risks to employment have increased in recent months."

Individuals/Factions

Position

Core Views and Statements

Voting Results

Mainstream Faction

Support for a 25 basis point cut

Believes it is necessary to balance inflation and employment risks. Economic activity is expanding moderately, job growth is slowing, and the unemployment rate has risen slightly, but inflation remains high. Given the changing balance of risks, a rate cut is decided.

10 votes in favor

Jeffrey George

Hawkish Opposition

(Opposed to the rate cut, supports maintaining rates)

Believes the U.S. economy remains resilient.

1 vote against

Stephen Waller

Dovish Opposition

(Advocates for a 50 basis point cut)

Believes more aggressive support for employment is needed.

1 vote against

Source: AiCoin整理

2. Ending the Balance Sheet Reduction Plan

In addition to the rate decision, the Federal Reserve also announced an important decision—to end the balance sheet reduction (QT) on December 1.

● The FOMC statement clearly stated: "The committee has decided to end the reduction of its total securities holdings on December 1."

● Powell explained that "pressures in the money market require immediate adjustments to balance sheet operations," and pointed out that "there are clear signs indicating that it is time to stop quantitative tightening."

Federal Reserve Balance Sheet Adjustment Plan

Adjustment Aspects

Specific Measures

End of Balance Sheet Reduction

Decided to end the reduction of the overall securities holdings on December 1.

Treasury Handling

Will extend the principal of all held Treasury securities through auction.

MBS Handling

Will reinvest the principal of maturing agency debt and MBS into short-term Treasuries.

Source: AiCoin整理

3. Powell's Hawkish Statements

Despite implementing a rate cut, Federal Reserve Chairman Powell's statements at the press conference were interpreted by the market as hawkish. His comments regarding the possibility of a rate cut in December struck a sensitive nerve with investors.

● Powell clearly stated, "The market's expectation of another rate cut in December is 'far from a done deal.'" He emphasized that "there is significant disagreement on how to act in December, and whether to cut rates further in December is far from a done deal."

● He further explained, "In the absence of data, it may be necessary to be more cautious; the lack of economic data may constitute a reason to pause rate adjustments."

● This statement directly affected market expectations, with traders subsequently lowering their bets on a December rate cut by the Federal Reserve, with the probability of a cut dropping sharply from 90% before the meeting to 65-71%.

4. Market's Dramatic Reaction

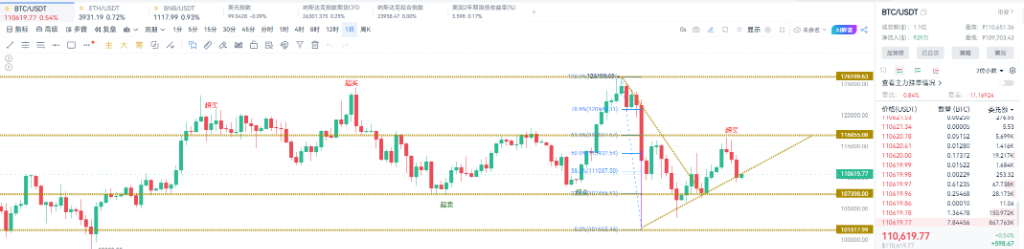

Powell's hawkish remarks triggered immediate turmoil in the financial markets, with significant volatility observed in both traditional financial markets and cryptocurrency markets.

Major Asset Market Performance Comparison

Asset Class

Performance

U.S. Stocks

Plummeted during trading, with the Dow down 0.16%, the Nasdaq up 0.55%, and the S&P 500 closing flat.

Dollar Index

Soared sharply, reversing from a decline to an increase.

U.S. Treasury Yields

Two-year U.S. Treasury yields surged to 3.59%.

Gold

Spot gold fell below $3950 per ounce.

Cryptocurrency

In the past 24 hours, 130,000 people were liquidated, with liquidation amounts reaching $560 million.

Source: AiCoin整理

In the cryptocurrency market, Bitcoin briefly declined, with nearly 130,000 people liquidated in the past 24 hours, amounting to approximately $560 million in liquidations.

5. Analysis of the Impact on the Cryptocurrency Market

The Federal Reserve's decision has had multiple impacts on the cryptocurrency market, primarily reflected in liquidity expectations, trading dynamics, and investor sentiment.

● From the liquidity transmission mechanism, a rate cut should lower the dollar financing costs, benefiting risk assets. However, Powell's cautious stance on subsequent rate cuts suppressed the market's risk appetite, leading to a rapid withdrawal of leveraged funds from the cryptocurrency market.

● From a historical perspective, lower interest rates typically encourage investors to explore unknown areas such as digital finance. When traditional investment returns decline, capital often flows into cryptocurrencies, enhancing overall market vitality.

● However, this increase in liquidity, while beneficial for market health, also introduces volatility factors. DeFi platforms are likely to see a surge in activity as investors chase higher returns in a low-interest-rate environment.

6. Future Policy Outlook

The future policy path of the Federal Reserve will primarily depend on two factors: the economic data released after the end of the government shutdown and the actual trend of inflation.

● Powell has acknowledged that the data gaps caused by the government shutdown have made the Federal Reserve's decision-making environment more complex. If the shutdown leads to a lack of data for the Federal Reserve, causing officials to face very high uncertainty regarding economic prospects, "this may be a reason to remain cautious when supporting another rate cut."

● It is also worth noting that the Federal Reserve faces uncertainties in the political environment. U.S. President Trump is expected to announce a new Federal Reserve Chair nominee before the end of the year, a decision that may further impact the Federal Reserve's independence and future policy direction.

As of the morning of October 30, the cryptocurrency market is still in a phase of digesting the shock from the Federal Reserve's decision. Federal funds futures indicate that traders' expectations for a December rate cut have plummeted from 90% before the meeting to 65-71%.

With the end of the U.S. government shutdown and the release of new economic data, the market will reassess the Federal Reserve's policy path, and the cryptocurrency market may face a new round of volatility.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。