作者:Simon Taylor

编译:深潮TechFlow

本周,我在一家银行董事会上就稳定币进行了主题演讲。虽然他们从这次讲座中收获颇多,但真正让他们惊叹的是,我用一张与稳定币绑定的卡买了一杯咖啡。

所有人都聚精会神。试想一下,如果你可以将余额存储为稳定币,随时随地消费,用于信用借贷,还能赚取收益,那银行的存在还有什么必要?当然,大部分国内银行用户不会立刻接受这种模式。

但,瓶中精灵已经被释放。

那杯价值 3.50 英镑的咖啡,向他们展示了一个银行变得可有可无的未来。

要理解这杯咖啡为何如此重要,你需要看看卡片支付领域如何超越银行,迎来爆炸式的增长。

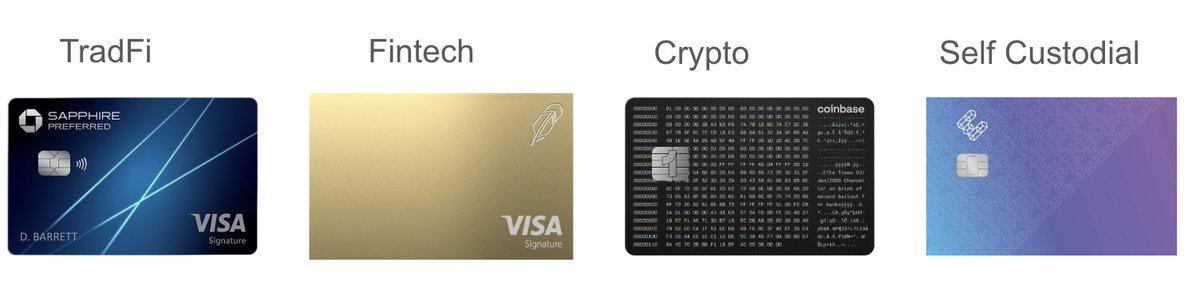

卡片支付领域正在扩展*

以下四个类别中的三个在十年前几乎不存在,而如今它们已成为主要竞争者。

富裕群体正成为重点目标。

一种“稳定币绑定”卡可以由中心化交易所(例如 Coinbase)发行,也可以是“自托管”的形式。

虽然在卡片背后有发行方和项目管理方,但没有银行或中心化机构来管理底层资金。

这种第四类型的卡片具有颠覆性影响。

让我们深入探讨一下。

(如果你想更进一步,理论上没有理由阻止新型银行(Neobank)或传统银行允许用户直接从稳定币余额中消费,但目前还是将这四种产品类别区分开来比较有帮助。)

什么是自托管稳定币绑定卡?

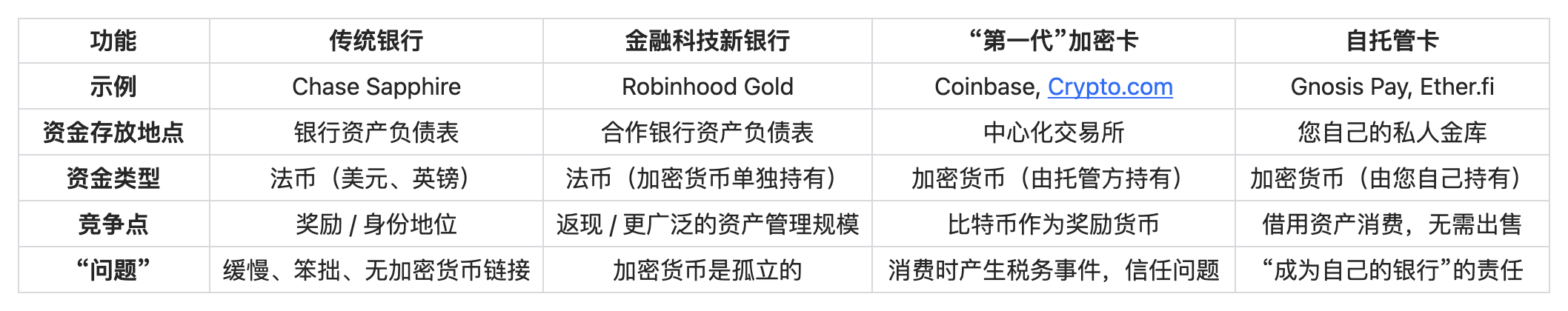

稳定币绑定卡允许你使用稳定币(如 USDC 或 USDT)在任何接受 Visa 或 Mastercard 标准支付网络的商户处消费。请特别关注第 4 步。

-

假设用户持有一张稳定币绑定卡,并在其账户中有稳定币余额。这些稳定币可能是通过薪酬形式支付到用户的钱包(例如 Metamask、Phantom或类似钱包)中。

-

用户像往常一样前往商店消费,可以使用实体或虚拟的借记卡或信用卡。

-

商户的销售点系统(POS)会将卡片视为普通银行卡,并向支付服务提供商(PSP)发送授权请求。

-

卡发行方(例如 Gnosispay、EtherFi)会立即出售用户的稳定币,将其转换为法币,并授权交易。

-

随后,Visa将该授权交易路由至收单行(商户的银行),并标记为已批准交易。

-

收单行将交易信息发送给支付服务提供商(PSP)。

-

PSP接收到授权后,通知商户可以完成交易,用户即可带着商品离开商店(支付完成)。

几天后,结算通过传统法币支付系统完成。

对消费者和商户而言,这种支付方式的体验与使用传统信用卡或借记卡支付几乎没有区别。

稳定币绑定卡的最大亮点在于其完全基于钱包的设计。

作为用户,你通过自己的私钥管理这些稳定币。自托管卡片为整个卡片支付系统创造了一种全新的经济模式——没有中间人,直接掌控资产。

自托管稳定币绑定卡的运作方式

将富裕阶层的支付模式带向大众市场。

想象一下,如果你可以将自己的 Visa 卡直接与家里的一座私人保险箱(只有你拥有钥匙)连接,并且它依然可以在所有结账场景中使用。

你的资金不需要存放在“银行”或“Coinbase”等机构,而是存储在区块链上的智能合约钱包中,由你完全掌控。

运作方式:

-

你将这种高科技“保险箱”(即钱包或金库)加载稳定币,比如 EURe(一种区块链上的欧元稳定币)。

-

当你刷卡购买咖啡时,像 Ether Fi这样的金库会即时搭建一座桥梁,将你的个人钱包与 Visa 网络连接起来。 它以普通欧元(法币)支付商户,同时从你的保险箱中扣除等值的 EURe。

-

目前有许多类似的例子,比如 Etherfi、GnosisPay、Thorchain、Pyra等,它们在定价、区块链偏好和服务优势方面各有不同。但 Etherfi 是一个非常适合用来解释的案例。

以金库为保障的卡片

Ether.fi 的“借贷与消费”模式

你将稳定币以及其他加密资产存放在 Ether.fi 的金库中,作为回报,它为你提供约 10% 的收益,同时允许你以 4% 的利率借款。

这张卡片的设计非常巧妙,提供两种支付模式:

-

直接支付模式(Direct Pay Mode):你直接使用稳定币(例如 USDC)余额进行消费,简单直接。

-

借贷模式(Borrow Mode):这是关键所在。你可以将整个资产组合(比如 weETH、eBTC 等)作为抵押,借用法币(年利率 4%)进行消费。

-

你无需出售底层资产,因此不会触发税务事件。

-

同时,你还能继续获得资产的质押或重质押奖励。

-

金库是一个用于锁定抵押资产的地方(类似银行保险箱),并且通过将资产借给 Morpho、Aave 或 Centrifuge 等协议来赚取收益。那 10% 的收益正是来自于其他人借用你的资金并支付利息。

为什么这些卡片意义重大?

Ether.fi 本质上是一款伪装成信用卡的财富管理工具,专为 DeFi 原住民设计。但为什么不能让所有人都享受这样的工具呢?

事实上,大多数人并没有如此高的风险偏好,不愿意将全部资产停放在 DeFi 协议中以获取 10% 的年化收益。不过,这个想法确实很有趣——如果抵押型信用卡结合收益与借贷机制成为主流应用,会不会成为一个杀手级应用?

潜在问题

"成为自己的银行"问题:“自托管”是一把双刃剑。如果你丢失了密码(即“私钥”),就没有客服热线可拨打,也没有“忘记密码”链接可以点击。你的资金将永远丢失。这对普通用户来说是一个令人恐惧的前景。

复杂性与费用:尽管操作正在变得更简单,但使用稳定币绑定卡仍需与区块链交互。这可能涉及“Gas 费用”(网络交易费用),对于习惯于免费借记卡的用户来说,这种费用显得陌生且不易接受。

抵押资产的波动性:如果你的加密资产组合价值大幅下跌会发生什么?协议会自动出售资产以偿还贷款。这种情况可能会让人非常痛苦。

资本风险:并非所有客户都愿意承担将 10% 或更多净资产投入加密货币的风险,尤其是在这种模式真正带来显著收益的情况下。

收益可能无法持久:当前的 10% APY 是基于加密市场现状的收益,但如果市场低迷,这些收益可能会大幅减少。

如今,稳定币已经被普遍认为适合于全球南方市场,在那里高通胀问题十分严重。然而,我接触的大多数人都低估了这种模式在国内大众富裕群体中的潜在采用可能性。

对于全球南方的消费者来说,稳定币绑定卡代表着自由。

如果你没有常规的信用卡或借记卡,这意味着无法使用 ChatGPT、AWS 或 Netflix。对于 G20 以外的消费者和成长型企业而言,稳定币绑定卡是一项巨大的突破。

稳定币绑定卡:高净值生活方式的普及化尝试

富人很少出售资产,他们选择以资产为抵押进行借贷。这不仅避免了税务问题,通常资产的增值还会超过债务融资的成本。而稳定币绑定卡正在将这种高净值的财富管理方式带入大众市场。

对加密富豪来说,这是一种银行替代方案。

对于加密富豪而言,这张卡片就像是自我主权版的 Amex Black Card(美国运通黑卡)。它是一种资本高效的工具,宣告着“我可以随时随地以自己的方式访问我的财富,无需向银行申请。”

“鱼与熊掌兼得”的终极产品:通过这张卡,你可以在 DeFi 中获得 8% 的资产收益,同时还能在超市用它进行消费。它将你的自托管钱包变成了一个高收益的支票账户。

是否应该放弃新兴银行,转而构建稳定币绑定卡?

别急。

这些产品仍面临一些系统性挑战:

目前,大多数企业和消费者的生活仍然处于链下,全面转向链上的复杂性和风险不容忽视。

-

用户体验的瓶颈:从“加密原生”(管理 Gas 费用、钱包权限)到“简单消费”(直接点击支付)的桥梁仍然像是摇摇欲坠的绳桥。要真正启动这些产品(Pyra 是个例外),用户需要付出极大的努力。你需要稳定币,但将余额转移到正确链上的钱包中却令人沮丧。

-

专属牛市的卡片:这些卡片在牛市中表现优异,尤其是在美国监管环境支持加密货币的时候。但不要忘记 Celsius 的教训:它曾提供令人难以置信的奖励,但在市场崩溃时破产了。这些奖励消失了,用户的大量储蓄也随之蒸发。在 DeFi 中,没有破产法院,当这种情况发生时,你只能被清算。

-

责任缺口:如果这些产品广泛流行并开始破产或清算主流消费者,会发生什么?这将成为一个需要解决的重大问题。

当前大多数自托管卡片都面临冷启动难题:你需要为底层 DeFi 协议和金库提供资金。此外,你还需要下载新的应用程序、创建新的钱包并完成新的 KYC(身份验证)流程。

我认为以下两件事可能会发生:

-

这些卡片及其底层协议将融入金融科技行业。

-

“链上/链下转换”将变得无形化,用户无需感知复杂的操作流程。

并非所有人都准备好完全进入链上世界。

金融科技前台,加密链上后台

我们之前关于稳定币背书的信用卡如何工作的图中“转换为法定货币”这一步骤只是一个时间节点。未来十年,将会有越来越多的资产迁移到链上。

这种趋势有以下几种表现形式:

-

链上收益和借贷功能将通过金库(Vaults)集成到金融科技应用和钱包中。

-

原生链上钱包将成为未来最大的金融科技公司。

-

稳定币的链上/链下转换将在大多数应用中变得无形化,用户无需感知复杂的操作。

-

即时结算将成为稳定币的杀手级应用。

金库是链上借贷融入金融科技的关键工具。

例如,Morpho 金库产品就是一个典型案例。Morpho 是一个链上去中心化借贷协议,其“金库”产品简化了链上的收益管理。用户可以将资金(如 USDC)存入金库,金库会自动管理借贷,为用户提供最佳的风险调整收益。

Coinbase 现在为普通用户提供比特币抵押贷款服务。但当用户点击“借款”按钮时,Coinbase 并不是直接借给用户自己的资金。实际上,Coinbase 在后台将用户的比特币发送到链上的 Morpho 协议作为抵押,并代表用户从协议中获得 USDC 贷款。用户完全不需要接触到“Morpho”、Gas 费用或加密钱包,他们只需在熟悉的 Coinbase 应用中看到一个简单的“借款”按钮。

(插一句,我认为这些金库比传统的点对点借贷意义更重大,因为它们效率更高、初始收益更高且分发更容易。从某种意义上说,它们是嵌入式金融的极致体现。)

如果我们今天选择金融科技创业,你会在哪里布局,链上还是法币轨道?

在现有的监管环境下,很难找到理由去选择链下技术作为金融科技公司的基础。一个经典案例是 Sling Money,这家由前 Neobank Monzo 首席产品官创立的公司,本可以选择任何技术,但为了打造全球版的 Venmo,他们最终选择了更适合跨境支付的链上解决方案。

创始人 Mike 曾解释过原因:

-

链上支付如今已经足够快,可以满足日常使用需求。

-

它可以外包约 70% 的账本构建和对账复杂性。

对于曾参与过金融服务产品开发的人来说,对账工作至少占了开发任务的一半。这是一项困难且充满边界案例的工作。而链上支付虽然在某些方面可能还不够完美,但它让产品更快、更便宜地推向市场。

随着应用逐渐将链上金融嵌入其中,“链上与链下转换”的费用和障碍正在迅速减少。

目前,从 USD 稳定币到法币 USD 的转换,在消费者平台上可能需要支付高达 2% 的费用。这种效率低下的问题与稳定币的“节约成本”初衷背道而驰,但这一情况正在快速改变。

例如,Revolut 最近宣布了稳定币与法币 USD 的直接 1:1 转换,而且没有任何价差。同时,他们还推出了零手续费的质押服务,收益高达 22%。值得注意的是,Revolut 是一家拥有 6500 万用户的金融科技应用。

未来,我们将看到“即时结算”成为稳定币的杀手级应用。现有的通过稳定币快速转换为法币以完成结算的模式将逐渐消失,因为越来越多的商户和银行开始直接接受稳定币支付。稳定币将转化为可与央行结算的代币化存款。

当卡片网络、收单行和卡片发行机构开始更频繁地采用这种模式时,从“刷卡”到商户收到付款的时间差将压缩至零。目前,企业通过收取商户 1%-2% 的费用来伪造这种时间差以实现提前支付,但这种模式也将逐渐消失。

稳定币时代已来

当 Revolut 向其 6500 万用户推出零手续费的稳定币服务时,24/7 全天候可用的即时美元支付承诺开始成为现实。

类似 Ether Fi 或 Pyra 的卡片已经展现了未来发展的初步迹象。

当金库概念融入每个金融科技应用后,非银行机构可以为客户提供以下服务:

-

从去中心化金融(DeFi)市场借款,年化收益率(APY)从 4% 到 22%(取决于借款期限)。

-

向 DeFi 市场出借资金,赚取 7%-12% 的收益。

这些金融科技公司通过赚取利差和利润实现盈利,但它们并未从事资产负债表上的借贷。这是一种链上分布式的私人信贷模式,同时也是金融行业的新收入模型。

虽然这种模式不会完全取代基于资产负债表的信用卡借贷,但它为私人信贷提供了一个吸引人的平台,尤其适用于“先买后付”(BNPL)模式的金融科技公司或任何希望在不增加资产负债表风险的情况下驱动收入增长的银行。

金库的概念不仅限于卡片,它可以应用于任何形式的借贷。但一旦你见证了这些卡片的实际运作,便很难忽视它们的潜力。

如果你的职责是寻找新的收入增长方式并更好地服务客户,你绝对应该关注这些卡片的演变,以及它们如何帮助你满足客户需求。

那杯我请银行董事会喝的咖啡?我认为他们看到了自己的未来,而且他们心知肚明。

ST的注解:

-

Georges Lemaître 的“大爆炸理论”也延伸到了卡片领域。

-

Centrifuge、Veda 和 Aave 等竞争对手正在开发类似产品。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。