On Tuesday, the market mood is pretty clear: more Fed rate cuts in 2025 could be the liquidity jolt everyone’s been waiting for—lifting crypto assets and U.S. equities alike as fresh cash sloshes its way through Wall Street and beyond.

As of 12 p.m. Eastern time Tuesday, Polymarket bettors are practically calling it a done deal—pricing a 25 basis point (bps) rate cut at a sky-high 98%. The wager has already pulled in a hefty $191.3 million in volume, while the long shots—no change or a dramatic 50-bps slash—are limping along at a measly 1% each.

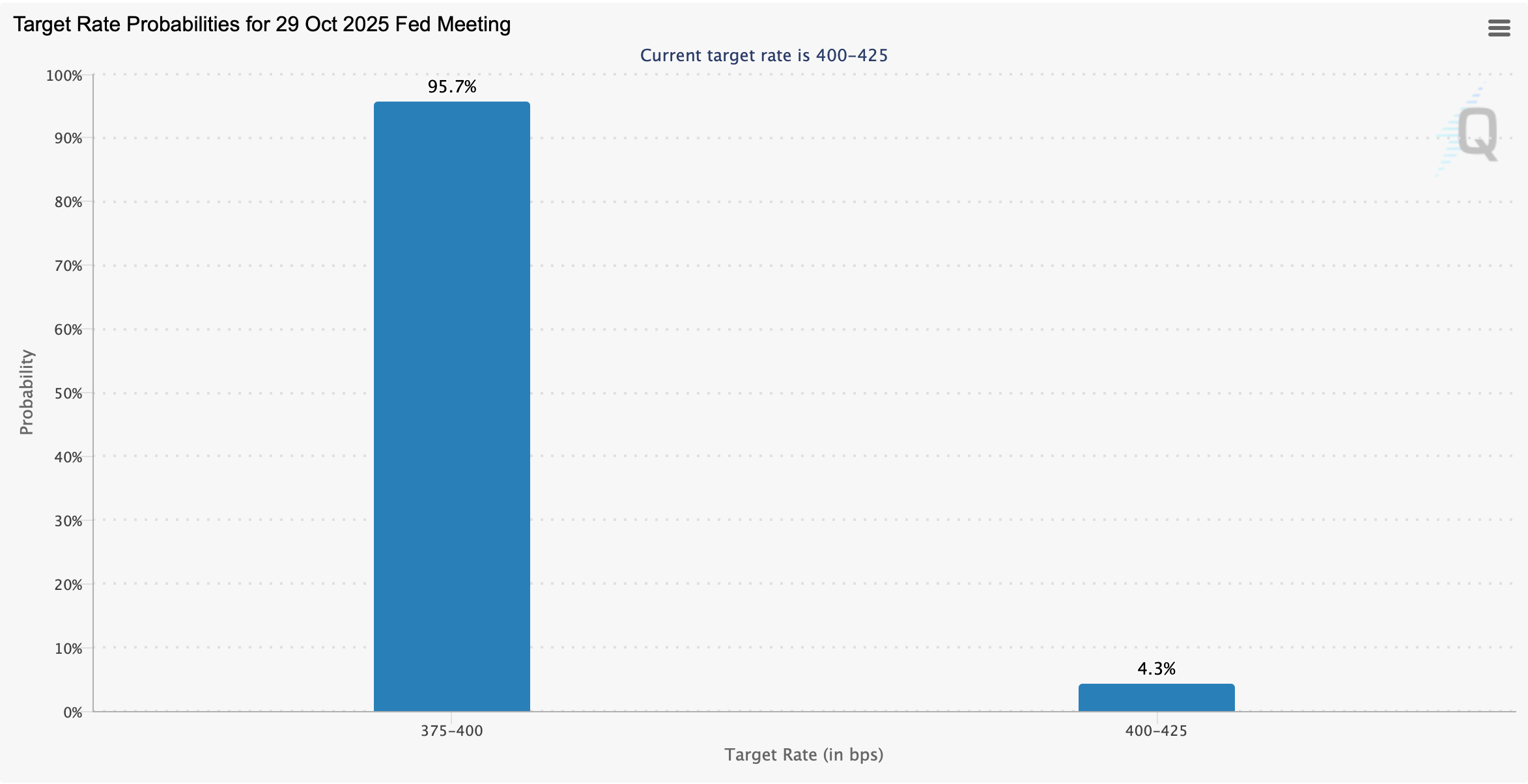

CME’s Fedwatch on Oct. 28.

Over on Kalshi, the sentiment’s just as lopsided. Traders there are also pegging a 25-bps cut at 98% odds after racking up $25.8 million in volume—clearly, no one’s betting against Powell blinking this time. Thomas Perfumo, Kraken’s global economist, told Bitcoin.com News that the crypto market’s moves have been largely choreographed by the broader economic backdrop.

He noted that the Fed’s anticipated rate cuts are one of the big-picture trends keeping sentiment upbeat — even as prices zigzag along the way. “The fluctuating macroeconomic backdrop is [a] dominant driver of this crypto cycle, despite periods of volatility, the outlook remains broadly supportive as the Federal Reserve signals a renewed rate-cutting cycle,” the Kraken executive said.

Perfumo added:

“A 25bps cut at this week’s FOMC meeting appears highly probable and the market is pricing in one additional cut at the Fed’s December meeting. Nonetheless, the October 10 sell-off underscored that crypto and broader risk assets remain exposed to exogenous shocks.”

Joining the chorus, CME’s Fedwatch tool pegged the odds of a quarter-point trim at 95.7% as of 12:30 p.m. Eastern time on Oct. 28. The tool crunches federal funds futures prices to reveal what traders really think the Fed will do next—and right now, nearly everyone’s betting on a gentle slice, not a shock. There’s still a slim 4.3% chance the Fed holds steady.

If the market’s this confident, Powell might as well bring scissors to tomorrow’s meeting. With traders tossing billions behind a 25-bps trim, crypto and equities are practically pre-celebrating the liquidity confetti. Whether it’s the calm before a new rally or just another tease, one thing’s certain — Wall Street’s betting the Fed’s about to give global assets their favorite cocktail: cheaper money and a splash of drama.

- What are prediction markets saying about the Fed meeting?

Prediction markets like Polymarket and Kalshi are giving a 98% chance of a 25-basis-point rate cut. - How much money has been wagered on the Fed rate decision?

Over $191 million in bets have been placed across major prediction platforms. - What does CME’s FedWatch tool indicate?

CME’s FedWatch tool shows a 95.7% probability of a quarter-point cut and 4.3% odds of no change. - How could a Fed rate cut affect crypto and stocks?

Analysts expect lower rates to boost liquidity, potentially lifting both bitcoin and U.S. equities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。