Author: p2p.org

Compiled by: Tim, PANews

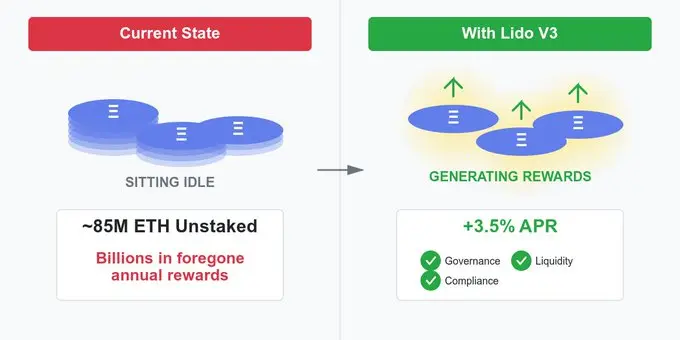

Currently, approximately 85 million ETH remains unstaked. For institutional holders, this represents a significant opportunity cost, with an estimated loss of about $3.5 million in potential earnings per year for every $100 million in ETH held, based on current yield rates.

Lido V3 stVaults introduces customizable institutional-grade staking solutions: supporting localized validation nodes, automated risk control, and custody integration, relying on P2P.org's institutional service quality, with operational costs only one-tenth of building independently.

Institutions can now meet governance requirements while maintaining liquidity staking efficiency.

Fund managers face a paradox that results in billions of dollars in losses each year.

On one hand: approximately 85 million ETH remains unstaked, meaning a large amount of assets held by institutions are idle. On the other hand: staking yields can average 3-4% annually, with institutional-grade security already in place. Yet, between the two: traditional staking solutions have consistently failed to meet institutional needs.

The Lido V3 version is expected to launch on the mainnet in December 2025, which will fundamentally reshape the industry landscape. Institutions will be able to access customizable, compliant, and capital-efficient Ethereum staking services for the first time, without sacrificing the control and financial reporting functions required by their boards.

This article explores why Lido V3 will be a watershed moment for institutional staking, analyzes which specific features are most important to financial decision-makers, and introduces how enterprises can prepare for rapid deployment when V3 goes live.

The Crux of Institutional Staking: Why Previous Solutions Failed

Before the launch of Lido V3, institutional fund managers faced unappealing trade-offs.

The Cost Burden of Independent Staking

While independent staking offers maximum control, its operational complexity is daunting. Operating validation nodes independently means hiring a professional DevOps team, building a 24/7 monitoring system, managing slashing risks, and bearing the technical burden of Ethereum client updates. For a $100 million ETH position, annual operating expenses typically exceed $500,000, assuming the ability to recruit the necessary professionals.

The Compromise of Staking Pools

Traditional liquid staking (including Lido V2) alleviates operational burdens but introduces new systemic issues. Its "one-size-fits-all" validator set means customization based on regulatory requirements is impossible. Fund management departments cannot select validators based on jurisdiction, compliance certification, or institutional relationships.

Perhaps most critically, boards and compliance teams struggle to accept the lack of refined control and audit capabilities. The result? Billions of dollars in opportunity costs due to ETH held by institutions not participating in staking.

Three Main Issues

1. Compliance Rigidity

The standard model of liquid staking employs a democratized validator set. This model works for retail investors but creates compliance complexities for regulated institutions. For example, how can a fund in Singapore ensure its validator set complies with the Monetary Authority of Singapore's guidelines? For compliance teams, the past answer was often, "We cannot approve this structure."

2. High Integration Friction

Integrating enterprise asset management systems with liquid staking protocols requires extensive custom development, with implementation cycles lasting 6-12 months, and costs comparable to first-year returns. CFOs find that once construction costs are accounted for, the profit margins of these projects are very limited.

3. Lack of Control and Visibility

Typically, a company's board requires detailed reporting and risk management capabilities. Previous solutions offered limited visibility into validator node performance, could not customize fee structures, and had minimal control over risk parameters. Asset managers face a dilemma: either gain complete control but bear a significant operational burden, or choose ease of operation but endure unacceptable control limitations.

The Real Change Brought by Lido V3: A Detailed Look at stVaults

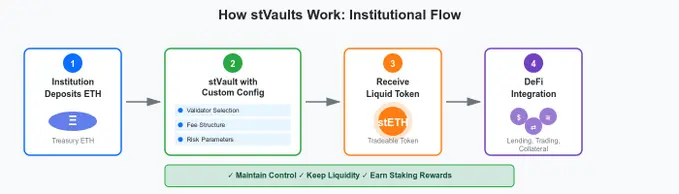

Lido V3 introduces stVaults, a customizable staking vault that connects institutional needs with the efficiency of liquid staking.

You can think of stVaults as a customizable staking configuration within the Lido protocol. Each stVault has its own independent validator set, fee structure, risk parameters, and integration specifications. Most importantly, stVault tokens maintain liquidity and can be used across various DeFi applications, thus preserving capital efficiency.

What Does "Customizable" Really Mean in Practice?

For institutional decision-makers, customizable services mean four core capabilities that traditional fund pool staking models cannot achieve:

Validator Selection: Choose from Lido's vetted operator network based on your set criteria (jurisdiction, compliance certification, institutional relationships, or historical performance). A Singapore fund can specifically configure a pool of operators holding relevant certifications in the Asia-Pacific region; a U.S. institution can require validators to operate within the U.S. and meet SOC2 compliance standards.

Risk Parameters: Set custom performance thresholds, diversification requirements, and operator limits based on your risk framework. You can specify maximum allocation ratios for individual operators, minimum uptime requirements, or geographic diversification directives, all of which are automatically executed through smart contracts.

Integration Specifications: Configure API interfaces, reporting formats, and financial system connections based on existing infrastructure. Your custody platform, asset management system, and reporting dashboard can all connect through standardized endpoints without the need for custom development for specific protocols.

Governance Rights: Independently participate in decision-making for specific vaults, unconstrained by the overall governance framework of Lido. Your compliance requirements will dictate how the vault is configured, without being subject to governance votes that may not align with institutional needs.

This level of customization was previously only achievable through independent staking, but with operational costs and complexity up to ten times higher.

Five Core Advantages Driving Institutional Adoption

1. Native Compliance Architecture

The regulatory landscape for institutional crypto staking remains complex and varies by country and region, while Lido V3's customization features can transform barriers into orderly processes.

Through stVaults, institutions in Singapore can form exclusive validator clusters, limited to node operators in Singapore or Switzerland, enjoying the benefits of liquid staking while meeting the Monetary Authority of Singapore's compliance requirements. Need all operators to hold SOC2 certification? Or wish to obtain insurance coverage? These requirements can be directly programmed into the validator admission criteria.

With stVaults' independent reporting functionality, institutional business data will be stored separately from the overall protocol, simplifying audit and regulatory reporting processes. There’s no need to explain the entire operation of the Lido protocol to auditors; just provide clear vault configuration descriptions and exclusive historical performance records.

2. Simplified Financial Integration

Traditionally, integration complexity has been one of the biggest obstacles. Lido V3 directly addresses this challenge with an API-first design, allowing finance teams to seamlessly integrate into existing workflows.

stVaults provide standardized API interfaces that can directly connect to platforms like Fireblocks, Copper, or Anchorage Digital, without the need for custom development for the protocol. Implementation cycles can be shortened to weeks rather than quarters.

3. Refined Risk Management

Mature institutional investors require refined risk management capabilities and the ability to adjust strategies based on changing environments.

stVaults allow institutions to set specific risk control parameters: maximum weight limits for single-node operators (e.g., no more than 10%), minimum performance thresholds (e.g., 99% uptime requirements), and configure automatic rebalancing trigger conditions. These parameters will be automatically executed through smart contracts.

4. Optimized Cost Structure

Unlike traditional independent staking, which incurs hidden costs for infrastructure, personnel, software, and monitoring tools, stVaults offer a transparent and predictable fee structure. For a $100 million staking position (with an annual yield of 3.5%, equating to $3.5 million in earnings), total fees are approximately $350,000, far below the over $500,000 in infrastructure costs required for independent staking.

In addition to direct costs, the capital efficiency advantages include: no need to meet the minimum validator threshold of 32 ETH (deploy any amount), instant liquidity through stVault tokens (no waiting for redemption delays), no need to hire specialized personnel, and elimination of single points of failure risks that may arise from building infrastructure independently.

5. Institutional-Grade Infrastructure

The value realization of stVaults is entirely built on reliable infrastructure. Validator downtime will directly impact earnings—taking a $100 million staking position as an example, for every percentage point below a 99% uptime rate, the average annual reward loss is about $35,000.

Conclusion

The institutional staking landscape has undergone a fundamental transformation. Faced with the challenge of balancing control and operational efficiency, Lido V3 provides a clear path: through customizable, compliant, and capital-efficient staking solutions, it meets institutional requirements while retaining the unique advantages of liquid staking.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。