The U.S. national debt broke $38 trillion on Wednesday after what the Associated Press reported as “the fastest accumulation of a trillion dollars in debt outside of the COVID-19 pandemic.” The national debt stood at $37 trillion in mid-August, and in just two months, it jumped by $1 trillion. Bitcoin climbed to $110K on the news, seemingly buoyed by what may be a flight to safety as investors become increasingly wary of the government’s fiscal condition. The cryptocurrency had eased to $109K by mid-morning Thursday.

The current government shutdown, now entering its 23rd day, has only exacerbated the situation. Senate Republicans and Democrats are still deadlocked over how to structure a temporary spending bill. Democrats want an extension of health insurance tax credits, but Republicans say it’s too costly.

With the government machinery compromised by the shutdown, federal workers miss their pay, national programs are halted, and key fiscal decisions are deferred. The result is a drop in economic activity, as seen in the 2018-19 shutdown where $3 billion in gross domestic product (GDP) was lost, according to the Congressional Budget Office. All of these downstream effects may cause an even faster acceleration to $39 trillion if nothing changes.

“The US is broke. The real debt is $175T+,” said Balaji Srinivasan, author and former Coinbase chief technology officer. “There is no fix. It’s a writeoff. A national bankruptcy.”

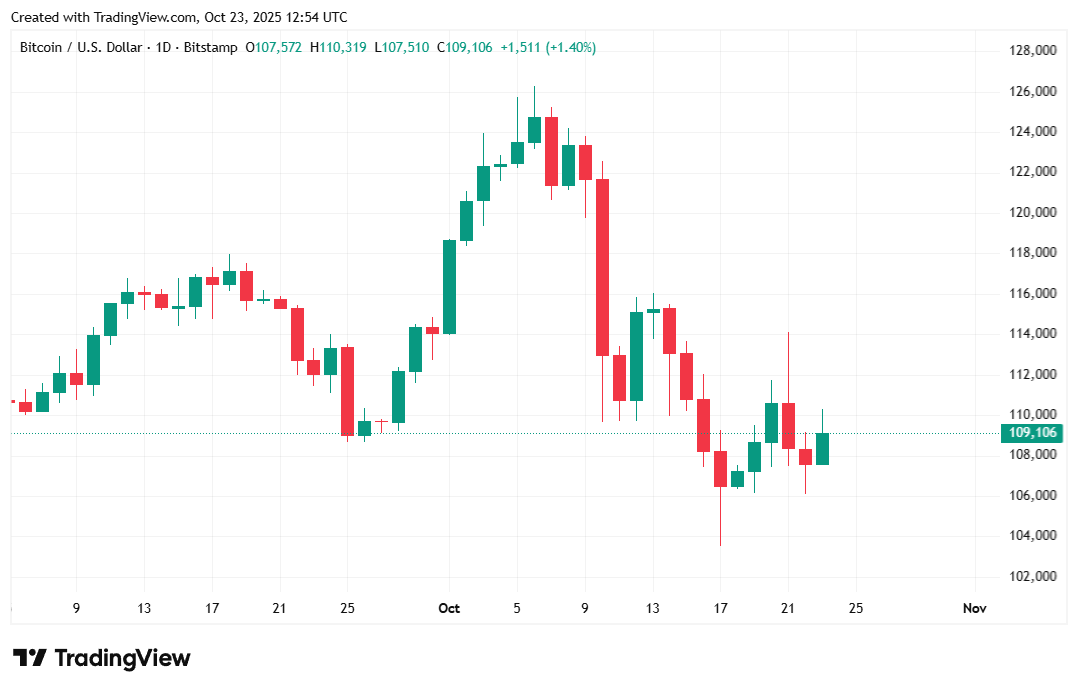

Bitcoin was priced at $109,158.01 at the time of reporting, up 1.01% for the day but still lower by 2.14% on a weekly basis, Coinmarketcap data shows. Intraday price action ranged from $106,778.00 to $110,295.02.

( BTC price / Trading View)

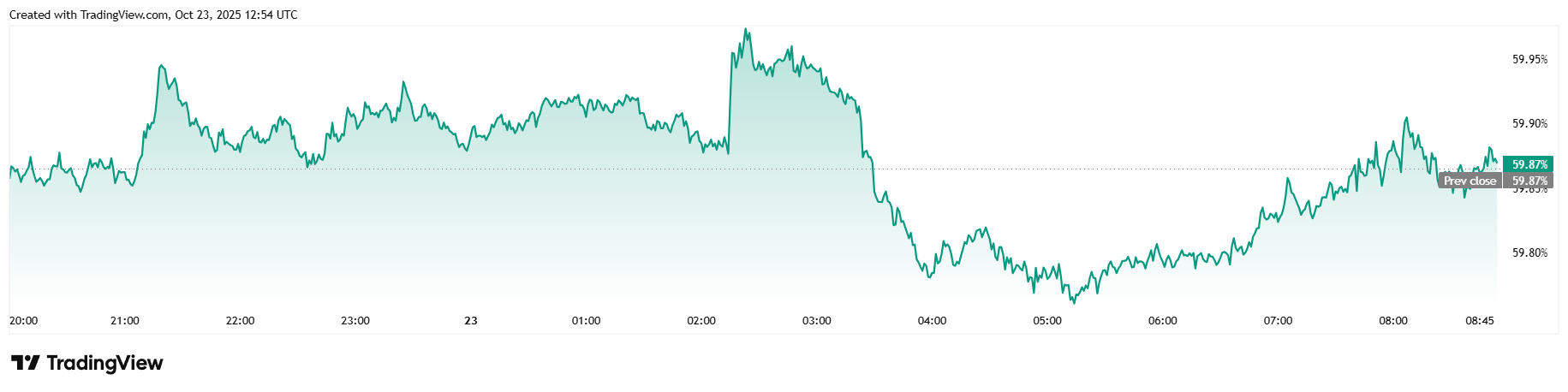

Twenty-four-hour trading volume fell 32.87% to $70 billion, but market capitalization, which moves with price, rose 1% to $2.17 trillion. Bitcoin dominance was mostly flat, dipping 0.01% over 24 hours to 59.87%.

( BTC dominance / Trading View)

Total value of open futures contracts fell slightly by 0.66% to $68.96 billion over 24 hours, according to Coinglass. Liquidations started the day lower at $67.10 million, with a relatively even distribution of losses between shorts and longs. Short sellers bled $36.72 million, and long investors lost a slightly smaller $30.39 million.

- Why did bitcoin climb above $110K?

Investors sought refuge in bitcoin as U.S. debt soared to a record $38 trillion, signaling waning confidence in fiscal policy. - How fast is the U.S. accumulating debt?

America added $1 trillion in just two months—the quickest pace outside of the COVID-19 era. - What’s driving investor concern?

A 23-day government shutdown and political gridlock are heightening fears of deeper economic strain. - What does this mean for Bitcoin’s outlook?

Analysts see continued upward pressure as more investors treat bitcoin as a hedge against U.S. debt and inflation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。