Ether Sees $146 Million Outflow While Bitcoin ETFs Record $40 Million Exit

What started as a day of promising inflows for bitcoin exchange-traded funds (ETFs) on Monday, Oct. 20, turned sharply negative by the close, as institutional investors took profits and sentiment cooled across the board.

Bitcoin ETFs recorded a combined outflow of $40.47 million, erasing early gains. Earlier in the day, Vaneck’s HODL led with inflows of $21.16 million, followed by Bitwise’s BITB with $12.05 million, Invesco’s BTCO with $9.94 million, Fidelity’s FBTC with $9.67 million, and Grayscale’s Bitcoin Mini Trust with $7.36 million.

Altogether, inflows approached $60 million, but a sizable $100.65 million exit from Blackrock’s IBIT flipped the script. Trading activity remained lively at $4.87 billion, though total net assets closed at $149.66 billion.

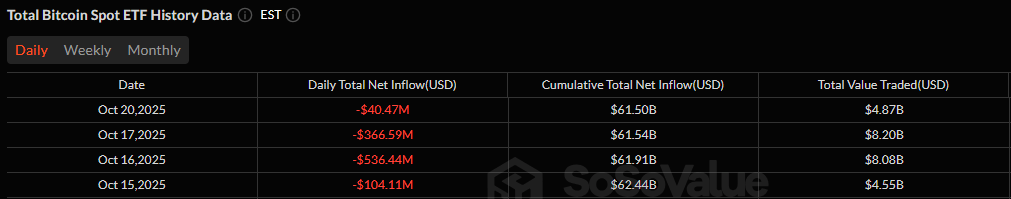

Bitcoin ETFs have seen four days of straight outflows worth over $1 billion. Source: Sosovalue

Ether ETFs, meanwhile, had no such balancing act, as they sank firmly into red territory. Redemptions totaled $145.68 million, driven entirely by the two biggest players. Blackrock’s ETHA saw a heavy $117.86 million outflow, while Fidelity’s FETH shed $27.82 million. The day’s total trading volume reached $2.15 billion, with net assets closing at $26.83 billion.

The red Monday extended the pullback that began at the end of last week. Still, with markets awaiting new macro triggers and ETF demand proving highly reactive, the next few days could set the tone for whether this dip is a pause or the start of a deeper correction.

FAQ

How did bitcoin ETFs perform to start the week?

Bitcoin ETFs saw $40 million in net outflows after early gains reversed, led by a $100 million exit from Blackrock’s IBIT.What happened with ether ETFs on Oct. 20?

Ether ETFs faced $146 million in redemptions, with Blackrock’s ETHA and Fidelity’s FETH accounting for all the losses.How much trading activity did crypto ETFs record overall?

Combined trading volume hit nearly $7 billion across bitcoin and ether funds, reflecting continued investor engagement despite outflows.What does this mean for market sentiment?

The sharp reversal shows cautious sentiment returning to crypto ETFs as investors await fresh macro or market catalysts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。