From the current market sentiment, it is highly likely that there will be a 25 basis point rate cut in October, and there shouldn't be any black swan events. The biggest contention ahead is whether the Federal Reserve will stop the balance sheet reduction in October or if Powell will announce that it will stop within the year. The reasons for this speculation are mainly as follows:

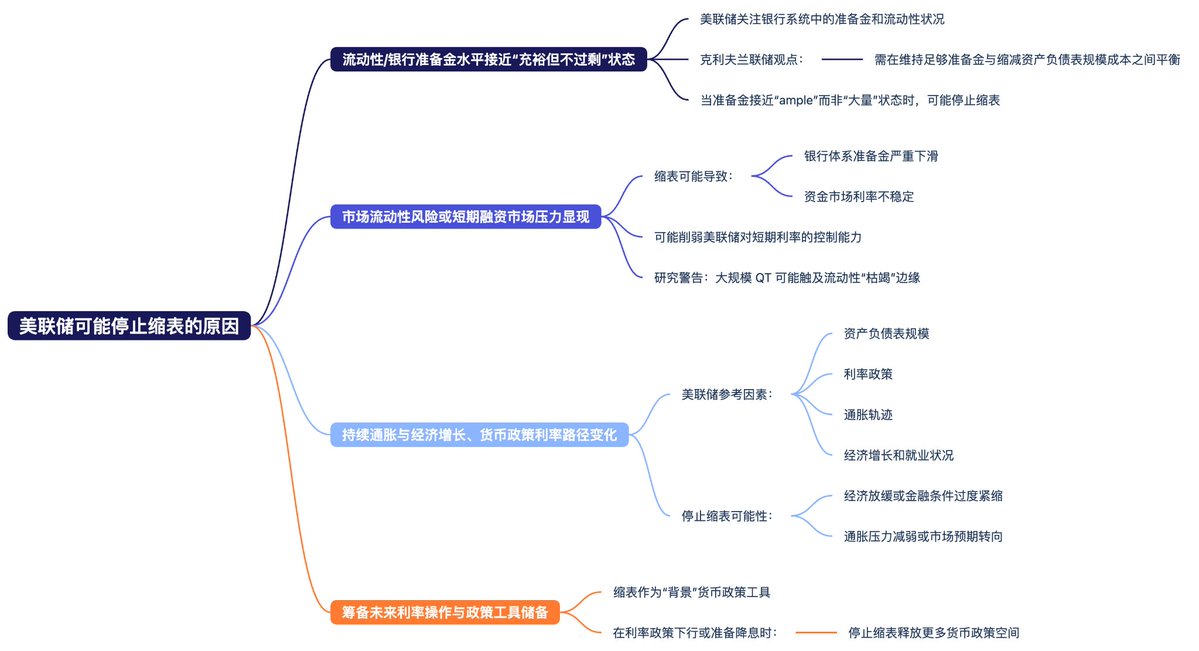

- The liquidity or bank reserves are close to a state of being ample but not excessive. A key consideration in the Fed's balance sheet reduction policy is the liquidity situation in the banking system, including reserves and overnight repurchase agreements.

For example, the Cleveland Fed has pointed out that when deciding when to stop the balance sheet reduction, the Fed needs to balance maintaining sufficient reserves (to facilitate control of the federal funds rate) with the costs of reducing the balance sheet size. When bank reserves approach "ample" rather than "excessive" (i.e., liquidity is neutral rather than loose), the balance sheet reduction may stop.

Market liquidity risks or pressures in the short-term financing market may emerge. If the balance sheet reduction continues and leads to a significant decline in bank reserves and instability in money market rates, it could weaken the Fed's ability to control short-term rates. Some research reports indicate that continuing large-scale balance sheet reduction could push liquidity to the brink of exhaustion.

Persistent inflation and changes in economic growth and monetary policy rate paths. When deciding to end the balance sheet reduction, the Fed will not only look at the size of the balance sheet but also consider interest rate policy, inflation trajectory, economic growth, and employment conditions. If the economy slows down or financial conditions tighten excessively, the Fed may be more inclined to stop the balance sheet reduction to avoid further tightening. Conversely, if inflationary pressures weaken or market expectations shift, it could also prompt an earlier stop to the balance sheet reduction.

Preparing for future interest rate operations and policy tool reserves. The balance sheet reduction is a background monetary policy tool, and when interest rate policy enters a downward channel or prepares for rate cuts, the Fed may want to retain the option to stop the balance sheet reduction as ammunition. If the Fed anticipates future rate cuts or liquidity releases, stopping the balance sheet reduction can free up more potential monetary policy space.

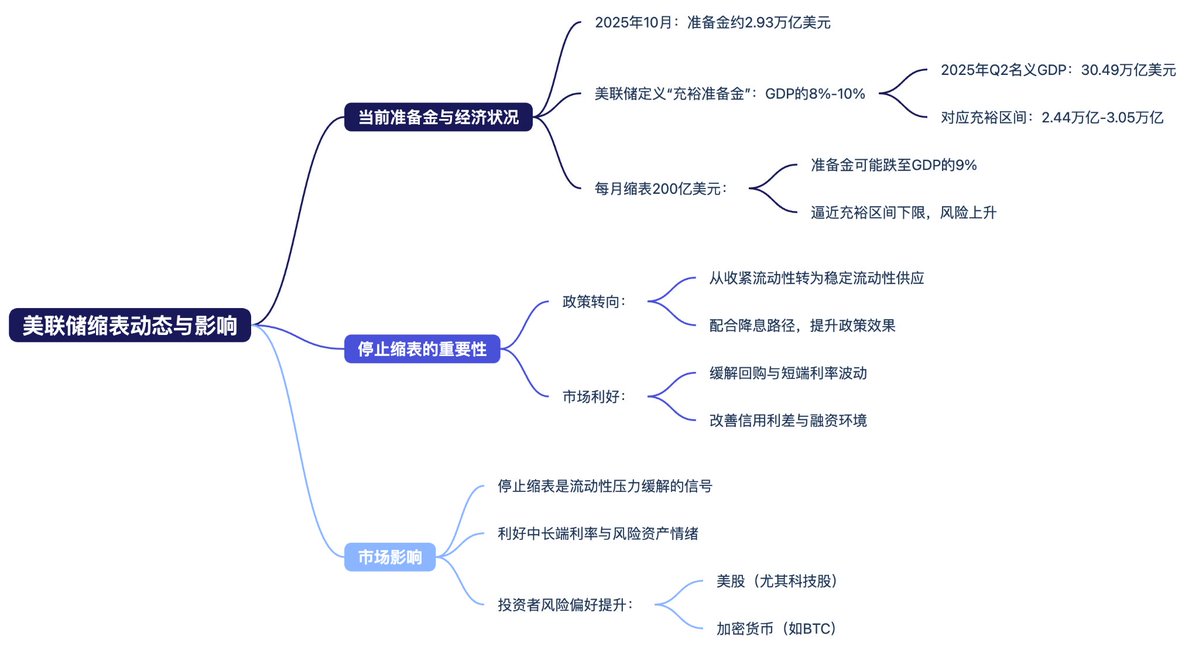

As of the current situation, total reserves of bank deposit institutions are approximately $2.93 trillion as of October 2025. The Fed's recent research defines "ample reserves" as around 8% to 10% of GDP.

As of the second quarter of 2025, the nominal GDP of the U.S. is approximately $30.49 trillion, which corresponds to reserves of $2.44 trillion to $3.05 trillion at 8% to 10%. Currently, this is just close to the "ample range." If the balance sheet reduction continues at a rate of $20 billion per month, it may drop to around 9% by next year, nearing the lower edge of the ample range (about 9% of GDP). At that point, the Fed may consider that further balance sheet reduction could pose systemic liquidity risks.

Therefore, if the balance sheet reduction can stop in October, it indicates that the Fed's policy will shift from continuing to tighten liquidity to stabilizing liquidity supply, in coordination with the rate cut path, enhancing policy transmission efficiency. Bank reserves in the banking system will no longer continue to decline, and fluctuations in repurchase and short-term rates may ease, which is mildly beneficial for credit spreads and the financing environment.

Stopping the balance sheet reduction is often one of the leading signals of easing dollar liquidity pressure, which is favorable for expectations of declining mid- to long-term rates and risk asset sentiment. When combined with expectations of rate cuts, it enhances investors' risk appetite.

In simpler terms, stopping the balance sheet reduction is a prelude to the Fed entering a phase of large-scale rate cuts, indicating that liquidity will gradually recover, and investors will be more willing to invest in risk assets. Currently, the strongest asset is U.S. stocks. In the past two weeks, I have extensively expressed the correlation between Bitcoin and U.S. stocks, mainly tech stocks, so the balance sheet reduction will have a good liquidity stimulating effect on cryptocurrencies, especially BTC.

Therefore, I believe that even if the Fed does not stop the balance sheet reduction in October, it is very likely to consider stopping it within 2025, particularly in the December meeting. It is also quite possible that Powell will mention the imminent possibility of stopping the balance sheet reduction during the Q&A session in October.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。