根据Coinglass期货数据,以太坊期货的未平仓合约总额为462.7亿美元,标志着各交易所之间的显著扩张。

CME在以太坊期货市场中领先,未平仓合约为104.7亿美元(市场份额22.6%),其次是Binance的84亿美元、Bybit的35亿美元和OKX的25亿美元。Gate和Bitget的期货活动在24小时内各增加了超过3%,显示出重新燃起的投机动能。

虽然美国CME的未平仓合约反映了机构的信心,但Binance和OKX的永续合约显示出强烈的零售参与。尽管小时间略有收缩(-0.10%),但市场的24小时变化仍保持在正值,增幅为+0.17%,总未平仓合约代表着1174万ETH。

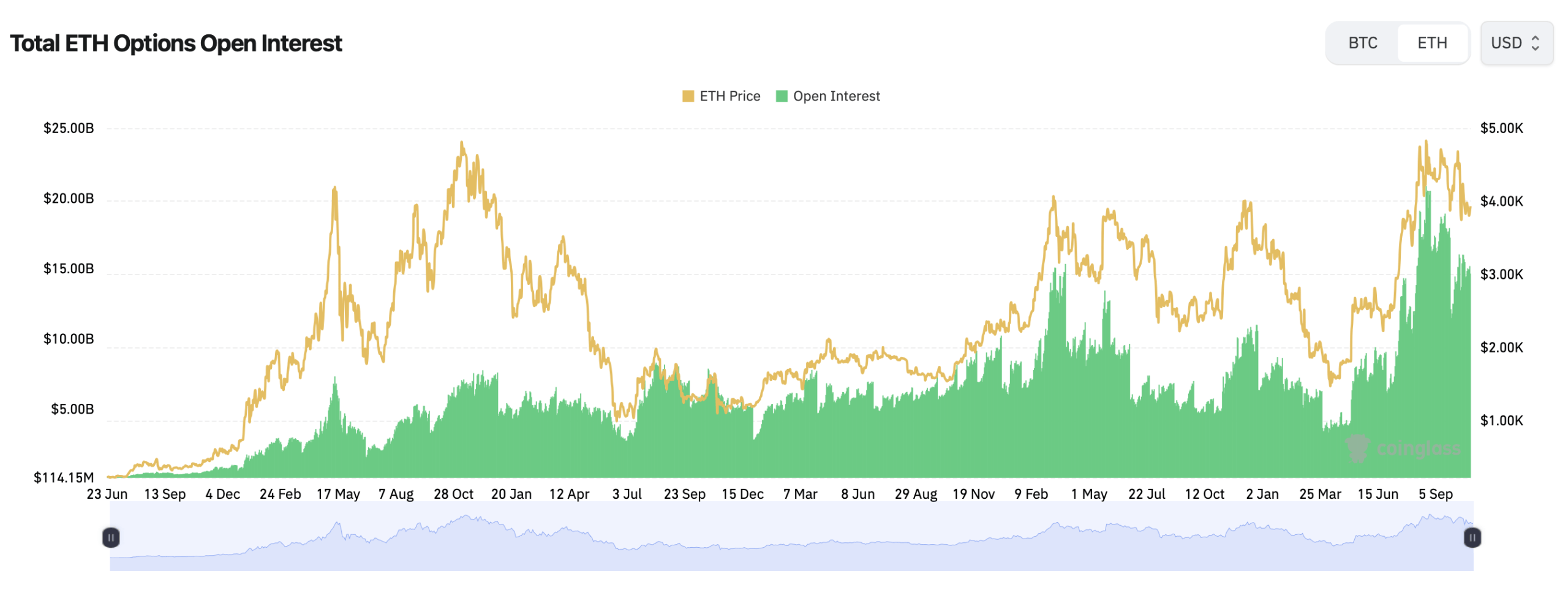

根据Coinglass指标,2025年10月25日的以太坊期权未平仓合约。

在期权领域,以太坊交易者正在展现出看涨的力量。ETH期权的未平仓合约在145亿美元到超过150亿美元之间,63.7%的合约为看涨期权,相比之下看跌期权占36.3%。过去24小时的交易量也类似,60%的交易为看涨期权,总计87153 ETH,而看跌期权为58062 ETH。

Deribit主导着以太坊期权市场,拥有6000美元、5000美元和7000美元行权价的最大未平仓合约,这些合约将于2025年12月26日到期。值得注意的是,最活跃的短期合约集中在4200美元到4250美元的行权价范围,反映出交易者对以太坊在短期内保持在3900美元以上的信心。

以太坊的最大痛点——大多数期权到期时变得毫无价值——目前位于3900美元,与过去一周以太坊的七天现货范围3749美元到4080美元相符。这表明在看涨乐观和获利了结行为之间存在平衡,交易者在11月潜在波动之前对风险进行对冲。

随着未平仓合约(OI)保持稳定和看涨情绪占主导地位,以太坊的衍生品市场描绘出一种激进的定位图景,但在4000美元区域周围保持谨慎——这是一个心理战场,可能决定ETH的下一个突破或修正。

- 以太坊当前的期货未平仓合约是多少?以太坊的总期货未平仓合约为462.7亿美元,由CME和Binance主导。

- 在ETH期权中,看涨期权与看跌期权的比较如何?看涨期权占主导地位,未平仓合约的63.7%显示出交易者明显的看涨偏好。

- 以太坊的最大痛点水平是多少?以太坊期权的当前最大痛点为3900美元。

- 哪个交易所主导ETH衍生品?CME在以太坊期货中领先,而Deribit则占据了以太坊期权活动的主要份额。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。