KuCoin KCS 超越比特币,交易量和市场份额上升

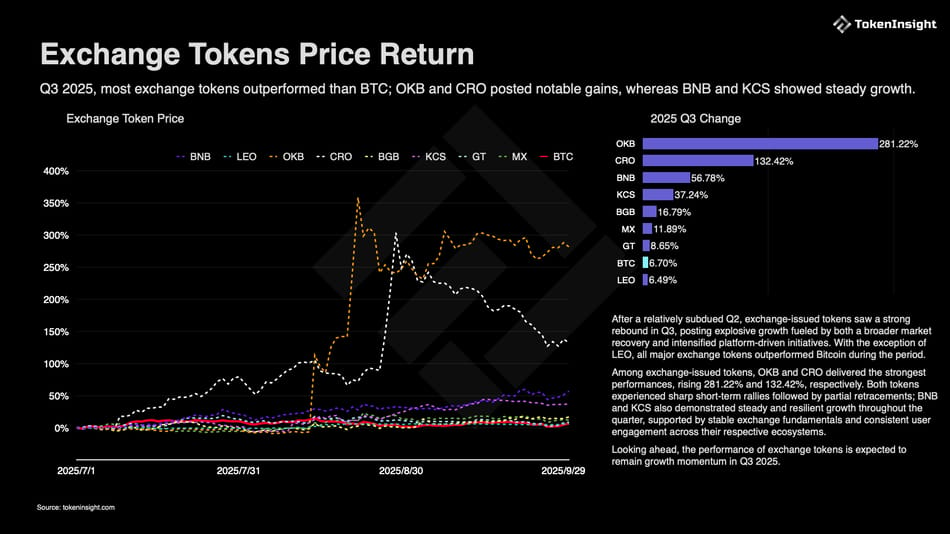

加密世界再次升温,但这次谁在领先呢?根据 TokenInsight 最新发布的 2025 年第三季度加密交易所市场报告,KuCoin 的原生代币 KCS 以 37.24% 的季度涨幅超越比特币(6.70%),标志着基于交易所的资产的大幅回归。

来源: Token_Insigh

报告强调了 KCS 代币在大多数交易所代币从上个季度的下跌中急剧反弹时,仍保持强劲、稳定的增长,显示出对中心化交易所的新信心。

KuCoin 的 KCS 代币如何超越比特币?

本季度 KCS 显著上涨,得益于 KuCoin 不断扩展的平台实力和日益增长的生态系统实用性。该交易所增强了 KCS 的实用功能,包括费用折扣、质押奖励和加速代币销毁,促进了更强的社区参与。

相比之下,比特币在第三季度的表现平平,主要是由于最近的 重大市场行动,根据 TokenInsight 的季度市场数据,仅上涨约 6%。

报告指出,尽管 OKB 和 CRO 分别录得 281% 和 132% 的强劲涨幅,但 KCS 仍保持稳定和可持续的增长。由于 KCS 代币与 KuCoin 的交易表现直接相关,从现货和衍生品交易量到代币实用性,它在交易所强劲的第三季度增长中受益匪浅。

KuCoin 随着市场反弹而攀升

2025 年第三季度,加密市场明显复苏。比特币 ETF 流入总额达到 78 亿美元,比特币的主导地位跃升至 64%,帮助总市值从 6 月的 3.46 万亿美元提升至近 4 万亿美元。

另一方面,衍生品交易跃升 28.7% 至 26 万亿美元,使 KuCoin 跻身全球前三,与 Binance、Bybit 和 Bitget 并列。

有利的货币信号,包括对降低利率的预期和全球监管的改善,尽管持续存在通货膨胀担忧,仍保持了投资者的乐观情绪。

带着谨慎的乐观

展望 2025 年第四季度,市场前景依然谨慎乐观。预计美联储的降息和持续的 ETF 流入将支持比特币和顶级交易所代币的持续增长。

然而,分析师警告称,通货膨胀压力和地缘政治风险可能会使波动性保持在高位。预计中心化交易所将保持强劲,受益于更强的合规性、透明度和机构需求。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。