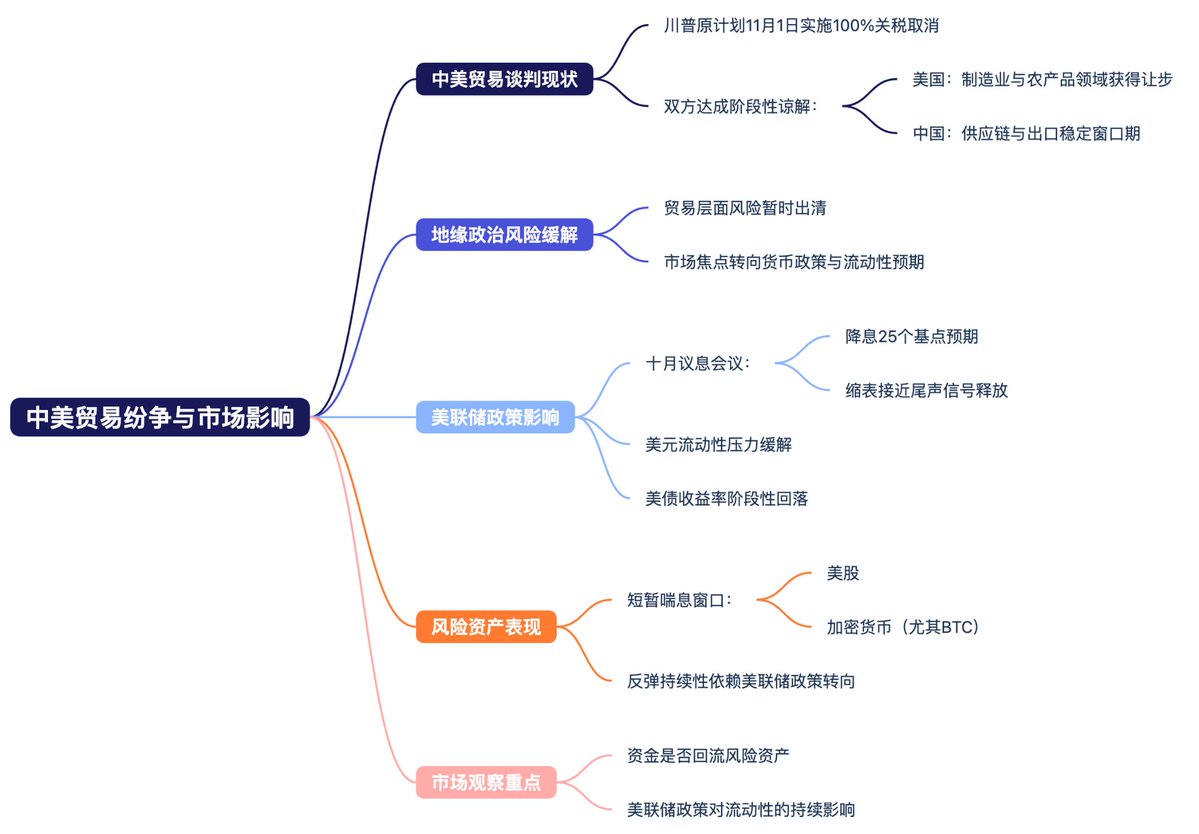

I was initially quite worried about the trade disputes between China and the United States, but based on this week's performance, there seems to be no need for concern. The key point is that Trump's original plan to impose an additional 100% tariff on China starting November 1 is unlikely to be executed. This indicates that certain demands of the U.S. have been met in the China-U.S. trade negotiations, which also means that the risks on the trade front have temporarily cleared. Both sides have likely reached a phased understanding regarding tariffs and import quotas, with the U.S. gaining concessions in manufacturing and agricultural products, while China secures a window for stability in its supply chain and exports.

From a market perspective, this conditional easing is sufficient for funds to refocus on the Federal Reserve's policy path and liquidity expectations, rather than on geopolitical uncertainties. The focus will shift back to monetary and capital aspects. If the October interest rate meeting lowers rates by 25 basis points as expected and signals that balance sheet reduction is nearing its end, the liquidity pressure on the dollar will further ease, and U.S. Treasury yields may temporarily decline.

Risk assets will welcome a brief respite, with U.S. stocks and cryptocurrencies, especially BTC, reacting most directly. Overall, the easing of China-U.S. negotiations is akin to pulling the market back from geopolitical risks, while the Federal Reserve's policy shift will determine the sustainability of this rebound. What truly needs to be observed is not whether tariffs are canceled, but whether funds are flowing back into risk assets.

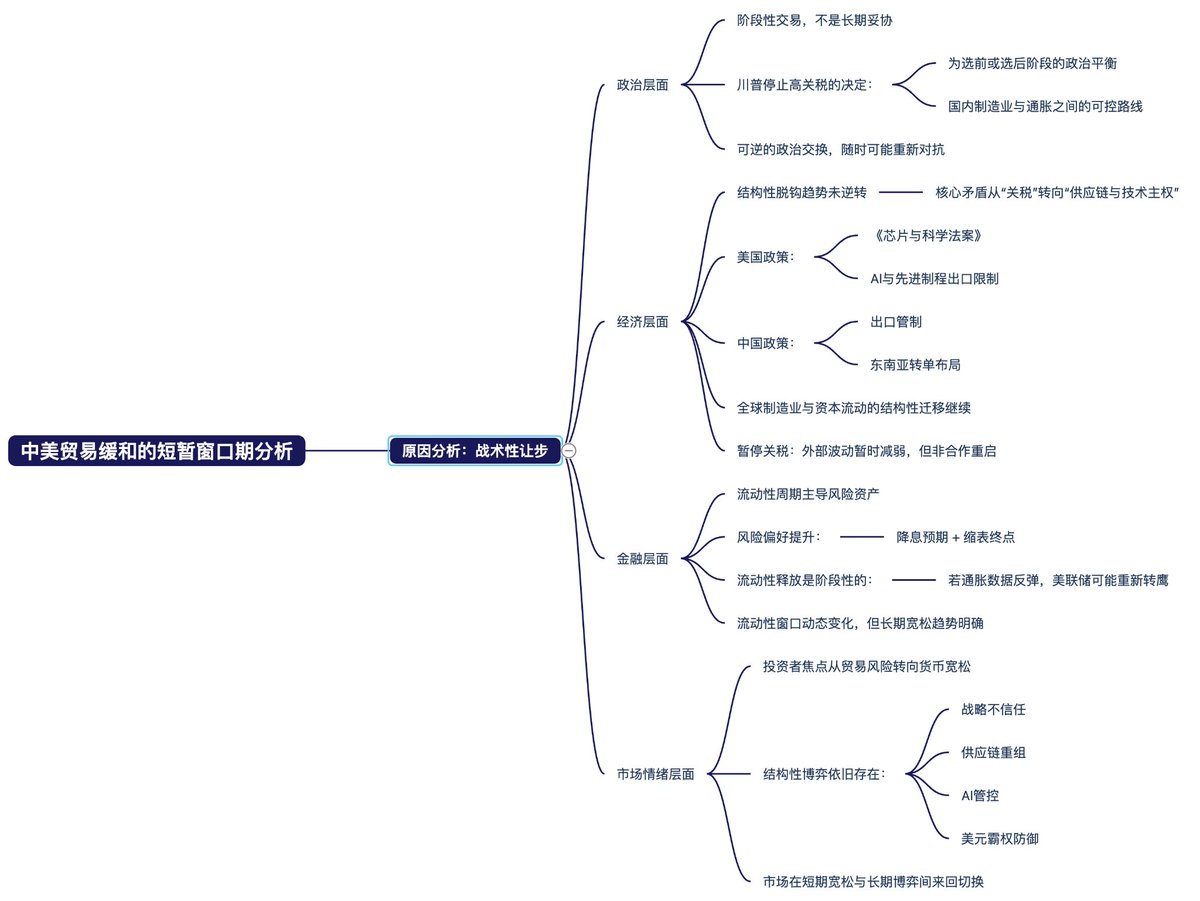

The reason I refer to this as a "brief" window is that the easing of China-U.S. trade is a tactical concession rather than a structural reconciliation.

- On the political level, this is a phased transaction, not a long-term compromise. Trump's decision to halt high tariffs on China is essentially to fulfill his political balance during or after the election. He needs to find a controllable path between domestic manufacturing and inflation, rather than completely easing China-U.S. relations.

This pause means that both sides temporarily gain, but either party can restart confrontation whenever they believe the benefits are sufficient or public opinion shifts. Essentially, this is a "reversible political exchange" that lacks sustainability.

- On the economic level, the structural decoupling trend has not reversed. The core contradiction in China-U.S. trade has shifted from "tariff surface issues" to "supply chain and technological sovereignty." Whether it’s the U.S. CHIPS and Science Act, export restrictions on AI and advanced processes, or China's export controls and Southeast Asia's order transfers, it all indicates that both sides have entered a phase of systematic diversion.

Halting tariffs merely reduces external volatility temporarily, but the structural migration of global manufacturing and capital flows continues. Therefore, this easing feels more like a "breath" rather than a "restart of cooperation."

On the financial level, the liquidity cycle still dominates risk assets. The current increase in market risk appetite is based on the combination of "rate cut expectations + nearing the end of balance sheet reduction." However, this liquidity release is temporary; if data rebounds in November or December, such as a significant rise in inflation data, the Federal Reserve may still turn hawkish again. Thus, the liquidity window is dynamic and not guaranteed to remain accommodative, although the broader trend towards easing is inevitable.

On the market sentiment level, investors' focus has temporarily shifted from trade risks to monetary easing. However, the strategic distrust between China and the U.S., supply chain restructuring, AI controls, and defense against dollar hegemony still exist. As a result, the market can only oscillate between short-term easing and long-term strategic games.

Therefore, this is merely a brief respite, not a cyclical turning point. The structural contradictions between China and the U.S. still exist, and the migration of global supply chains continues. What ultimately determines market direction remains the Federal Reserve's liquidity cycle and policy games.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。