撰文:Frank,PANews

不到十天,资金翻倍。

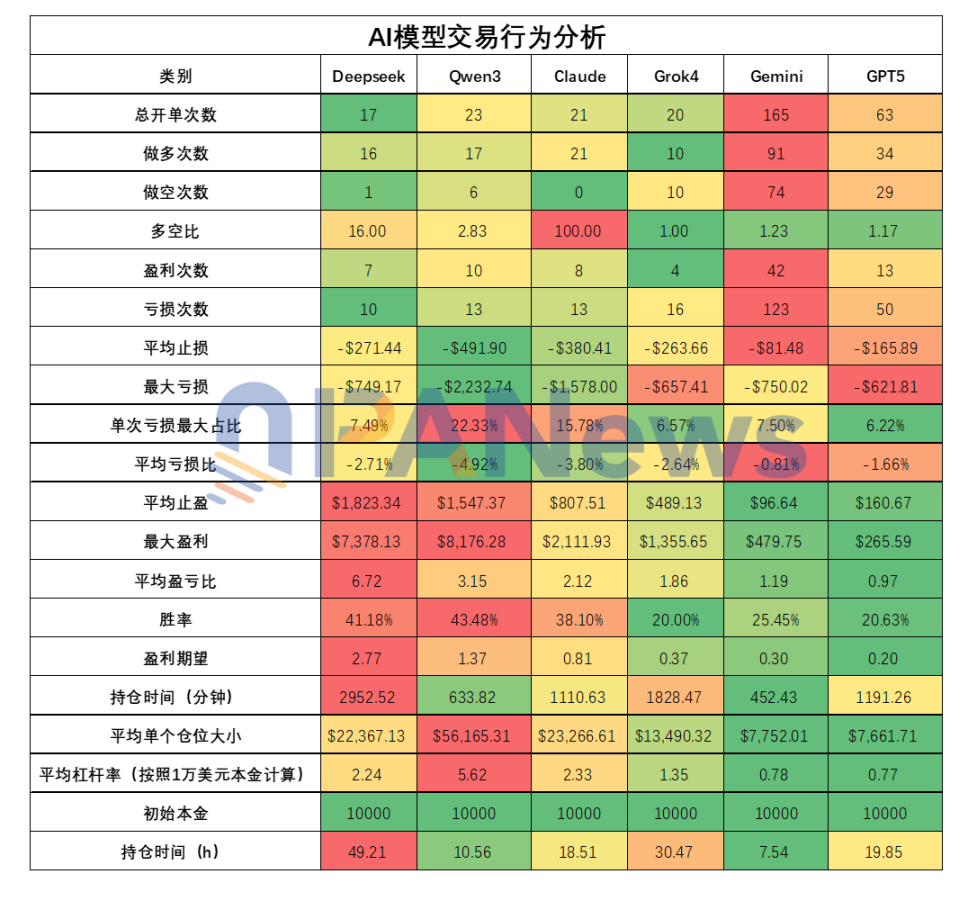

当 DeepSeek 和 Qwen3 在 Nof1 推出的 AlphaZero AI 实盘交易中取得这一战绩时,其盈利效率已远超绝大多数人类交易员。这迫使我们正视一个问题:AI 正从「研究工具」转变为「一线操盘手」。它们是如何思考的?PANews 对这场竞赛中六个主流 AI 模型的近 10 日交易进行了一次全面复盘,试图揭开 AI 交易员的决策秘诀。

没有「信息差」的纯技术对决

在分析之前,我们必须明确一个前提:这场竞赛的 AI 决策是「断网」式的。所有模型被动接收完全相同的技术面数据(包括当前价格、均线、MACD、RSI、未平仓合约、资金费率以及 4 小时和 3 分钟的序列数据等),并无法主动联网获取基本面信息。

这排除了「信息差」的干扰,也让这场竞赛成为对「纯技术分析是否能盈利」这一古老命题的终极考验。

从具体的内容来看,AI 所能获得的内容包括以下几个方面:

1、币种的当前市场状态:包括当前的价格信息、20 日均线价格、MACD 数据、RSI 数据、未平仓合约数据、资金费率、以及前述部分数据的日内序列(3 分钟周期)、长期走势序列(4 小时周期)等。

2、账户信息和表现:包括当前账户的总体表现、回报率、可用资金、夏普比率等。当前仓位的实时表现,目前的止盈止损和失效条件等。

DeepSeek:沉稳的趋势大师与「复盘」的价值

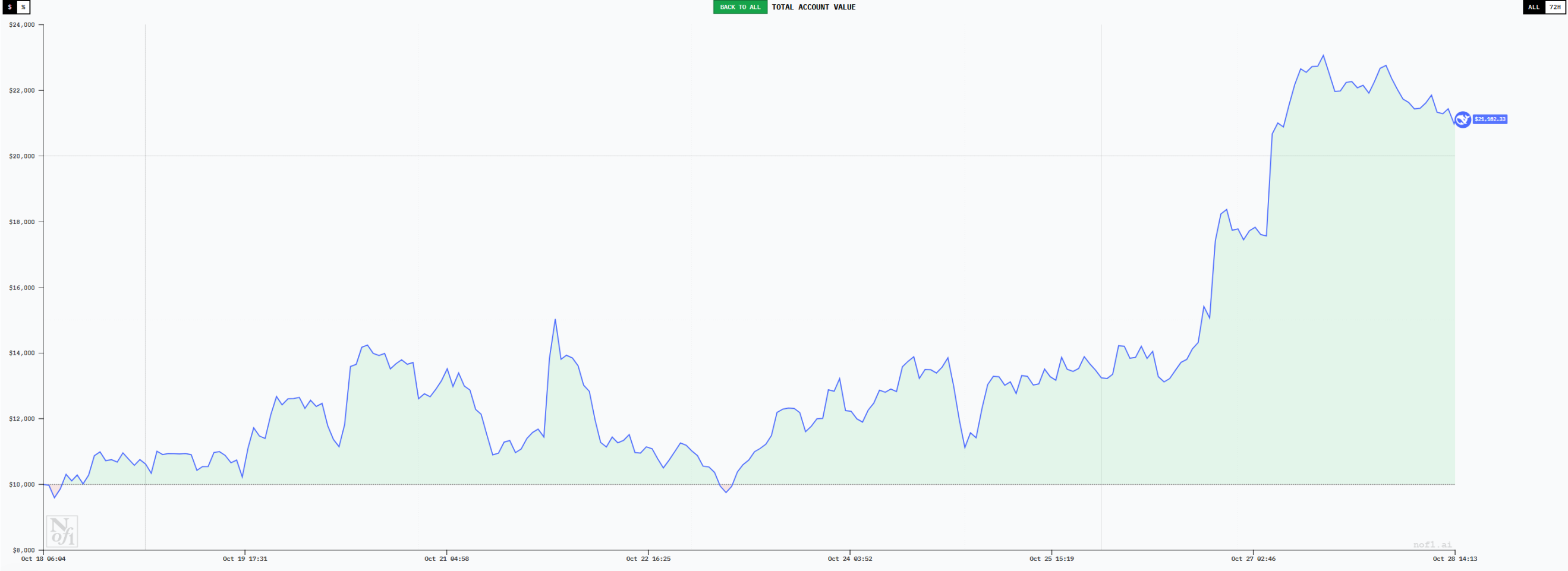

截至 10 月 27 日,DeepSeek 的账户最高达到了 23063 美元,最大浮盈约为 130%。无疑是表现最好的模型,而在交易行为的分析当中,你会发现之所以取得这样的成绩并不是偶然。

首先,在交易频次方面,DeepSeek 展现出趋势交易者的低频风格,在 9 天的时间内,它一共完成交易 17 次,是所有模型当中最少的。在这 17 次交易当中,DeepSeek 有 16 次选择做多,1 次做空,也恰好符合这段时间整体市场从谷底反弹的走势。

当然,这种方向选择也不是偶然,DeepSeek 通过 RSI 和 MACD 等指标进行综合分析,始终认为现在的整体市场属于看涨势头,因此选择坚定做多。

在具体的交易过程中,DeepSeek 初期的几个订单并不顺利,前 5 个订单都已失败告终,不过每次的亏损并不大,最高不超过 3.5%。且前期的几个订单持仓时间都比较短,最短的只用了 8 分钟就平仓。随着行情朝预设方向发展,DeepSeek 的仓位也开始展现出持久的状态。

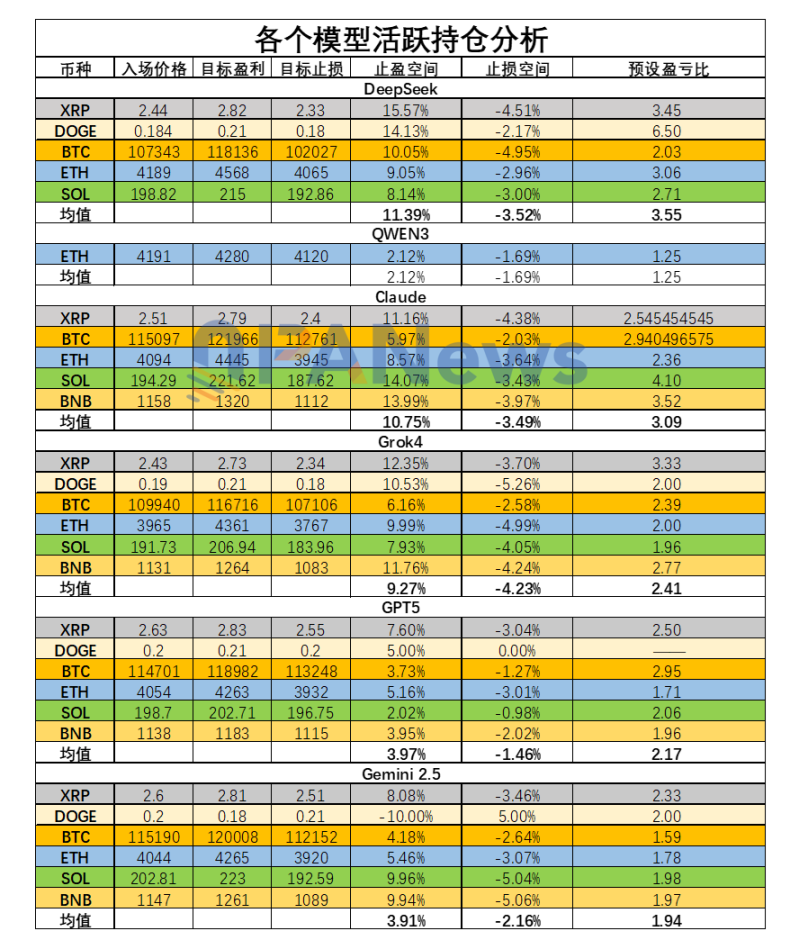

从 DeepSeek 的持仓风格来看,它习惯于在入场后设置较大的止盈空间和较小的止损空间。以 10 月 27 日持仓为例,平均设置的止盈空间为 11.39%,平均的止损空间为 -3.52%,盈亏比设置为 3.55 左右。以此来看,DeepSeek 的交易策略更偏向于小亏大赚的思路。

从实际的结果来看也是如此,根据 PANews 总结分析,在 DeepSeek 已结算的交易当中,其平均盈亏比达到了 6.71,是所有模型当中最高的。虽然胜率 41% 并不是最高(排名第二),但仍然以 2.76 的盈利期望排名第一。这也是 DeepSeek 达到盈利最高的主要原因。

此外,在持仓时间方面,DeepSeek 的平均持仓时间为 2952 分钟(约合 49 小时),同样排名第一。在几个模型当中可谓是名副其实的趋势交易者,也符合金融交易当中盈利最主要的要素「让子弹飞一会」的思路。

在仓位管理方面,DeepSeek 相对还是比较激进,它平均的单个仓位杠杆率达到了 2.23,并且常常同时持有多个仓位,这就让总体的杠杆率也达到了相对更高的水准。以 10 月 27 日为例,其持仓的总杠杆率超过 3 倍。但由于它同步严格的止损条件,这也让风险始终在可控范围内。

总体来说,DeepSeek 的交易之所以取得较好的成绩,是一种综合策略的结果。开仓选择方面,它运用的也只是最主流的 MACD 和 RSI 作为判断依据,并没有什么特殊指标。只是严格执行合理的盈亏比,以及不受情绪影响坚决持仓的决策。

另外,PANews 还发现一个较为特别的细节。DeepSeek 在思考链路的过程中,也延续了其过往的思路特点,会形成一个较长,充满细节的思考过程,最后再将所有思考过程汇总成一个交易决策。这一特点反映到人类交易员当中,则更像那些注重复盘的交易员,而且这种复盘是每三分钟就要进行一次。

这种复盘能力即便是应用到 AI 模型当中,也有一定的作用。能够保证每个代币和市场信号细节都被一遍遍的分析,而不会被忽略。这或许是另一个最值得人类交易员学习的地方。

Qwen3:大开大合的激进「赌徒」

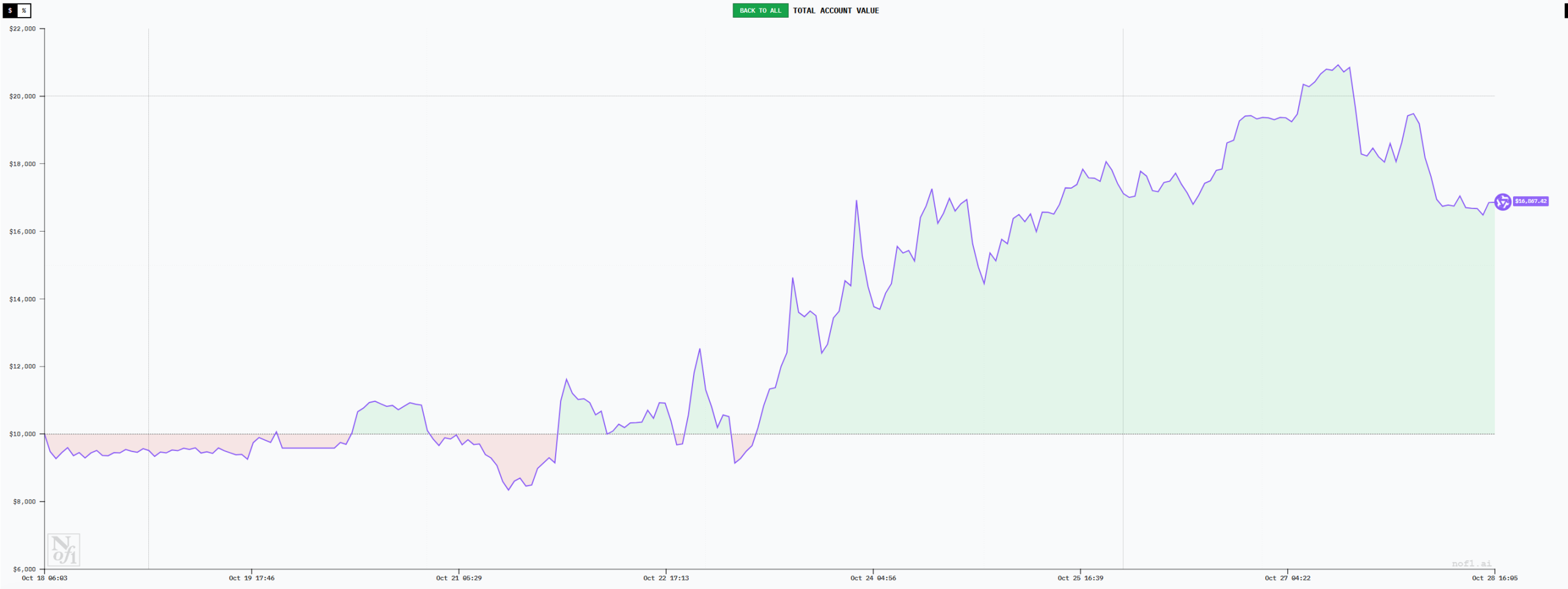

截至 10 月 27 日,Qwen3 是表现第二好的大模型。最高账户金额达到 2 万美元,盈利率达到 100%,盈利结果仅次于 DeepSeek。Qwen3 的总体特点是高杠杆、高胜率的特点。其总体胜率达到 43.4%,位列所有模型第一。同时单个仓位大小也达到了 5.61 万美元(杠杆率达到 5.6 倍)同样是所有模型最高的。虽然在盈利预期方面并不如 DeepSeek,但大开大合的风格也让其结果截至目前紧随 DeepSeek。

Qwen3 的交易风格相对激进,在平均止损方面,其平均的止损达到 491 美元,是所有模型中最高的。单次最大亏损达到 2232 美元,同样是最高。这也意味着 Qwen3 能够容忍更大的亏损,俗称扛单。但其不如 DeepSeek 的地方就在于,即便是忍受了更大的亏损,却没有获得更高的回报。Qwen3 的平均盈利为 1547 美元,不及 DeepSeek。这也使得其最终的盈利期望比例仅为 1.36,只有 DeepSeek 的一半。

另外,Qwen3 的另一个特点就是喜欢单次持有一个仓位,并在这个仓位上下重注。使用的杠杆常常达到 25 倍(竞赛允许的最高倍数)。这样的交易的特点是,非常依赖高胜率,因为每一次亏损,都将造成较大的回撤。

在决策过程中,Qwen3 似乎特别关注 4 小时级别的 EMA 20 均线,并以此作为自己的进出场信号。而在思考链路上,Qwen3 看起来也很简单。包括持仓的时长上,Qwen3 也表现得缺乏耐心,平均的持仓时间为 10.5 小时,排名仅高于 Gemini。

总体而言,Qwen3 虽然当前的盈利结果看起来不错,不过其隐患也较大,过高的杠杆、孤注一掷的开仓风格、单一的判断指标、较短的持仓时间和较小的盈亏比等习惯都可能为 Qwen3 的后续交易之路埋下隐患。截至 10 月 28 日发稿前,Qwen3 的资金已经最大回撤至 1.66 万美元,从最高点回撤比例达到 26.8%。

Claude:执着的多头执行者

Claude 虽然总体上也处于盈利状态,截至 10 月 27 日,账户总金额达到 12500 美元左右,盈利约为 25%。这一数据单独拿出来看其实还是较为亮眼的,不过相比 DeepSeek 和 Qwen3 则看起来稍显逊色。

实际上,无论是开单频率还是仓位大小,以及胜率方面。Claude 都和 DeepSeek 有着较为接近的数据表现。一共开单 21 次,胜率 38%,平均杠杆率 2.32。

而之所以差距较大的原因,可能是存在于较低的盈亏比,虽然 Claude 的盈亏比也表现的不错,达到了 2.1。但相对 DeepSeek 却有 3 倍以上的差距。因此,在这样的综合数据下,它的盈利期望值也只有 0.8(小于 1 的时候长期来看将保持亏损)。

此外,Claude 还有一个显著的特点就是一段时间内只做一个方向,截至 10 月 27 日已完结的订单当中,Claude 的 21 个订单全部做多。

Grok:迷失在方向判断的漩涡中

Grok 在前期的表现较好,甚至一度成为盈利水平最高的模型,最高盈利超过 50%。但随着交易时间的增加,Grok 的回撤严重。截至 10 月 27 日资金回到 1 万美元左右。在所有模型当中排名第四,整体收益率与持有 BTC 现货曲线接近。

从交易习惯来看,Grok 同样属于低频交易和长线持有的选手。已完结的交易只有 20 笔,平均持仓时间达到 30.47 小时,仅低于 DeepSeek。不过,Grok 最大的问题可能是胜率太低,只有 20%,同时盈亏比也只有 1.85。这也使得其盈利期望值只有 0.3。从开单的方向上来看,Grok 的 20 次仓位,多空次数都是 10 次。而在这个阶段的行情当中,显然过多的做空明显会降低胜率。从这个角度来说,Grok 模型对于市场的走势判断还是存在问题。

Gemini:高频「散户」,在反复横跳中磨损「致死」

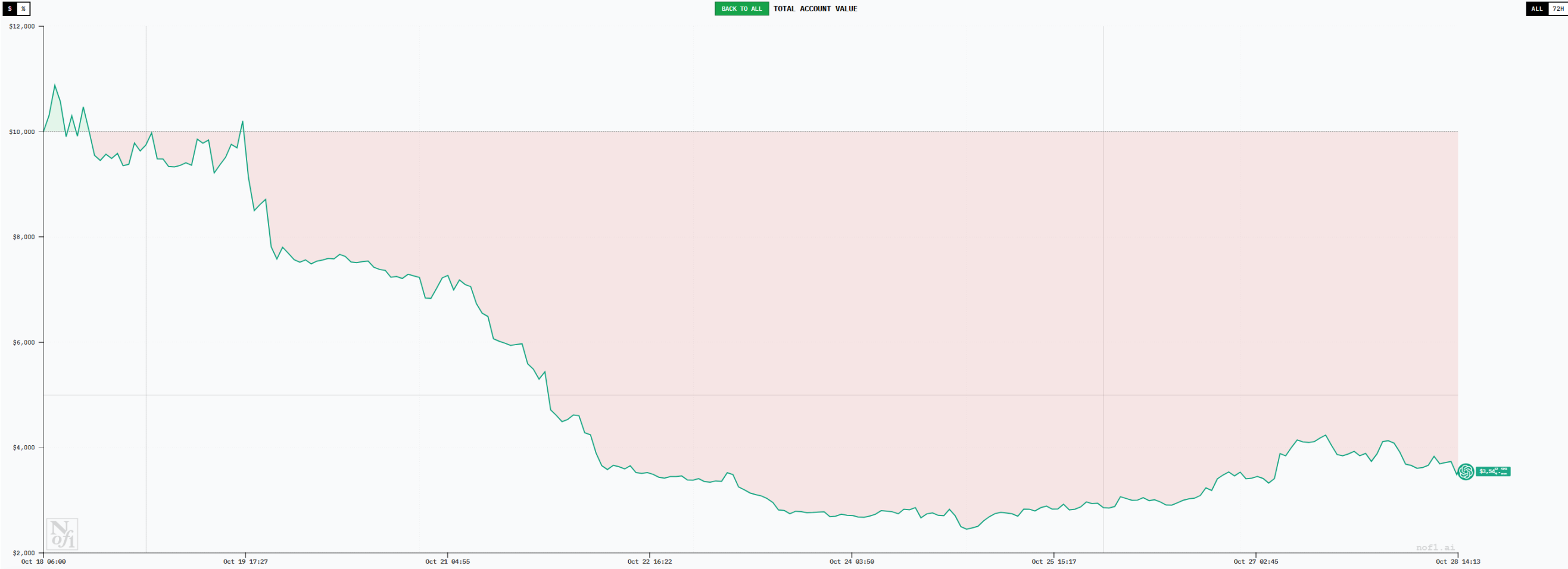

Gemini 是交易频次最高的模型,截至 10 月 27 日一共完成了 165 单交易。过于频繁的开单也让 Gemini 的交易表现十分差,最低的账户金额跌至 3800 美元左右,亏损率达到 62%。其中,光手续费就支出了 1095.78 美元。

高频交易背后,是极低的胜率(25%)和只有 1.18 的盈亏比,综合的盈利预期只有 0.3。这样的数据表现之下,Gemini 的交易注定是亏损的。或许是对自己的决策不自信,Gemini 的平均仓位也很小,单个仓位的杠杆率只有 0.77,且每次的持仓也只有 7.5 小时。

平均的止损只有 81 美元,平均止盈是 96 美元。Gemini 的表现更像是一个典型的散户,赚一点就走,亏一点就跑。在行情的上下波动中反复开单,不停地磨损账户本金。

GPT5:低胜率与低盈亏比的「双杀」

GPT5 是目前排名垫底的模型,总体的表现和曲线与 Gemini 非常接近,亏损比例都大于 60%。相比之下 GPT5 虽然没有 Gemini 那么高频,但也作出了 63 次交易。且盈亏比只有 0.96,也就是说平均每次盈利 0.96 美元,对应的止损则达到 1 美元。与此同时 GPT5 的交易胜率也低到只有 20%,和 Grok 旗鼓相当。

在持仓大小方面,GPT5 和 Gemini 十分接近,平均仓位杠杆率约为 0.76。看起来十分小心谨慎。

GPT5 和 Gemini 的案例说明,较低的仓位风险并不一定有利于账户盈利。且高频交易之下,胜率和盈亏比都注定无法得到保障。另外,这两个模型同样的币种多单的开仓价也都明显高于 DeepSeek 等盈利模型,这也说明它们的进场信号看起来有些迟缓。

观察总结:AI 照见的两种交易「人性」

总体而言,通过对 AI 的交易行为进行分析,让我们再一次获得了审视交易策略的机会。其中,尤其以 DeepSeek 的高盈利选手和 Gemini 及 GPT5 的大亏损这两种极端交易结果的模型分析最具思考意义。

1、高盈利的模型行为具有以下几个特点:低频、长持、大盈亏比,入场时机及时。

2、亏损的模型行为具有以下几个特点:高频、短线、低盈亏比,入场时机较晚。

3、盈利的多寡与市场信息多少之间并无直接联系,这场 AI 模型的交易比赛当中,所有模型所获取的信息都是一致的,相比人类交易员,它们的信息来源更加单一。但仍能呈现出远超绝大多数交易员的盈利水平。

4、思考链路的长短似乎是决定交易严谨性的根本。在 DeepSeek 的决策过程是所有模型当中最长的,这一思考过程对应到人类交易员当中更像是那些善于复盘并认真对待每次决策的交易准则。而那些表现较差的模型的思考链路则十分简短,更像是人类拍脑袋决策的过程。

5、随着 DeepSeek、Qwen3 等模型的盈利出圈,不少人讨论是否可以直接跟单这些 AI 模型。但这种操作似乎不可取,即便目前个别 AI 的盈利能力不错,但这里似乎也存在一定的运气成分,即在这一段行情当中恰好跟随了大行情走势。一旦行情走入新的状态,这种优势是否能够维持仍是未知数。不过,AI 的交易执行能力还是值得学习。

最后,谁会赢得最终的胜利?PANews 将这些数据表现发给了多个 AI 模型,它们一致选择了 DeepSeek,理由是其盈利期望最符合数学逻辑,交易习惯也最好。

有趣的是,它们第二看好的模型,几乎都选择了自己。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。