Crypto ETFs Split Paths as Bitcoin Rises but Ether Retreats With $128 Million Outflow

The crypto exchange-traded fund (ETF) market showed a tale of two assets on Thursday, Oct. 23, with bitcoin inching forward while ether retreated sharply. Investor sentiment seemed to pivot toward BTC again, though with a hint of caution after a volatile week.

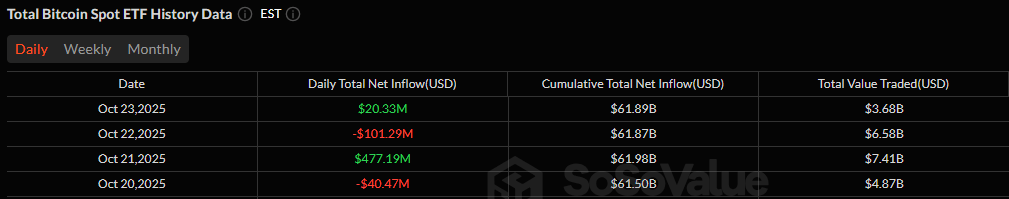

Bitcoin ETFs ended the day with a net inflow of $20.33 million, as four funds saw positive entries. Blackrock’s IBIT continued to dominate the field with a $107.78 million inflow, reinforcing its status as the institutional favorite. Bitwise’s BITB contributed another $17.41 million, while Fidelity’s FBTC and Grayscale’s Bitcoin Mini Trust added $7.22 million and $3.42 million, respectively.

But the gains were nearly undone by outflows. Grayscale’s GBTC lost $60.49 million, and Ark & 21shares’ ARKB shed $55.02 million. Still, bitcoin ETFs managed to close green, supported by steady trading activity of $3.68 billion and net assets rising to $149.43 billion.

Bitcoin ETFs have seen split movement this week, with two days of inflows and two days of outflows. How does the week end?

Ether ETFs, meanwhile, extended their losing streak with $127.51 million in outflows, suggesting investor hesitation remains high. Fidelity’s FETH led the redemptions with a $77.04 million exit, followed by Blackrock’s ETHA with $23.35 million. More redemptions came from Bitwise’s ETHW ($8.85 million), Grayscale’s Ether Mini Trust ($6.91 million), ETHE ($5.71 million), and Vaneck’s ETHV ($5.65 million). Trading volumes settled at $1.52 billion, with net assets slipping to $26.02 billion.

The diverging flows underscore the current mood of the market, with bitcoin holding investor trust amid turbulence, while ether continues to face cautious profit-taking and cooling demand.

FAQ💹

- Why did Bitcoin ETFs see inflows?

Bitcoin ETFs drew $20 million as investor confidence shifted back toward BTC after recent volatility. - Why are Ether ETFs still facing outflows?

Ether funds lost $128 million as traders continued profit-taking and showed caution toward ETH exposure. - Which funds led the Bitcoin ETF gains?

Blackrock’s IBIT led with a $107 million inflow, followed by Bitwise’s BITB and Fidelity’s FBTC. - What do these flows signal for the market?

They show a split sentiment with investors favoring bitcoin’s stability while staying wary of ether’s short-term outlook.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。