The young Bitcoin still has a long way to go in its evangelism.

Written by: Liam, Deep Tide TechFlow

Do you remember the end of 2024, when everyone was writing asset predictions for 2025?

Stock investors were focused on the S&P and the A-shares, while those in the crypto circle were betting on Bitcoin.

But if someone had told you that the best-performing asset in 2025 would not be Bitcoin or stocks, but that "old antique" gold, which is looked down upon by Generation Z, you would have thought they were joking.

But reality is indeed magical.

In the past five years, Bitcoin has outperformed gold by more than 10 times with a rise of over 1000%, repeatedly topping the list of the strongest assets of the year. However, by 2025, the script had completely reversed: gold has risen over 50% since January, while Bitcoin has only increased by 15%.

The early buyers of gold are laughing, while the elite traders in the crypto industry are silent.

Even more bizarre is that gold and Bitcoin seem to have entered parallel worlds: when gold rises, Bitcoin falls; when Bitcoin falls, gold rises.

On October 21, gold suffered a heavy blow, dropping 5% in a single day, while Bitcoin, as if injected with adrenaline, reversed its downward trend and began to rise…

Why has Bitcoin, touted as digital gold, become unanchored from physical gold?

Buying Gold in Turbulent Times

In 2025, who are the craziest gold buyers? Not retail investors, not institutions, but central banks around the world.

Data does not lie: in 2024, global central banks net purchased 1,045 tons of gold, breaking the 1,000-ton mark for three consecutive years.

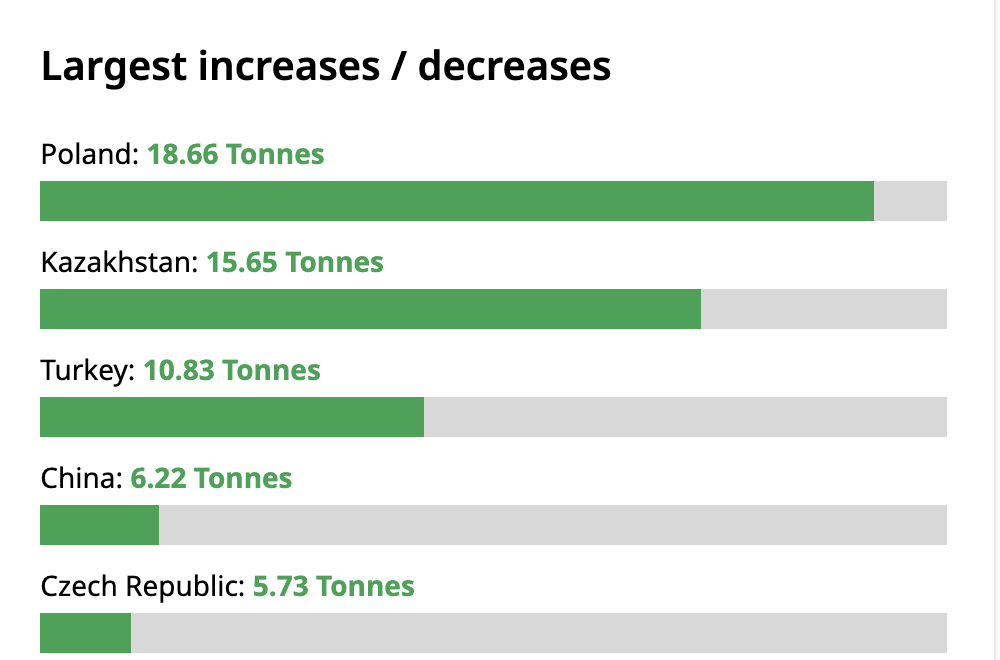

According to the World Gold Council's Q2 2025 data, Poland increased its holdings by 18.66 tons, Kazakhstan followed closely with an increase of 15.65 tons, and the People's Bank of China steadily added 6.22 tons…

Why are developing countries the ones increasing their gold reserves?

Looking at the proportion of gold reserves held by various central banks, developed and developing countries are two completely different worlds:

The U.S. has 77.85% of its asset reserves in gold, holding 8,133 tons, far ahead of second-place Germany with 3,350 tons, followed by Italy and France, which hold 2,452 tons and 2,437 tons of gold, respectively.

The People's Bank of China's gold reserves account for only 6.7% of its total asset reserves, but the absolute amount has reached 2,299 tons and is continuously increasing.

This comparison is quite clear; emerging market countries still have significant room to increase their gold holdings. Economies like China have gold reserves that account for less than 7%, while developed countries in Europe and America generally exceed 70%. This is like a "catch-up" game; the greater the gap, the stronger the motivation to catch up.

Exaggeratedly, the proportion of central bank gold purchases in total demand has skyrocketed from less than 10% in the 2000s to 20%, becoming an important support for gold prices.

Why have central banks suddenly become so keen on gold? The answer is simple: the world is chaotic, and the dollar is no longer trustworthy.

The Russia-Ukraine conflict, the situation in the Middle East, and Sino-U.S. trade frictions… the global village has turned into a warring states period.

For a long time, the dollar has been the core foreign exchange reserve for central banks around the world, also serving as a safe-haven asset. However, now the U.S. is preoccupied with its own issues, with a staggering $36 trillion in debt, a ratio of debt to GDP reaching 124%, and the Trump administration's erratic policies creating external enemies and internal divisions…

Especially after the outbreak of the Russia-Ukraine conflict, when the U.S. can freeze other countries' foreign exchange reserves at will, countries have realized: only the gold stored in their own safes is truly their own wealth.

Although gold does not earn interest, at least it will not suddenly "disappear" due to the policies of a particular country.

For both individuals and nations, gold serves as a risk hedge; the more chaotic the world becomes, the more gold is pursued. However, when news like "the Russia-Ukraine conflict may be coming to an end" emerges, a significant drop in gold prices is also understandable.

Digital Gold or Digital Tesla?

The most awkward asset in 2025 may be Bitcoin, whose long-term narrative is "digital gold," yet it has ended up living as "digital Tesla."

Data from Standard Chartered Bank shows that the correlation between Bitcoin and the Nasdaq is now as high as 0.5, reaching 0.8 at the beginning of the year. And the correlation with gold? A pitiful 0.2, which even dropped to zero at one point earlier this year.

In plain terms: Bitcoin is now tied to tech stocks; when the Nasdaq rises, it rises, and when the Nasdaq falls, it falls.

Everything has its cause and effect.

Under the push of the Trump administration, the U.S. attitude towards Bitcoin shifted from "illegal cult" to "welcome aboard." The approval of Bitcoin spot ETFs in 2024 marked the formal incorporation of Bitcoin into the dollar system.

This was initially a good thing, proving Bitcoin's legitimate status. But the problem is, once you become part of the system, it becomes difficult to resist it.

Bitcoin's initial allure lay in its rebellious spirit, not relying on any government and not being controlled by any central bank.

But now? Wall Street giants like BlackRock have become the largest buyers in the market, and Bitcoin's price fluctuations are entirely dependent on the Federal Reserve and Trump, to the extent that crypto traders now have to stay up late listening to Powell and Trump’s speeches, effectively turning themselves into macro analysts of the dollar.

In terms of consensus, Bitcoin is still in many parts of the world at the stage of "what is this thing," while gold is already at the level of "my grandmother's grandmother also likes it."

The number of holders of gold bracelets and necklaces among Chinese aunties may exceed the total number of Bitcoin HODLers worldwide.

Compared to gold, the young Bitcoin still has a long way to go in its evangelism.

Gold in One Hand, Bitcoin in the Other

Many people like to choose between gold and Bitcoin, but smart investors know this is a fill-in-the-blank question.

Although central banks around the world are buying gold like crazy, driving gold prices up, this process cannot continue indefinitely. When gold prices reach a certain level, issues such as storage, transportation, and delivery of physical gold will arise, at which point Bitcoin's advantages will become apparent.

Imagine a specific scenario: a war breaks out in a country, and the wealthy realize that gold is too heavy and too conspicuous to quickly transfer their wealth. At this moment, Bitcoin in a hardware wallet becomes the best choice; such an event has already occurred in Russia.

In simple terms, gold is "bulky value storage," while Bitcoin is "lightweight value storage."

If gold prices reach a terrifyingly high level, funds will need to seek similar alternatives that are cheaper; in this case, Bitcoin has the opportunity to gradually break free from the gravitational pull of the dollar and Trump, gaining the overflow of funds from gold and moving closer to being "digital gold."

In summary, the relationship between Bitcoin and gold should not be understood as one replacing the other, but rather as inheritance and evolution.

Gold is the wealth memory of human civilization, while Bitcoin is the wealth imagination of the digital age.

Seventy-year-old Aunt Li buys gold jewelry, while 25-year-old programmer Li Xiaoming hoards Bitcoin; everyone has a bright future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。