撰文:Haotian

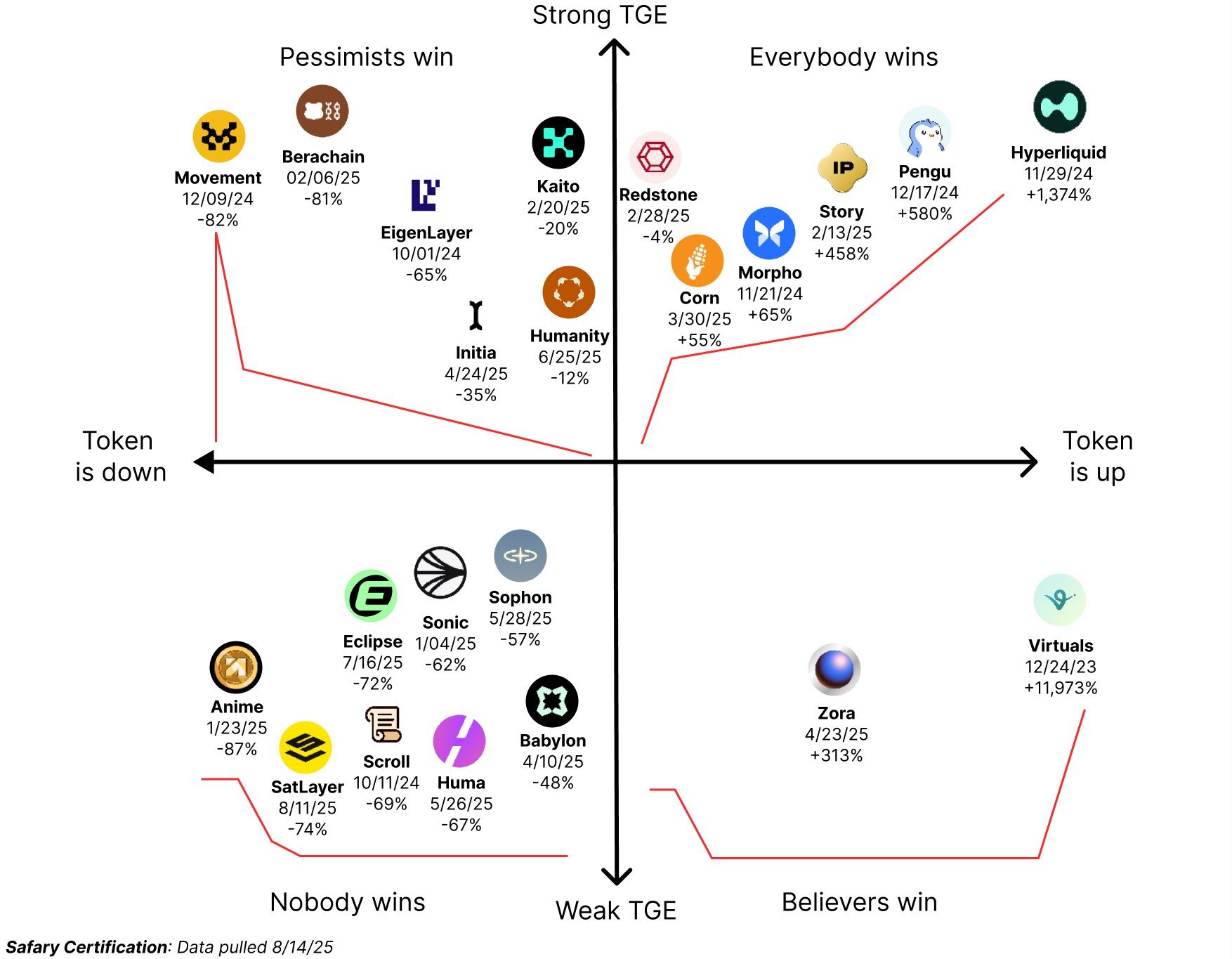

早上刷推看到一张图,产生了一些思考,分享一下:

1)选择在流动性充沛的时间窗口 TGE 很重要,重要到无视项目的基本面。

比如,$Pengu,一个 NFT 社区 MEME 代币,在去年 12 月 17 日流动性非常充沛的时间段上线,但比大部分项目表现都要强,而 $BABY、$HUMA 这些都是有技术叙述和 VC 布局背书的项目,在今年四五月份流动性相对枯竭的阶段上线,表现就非常糟糕。

2)项目都喜欢扎堆上线,但需要考虑市场流动性能否承接。

比如,去年 11-12 月出现了 Hyperliquid、Movement、Pengu、Morpho 等项目,因为扎堆虽然表现参差不齐,但好在大部分出来都跑了;而,今年 4-5 月又扎堆出现了 Babylon、Initia、Zora、Huma、Sophon,结果流动性不足,表现都差强人意;

3)对 TGE 时间窗口下,也可能出现一些「开盘即巅峰」的项目。

有些项目会趁着市场流动性充沛,散户 Fomo 的时间点 TGE,以忽略自身基本面不足的问题。比如,动向、Berachain,开盘时 Fomo 情绪爆棚,但最终都以无止境暴跌收场。只能说明,市场流动性红利如果没有基本面的支撑,反倒会加速一些项目的「衰亡」。

4)在错误的 TGE 时间窗口下,对于一些基本面恐慌,但有心理的项目,反而是发现价值的黄金机会。

$ZORA 就是典型的例子,在市场最冷清,流动性最竭的时间上线,成为那批项目中唯一的赢家。更早期的 $Virtual 也类似,在最昏暗的上线,却时刻出彩的基本面表现,引领一波波索拉纳 AI 代理热潮,让集体信仰者赢到了最后。

5)无论强弱退出时间窗口,总能有基本面优秀的项目最终出来。

比如,Hyperliquid 能够建立起庞大的支持者社区,引领一波 Perp Dex 的叙述热潮,$HYPE 价格也爬梯式阶梯增长;@flock_io

另外,尽管踩在去年 TRUMP 大肆吸流动性的尖点上线,$FLOCK 最低流通市值跌至夸大的 300 多万,但也凭借出色的基本面表现,几乎实现了交易所上架大满贯,让信仰者赢到了最后。以上。对于大部分散户来说,能看懂 TGE 时间窗口的重要性,采用差异化的策略:强 TGE 期恐追高、快进快出;弱 TGE 期专注投研,寻找被低估的优质指数、长期持有;都有可能成为最后的赢家,虽然艰难了点。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。