Metaplanet 新闻:5亿美元回购和信贷设施解析

在最新的 Metaplanet 新闻 中,这家日本投资巨头在其比特币投资策略上采取了大胆的举措。该公司,通常被称为亚洲的 MicroStrategy,已公布一项价值 5 亿美元的股票回购计划,作为其以比特币为中心的储备策略的一部分。

为了促进这一计划,该公司还建立了一项 5 亿美元的信贷设施,强调其改善效率和增加 BTC 收益的承诺。

Metaplanet 新闻:回购和信贷交易

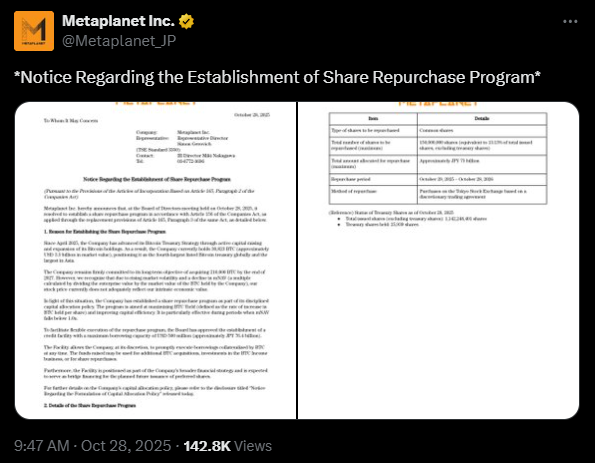

亚洲最大的比特币持有者再次巩固了其在加密领域的地位,确保其对加密资产积累策略的承诺。在最近的一条 X 帖子 中,Metaplanet 宣布了公司新的资本配置和股票回购计划。

这则 Metaplanet 新闻聚焦于资产管理公司的比特币资本策略。据报道,董事会已批准一项价值 754 亿日元(约合 5 亿美元)的规模庞大的股票回购计划。该计划使公司能够在未来一年内回购多达 1.5 亿股,约占其流通股的 13.1%,以提高资源效率并增加其“BTC 收益”。

作为该计划的一部分,资产管理公司获得了一项 5 亿美元的信贷设施,该设施将以公司的比特币储备作为担保进行提款,以资助回购。这项信贷设施为公司提供了灵活性,以支持其比特币收购策略,并帮助其实现到 2027 年累计 210,000 BTC(占总供应量的 1%)的雄心勃勃的目标。

股票价格飙升

受最新 Metaplanet 新闻的推动,股票价格上涨了 2.25%,达到了 499 日元。尽管过去一个月下跌了 4.5%,但在过去五天内,股票上涨了显著的 16.5%。

为何采取这一战略举措?

值得注意的是,股票回购计划旨在当 Metaplanet 的市场价值低于其净资产价值时提升股东价值。当公司的企业价值低于其 比特币持有量 的市场价值的 1.0 倍时,该策略便会生效。凭借类似的资金,这家投资巨头已收购了 30,823 BTC,价值约 35 亿美元,成为全球第四大公共比特币国库,并且是亚洲最大的。

新创建的资本配置政策建立了一个框架,用于将资本分配用于融资和投资,以及回馈股东。根据资本配置政策采取的行动将专注于最大化比特币的收益和公司在根据市场条件灵活分配资源时保持长期价值,从而实现稳定和增长。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。